- What is trading psychology?

- Four main feelings to control while trading forex?

- How do greed, fear, hope, and anger affect your trading?

Assuming you are a beginner or an advanced forex trader and are very good at technical or fundamental analysis. You make a profit, but somehow you cannot keep it as your profit; instead, you make some mistakes and miss the profit and loss in the end.

If yes, this must have been a weird situation for you, ending up in loss even after your analysis is right many times.

Now have you ever thought about why it happens? If yes, then we have an answer for you. The whole scenario here points straight toward one trading segment called “trading psychology.”

Moving forward, if you want to know how trading psychology works and how you can manage your emotions and profit from FX and any other market, this is the article for you.

What is trading psychology?

The biggest problem with most traders is that they directly jump into trading, downloading the terminals, MT4 or MT5, and placing a trade in a real account.

But actually, all these are not the first steps when it comes to trading. The primary thing to do is learn the fundamentals, and by that, we mean trading emotions.

Trading psychology is about traders’ intellect and managing their emotions, feelings, thought processes, and trading decisions. By this definition, it simply means you will do much better and will be profitable if you have a strong mind that knows when to do what according to the scenario.

Even though psychological motives are personal and different for specific traders, some generic emotions are the same for every trader worldwide. We will be looking into the most important feelings in the below section.

Four main emotions to control while trading forex

Let’s talk about four main feelings that you must keep in check before trading.

Greed

You would have experienced this emotion many times; greed is the primary reason traders lose even a winning trade. Greed comes when a trader becomes overconfident and wants to make more profit or only trades to make big profits.

Suppose you open the buy position during intraday trade in FX, and after some time, you look into the profit as your analysis went right. Now you realize a resistance, here according to the logic, you would have exited the trade. But if sometimes you keep the trade running assuming to make more profit.

Let’s look at the example.

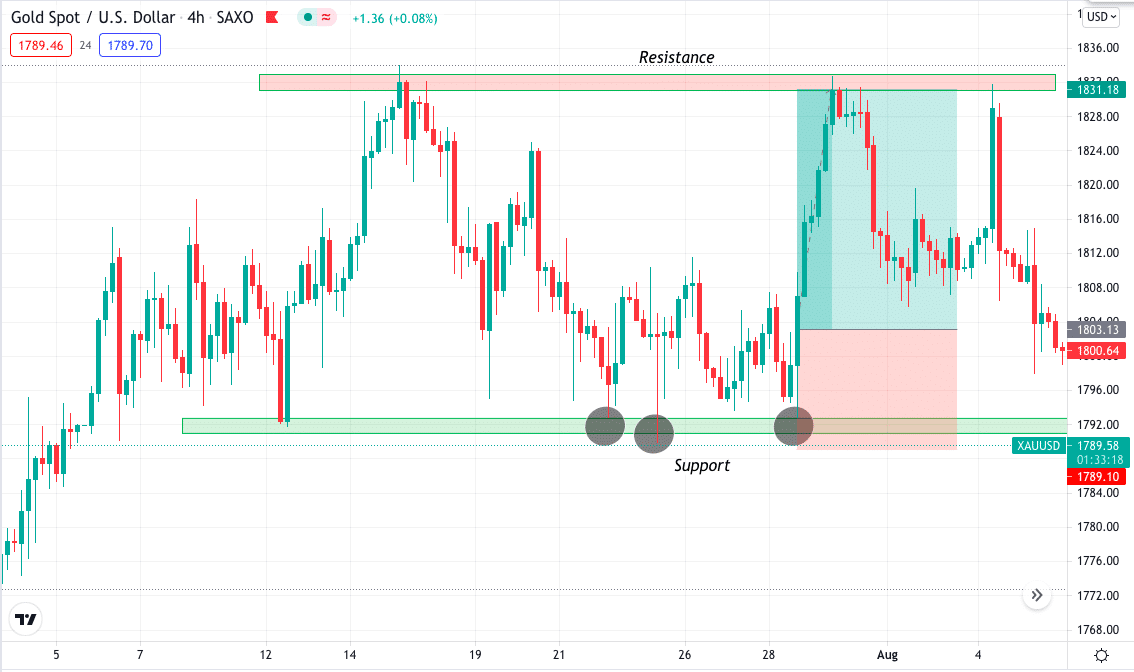

The XAU/USD example below shows an excellent trade buy set up giving you a 1:2 risk to reward. Hereafter, three touches on the support if you would have traded for long on XAU/USD, you would have been in profit.

But at the same time, you can see the market went so high. The bullish candles seem so strong would have given you a feeling to hold it further as the price would break the resistance. But then you can see the market fell drastically, giving you a loss even though you were in profit in the beginning.

If you find yourself in this position, you must seriously consider controlling yourself and not become overconfident. It would be best if you were not stubborn with your decision.

To control your greed, you must take some action — take your profit once you analyze the market and wait for the price to reach it. If you find the market has to go up, you can jump into the trade anytime.

Anger

Once you lose a trade, you put another and another, just chasing the trade one after the other. This usually happens when you’re angry and try to take revenge from the market. Anger leads to over-trading, and overtrading in return leads to committing more mistakes that would eventually blow your trading account.

Now, if you are among those who have this issue, you must make sure to control your anger. As we all know, the FX market is the largest volatile market, and it does not wait for anyone. It would help if you always remember, the market does not move the way you want.

To eliminate such a situation, you must not trade when you are angry. Let’s take a loss in your trade; make a rule not to trade that day if you have two consecutive losses. This way, you will not overtrade.

Fear

After you are angry and have lost many trades or even blown your account due to overtrading, you must have been in a place where you would be frightened to take any trades. Even if you had to take it, you would have been impatient due to the fear of previous losses you had.

Due to fear, you sometimes miss the best opportunities in the market. Opportunities that would have fetched you all the money you would have lost in your previous trades.

The best advice you could get here is constantly being neutral when it comes to trading. Even when it is a profit or a loss, treat each trading day the same. Every day is a new day, and you must treat it like that, do not let your previous failure pull you back.

Hope

There is no place for a word such as hope in FX trading. Some traders have a habit of not putting their stop loss while trading; this probably is the biggest mistake.

Keeping hope from the market is very critical. Imagine you have not put stop loss and the market reversed, giving you a failure. In this situation, as a professional trader, the first thing you should do is cut your losses as soon as you feel your analysis is wrong. Many traders would keep it running and add more positions, hoping the price would reverse again and give them profit. But it does not happen so quickly.

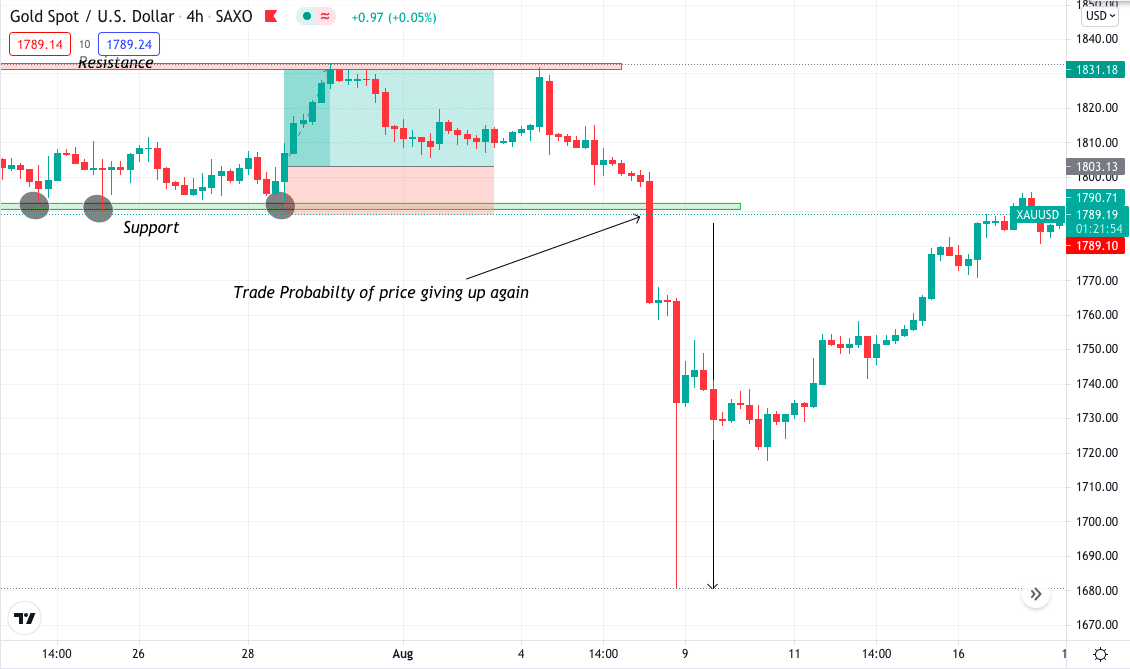

In the above XAU/USD example, you can see, this is the effect of recent NFP news. There are times when every trader will make wrong decisions, and sometimes it’s wrong because of the news.

According to many trades, there would have been a possibility to buy an option when the price reached the support zone. But the NFP news made the USD more robust, and XAU/USD fell drastically. If you ever find yourself in this position, do not hope the market comes down. Always cut your losses and come out of the trade when you know it is a wrong decision.

Final thoughts

As already discussed above, trading psychology is the most vital segment of any form of trading. To reduce the negative effect of emotions, you must understand yourself and how you think.

To be precise, many traders associate their mistakes and losses as a stroke of bad luck, but there is nothing as such. Everything is logical in trading, and winning and losing depends on you and sometimes probability.

Almost 95% of the traders have suffered from not starting their trading career with trading psychology. As the FX market is volatile, one negative news and event is sufficient to wipe out the whole account in minutes.