- Can you make a living off day trading crypto?

- Which crypto is best for day trading?

- How much money do you need to trade crypto day?

For many people, the promise of quick profits from day trading is irresistible. However, it’s not uncommon for people to lose money when day trading. Index funds that track a broad market index such as the S&P 500, on the other hand, may provide investors with higher returns over time. In the past, the S&P 500 returned an average of 10%.

This article will walk you through day trading basics to avoid getting in over your head while getting started in day trading. From what is day trading to how to do day trading, we got everything covered in this article for you. So let us begin with the fundamentals.

What is crypto day trading?

Trading financial instruments (stocks, bonds, options, futures, or commodities) to profit from price movements inside a single trading day is known as day trading. Regardless of how long positions are held during the day, they are permanently closed out before the market shuts to avoid any risk of exposure during the night. When a person makes a round trip, they arrive and leave the same place at once.

For example, you could buy 100 XYZ shares for $26 and sell them at $26.30 20 minutes later. One way to describe speculative round trips made during market hours is “day trading.” Swing trading allows you to maintain positions for several hours or even days.

How to trade crypto?

Some market triggers cause price movements to be very irregular, which someday traders discover. For example, catalysts are uncommon to include quarterly earnings reports, company press releases, or even takeover mergers and partnerships.

Since most firms’ underlying fundamental value metrics seldom change within minutes or hours, day traders commonly use technical analysis to uncover potential entry and exit locations for trades. To predict future price movements, the technical study examines market data to identify patterns.

Day traders like highly liquid shares because they can enter and exit positions quickly. As a result of the narrow disparity between the price an investor pays to buy a stock and the somewhat lower price that an investor receives when selling it, liquid stocks have small bid-ask spreads. Huge bid-ask spreads may slash day-trading profits.

Day traders may hold both long and short bets throughout the day in the hopes of profiting from both rising and falling stock prices. Their trading strategy may allow them to trade a wide range of stocks and other assets throughout the day; alternatively, they may acquire and sell the same stock several times in a short period.

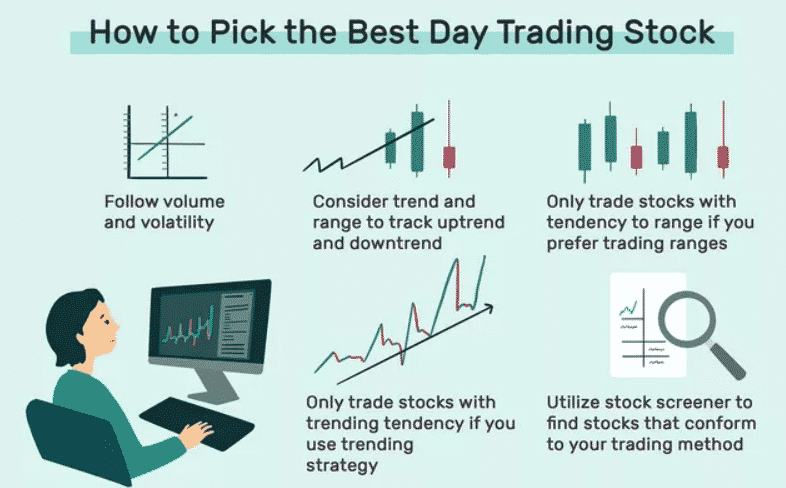

Characteristics of a good day trading equity

The most significant day trading equities, on average, have the following characteristics:

Good volume

Stocks are popular among day traders because of their high liquidity, which refers to how often and what volume they fluctuate. Liquidity makes it possible for a trader to buy and sell without affecting the price significantly. Currency markets are also very liquid.

Some volatility

How frequently an asset’s price fluctuates is called “volatility.” A day trader needs this type of volatility to make money. Following a position, someone must be prepared to pay a different price.

Familiarity

Make sure you understand how securities are traded and how the triggers work. Whether or not a stock is in a trading range is a question that must be answered. Will the company’s earnings report help or hurt it?

Newsworthiness

As a consequence of media coverage, people get interested in buying or selling shares. Volatility and liquidity are created as a result of this. As a result, many day traders keep a close eye on the financial headlines searching for trading chances.

Trading stocks on the open market, day traders often utilize “technical analysis,” or analyzing stock price movements on a chart, rather than doing “fundamental research,” which looks at company factors including products, industry, and management.

However, for those who like to concentrate on only a few investments, the day trader can be intimately familiar with each one of them. With this knowledge, you can predict how a stock will move in the future and when you should buy and sell it.

Sample of the crypto day trading strategy

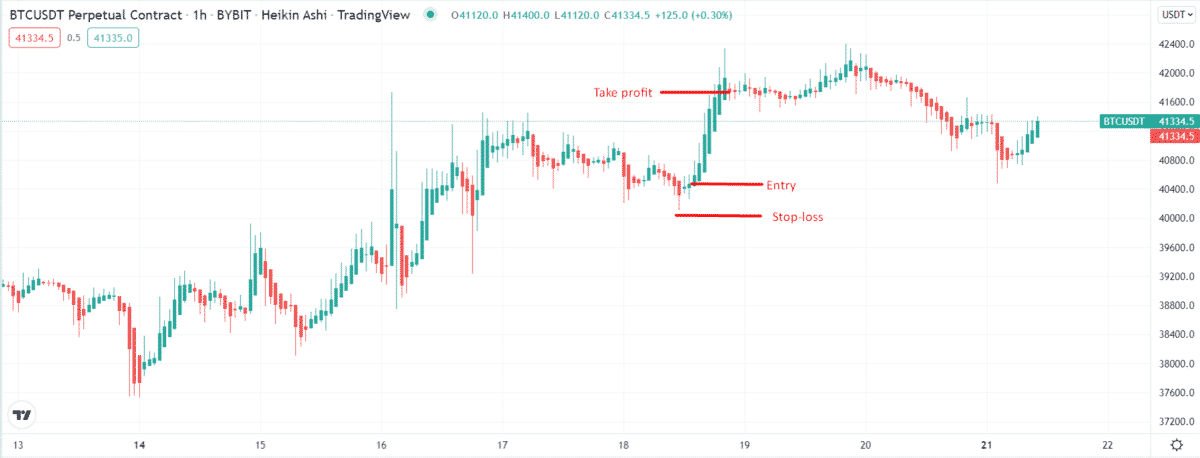

There are several trading strategies to use in crypto day trading. Let’s discuss an easy method known as the “Heiken Ashi,” which filters the noise and clearly understands the trend.

Sample trades

Let’s start with the bullish and bearish trade setups to make things easier to understand.

Bullish trade setup

Enter the long trade when you see a bullish Heiken Ashi candle after a downside halts. Keep the stop-loss below the swing low while exiting the trade in profit when a bearish candle appears.

Bearish trade setup

You can enter the short position when you see a bearish Heiken Ashi candle. Put the stop-loss just above the recent swing high. Your take profit should activate when a bullish Heiken Ashi candle appears.

Final thoughts

When it comes to one-day bets on speculatively held assets, it’s common for individuals to boast about their vast profits on social media. Some individuals like this kind of trade. Investing in a few hot firms seems like a no-brainer to gain over $100,000 in only an hour or two. At first glance, it appears to be relatively straightforward.

The reality is that making money consistently as a day trader is tough. Even if it’s not impossible, it’s a hazardous investment strategy. People considering day trading to make a living should be aware of some risks.