- Is it safe to invest in options?

- How can you lose money on such an investment?

- Can you lose more than you invest with options?

Options exchanging offers the possibility of making money regardless of whether stocks go up, down, or sideways. Using these strategies, you can control large portions of stock while cutting losses, protecting gains, and spending relatively little.

With options trading, you can lose more money than you invest. Isn’t that wonderful?

Buying a stock outright is not the same as trading options. But, trading securities can result in losses greater than your initial investment within a short period. The lowest that a stock price can plummet is zero, and therefore the amount you paid for the stock will be the maximum you can lose.

Futures trades can result in you losing more than your initial investment, depending on which type of deal you are taking part in. This is why you need to proceed cautiously. Even experienced investors can lose money if they misjudge an opportunity. If you are interested in finding out possibilities of losses with this type of trading activity, reading on you will find out everything you need to know.

Can I lose money on a call option?

The possibility of losing the entire investment in call securities is 100%. You run the risk of losing money if the stock drops and your option expires. The trader might not profit from the contract even though it is in the money at expiration in some cases.

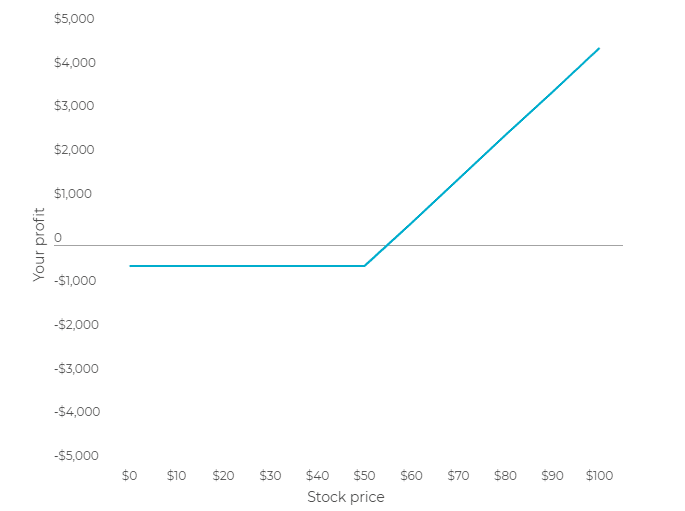

Let’s look at an example. Company ABC’s stock is priced at $50 per share. You can buy $50 calls for a $5 premium that will expire in six months. It costs $500 to buy a hundred shares under a call contract. As one contract represents 100 shares, a $1 rise in the stock price above the strike price increases the call’s value by $100. Thus, $5 premium x 100 shares.

The breakeven point, in this case, is $55 per share — the point at which the stock starts to make money. In this case, $50 is the strike price, while $5 is the cost of the call. Thus, stocks exchanging between $50 and $55 would recoup some of the investor’s initial investment, but this would not result in a net profit.

An option that goes below its strike price is worthless since it’s out of the money. Once the futures value flattens, an investor can incur a maximum loss of $500.

What is the max loss on a call investment?

The maximum loss on a call options strategy is limited to the difference between the price paid for the stock and the premium received for the call strategy sold.

Formula to calculate loss

Maximum loss per contract = entry price – option premium received.

Take, for example, the case of you own 100 shares of TUV for $10 each. In six months, you believe revenue will reach $15, and you will be willing to sell the stock at $12. Let’s assume you are selling one TUV call spread with a strike price of $12, which expires in six months, for $300 per contract.

In the hours before the expiration of the call option contract, TUV announces it is filing for bankruptcy, resulting in the stock price going to zero on the day of the expiration. If you held the long call option contract, you would lose $1,000. Due to the $300 premium you received, your loss is $700, i.e., $1000-$300.

Buying puts: how much can you lose?

In the case of a substantial decline in the stock, buying puts offers more profit potential than shorting it. If the stock does not decline below the strike price by expiration, the entire put buyer’s investment can be lost, but the loss is limited to the original investment.

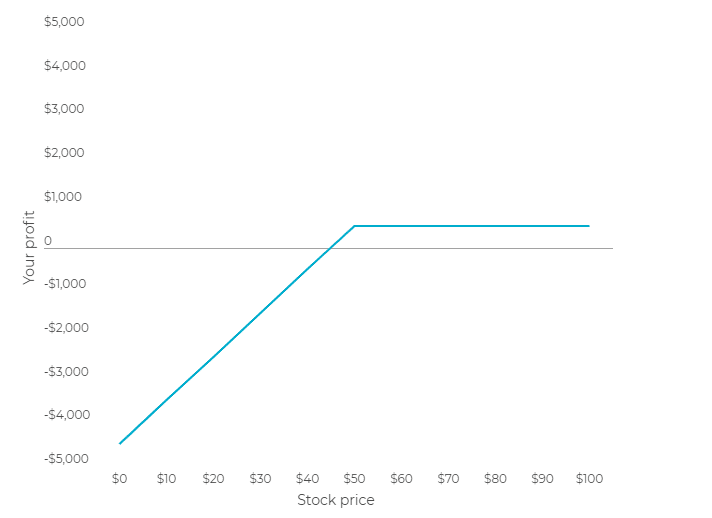

Let’s look at the example. Company XYZ’s share price is $50. The strikes for these puts are $50, and they expire in six months. Each put contract costs $500 in total ($5 premium x 100 shares).

Sellers of puts have little upside and a large downside compared to buyers. The maximum that the put seller can receive is $500, but if the buyer exercises the put agreement, they must purchase 100 shares at the strike price.

The potential loss is the entire stock value when the underlying stock price drops to zero. For example, according to the graph, the put seller could lose $5,000 if the underlying stock dropped to zero ($50 strike price paid x 100 shares).

Is option trading is a gambling or real money-making?

The business of options is often considered to be similar to gambling by some people. All it takes is a lucky break to get a good trade. However, it’s more than just pressing the higher or lower button when selling this derivative’s type.

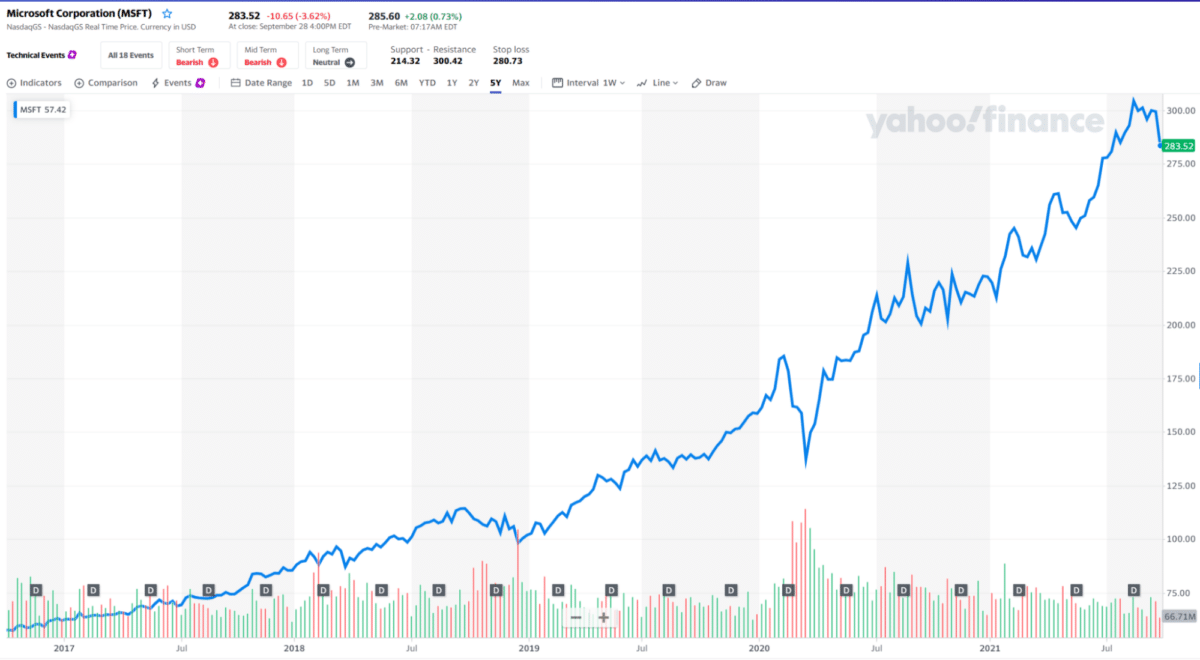

Let’s suppose Microsoft is trading at 305 for $1.50, and it has four days to expire. At the date of expiration, if the MSFT doesn’t close above 305, you will lose your entire premium, i.e., $150 per call purchased. So, it depends on luck whether you will be able to earn a profit or not.

Which option strategy can bring the most significant profit?

The most profitable of them are put and call options that are out of the money. The benefit of this investing strategy is that you can accumulate large amounts of premium while at the same time reducing your risks. It is estimated that traders using this strategy can make a 40% annual return.

You have a higher probability of profit when you sell futures premium. On the other hand, purchasing and selling a stock or options is much riskier than selling an option premium.

Why won’t win-win schemes help you?

Some investors try to cheat the system and use schemes that will allow them to make money. There are many such schemes, but more often than others, three are used: the Martingale method, price lock, and ready-made signals. In theory, each scenario looks like a win-win, but it leads to a loss of money in the account.

Martingale method

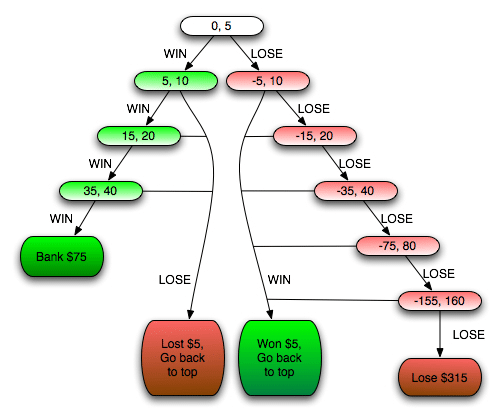

It is an increase in the bet after each loss. If a trader loses, he should recapture the lost money with the successive win and get the profit he expected. For example, a trader bets $100 with a yield of 80% — that is, if he wins, he will receive $80 on top. Let’s focus on these $80 — the trader needs to win them. What happens next?

If the first bet loses, the trader needs to win $80 with the second bet and recoup the costs of the first bet. That is, you need to bet so much to win $180. With a yield of 80%, you need to bet $225.

If the second bet is also lost, the trader needs to win $80 with the third bet and recoup what was spent on the first two bets: $100 and $225. In total, you need to win $405 — that is, bet $506.

And so on until the bet wins. Once the bet wins, the trader recoups all his expenses and earns $80 on top. You can start dancing over again.

It will be possible to make money on Martingale bets only if the trader has unlimited money. For example, if the trader from the model above loses five times in a row, he will need a total deposit of $10,299.71 to recoup his expenses on the sixth bet and earn $80. But it’s not a fact that the sixth bet will work in his favor.

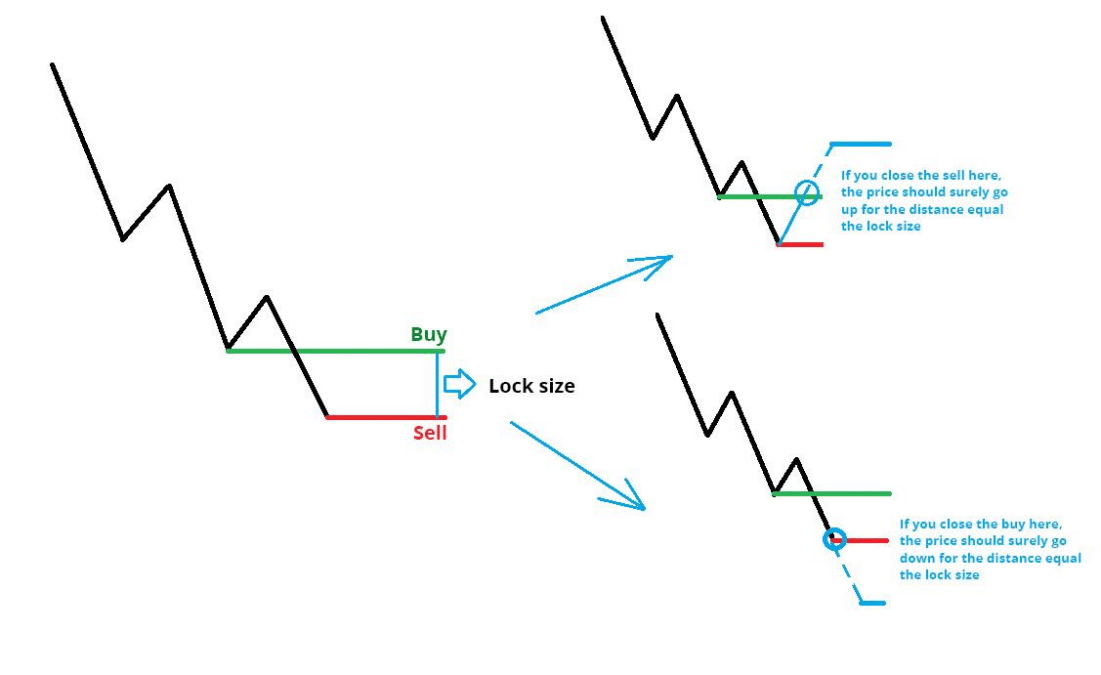

A price lock

It is the opening of two opposite trades on the same asset with the same rate and yield. It works like this. The trader selects an asset and opens two deals of $100 each:

- One for an increase.

- Second for a decrease.

When the price changes, the trader finds himself in such a situation: one deal brings $80 in profit and the second $100 in a loss.

The user leaves the deal that is more likely to win and earns $80 on it. The trader closes the second deal ahead of schedule — the broker will return from $10 to $ 80 out of the $100 put.

A perfectly worked out price lock gives the following result: a won trade will bring $180; a lost but pre-closed trade will get $80. Total on the account $260 with $200 investment, $60 net profit.

But this tactic has its problems: the broker does not always make it profitable to close an early deal. And the dynamics can change dramatically, and the deal that the trader closed ahead of time will win.

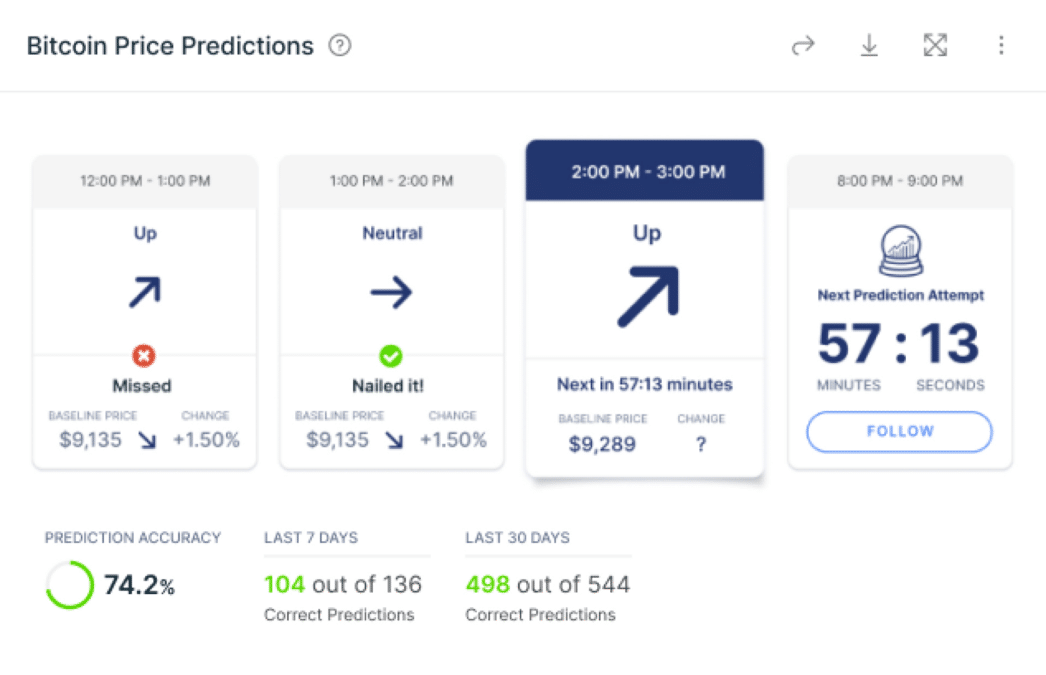

Predictions and signals

They are paid services that give binary predictions. It works like this: a trader subscribes to a service that promises to provide accurate forecasts. The service sends a signal: such an asset will now grow. The user opens a deal and earns.

The signal services often do not provide inside information and do not provide legal guarantees that the predictions made will be profitable. Subscribers do not have the opportunity to check the qualifications of traders and evaluate the quality of the strategy based on which each forecast is generated.

Since it is impossible to verify the signal source, there is no guarantee that these signals will work under unfavorable expectation conditions. If there are no guarantees, then the trader will have to rely on luck. Luck with negative expectation means 50% of exact trades, a leaked deposit, and a vain paid subscription.

Final thoughts

Options trading can be an excellent way to diversify your portfolio, reduce risk, and generate profits — if you execute it correctly. However, you should never forget that no trade is free of risk, and the options market can result in significant losses if you’re not careful.