- Is forex riskier than options?

- Do options or forex make more money?

- Options vs. forex — what is the best choice?

All the markets like FX and options allow you to start trading effortlessly and quickly. These are quicker ways to make money if you play wisely.

The most excellent trader, George Soros, sealed his success as a substantial investment by earning £1 billion from a minimum position in pound sterling. So, if you want to become a successful trader, the first step is to choose the best trading market for yourself.

You must have heard about two well-known markets for trading. Also, you have been exposed to many rumors about the unsuccessful stories of both mentioned markets. If you are confused in deciding between forex and options trading, we have addressed the facts about both.

So let’s look at choosing the best for you according to your trading aptitude and desires.

Options vs. forex

The options are well known for trading multiple instruments, while the forex is an overall currency market or a typical foreign exchange. Both markets can potentially secure significant profits. It depends on the trader how much he is willing to risk to secure maximum gains. Still, to find the most appropriate one, let’s define the fundamental differences among both.

Fundamental differences

Trading with instruments, you are investing in contracts which can be ETFs, index products, and stocks. But when you are purchasing an option, you are paying a premium that enables you to trade in a market at a fixed cost before the time of the contract’s expiry. The currency trade is mostly in pairs in which a trader exploits the inefficiencies between two base currencies like USD and EUR. In contrast, FX trading allows you to secure profit with fluctuating currency rate conversion.

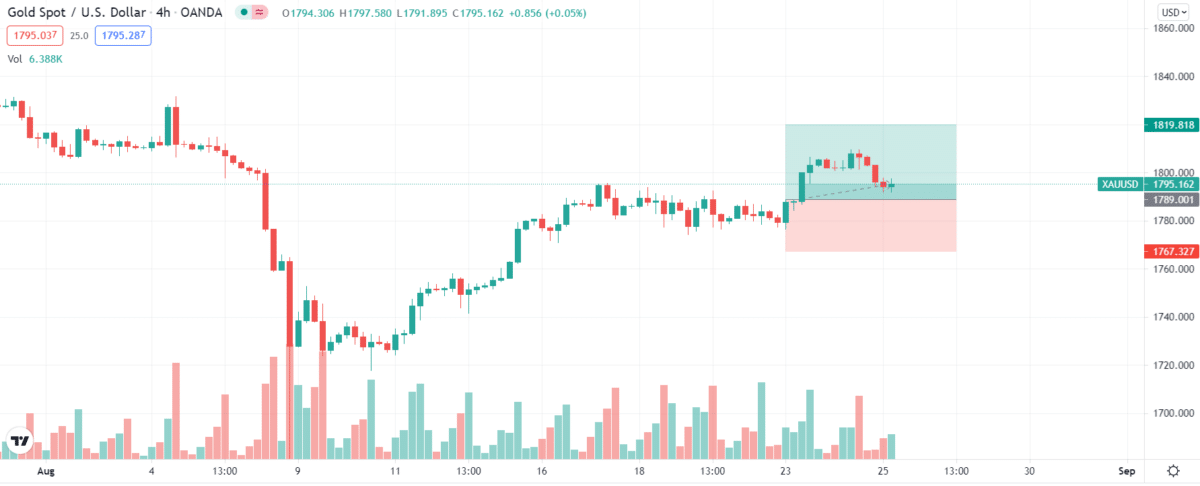

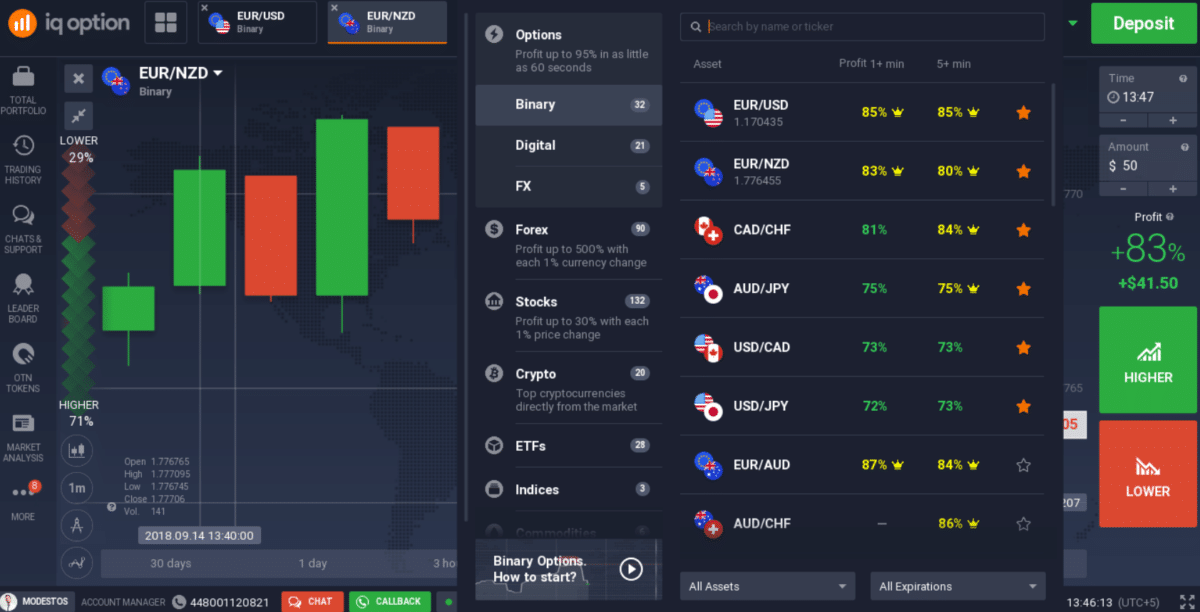

Suppose you are an options trader, and the call contract allows you to purchase gold for $100 for the next three days. If the price of gold rises during the specified time limit, you will end up making a profit of $85 (up to 85% of your contract size). Read on to find out various characteristics of both investment opportunities, i.e., FX and options.

On the other hand, if you trade gold in the FX market, the market price must rise above your buying price to let you make a profit. The more the price rises, the more you earn. There is no contract expiry, and you can hold the position for as long as you can.

Access to the market

The forex market is accessible all the time for traders, and it is the famous term of this platform. It is known that the FX market is open 24/5. The weekend markets are also technically open. But, most of the traders forgo trading at weekends. In comparison to that, option contract trading is linked to the stock market. So mainly, the trading hours are tied from 9:00 am to 4:30 pm.

The traders of instrumental markets get mentally switched off. On the other hand, restricted timing has a positive factor in that savvy investors are prohibited from entering the market at any event and unexpected announcement. So, FX is accessible, but options are secure in odd timings and could save investments of many traders.

Quick trades

Forex took distinction over optional contracts with its quick trades. Everything in the FX market is speedy, and anything is expected to happen in minutes or even seconds. So you can trade straight away with active trade executions.

It is the opposite of options trading, where a contract must expire to let you win or lose money. However, you may trade a 1-minute contract as well. Mostly you have to wait for days, weeks or months according to your contract. You will receive your order at a specified amount without taking any stress of slippage. For example, trading an ETF with a warranty of two weeks has to wait two weeks, which creates more stress than active trading with the FX market.

Commissions

Before choosing options trading, one must keep in mind that you have to pay commission to the broker to initiate a trade.

For example, if a contract call’s broker charges $20 as a commission and you have only $1000 to invest. Thus, 2% of your investment already ends up as commission when you initiate your contract.

But with forex, you are trading at a marketplace that is dealt with via traders and computers. So, FX trading is commission-free with most brokers. Still, you are paying the companies in the form of spreads. So, if the FX trading model is receiving money in that form, you will end up paying a little higher than the base currency rate.

Risk management

When you talk about a better investment platform in terms of risk management, it depends upon which skill you have as a trader to minimize risk. The FX platform allows you to use automated software that creates margin calls for you. That’s how you can keep checks on your losses, thus reducing risk to a certain level.

With forex, you have to determine the time interval between trades. Meanwhile, with options, all you have a specified time in contract in which you have to trade before options expire. However, you are prone to lose on the amount risked in a contract.

Leverage

While investing in FX trading, the leverage level should be increased 50-400 times the capital value. In contrast, the leverage with options trading is relatively more minor. So, forex allows its traders to get maximum profits in a short interval of time with little upfront investment. Still, traders should deal with the leveraged products carefully to avoid disastrous results. The critical point in the FX market is to invest in small and increase leverage positions progressively.

Investment feasibility

Options trading is a good investment platform to choose from if you have a lot of risk appetite and investment at the beginning. But if you have only a limited amount to invest, you will always choose forex.

For example, many FX brokers have a minimum deposit of just $25. Also, many of these platforms provide free bonus and demo accounts to facilitate users.

Final thoughts

If you want more volatility, strike price, and premium contracts, then options could be a better market. But, forex is a better choice for essential things like risk management, leverage, commissions, and quicker trade. The global activity and 24/5 availability are a problem for some traders as some want to avoid unexpected changes in the market.

But, FX traders are somehow more lucrative, exciting, and risk aversive. It is best for those who want to earn much profit quickly as you can earn by leverage without huge investments. So, positively forex proved itself as a growing and leading investment platform from the above-given facts.