- What are restaurant ETFs?

- Why invest in this “tasty” asset?

- Which three ETFs stand to profit the most in 2022?

The restaurant and food industry has been thriving for many decades as people carry a never-ending love for dining out and eating all kinds of delicacies. Correspondingly, restaurant stocks and partial-restaurant ETFs have remained a popular investment option among investors due to the booming potential of this sector.

The restaurant domain negatively impacted Covid-19 restrictions; however, the industry has swiftly recovered after lockdowns. According to the US National Restaurant Association report (August 2021), the food and beverage sales increased to more than 20%, amounting to $789 billion in 2021, than the disastrous 2020 spending.

So, do you want to know about restaurant ETFs that can show remarkable growth in the upcoming years? Read this article to learn about the best restaurant ETFs that can deliver high yields in the coming years.

Restaurant ETFs: how do they work?

Restaurant ETFs track the investment results of a benchmark index that contains restaurant or restaurant-related stocks. The eateries industry has rebounded after the pandemic recession, and more people are seeking to dine out than at the pre-pandemic levels.

Resultantly, the restaurant investment products can settle on an upward momentum amid the high demand and growth potential. Investors can take advantage of the trend by investing in restaurant stocks or funds according to their investment goals.

However, the majority of the restaurant ETFs include consumer discretionary, grocery, and food distribution companies stocks aside from the pure restaurant stocks. Therefore, these ETFs provide substantial diversification by incorporating stocks of different food sectors.

What to check before choosing restaurant ETFs?

Analyzing a few crucial factors before directing your capital towards the restaurant ETFs is essential. Firstly, examine the level of liquidity and trading volumes of the fund. Higher liquidity provides tight bid-ask spreads and allows investors to easily enter and quit the trades.

Next, evaluate the fund’s expense ratio and tax implications. High expense fees and taxes can significantly reduce profits. Moreover, determine the fund’s size and the number of assets. Net assets lower than $10 or $20 million indicate a meager investor’s interest in a security.

In addition, careful research about the fund issuer and tracking differences can provide insight into the fund’s sustainability.

Best restaurant ETFs to buy in 2022

Restaurant ETFs have gained significant investors’ attention with the rebounding of restaurant businesses. Here, we have compiled some of the best restaurant or partial-restaurant ETFs.

1. The AdvisorShares Restaurant ETF (EATZ)

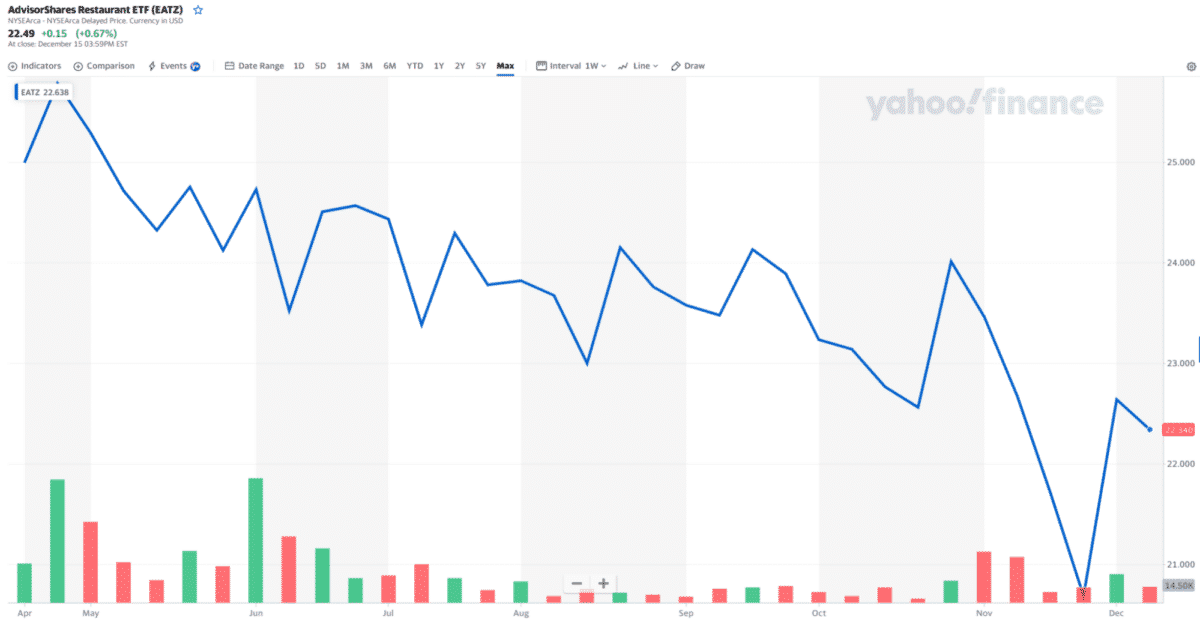

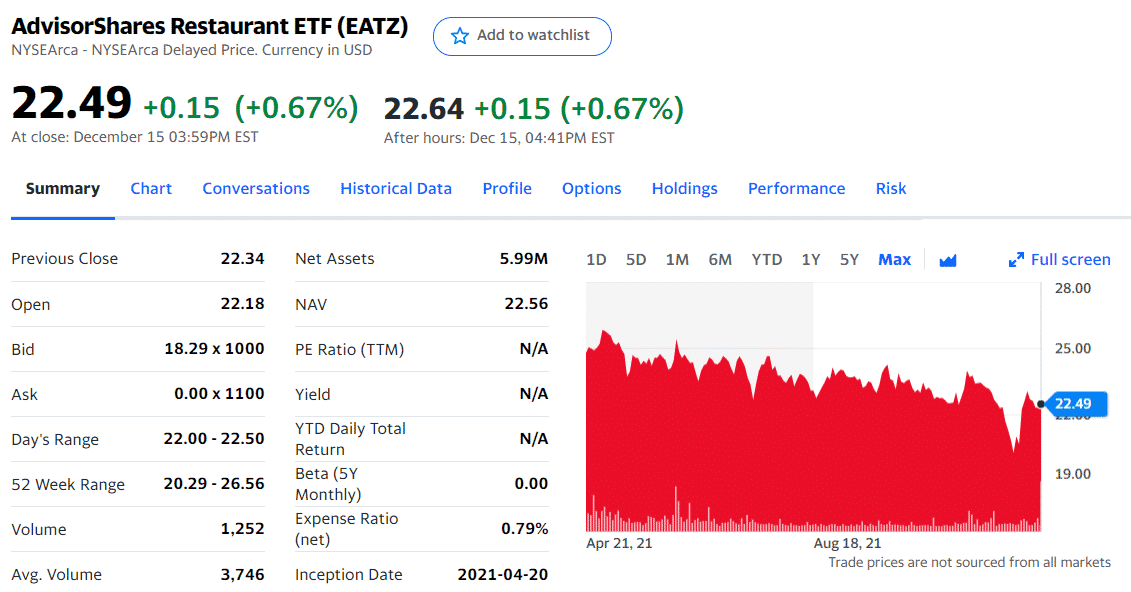

Price: $22.49

Expense ratio: 0.99%

The AdvisorShares Restaurant ETF is an actively managed ETF that invests in companies generating more than 50% of their food and restaurant industry revenue. EATZ is the exclusive restaurant ETF that follows the investment results of bars, pubs, food take-outs, fast foods, and restaurants stocks.

This relatively-new fund became available earlier this year to target the pent-up demand in the post-pandemic environment. Currently, it has around $5 million assets under management with 205,000 shares outstanding. The fund has given a maximum asset allocation to North American eateries, Asia, and Europe.

The fund’s top three holdings with their assets percentages are as follows:

- RCI Hospitality Holdings Inc. 6.05%

- Papa John’s Intl Inc. 5.82%

- Del Taco Restaurants Inc. 5.69%

2. Global X Millennial Consumer ETF (MILN)

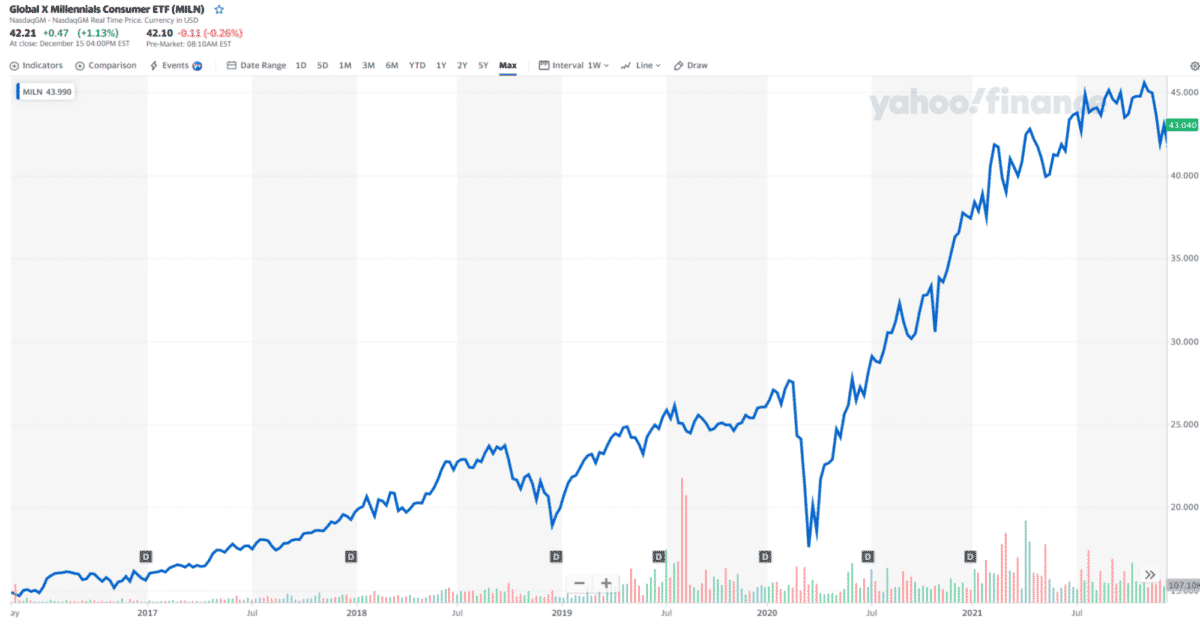

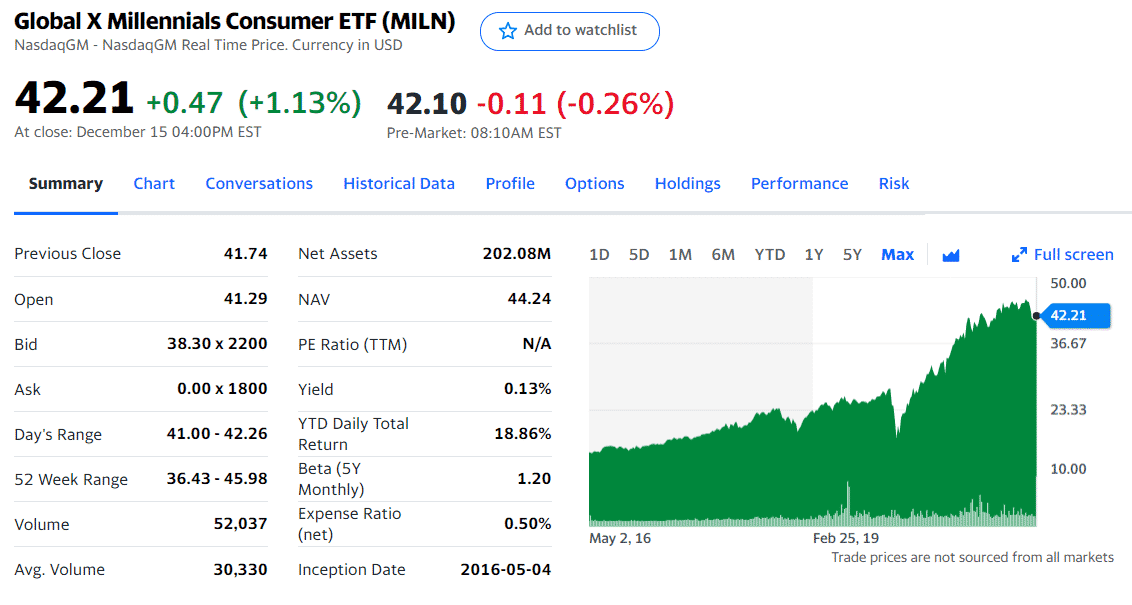

Price: $42.21

Expense ratio: 0.50%

Global X Millennial Consumer ETF tracks the performance of Indxx Millennials Thematic Index, which includes companies targeting the US millennial generation. MILN is a pseudo-restaurant ETF that invests in food and dining, entertainment, clothing, housing, and travel sectors.

This ETF has total net assets of $223.7 million with 5 million outstanding shares. According to its quarter-end (average annualized) report, this fund has shown a remarkable 1-year and 5-years NAV growth of 38.10% and 22.52%, respectively. Moreover, its weighted average market cap is 383 billion with a return on equity of 18.50%.

As of December 2021, the fund has a total of 82 holdings, with the top three spots occupied by:

- Intuit Inc. 4.94%

- Costco Wholesale Corp. 4.71%

- Apple Inc. 4.11%

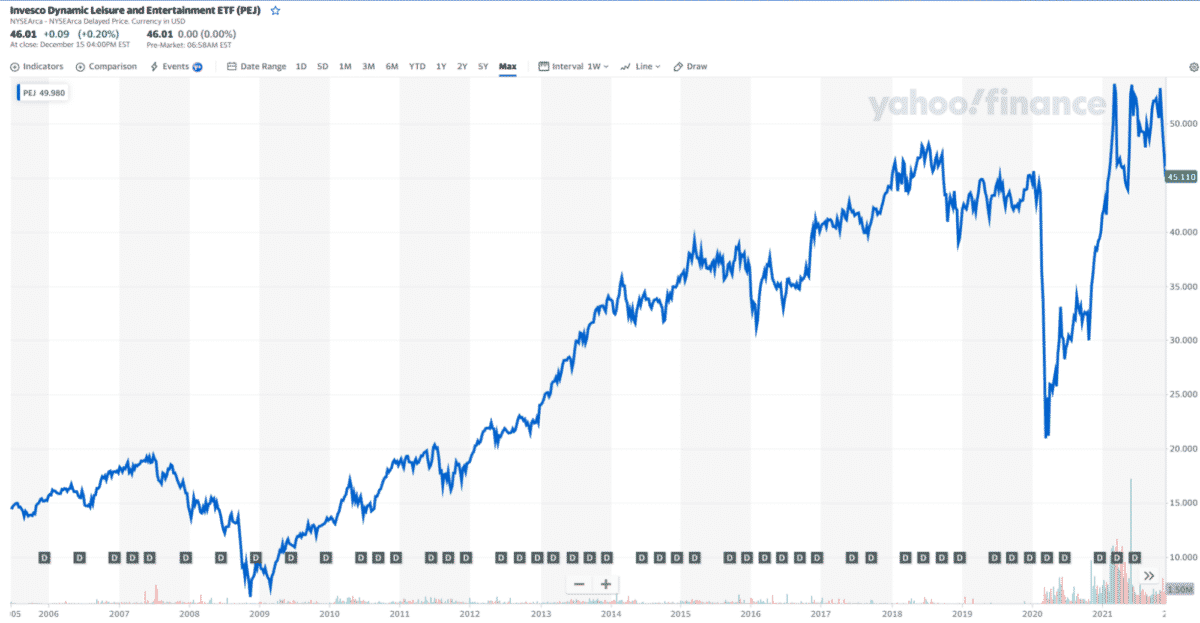

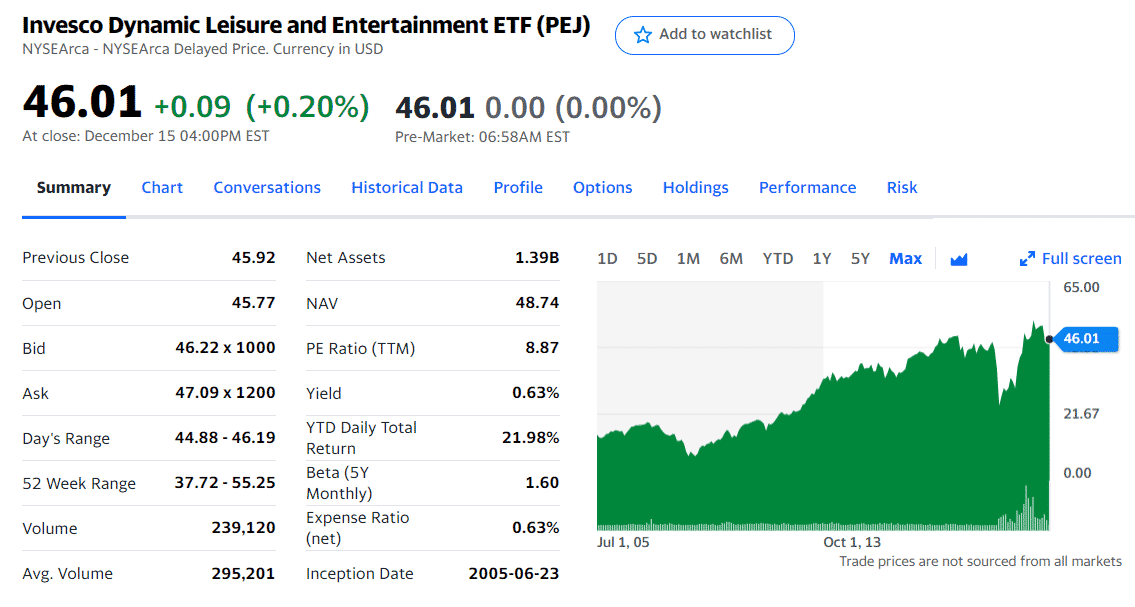

3. Invesco Dynamic Leisure and Entertainment ETF (PEJ)

Price: $46.01

Expense ratio: 0.55%

Invesco Dynamic Leisure and Entertainment ETF mimic the investment results of the Dynamic Leisure & Entertainment Intellidex℠ Index. This index includes US companies that engage in the production and distribution of leisure and entertainment services or products. Out of the fund’s 31 holdings, 11 are of the restaurant or fast-food sector.

PEJ has a market value of $1.2 billion and about 26.8 million outstanding shares. According to the fund’s quarterly data, this ETF has significantly recoiled to the higher pre-pandemic levels by manifesting a one-year NAV growth of 58.35%.

As of December 2021, the top holdings of this fund are:

- McDonald’s Corp. 5.46%

- Marriott International Inc/MD 5.19%

- Sysco Corp. 5.14%

Pros and cons

We have listed a few pros and cons down for you to better understand before investing in them.

| Pros | Cons |

| The restaurant industry incorporates an enormous growth potential as dining activities are part of everyday life that would increase with time. | Stocks under the restaurant ETFs can display volatility and violent price fluctuations. |

| Restaurant ETFs provide diversified exposure to various restaurants and food chains. | Restaurant ETFs can take an ample amount of time to deliver substantial gains. |

| There is transparency about the funds’ holdings and performance records that help investors decide. | The exclusive restaurant ETF, EATZ, has a larger expense ratio than the category average. |

Final thoughts

People hold an inherent love for eating out that translates to the growth opportunities of this sector. Most of the reputable restaurants are expanding their services globally. In addition, delivery services and other advanced technologies can considerably increase the valuation of this industry.

Restaurant ETFs are a suitable option for investors who want to capitalize on the long-term potential of this sphere. However, most restaurant ETFs focus on varied sectors besides the restaurant domain. Correspondingly, investors can choose the investment approach that best matches their long-term financial goals and risk appetite.