Alphi is the flagship program of Lefturn that manages your trading with its tested approach and profitable trade execution. As per the vendor info, this program is not a fully automated system. Instead, it uses a part discretionary approach and part automation. The automation part involves the use of machine learning, algo, and artificial intelligence. Complete protection of customer investment via its efficient trading is the main objective of this program. To check the veracity of the claims, we are doing a complete evaluation of the program including its features, results, trading approach, and more in this review.

Alphi company profile

Alphi is part of Lefturn Inc., a company with headquarters in the Bahamas. It also has an office in Ontario, Canada. A license number and copyright from 2017 up to 2021 are present on the official site. As per the info found in the About Us section, the company was founded in 2017. The team members consist of professionals in different fields like computer science, physics, mathematics, statistics, finance, and more. We could not find further info on the team members like their experience and other credentials.

The highlights of Alphi

According to the vendor, the key objective of the company is to lower risk in any market situation. To ensure this a combination of fundamental and technical analyses are used along with a hedging approach for added protection. Trading activities are stopped during major market events that cause high-risk exposure.

Some of the key highlights the vendor concentrates on for this program include:

- A low drawdown of 10% and an average monthly return of 9% to 12%.

- Works on all major currency pairs.

- A minimum investment of $3000 and a recommended capital of $25000.

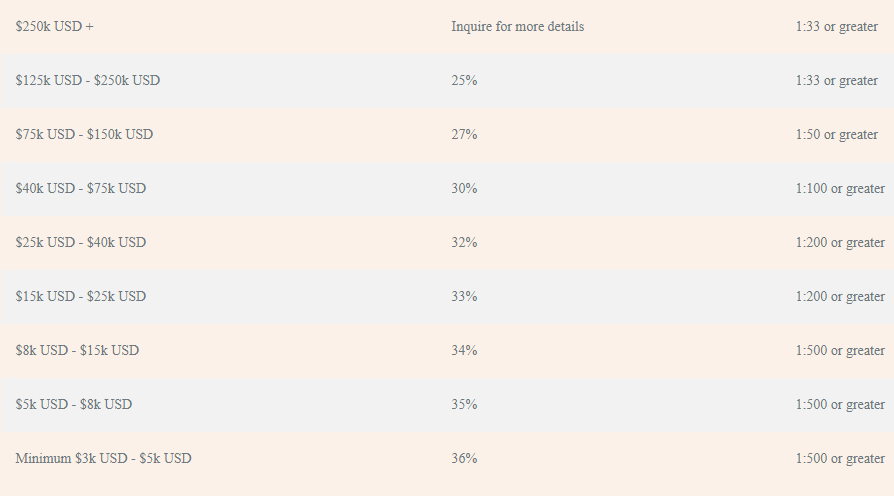

For use of brokers, the vendor leaves the choice to the user but also provides a list of recommended brokers like LMFX, FBS, and more. The leverage needed is based on the investment amount and starts from 1:500 for a minimum of $3000 investment up to 1:33 or higher leverage for investment over $250,000.

Facts & figures with Alphi

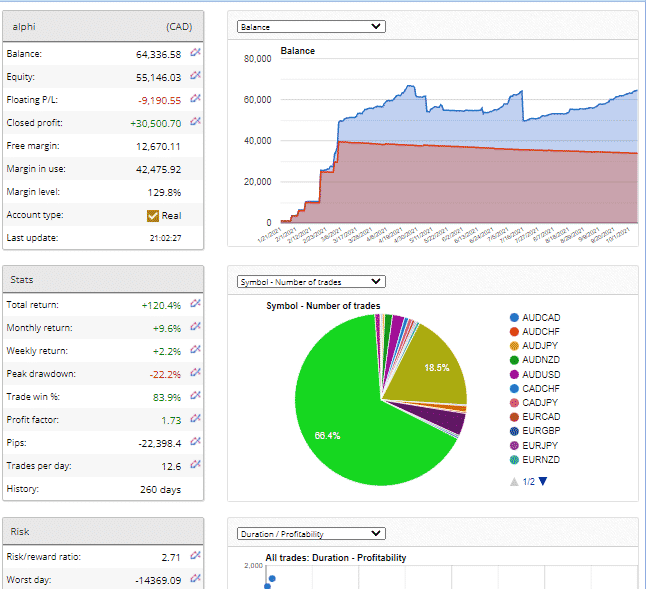

A live trading result verified by the FXBlue site is provided by the vendor. Here is a screenshot of the trading statement.

From the above screenshot, the real CAD account started in January with net deposits of $1000 shows a closed profit of CAD 30,500.70. The total profits generated is 120.4% and the weekly and monthly profits for the account are 2.2% and 9.6% respectively. A peak drawdown of 22.2% is present with 83.9% profitability and a profit factor value of 1.73. The risk/reward ratio is 2.71. From the results, we can see the drawdown is high and profits are not sufficient considering the trading history of 260 days. Further, the high risk/reward ratio also indicates a risky approach that can end in losing your account. No backtests are present for the account so we are unable to compare the results.

Alphi packages

A performance fee is charged instead of a subscription package or a license fee. Based on the amount you invest the fee percentage differs. For instance, an investment of up to $5,000 carries a fee of 36% and it reduces as the investment amount increases. For an investment of $125,000 to $250,000, the fee is 25%. We could not find a refund policy which makes us suspect the company is not reliable.

Assistance

For customer support, the vendor provides phone numbers for its offices in the Bahamas and Canada. Besides an FAQ section, there is an online contact form for users to put forth their queries and concerns.

Other notes

Alphi was earlier named AVIA, a program with a more discretionary and less automation approach. The change of the brand name, features, and other aspects is probably because AVIA showed poor performance. On further checking of the ‘Who is domain’ tool, we find that the changes have been added in September 2021 with the new trading account uploaded on October 5, 2021. Since the changes are recent, no user reviews are present as of now.

Is Alphi a profitable bet in 2021?

No, it is not. Albeit the changes made to the program and renaming it, we find that this managed FX account feature is of the high-risk category. Our reasons include:

- A high drawdown in the real trading results.

- Low profits and high risk/reward ratio indicating a high-risk approach.