- Fundamental analysis of the market is how?

- What do you need to know about fundamental analysis?

- How to carry out fundamental analysis in the stock market?

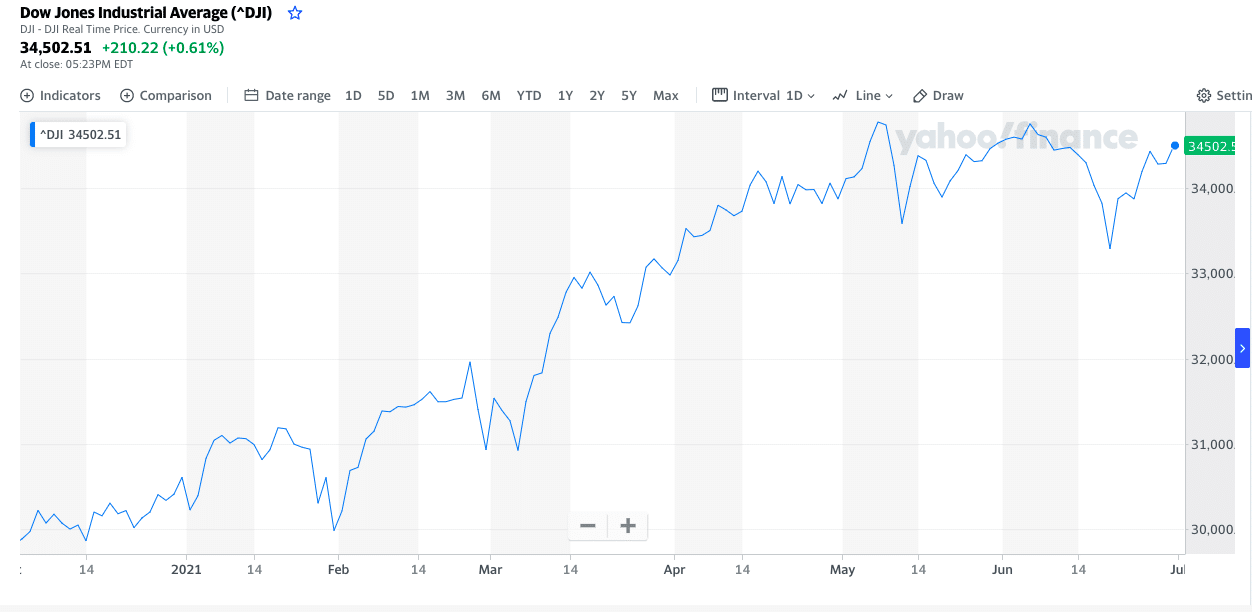

The Dow Jones Industrial Average is the oldest stock index, dating back to 1896. It was a gauge of the health of 12 stocks. Today there are multiple stock indices across the major stock exchanges, representing hundreds of successful companies. With the advancement of trading technology, brokers offer indices as tradable assets.

Many traders find the profitability of index trading alluring, but they fail to master it due to their lack of knowledge. Indices are highly volatile, more so during important news or political events.

To trade indices successfully, you need to understand what influences their price movements. In addition, you need to be aware of the risks involved.

What is fundamental analysis?

Unlike technical analysis, where you have to analyze price charts for patterns and critical levels, the fundamental analysis in trading involves analyzing economic reports.

These reports determine a currency’s intrinsic value, and the release of the data can create high volatility in the market depending on the gravity of the indicator.

There are multiple reports released at different predefined intervals, which gives traders an insight into a country’s economic health.

Examples of economic indicators important to the market are:

- Gross Domestic Product

- Non-farm payrolls

- Consumer price index (inflation)

- Oil inventories

- Federal funds rate (FOMC)

Besides these economic indicators, political and social factors play a role as well.

What are indices?

An index is a group of shares. The value of the index is calculated based on an average weighted price. Therefore, the stock with the highest share price contributes more weight to the index.

Here are a few examples of leading indices.

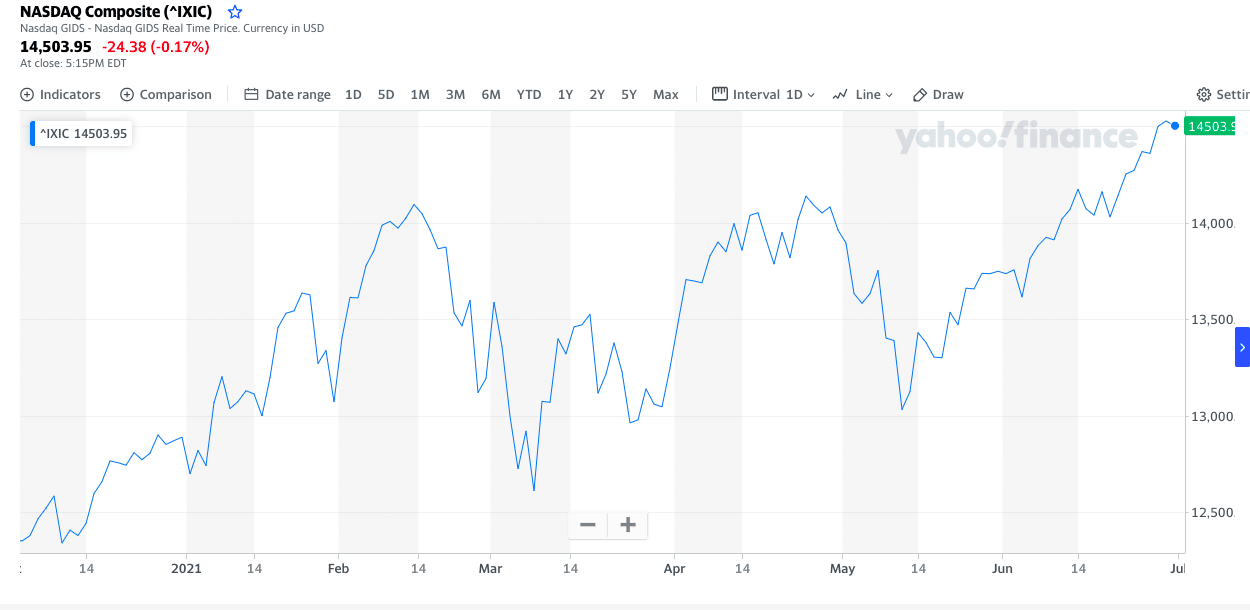

№ 1. Nasdaq100 (US Tech100, US100, NAS100)

Tracks the value of the 100 largest non-financial companies, which lists on the Nasdaq stock exchange.

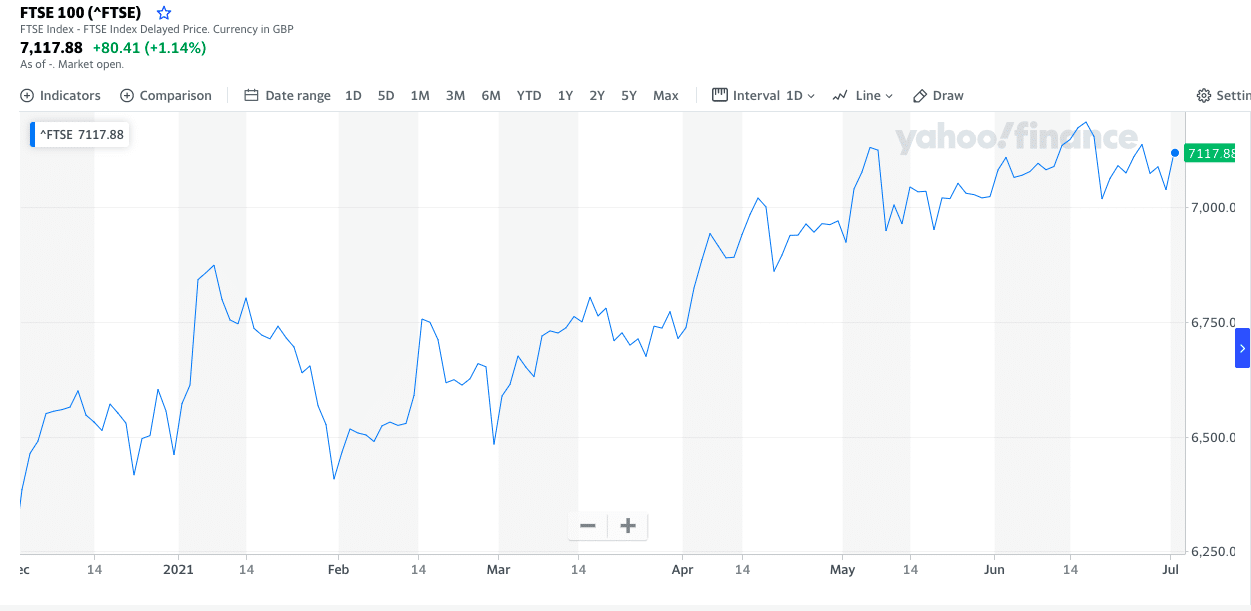

№ 2. FTSE100 (UK100)

The FTSE100 index represents the 100 companies listed on the London Stock Exchange with the highest market capitalization.

№ 3. DAX (GERMAN30)

The DAX tracks the value of the largest 30 companies listed on the Frankfurt Stock Exchange.

№ 4. DJIA (US30, Dow Jones Index)

The DJIA measures the value of top-performing 30 companies listed on US stock exchanges.

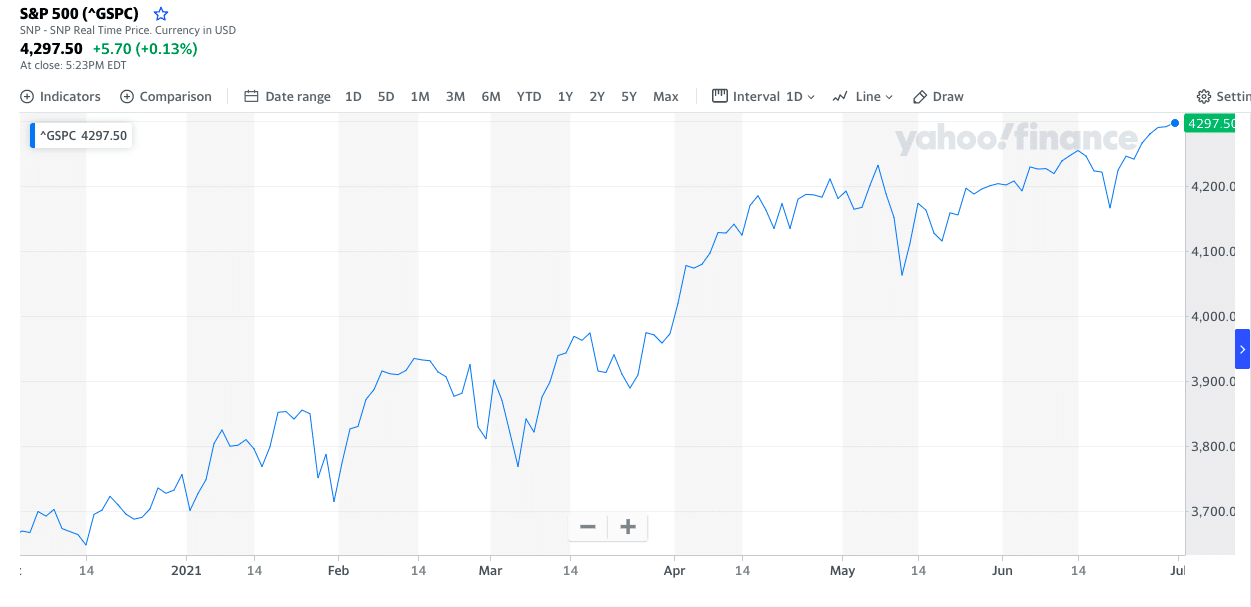

№ 5. S&P500 (US500)

Tracks the performance of the 500 largest companies on US Stock exchanges.

How to trade indices using fundamentals

Indices are highly volatile and require good risk management, and beginner traders should avoid them until they are competent. Whether you apply fundamental or technical analysis, trading indices is not as easy as currencies or commodities.

Before starting to trade indices, you have to determine the significant stocks’ performance in the index as these are one of the primary drivers of the index value.

A good indicator is the stocks earnings report, and this data you can obtain from numerous sources on the internet. The earnings report will show whether that particular company has done well or not for the specific period.

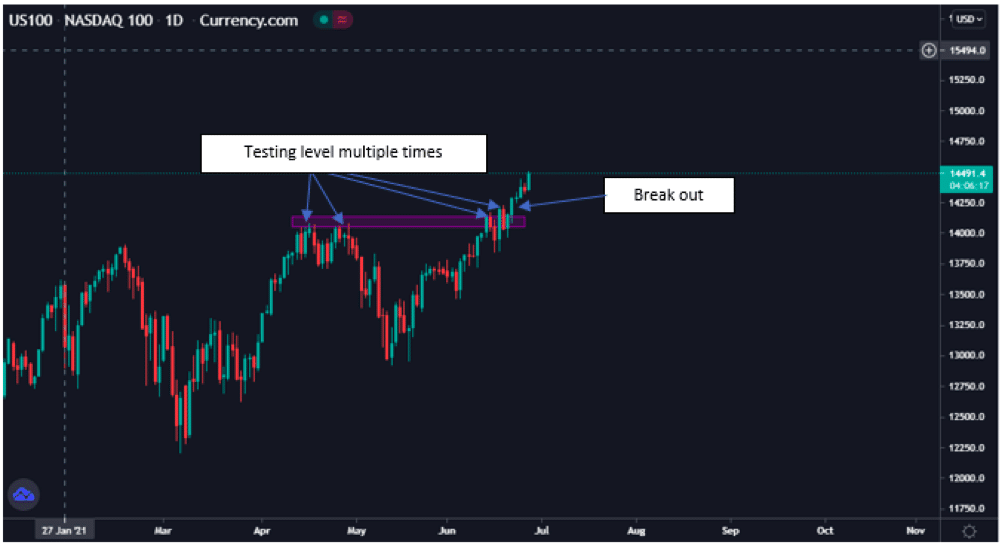

Secondly, you have to keep an eye on the economic calendar, which will indicate high volatility news as this will impact the stock market. Let’s look at an example of how fundamentals affected the Nasdaq100 in June.

From the above chart of the Nasdaq100, we can see it has reached a strong resistance level and failed to break it. However, certain events caused it to break out and move upwards.

Once it broke upwards, it moved further and reached a record high. What has caused the index to break out? Let’s unpack the events that fuelled this breakout.

The main drivers behind the move up came from the information technology sector and some political news:

Nvidia

Nvidia’s semiconductor manufacturers’ shares increased on the day by 4.9%, caused by the support from other companies of its take-over of its arm, a UK-based chip designer.

Tesla

Tesla stocks rose by 2.5%. Tesla is still outperforming the electric vehicle sector even though negative news such as vehicle recalls in China.

Biden’s infrastructure deal agreement

The infrastructure deal is to spend money to improve the country’s roads, repairing bridges, upgrading the water supply, including moving to cleaner energy sources. All these projects will create millions of employment opportunities which is good for the economy and good news for investors.

Nvidia and Tesla are two of the 100 stocks that make up the Nasdaq100 index; as seen, the share price of these stocks increased, which contributed to the index’s value.

These are just a few examples of how economic and political events can influence an index.

What to avoid

It would help if you considered a few important things to avoid when trading indices:

Overleveraging

Excessive leverage can lead to low margin, especially with indices, since the significant pullback in price can cause a high drawdown.

Allowing losses to escalate

Allowing your losses to grow is a mistake many traders make as they believe the trend will go in their favor, and when it’s too late, they blow their accounts. Therefore, applying an excellent risk to reward ratio with a stop loss will help manage your risk correctly.

Ignoring a trading plan

Trading without a plan is a sure way of risking your capital. The key to consistency in trading is to draft a trading plan with clear goals. Sticking to a trading plan is essential as it will help you maintain a trading discipline and prevent making emotional decisions.

Not protecting your profit

Indices rush, and you can easily lose as quickly as you made a profit. Therefore, a tip is to always trail your earnings at least by 30 pips when trading indices.

Final thoughts

Combined with news, as a skilled trader, you will have to apply technical knowledge to make the proper entries and deploy risk management. Just the news alone is not a reason to buy or sell an index.

The fundamental analysis helps to confirm your technical analysis, and you can enter trades with confidence. Keeping a close eye on the news to understand the different influences on the market will help you expand your knowledge and understand macroeconomics and its impact on the markets.