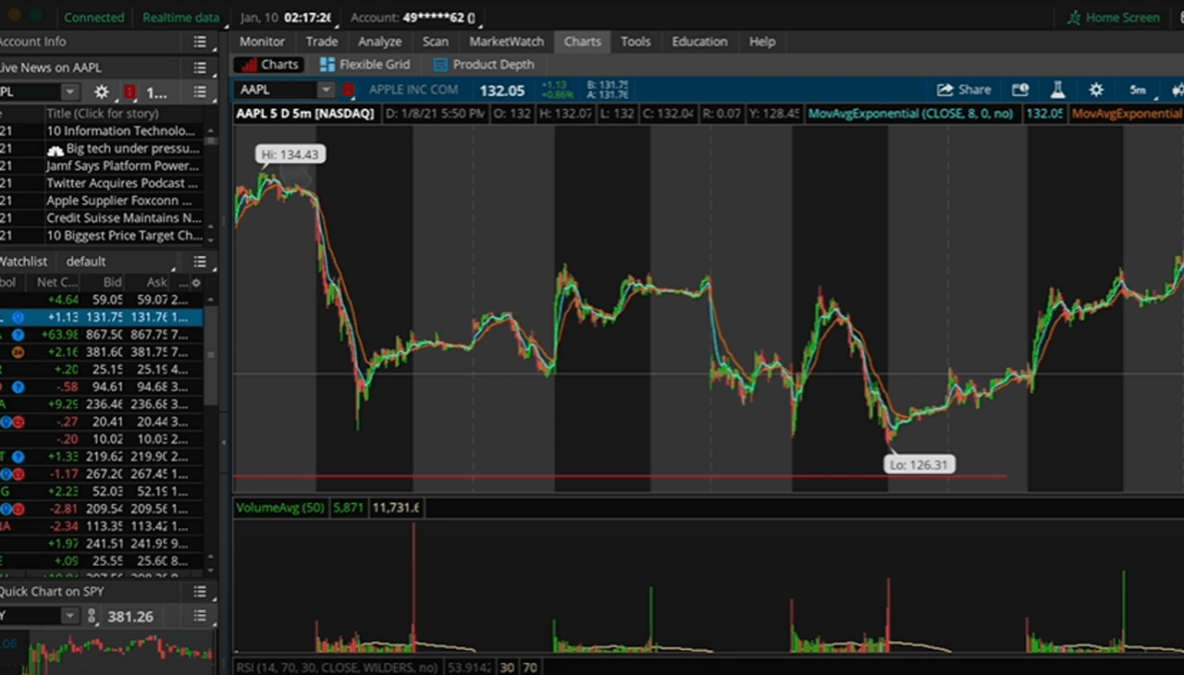

TD Ameritrade is a well-known online brokerage firm that offers a variety of investment products and services to its customers. In this review, we will be discussing the features and benefits of TD Ameritrade to help you determine if it’s the right platform for your investment needs.

Features

TD Ameritrade offers a range of features that can appeal to investors of different levels of experience and investment goals. Some of the key features include:

- Commission-free trading: TD Ameritrade offers commission-free online trading for stocks, ETFs, and options, making it an attractive option for cost-conscious investors.

- User-friendly platform: The platform is intuitive and easy to navigate, with a wide array of research tools and educational resources to help investors make well-informed decisions.

- Investment products: TD Ameritrade offers a wide range of investment products, including stocks, bonds, mutual funds, ETFs, futures, and options.

- Retirement planning: TD Ameritrade offers retirement planning services, including traditional and Roth IRAs, 401(k) rollovers, and annuities.

- Investor education: TD Ameritrade provides a wealth of educational resources, including articles, webinars, and in-person events, to help investors learn more about investing and make informed decisions.

- Mobile app: TD Ameritrade provides a mobile app that allows investors to trade on the go and access their accounts from anywhere.

Comparison to other trading platforms

Sure, here’s a comparison of TD Ameritrade to other well-known trading platforms:

- Robinhood: Robinhood is another popular trading platform that offers commission-free trades for stocks, ETFs, and options. However, Robinhood has a more limited selection of investment products and educational resources compared to TD Ameritrade. Robinhood also does not offer retirement planning services.

- ETRADE: ETRADE is a trading platform that offers a similar range of investment products as TD Ameritrade, including stocks, bonds, mutual funds, ETFs, futures, and options. E*TRADE also offers extensive research tools and educational resources, although it may not be as user-friendly as TD Ameritrade.

- Fidelity: Fidelity is a brokerage firm offering a wide range of investment products, including stocks, bonds, mutual funds, ETFs, and options. Fidelity offers commission-free online trades, similar to TD Ameritrade, but with a lower fee for options trading. Fidelity also offers a range of retirement planning services, although it may not be as user-friendly as TD Ameritrade.

Overall, TD Ameritrade stands out for its user-friendly platform, extensive educational resources, and retirement planning services. It is a strong choice for investors of all levels who want a comprehensive online brokerage experience.

Investment options offered by TD Ameritrade

TD Ameritrade offers a diverse array of investment options for its customers. Here are some of the investment products that are available on the platform:

- Stocks: TD Ameritrade offers a wide variety of stocks, including US-listed and most international securities.

- Bonds: TD Ameritrade provides access to various types of bonds, including corporate bonds, municipal bonds, US Treasuries, and other fixed-income securities.

- Mutual Funds: TD Ameritrade offers a vast selection of mutual funds, including no-load, load-waived, and transaction-fee mutual funds.

- ETFs: TD Ameritrade offers commission-free ETF trading for a wide range of ETFs from various providers such as iShares, Vanguard, and State Street Global Advisors.

- Options: TD Ameritrade offers options trading for stocks, ETFs, and indices with powerful tools and resources to help traders make informed decisions.

- Futures: TD Ameritrade provides futures trading in a wide range of asset classes, including commodities, currencies, and indices.

- Forex: TD Ameritrade also offers forex trading to its customers, allowing investors to trade more than 75 forex pairs.

These investment options provide investors with a range of choices, making it easier to build a diversified portfolio that meets their unique investment goals.

Analyzing customer reviews on the platform

When analyzing customer reviews of a trading platform, it’s essential to look for common themes or patterns that emerge. Here are some general steps to follow:

- Read a range of reviews: Look at the reviews with different ratings – both positive and negative. Read through the reviews carefully to understand what customers are saying about the platform.

- Look for patterns: Identify common themes among the reviews, such as ease of use, customer service, fees, and investment options.

- Look for consistency: Pay attention to the consistency of reviews across different review platforms. If the same issues arise repeatedly, it may be a sign that these issues are prevalent.

- Consider the source: Be aware of potential biases in the reviews. For example, reviews from long-time customers or high-volume traders may have a different perspective than occasional investors.

- Evaluate the overall sentiment: After analyzing the reviews, evaluate the overall sentiment towards the trading platform. Are the reviews generally positive or negative?

By following these steps, you can gain a better understanding of customer experiences with the trading platform and make more informed decisions about whether or not to use it.

Advice for newcomers to investing through TD Ameritrade

If you’re new to investing and plan to use TD Ameritrade as your trading platform, here are some tips and advice to help you get started:

- Educate yourself: Before making any investments, take the time to educate yourself on the basics of investing. TD Ameritrade offers a wide range of educational resources and tools, including webinars, articles, and courses.

- Start with a small amount: It’s important to start with a small amount that you’re comfortable losing while you learn about investing. Don’t invest more than you can afford to lose.

- Diversify your portfolio: Diversification is key to managing risk. Spread your investments across different asset classes, such as stocks, bonds, and ETFs, to minimize the impact of market fluctuations.

- Make use of research tools: TD Ameritrade offers several research tools and resources, including real-time quotes, analyst ratings, and technical analysis tools. Utilizing these tools can help you make informed investment decisions.

- Set realistic expectations: Investing is not a get-rich-quick scheme. Be patient, set realistic expectations, and avoid making emotional decisions based on short-term market movements.

- Monitor your investments: Keep an eye on your investments regularly and make adjustments as needed. Avoid checking your portfolio too frequently, as this can lead to emotional decision-making.

By following these tips and advice, newcomers to investing can start their investment journey with a strong foundation and increase their chances of achieving long-term success.