- How to day trade options?

- How does it work?

- Is such trading profitable?

Options trading and day trading are both complexes in their way. Using both simultaneously requires preparation. In the wake of Covid-19, 2020 for our little planet has been a rollercoaster ride-including the stock market.

Especially for options traders, more than $600 million worth of puts and calls were traded in the US in October 2020 alone. Compared to the same month last year, this represents an increase of 48%, which means that many people have a reason to trade.

Many reasons have contributed to the popularity of options trading. Still, most newcomers take advantage of today’s opportunity-rich market to compensate for the losses they sustained during the lockdown. Do you want to use the day trade options strategy? Are you aware of how to make profitable trades using it? Want to know what tips to use the strategy efficiently? Read on to find answers to all these queries!

How does the day trading option work?

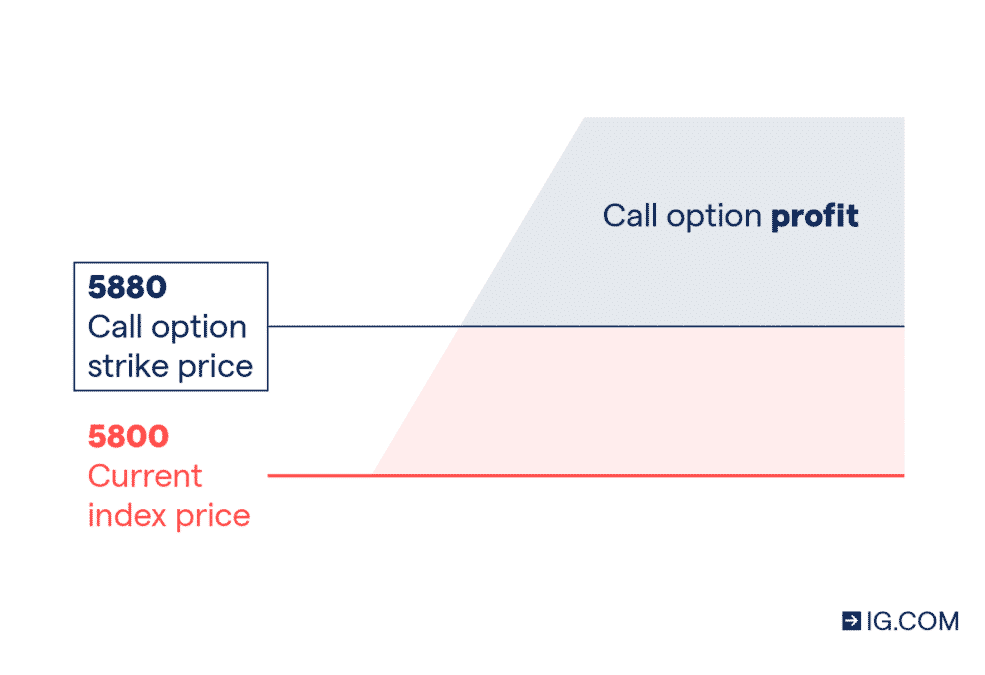

Option contracts let you purchase or sell an asset at a predetermined price within a certain period. Trading these contracts allows traders to bet on assets that they believe will rise or fall in value.

In this sense, they differ significantly from stocks: instead of buying shares directly, you purchase contracts that you can use to buy or sell securities at a later date and at today’s prices. In a nutshell, if you can predict the price movement, you win. However, if you make a mistake, you can still sell the contract and get out of the position before suffering enormous losses.

Unlike buying and selling stocks, which can be relatively simple, trading commodities requires more skill. Day traders, however, value these financial instruments to hedge their risks with options and open and close positions more efficiently. Ultimately, this slightly more complicated trading method is more likely to bring greater results if it is done correctly.

How to day trade options?

Moreover, day trading options share many similarities with trading stocks, indices, and other securities. It’s essential to understand how to analyze stocks to determine if they are worth trading, but your strategy will determine the type of assets you will trade.

Options can be used to profit from rising, falling, or stagnant securities, but it is better to select one category over another. Focusing on one type of trading will give more significant results than doing a little of everything. If you’re a new trader and are interested in learning how to trade options, this is especially true.

Once you have developed a plan and have the know-how to carry it out, finding a trustworthy broker is next. Nowadays, there is a wide range of online brokerage companies. These platforms are significantly more affordable and feature-rich than rivals. It would help if you used the top brokers when it comes to option trading.

Lastly, starting capital is a critical component to starting a day trading career. You must keep at least $25,000 in your brokerage account at all times to be able to make more than three trades a day; if your balance drops even one dollar below that limit, you are barred from day trading.

Tips for options day traders

Using options is an extremely versatile and powerful way to trade, especially for day trading. In addition, a single dollar’s worth of savings can make a big difference in the long run. These are some qualities that experienced options traders hold in high regard that you should consider if you’re looking to profit from your investment.

Be great at hedging risks

You must ask yourself a few questions before making any options trades — what are the chances of this one succeeding? What is the most I can lose? How much of my portfolio can be invested safely?

The strategies above help options day traders minimize their potential losses and diversify their portfolios as much as possible. Although day traders utilize top brokerages to execute their trades, they don’t leave their positions to sit overnight for fear that bad news might come in at the last minute.

Moreover, an options trader should have strong money management skills. Even when chances of success are high, it is not prudent to bet 50% of your portfolio on a single trade. The typical day trader invests about 0.5% to 1.5% of his portfolio daily and grows that percentage.

Be disciplined and cool-headed

A long-term trader doesn’t panic, sell at the first sign of a recession and follow the crowd. Maintaining your long-term strategy and remaining rational at all times is key to success. Warren Buffett’s rule no.1 in investing — never lose money — might be hard to remember when your money is on the line.

In addition, since day trading won’t make you rich overnight, being patient and disciplined is the best approach. Although taking a high-risk, high-reward position might be appealing, most successful investors thereby gradually build their portfolios day by day.

Watch the news

News is an important component of everyday trading strategy. News relevant to the economy, geopolitical, and the companies in which you invest. One big event can send a company’s stock price skyrocketing or plunging within days, so staying on top of developments is vital.

A good example happened in 2018 when Activision Blizzard announced a new mobile game called Diablo Immortal. Its stock price went through the roof the next day. Just two months later, the stock dropped to around 60% of its former price due to a strong reaction from shareholders.

The announcement did not go over well with the company’s customers, and that caused the prices to fall.

A good rule of thumb is to keep a finger on the pulse of the industry you’re investing in so you can react to any breaking news.

Never stop learning

A person who is not on top of the market can find day trading to be quite unforgiving. So, in addition to studying the news and the economy, you should also keep up with new techniques and adapt your strategies to the changing climate.

You will be better able to grasp the shifting financial landscape if you’re an active learner. If you are good at this, you may even be able to spot new opportunities before they arrive and maximize profits by taking advantage of them while they are hot.

Keep records

Keeping a record of your trades is a great way of looking back in the past and seeing what works and what doesn’t. The pros keep track of everything and learn from their mistakes so they can become better. Getting better will help you make more money.

Final thoughts

From a legal standpoint, day trading is not for everyone. However, you have to keep in line with some trading rules, and you need to know what will happen if you don’t comply with them.

You must trade more than three times per day to qualify as a day trader as a first requirement. You must also maintain an account balance of $25,000 or more at all times as a day trader. Also, if you don’t get everything sorted out within five business days, you cannot leverage your trades for the next 90 days or until the requirement is met.