- What is better for investors: ETFs vs. ETN?

- What the distinction between ETFs and mutual funds?

- What are the pros and cons of exchange-traded funds?

An exchange-traded fund (ETF) is an investment instrument made up of several underlying holdings. Similar to a mutual fund, ETFs allow investors to pool resources together and work on a common investment objective. The popularity of ETFs has risen in the recent past due to their unique characteristics that expose investors to the best of both worlds, mutual funds and stock markets.

Here we delve into the difference between ETFs and the other investment assets and what is endearing about the ETF market.

How are exchange-traded funds created?

The key to excelling in any venture starts with being knowledgeable. The beauty of investing in the ETF markets is that you don’t have to know the inner workings to be profitable in the markets. However, having an understanding of how they work will make you a complete investor.

ETF creation begins at the SEC offices, with a prospective ETF sponsor files their vision in the form of a plan. Once the SEC approves this plan, the sponsor gets into a contractual agreement with authorized market participants, either institutional trading desks or market makers, to exchange securities that form the ETF creation units.

What are creation units? They refer to a cluster of investment assets that form the building blocks for an ET. Creation units range from 10,000 to over 500,000, but the standard fund unit is usually 50,000. At this point, these collections of investment assets become an open-ended collective fund.

With knowledge of how ETFs are created, it is time to delve into what sets them apart from the other investment assets and has them as the most traded investment asset globally.

Pros and cons of ETF

ETFs are known as a hybrid of mutual funds, closed-end funds, and stocks. As a result, they have the following advantages over other investment instruments:

- Relatively low expense ratio and broker commissions

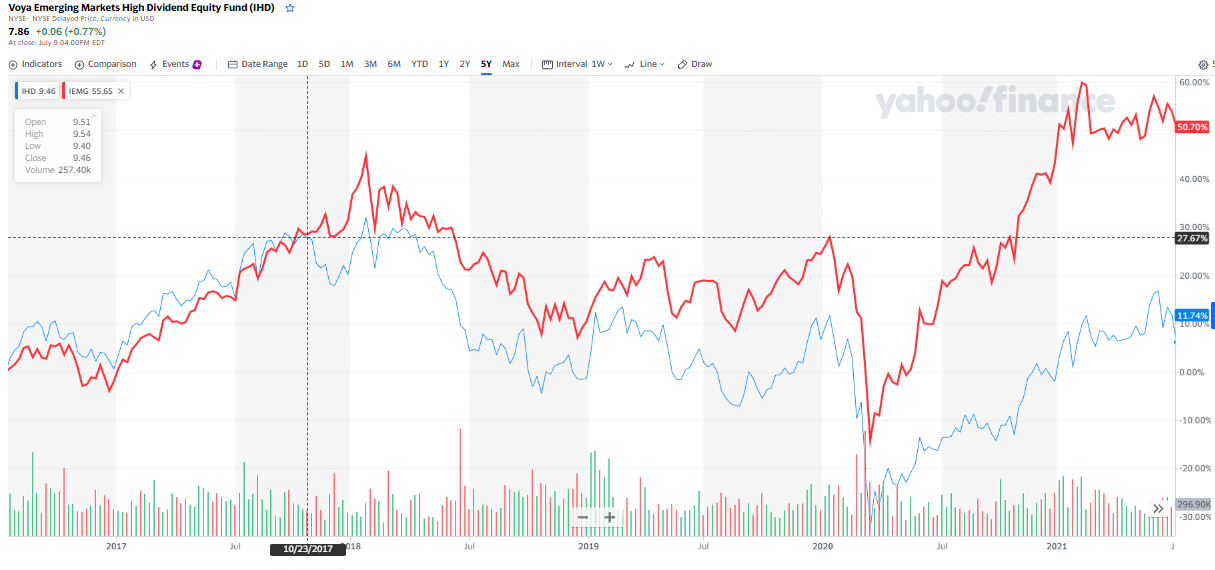

- Manage investment risk through diversification

- Provide instant portfolio diversification through a pool of assets

Despite all these positives, investing in these assets possess the following disadvantages:

- Industry-specific ETFs limit portfolio diversification

- Actively managed funds are relatively more costly to invest

ETFs vs. mutual funds

In terms of composition, ETFs and mutual funds are peas in a pond. They are a collection of tradable assets, with every individual share representing full ownership in that collection. They are also similar in their creation; they can occur at any time. Their trading is also per the SEC regulations, the Investment Company Act of 1940.

The separation between these two investment assets is in their trading. Mutual funds trade only at the end of the day after calculating their net asset value at day end. In contrast, investors get to trade finds as long as the market is open, just like stocks.

Market forces of demand and supply determine ETF trading price during market hours. The SEC also tasks ETF managers with the daily declaration of their composition, which is different from the mutual fund’s quarterly composition declaration.

ETFs vs. exchange-traded notes

From the names, it is crystal clear that ETFs and ETNs share some characteristics. The approach of these two investment instruments to the markets is similar, track an index and replicate its performance as closely as possible.

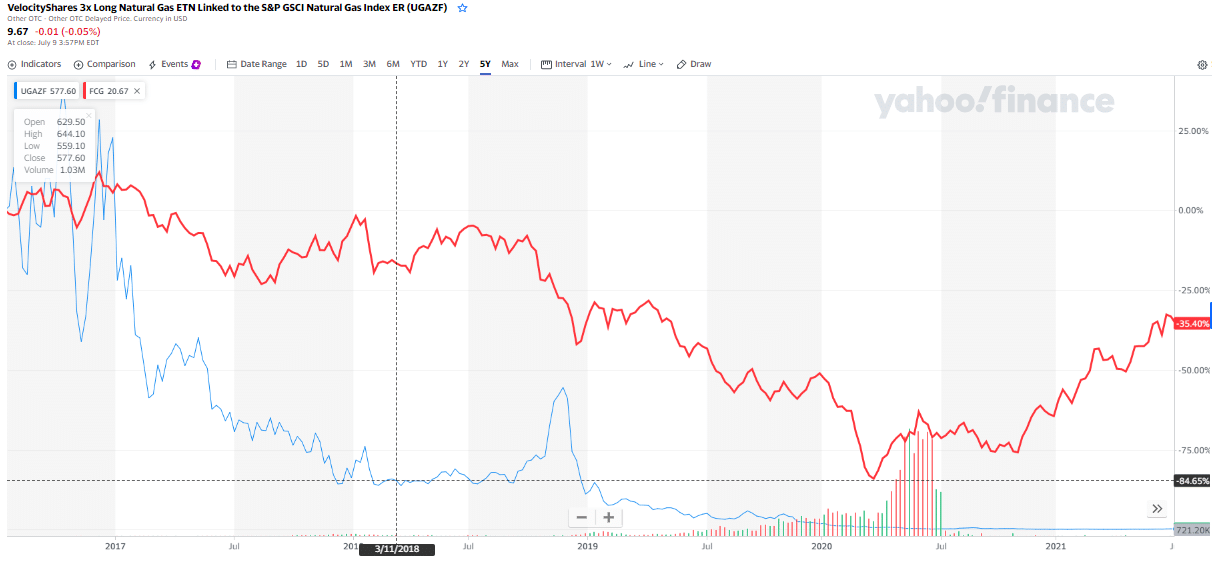

Despite approaching the markets in similar fashion, these two differ in their composition. Where ETFs are a pool of investment assets, ETNs are unsecured debt instruments. They also differ in terms of their performance. EFT performance is a result of the market forces of demand and supply of all its underlying holdings.

Therefore, the returns might vary to some degree from those of the benchmark index. ETN returns, on the other hand, are a perfect mirror image of their tracked index, less any administrative fees, since by its nature, an exchange-traded note is a promise of paying a specific return at a specified time in the future.

Whereas ETFs are one of the safest investment assets, the other ones are high-risk investment assets. By being unsecured debt instruments, ETN assets and sponsor assets are coupled; suppose the sponsor goes bankrupt, all investors are treated as unsecured creditors.

Therefore, there is a high probability of losing all ETN invested funds. ETFs, on the other hand, are separate from the sponsor’s assets.

ETFs vs. closed-end funds

Both EFTs and closed-end funds consist of several investment instruments pooled together, and operate under the same SEC guidelines, the Investment Company Act of 1940. The difference is in how they trade.

In the ETF market, investors have access to them for as long as the market is operational, allowing share redemption and creation to meet the market needs. In contrast, closed-end funds issue shares either in their initial offering or at secondary offering only. Closed-end fund share redeeming is also restricted. It is done either at predetermined intervals or on the fund liquidating.

The other significant difference is in valuation. ETFs typically trade within the market value of their composite holdings, while closed-end funds price fluctuations result in a substantial variance between their value and their underlying instruments.

Final thoughts

A competent investor should take into account all his costs, including personal time. Having a balanced portfolio of individual investment vehicles is expensive and time-consuming for even the most seasoned investors. Investing in ETFs does not require professional knowledge or skills. You can start with small amounts without spending a lot of time analyzing instruments and observing the diversification rule.