- What is short selling?

- What is a short squeeze?

- Is shorting a stock ever as good as taking a long position?

Throughout the history of trading, investors have taken different approaches to making a profit. The traditional way people invest is by following a long-position strategy.

That means that the investor would buy a security when its price is relatively low. While the investor is holding the security bought, they would reap the benefits of holding, such as yields or dividends. When the security price goes up high enough, the investors will sell it, with the difference in the buying price and the selling price as the profit.

It sounds pretty simple, and it is. The big question that we are trying to answer today is: can we reverse the process? Is it possible to twist the “buy low, sell high” strategy?

Let’s first establish what short selling is and how it works.

What is short selling?

The traditional way of investing is first to buy a security, hold it for a specific time, and sell it when its price is high enough to contribute to the fulfillment of your short-term or long-term investing goal.

While this strategy works on buying low and selling high, short selling or shorting takes the opposite approach. You sell high and buy low. But how can you sell something you don’t own in the first place?

How does it work?

Short sellers are betting that the price of a security will go down. That’s why they borrow a guarantee from a brokerage, sell it in the present at the current price, and repurchase it from the brokerage, hopefully when the price has gone down. This part of investing is known as “covering the short.”

To showcase this via an example, imagine that you borrow a stock worth $100 and sell it at a current price. After the agreed-upon period, the price of the stock has declined to $90. Since the security wasn’t yours, to begin with, you don’t end up with the entire $100 after having covered the short. You will have the $10 difference in the stock’s price.

On the other hand, if the stock price goes up and climbs to $110, you still have to cover the short, this time ending up $10 more inferior. If you look at things a bit more closely, you will see one of the most significant downsides of short selling.

With traditional long selling, you can only lose the amount of money you spend to buy the security but theoretically stand to gain an infinite amount later on. With short selling, the situation is entirely the opposite. In the best-case scenario of our example, you still stand to gain $100, but the security price can go up without limitations, meaning that your losses can also be uncapped.

This brings us to the short squeeze.

What is the short squeeze?

Short squeeze refers to the increase in price that occurs when many short-sellers need to cover their position. It usually happens in two phases. First, the security price goes up for some reason related to how the company is doing.

People who bet against the now see that the price rises and rush to sell and cover their short before the prices soar even higher, making their losses greater. Since higher demand almost always results in steeper prices, the stock price will climb even further.

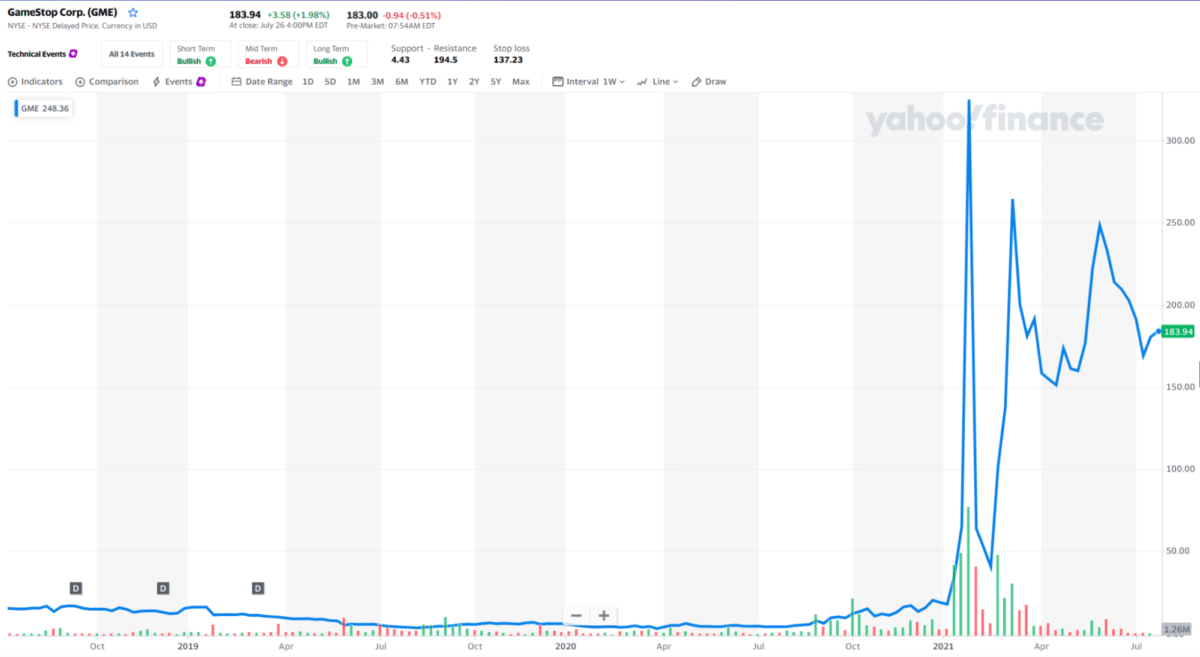

Above is the example of GameStop corporation showing short-sellers covering their positions. As you can see, stock prices are moving up and giving a more significant loss to the investors whose trades are against the price movement, ultimately making the stock price rise. In this case, the so-called retail investors joined forces via a group chat on Reddit, and managed to force the large hedge funds out of their short positions on the stock, making them lose tens of billions in the process.

The extra advice

The secondary surge in price has nothing to do with the underlying features of the stock. It is usually the result of many investors buying simultaneously, creating the illusion of higher demand for security.

Let’s go over this in an example. Imagine you are trying to short-stock a smartphone company. You borrowed and sold $1000 worth of the company’s shares because you predicted that the firm’s new model would not do well in the market against its competition.

However, the company’s rival had to push back the release date of its flagship model a couple of weeks, and the customers seem to like the camera on the smartphone made by the company whose shares you shorted. The price of the company’s stocks will now go higher, with your stake worth $1,400. You will end up losing $400 on the transactions.

The problem is, you were probably not the only one who attempted to make money by shorting said tech firm’s stocks. As more traders realized they would lose money, they rushed to buy back the stock they shorted at an even earlier date.

This is going to create an artificial surge in demand. Due to the secondary push, the price can go up even higher, with your losses jumping to, say, $1,600.

The extra $200 you lost results from the group of people buying the stock simultaneously and has nothing to do with the company’s actual performance.

Final thoughts

Short selling is just as valid a strategy as so many more in the world of finances. But due to short squeezes and the fact that you are betting against the company that is actively trying to prove you wrong, it comes with its downsides.

The most significant downside by far is the skew risk-to-reward ratio. Unlike traditional, long-position investing, where you can only lose the amount that you already funded, you can lose a lot more than you can afford to part with in the event of a short squeeze.

So be sure to take your time before you decide to dabble in short selling. While you can make hefty profits via this tactic, you can quickly end up with more in your mouth than you can chew.