Forex Trend Detector is an expert advisor assuring easy, quick, and stable profits. As per the vendor, money managers and professional traders use this FX EA. The system works using the volatility breakout and a conservative drawdown algorithm for producing successful returns. This EA is touted to be a potent tool with a proven approach. To test the veracity of the vendor’s claims we have evaluated the features, backtesting, performance, and other characteristics of this FX robot in this review.

Forex Trend Detector company profile

As per the info present on the official site, this EA is created by expert fund managers who have more than 15 years of active trading experience. We could not find further info on the vendor like the founding year, their location, phone number, how long they have been in the FX market, etc. The lack of info raises a red flag for this FX EA.

The highlights of Forex Trend Detector

From the info the vendor provides, this EA identifies the end of a volatile trend and the volatility borders that surround a dominant trend. Trades are entered based on predicted price levels that leverage the market adjustments when volatility breakout happens. Some of the main features that the vendor highlights are:

- The EA follows smart money with its accurate market entries.

- It promises a high risk/reward ratio.

- The system comes with efficient money management that includes tight SL levels.

- It is independent of the spread and slippage.

- The robot works with any MT5 or MT4 broker.

- It uses dynamic trading logic.

- The system does not need optimization.

- Forex Trend Detector has advanced time management and profit protection systems.

For recommendations, the vendor suggests the use of a balance of $1000 to $5000 for decent profits although the minimum deposit is $100-$500. This EA uses the M5 time frame and has default settings for the EURUSD and the GBPUSD pairs. There is no info on the leverage used.

Facts & figures

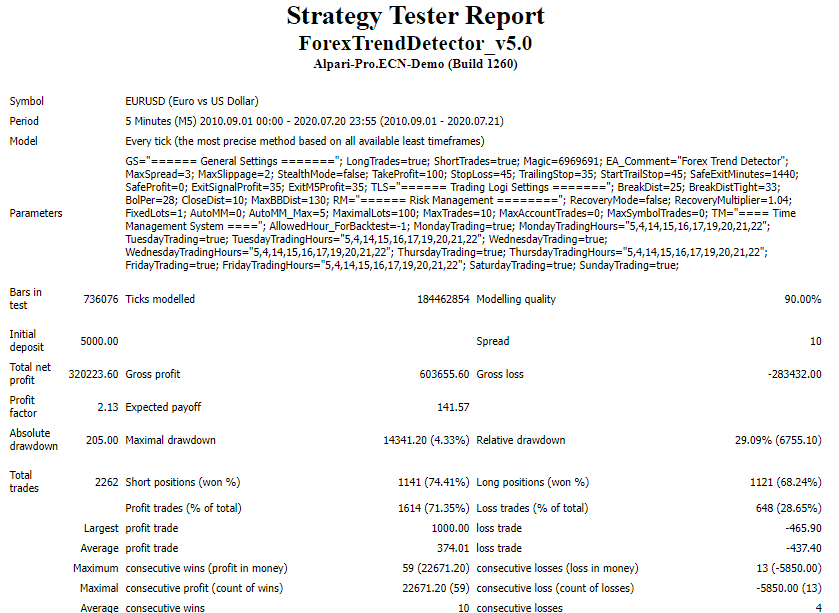

A few backtests are present on the official site. Here is a backtest done for the EURUSD pair based on the 2010-2020 historical trading data.

From the above report, we can see the EA had generated a net profit of 320223.60 from an initial deposit of $5000. For a total of 2262 trades, the maximum drawdown was 4.33%. Profitability of 71.35% and a profit factor of 2.13 were present for the account. Although the profits and performance look decent, we cannot predict a similar result in real trading.

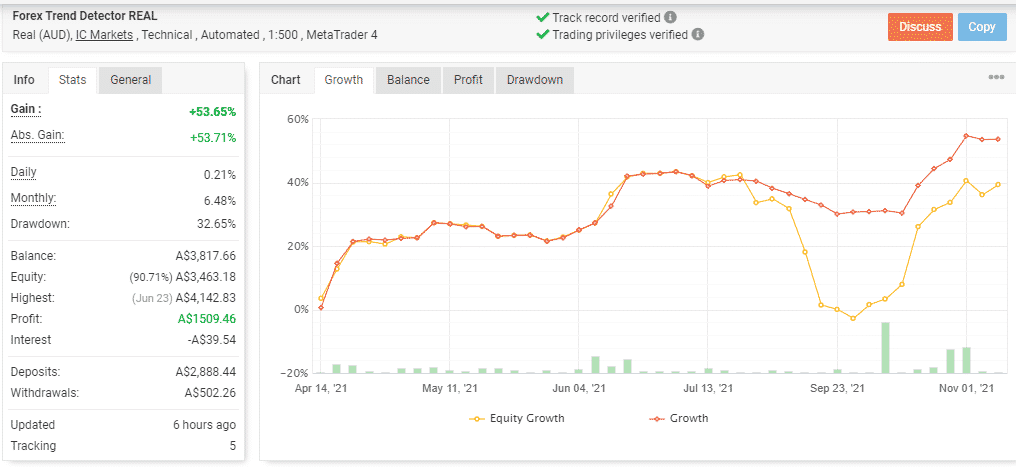

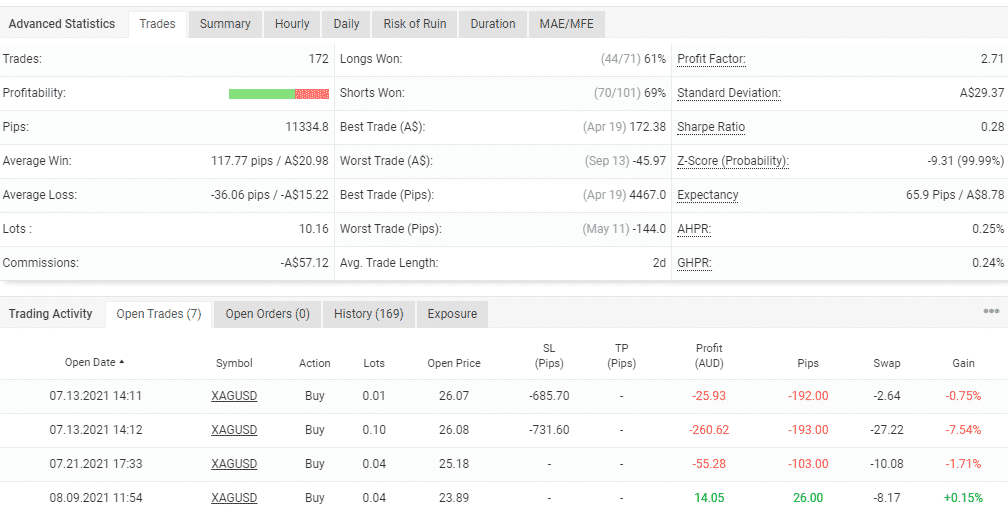

The vendor provides a real AUD account verified by the myfxbook site. Here are screenshots of the trading results for the account using 1:500 leverage on the MT4 terminal.

A total profit of 53.65% and an absolute profit of 53.71% are present for the account. The daily and monthly profits are 0.21% and 6.48% respectively. A drawdown of 32.65% is present for the account which indicates a risky approach. For the account that began in April 2021, the total number of trades executed is 172 with a profitability of 66% and a profit factor value of 2.71. From the trading history, we can see varying lot sizes are used ranging from 0.01 to 0.10. The high drawdown and varying lot sizes denote the strategy used is risky.

Forex Trend Detector packages

To purchase this FX robot, you need to pay $237. The package includes one real account and two demo accounts. A 60-day money-back guarantee is present. Compared to the price of competitor systems, the price is a bit expensive.

Assistance

For support, an online contact form and the FAQ section are present. We find the support is inadequate.

Customer reviews

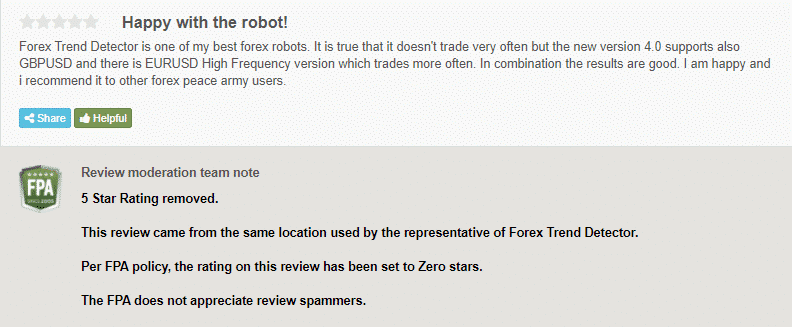

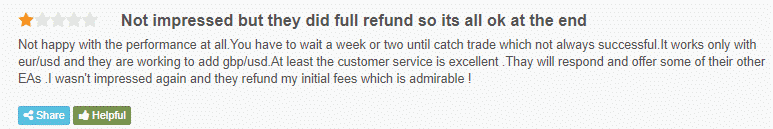

Unfortunately, there are only 2 customer reviews on the Forexpeacearmy site. While one testimonial has been declared as spam, the other one indicates the poor performance of the system.

Is Forex Trend Detector a profitable bet in 2021?

No, we don’t think so. The risks you face using this FX robot include:

- A risky approach as seen in the high drawdown and varying lot size used

- No vendor transparency which indicates this is not a reliable system

- Insufficient support and negative reviews