- Are options better than stocks?

- How to trade options and stocks?

- Why is trading stocks better than options?

Options trading and stocks trading are different ways in which a market participant can profit from the prices of the assets.

Stocks are more straightforward assets in which their owner earns money when the price rises and losses when it falls. Meanwhile, options trading is more complex because it offers different ways of money-making.

By mastering any of these markets, traders can earn money. Of course, it depends on what is suitable for a trader. To find out which one suits you better, let’s talk about the principles of these markets.

What are stocks?

In simple words, stocks are a way to build wealth. They are an investment that means you own a share in the company that issued the stock.

Companies sell stocks to allow a private investor to participate in the corporation. They make it with a primary goal — to get funds. Once a corporation sells stocks, the buyer owns shares of this company.

According to the company’s performance, the stocks can go up or down. Some of them give dividends to the owner of the stocks. But usually, a trader or investor takes the money back by selling his shares.

What are the options?

They are a derivative instrument through which the option’s owner earns the right to buy or sell the underlying asset. Note, the right, but not the obligation. So, it is a contract with expiration through which the buyer can exercise the right to buy/sell an asset if the condition or price is met.

If the asset reaches a certain price level, it triggers the right of the buyer to trade the underlying asset to the seller of the option.

Similarities

Stocks were invented to invest in companies, and options were meant to hedge investments. However, the truth is that you can trade both. As a result, market participants can make money without caring about the long-term future of the assets.

Capped buying risk. When purchasing an option, the maximum risk you take is the amount invested on the premium. While buying a stock, you could only lose the amount of money you invested in the stocks.

Differences

The ways of profiting in the stock market are always through increasing the price of the shares. Meanwhile, you can make money even when the underlying stays at the same level or even falls with options.

The price of the stock depends on itself, the performance of the company. On the other hand, the value of an option depends on the underlying value and not the option itself.

How to trade stocks?

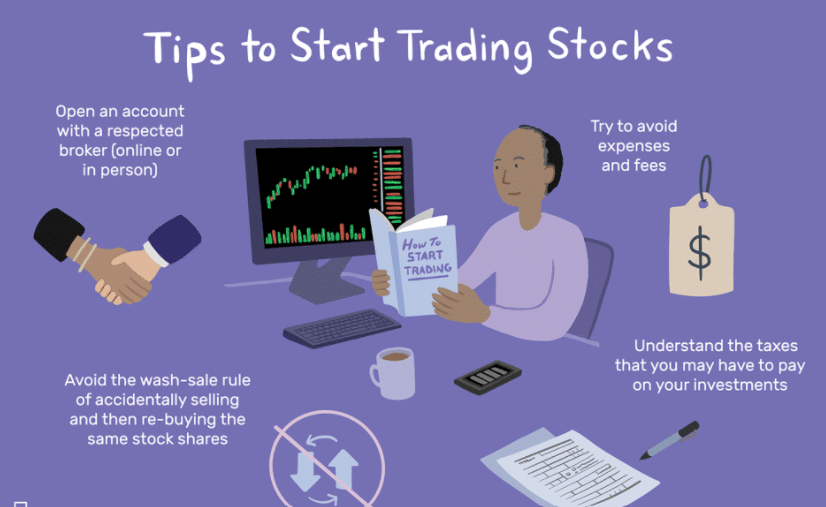

Trading is an attractive activity, but the truth is that it is also risky. There are some steps you should make correctly to trade stocks:

- Select your broker

- Set a limit to trade

- Use limit orders

- Use demo accounts

- Stick to a strategy

If you follow these recommendations, your chances of being a successful trader will increase. But beyond that, trading stocks requires being very aware of the market developments. To trade, you need to have a strategy that allows you to avoid emotions and make systematic operations that will make you profitable.

Bullish trades

There are many ways in which you could trade a bullish trend. Of course, it depends on your strategy, but in any case, looking at support and resistance levels is a great option.

Where to enter?

First, you need to confirm that the trend is bullish. So you have to watch the chart and draw one line connecting the lows of the price and another connecting the highs of the price. If you see higher lows and higher highs, that’s a bullish trend. You should enter once the price touches the support line for the third time.

Where to put your stop-loss?

It depends on your risk tolerance. For a risk ratio of 5:1, you should put your stops-loss 25% below the amount invested.

Where to put the take-profit?

The take profit should be at the resistance level.

Bearish trades

To identify a bearish trend, you need to find the support and resistance level and see lower highs and lower lows.

Where to enter?

You should enter the trade once the price touches the support level for the third time.

Where to put your stop-loss?

The stop-loss depends on the trader’s risk tolerance. For a stock price of $100 and 25% risk, the stop-loss should be at $75.

Where to put the take-profit?

The take profit should also be at the resistance level, indicated by the line connecting the highs in the trend.

How to trade options?

As a derivatives equity, the price of the options depends on the cost of the underlying assets. So it’s better to look at the behavior of the assets first.

Bullish trade setup

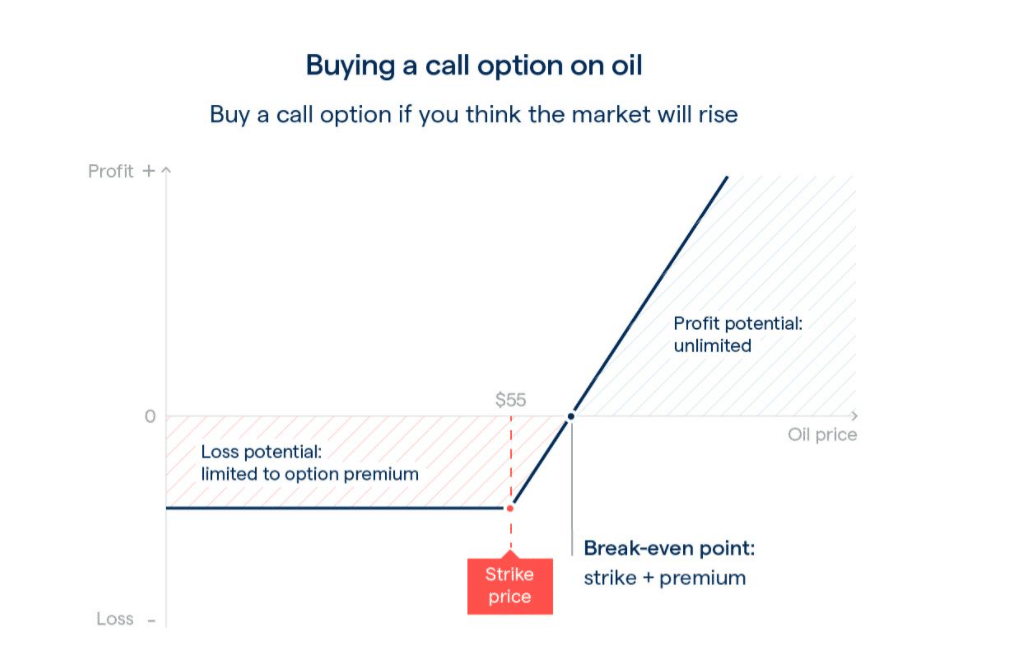

If the assets are on a bullish trade, a simple setup is to buy a call option.

Where to enter?

It would help make sure the trend is bullish by looking at higher lows and highs. You should enter the trade once the price touches the support line for the third time. The chart you use to identify the trend depends on the expiration period of the option.

Where to put the stop-loss?

Again, the stop-loss depends on your risk tolerance. With options trading, you are in a race against time and the price of the underlying. However, both factors are reflected in the price of the option.

Where to take profit?

Once reached the strike price, the price of the option can rise to increase our earnings. We should have a target on our earnings to know when to leave the trade. However, the price can rise even further, and we would miss that profit. To lock our profits and still keep winning, traders sell part of their options at a given level, let’s say 30% above the target. Then traders keep the other part until they consider it profitable.

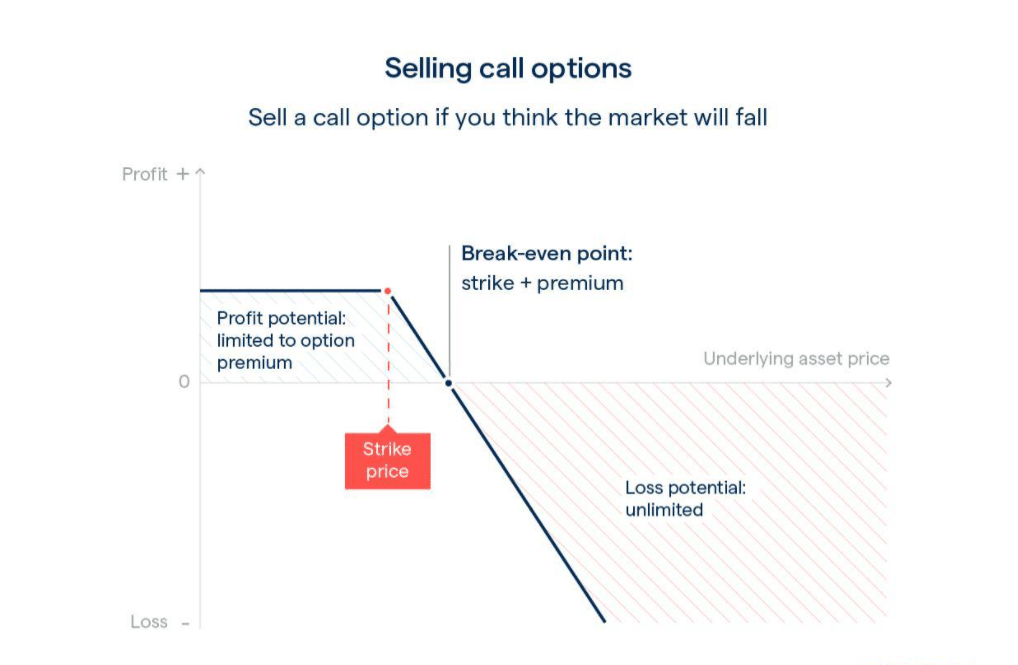

Bearish trade setup

If the assets are on a bearish trade, we could set up and buy a put option.

Where to enter?

You should enter the trade once the price touches the resistance line for the third time since you are betting on the falling underlying asset price.

Where to put the stop-loss?

Depending on the amount of money you are willing to lose. If you decide that you are not willing to risk more than 30%, that’s the level at which you place your stop-loss.

Where to take profit?

Through trailing stops, we could lock our earnings and get more than we initially aimed. For example, if your target is $100, you won’t want to miss that if the option price goes beyond that. A trailing stop at 10% will exit the trade for you if the price reverses 10% from its highest value.

Final thoughts

Both stock and options trading are great options to profit from the market. However, stock trading is a more straightforward system for beginners. In contrast, options trading allows you to benefit in many ways. But the risk can be huge because of leverage, and you need to learn the underlying asset to move to option trading.