- What are lithium stocks?

- Are they worth investing in?

- Which are the best to invest in?

Electric cars are the future, and it is already here. The world is quickly evolving to a new eco-friendly era, and electric cars are an essential part of that evolution. But there are no electric cars without lithium.

Nowadays, there are different projects to extract lithium from the ground to manufacture the batteries that power cars and electronic devices. This is because lithium batteries have proven to be the best option to store energy, and the market has noticed that.

The demand for it is rapidly increasing, and companies around the world are profiting from it. However, you can’t invest in lithium as you do with gold or silver. You can only do it by investing in lithium stocks. Find out which are the best stocks to invest in lithium today.

What are lithium stocks?

The shares of companies focused on extracting and producing lithium products such as batteries. They are used to power all kinds of devices such as laptops, smartphones, and of course, electric vehicles.

Lithium is one of the most common elements in the plant. However, extracting it is quite a challenge. However, it has proved that it is the best option to power our devices, defeating, for example, blue gas fuels that claim to be a clean source of power.

Lithium is more present in South America and Australia, but recently China has announced projects to extract it in the country. So, the offer is constantly increasing as it is expected that the demand will explode in the next decades.

Are they worth investing in?

The lithium stock demand can do anything but grow. During 2021 almost all lithium stocks have up-trended, and there is no question about whether the demand will increase or not.

Projects like the EU plan to produce 30 million electric cars by 2030 can only make producers like Tesla, General Motors, or Toyota buy more lithium every year. The real question is whether the companies will be able to satisfy that demand. In such a case, when the demand surpasses the supply, the price will rise even further, and your investment will pay off even more.

Which are the best lithium stocks to invest in?

It is a commodity that doesn’t represent any more problems than its extraction from deposits. When a product like this gets hot, there is no way to stop competitors from getting into the business. We see many projects to extract lithium, and we will see more in the future, but here we will tell you which companies to invest in lithium stocks for 2021/2023.

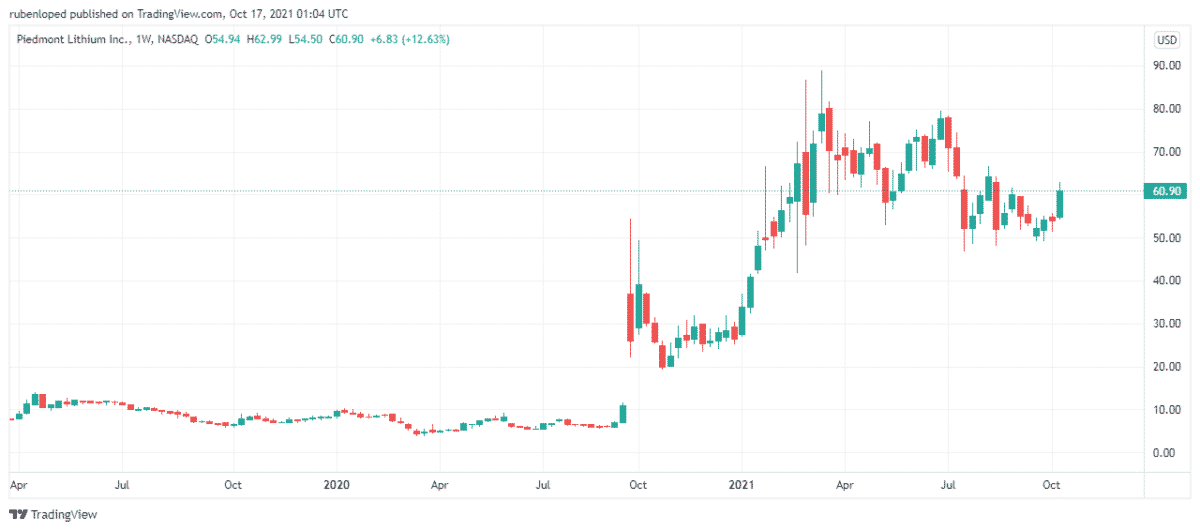

1. Piedmont Lithium (NASDAQ: PLL)

Price: $60.90

It is an American company focused on exploring and developing lithium products like batteries for electric vehicles.

The company based in North Carolina claims to be the producer of lithium hydroxide at a lower cost. It aims to become a strategic company for the supply chain of Electric Vehicles in the USA. Piedmont Lithium runs operations in Quebec and Ghana.

Still, its main project is in North Carolina, where the company plans to increase its lithium resources by 40% by making the recovery of the mineral economically possible.

The price of the company shares will take off by the end of 2020, and right now, its price is above $60.

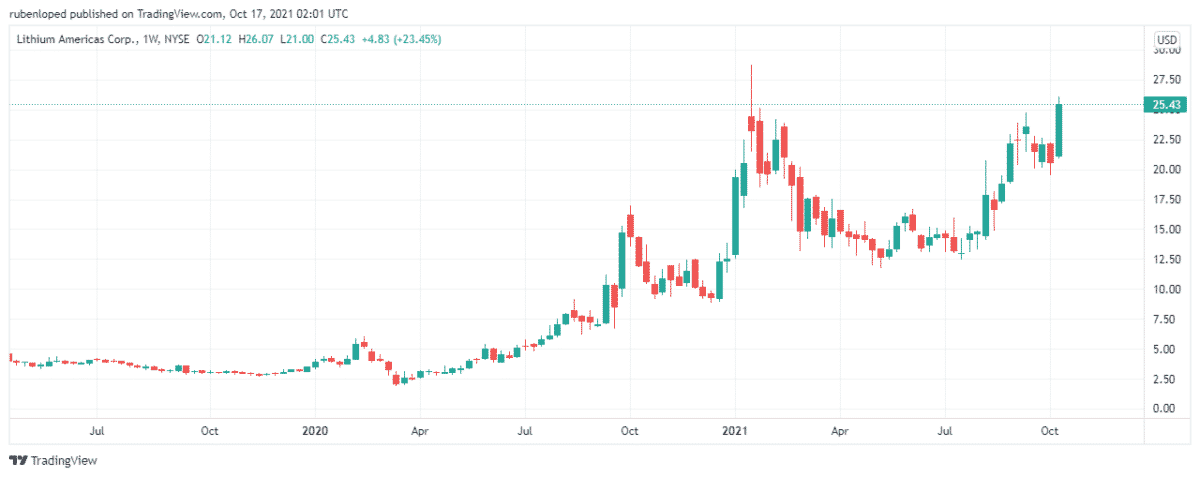

2. Lithium Americas Corp (NYSE: LAC)

Price: $25.43

Lithium Americas is a Lithium company based in Vancouver, Canada, and it currently develops projects for the extraction of Lithium in Thacker Pass, Nevada, and Caucharí-Olaroz, Argentina. The operations in Argentina will start in 2022.

The company has seen the price of its stocks increase quickly since the beginning of 2020. Today, the stock price is 747% more than the price it had in January 2020. In addition, the company recently released an update for its investors and the public where it presented its financial data for the last quarter and 2020. After the release of these documents, investors could confirm the financial shape of the company.

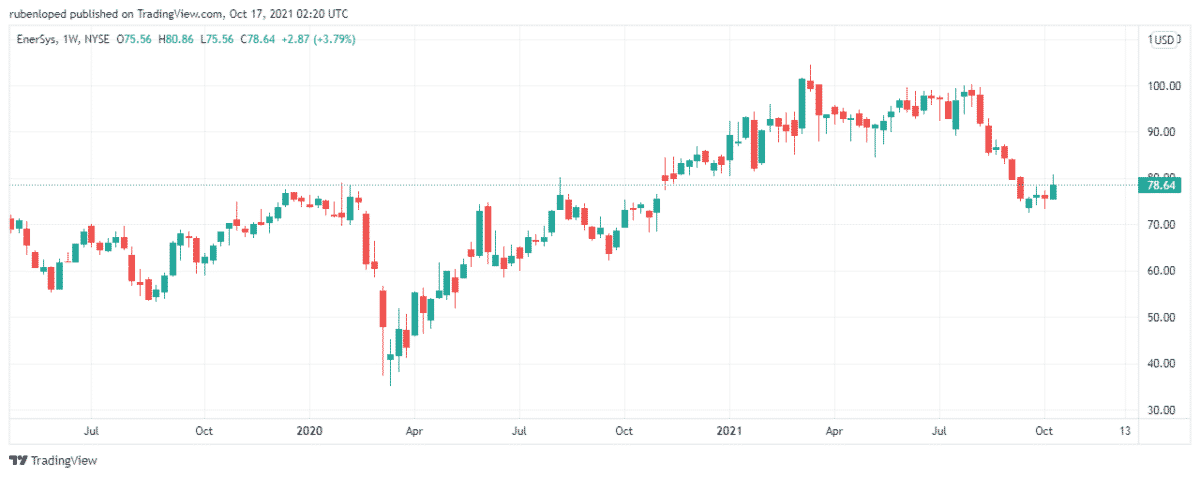

3. EnerSys (NYSE: ENS)

Price: $78.64

The company engages in stored energy solutions for all kinds of industrial purposes. The motive power segment to which the company is focused provides batteries and chargers for electric vehicles. The company also engages in the segments of Energy Systems, where it provides energy distribution and storage used in telecommunications.

The company produces reserve power batteries under many brands with a presence in more than 100 worldwide.

Since April 2020, the company’s stocks have been rising to the levels we see today and even surpassing $100 per share in March of this year. Since the low of March 2020, the stock price has risen 96%

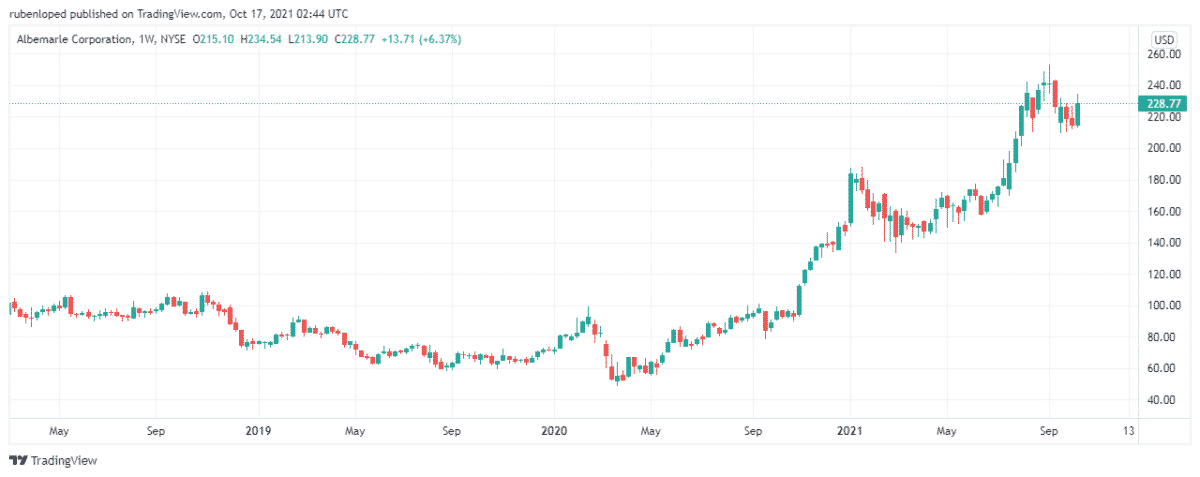

4. Albemarle Corporation (NYSE: ALB)

Price: $228.77

Albemarle Corporation is a chemical company that engages in the development and manufacturing of solutions for electronic devices. It focuses on Lithium, Bromine Specialties, and Catalysts solutions, and it claims to be one of the biggest Lithium battery producers on the planet. The batteries are mainly for electric vehicles, but the company also makes products for electronic devices and communications.

The price per share has been up-trending since the beginning of the pandemic, so Albermarle Corp. is an example of how the market expects Lithium battery producers to perform. The current price level of Albermarle stocks is now five times what it was before the beginning of the pandemic.

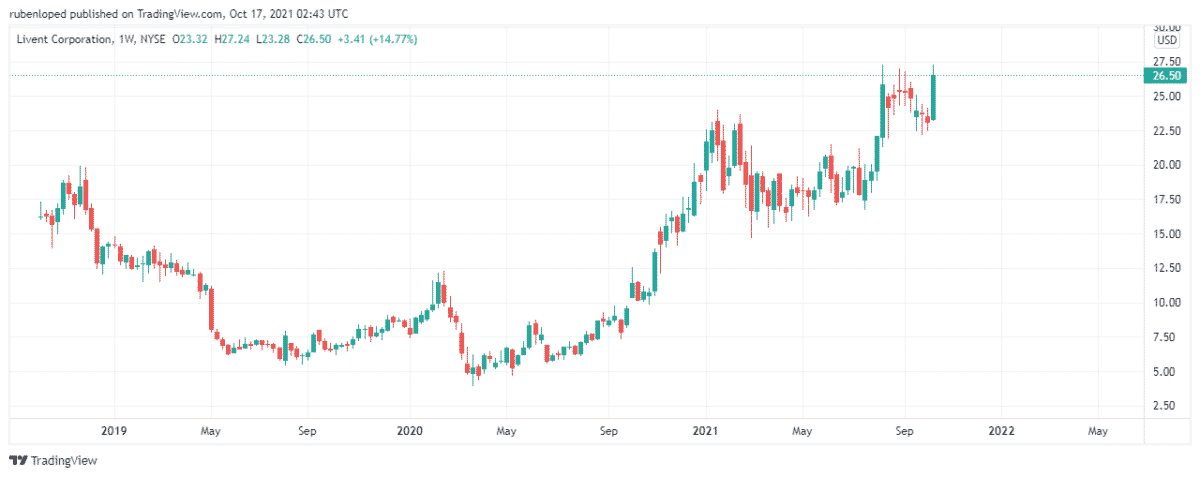

5. Linvet (NYSE: LTHM)

Price: $26.50

This is a company dedicated to the production of lithium compounds. It is a company that operates in North America, Europe, the Middle East, Africa, Latin America, Asia. The young company was founded in 2018. Since then, its stock price did nothing to fall until the 2020 election when Joe Biden won the presidency. Then, investors renewed their expectation for the government to boost the renewable energy sector.

Linvet currently has a contract with Tesla that expires by the end of 2021. However, Linvet executives say they are working in a long association with Tesla. If this happens, the investors will be glad to buy the company shares, and the price may skyrocket.

Final thoughts

Lithium stocks have already captured the market of electronic devices. Still, with the growth of the Electric Vehicle industry, the demand for the ore will reach all-time highs, and most experts doubt that the industry can cover the demand. This sector is just starting to develop, and it’s a long-term investment, but there is no doubt that it will be profitable over time.