- Is Morning Star a high probability trading pattern?

- How to trade it in a bearish trend?

- Is it better to use other indicators with the Morning Star?

It is the pattern having a specific structure depicted by three bars. This structure comprises three bars:

- The first one is down

- The second can also be bear-like but with a small body

- The third is a rising stick

There is no particular calculation to perform for this type of trading since it is a visual phenomenon. For example, the second spot has a low point in Morning Stars. Nonetheless, the low end cannot be observed until the third flame has closed.

How does the pattern look like? How can you trade it effectively? What are the bullish and bearish trade setups, including the timeframes, entry, stop loss, and exit? This article will cover all these questions regarding this highly known technical chart.

What is the Morning Star pattern?

This formation generally indicates a positive trend consisting of three candlesticks that signal the bottom reversal. Furthermore, the data suggest a weakening trough, which means the onset of an upward move. After observing its formation on the currency graph, traders use other techniques to confirm it.

The most important thing to remember is that the market must be heading down to trade this indicator strategy. Note the lower lows and the lower highs to confirm the downtrend.

The new buy signal begins with a sizeable downward-pointing candle. The bears control the selling signal, meaning the selling pressure will continue. There is no sign of a change yet in the market, so we need to only look for sell trades.

The second could be any of them but shorter, but it starts from a steep gap down. Although the sellers have been trying very hard, the figure shows that they have not lowered the rate. Ultimately, the market action forms a Doji signal that looks favorable or negative. It may be an early sign of a trend shift if this formation is a slight gain.

A large upward-pointing wick is considered the most significant because it offers and reveals the real pressure for buyers. It shows a definite price turnaround when a red bar begins with a gap, and a red bar closes above the opening.

Why is it worth using Morning Star?

As an intermediate trader, you can quickly identify this pattern on the stock diagram. Beginner traders can also recognize this move very quickly. We often see well-defined entries and an excellent risk-reward ratio when we trade these strategies.

Despite the formation of the Morning Star formation, there is the possibility that the prices could go further down if the sellers are strong enough. Hence, it is always recommended not to trade this method alone but rather to use the pattern with several other trading tools.

Bullish trade setup

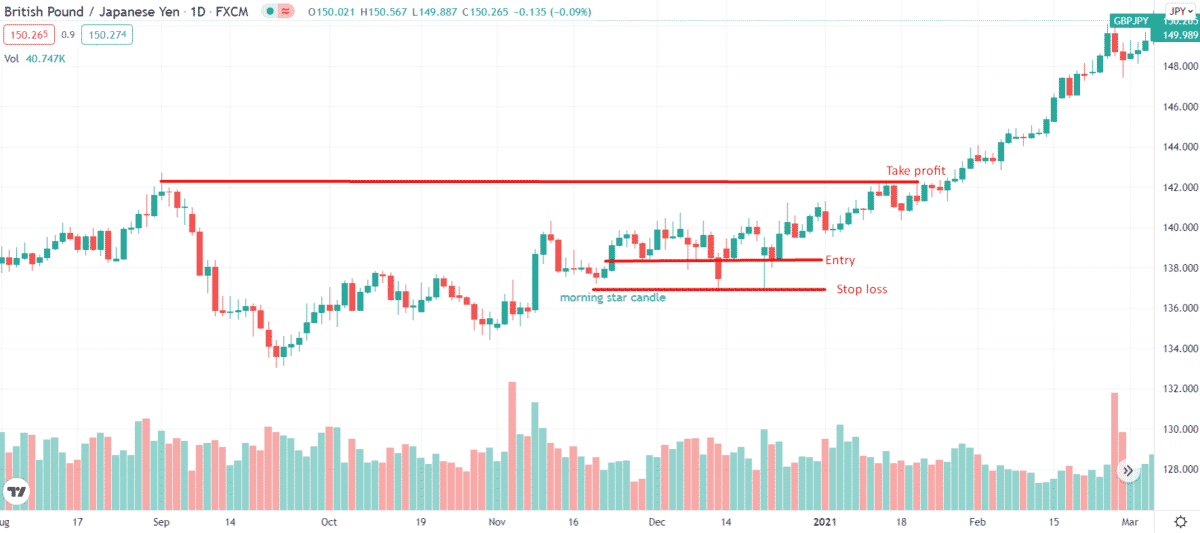

To find out how to trade its bull market, we must look into an actual example demonstrating this type of strategy. So let’s look into a daily bar graph of GBP/JPY to learn about the structure and how to trade it.

Best time frame to use

The best time frame to trade this type of setup is D1 (daily chart).

Entry

Once you find a Morning Star candle on the daily chart (after close), put a buy stop order a few pips above the high of the technical figure. Then, let the market fill your order on the same day or the next day.

Stop loss

The stop loss should be placed slightly below the low of the Morning Star candle. For conservative buyers, the stop loss can be at local lows.

Trade profit

You can place the take profit limit around the recent swing high, or you may also use any immediate horizontal level. You may also calculate the entry distance to stop loss and keep the take profit level twice the stop loss distance.

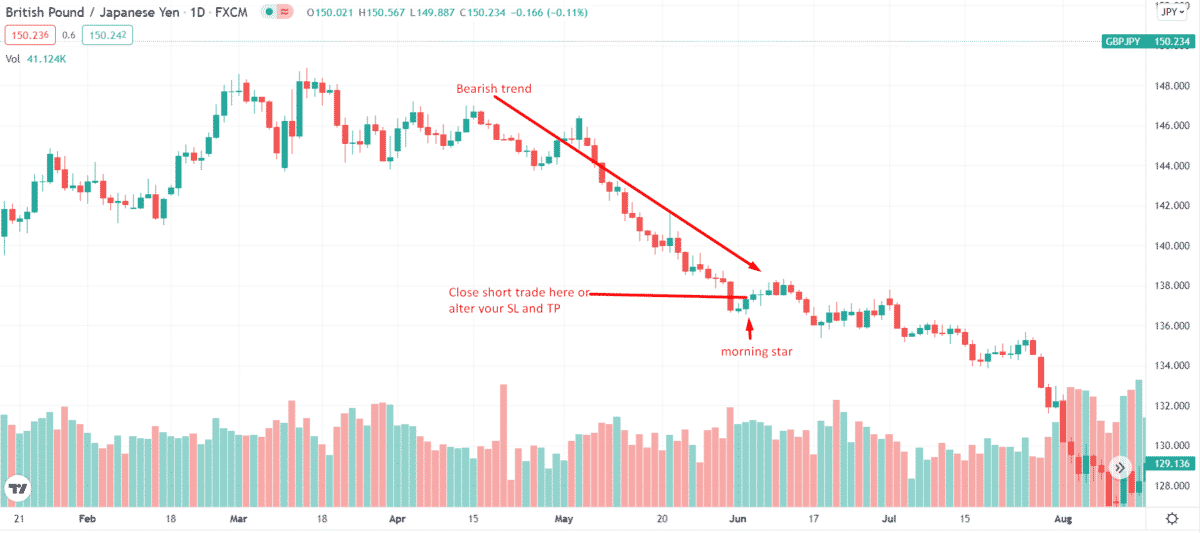

Bearish trade setup

There is no bearish trade setup in the pattern as it is purely a bullish pattern. However, you may see a Morning Star kind of pattern.

Best time frame to use

The best time frame to trade is the daily chart.

Entry

If you already have a bearish position, you may think of exiting when you see a Morning Star. Simply liquidate your position.

Stop loss

In case if you have a bearish position, you may consider altering your stop loss when you see a Morning Star. Bring your stop loss to break even.

Trade profit

You may also alter the take profit level. Like, you may not prefer a very far distant TP and switch it to the nearest support area.

How to minimize risk?

It can be risky to trade purely based on visual cues. Ideally, this trick should be accompanied by more factors like volume and support levels. In a downtrend, bright stars are easily visible whenever a small candle is spotted. The highest volume is usually seen on the third day of the move.

As a general rule of thumb, a trader wants to see volume increase throughout the three sessions. Even if other metrics do not confirm the pattern, high volume on the third day often demonstrates it. When a trader takes up a bullish position on a stock/commodity/pair/etc., there is a positive expectation for the future.

It would help if you familiarized yourself with candlestick patterns before you start trading so you can make informed decisions.

Final thoughts

An early MS pattern is a warning sign that the downtrend will reverse. It occurs at the bottom of a downtrend. Technical clues can be used to confirm that a base has been established following the formation of a Morning Star.

Bollinger Bands and the RSI are used for trading this trading style with minimum risk. It is considered a confirmed signal when volume and other factors such as a support level endorse it.