- What is the platinum put option?

- Is this a profitable tool?

- How to invest in it step by step?

Although it’s discussed less frequently, investors see platinum as a precious metal as important as gold and silver. It is used as a hedge against inflation and a haven when times are tough economically.

As a result of the Covid-19 pandemic, platinum prices in 2020 reached record highs and record lows, leading to increased investor interest in platinum as a precious metal and a decline in automotive demand. After hitting a two-year high in January, the platinum price crashed to a 17-year low in March.

Its prices stayed above $1000 per ounce in the first quarter of 2021, indicating strong investor demand for the metal. If you are also interested in knowing how to invest in platinum contracts, whether it’s a call or put a deal, this article is for you. You will find out how to do it with examples of long platinum call/put options.

What are platinum options?

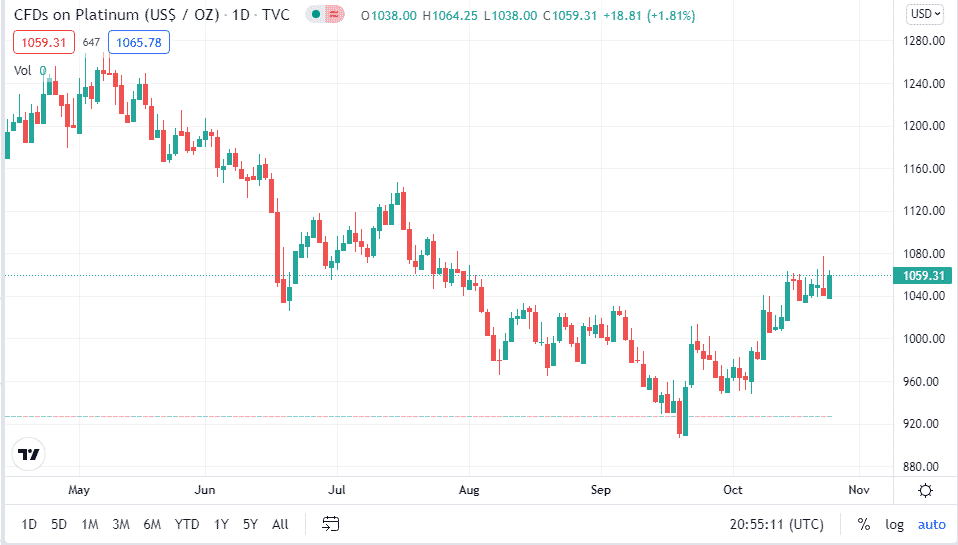

Here the underlying asset is a platinum futures contract. With its investment, an investor has the choice of taking a long position (with a call) or a short position (with a put). You can buy or sell assets in the underlying futures at the strike price. The right to exercise this transaction will end on the expiration date after the market closes. As for now, the price of the stock is 1059.31, as shown in the chart.

Steps to invest

You can invest in it by following three simple steps:

- Sign up for an account

- You should fund your trading account

- Learn how to predict the market activity and make money

Long platinum put option

The NYMEX Platinum near-month futures contract is trading at USD 964.00 per troy ounce. New York MEX put investments at 64.27/oz with the same expiration month and the nearby strike price of USD 960.00.

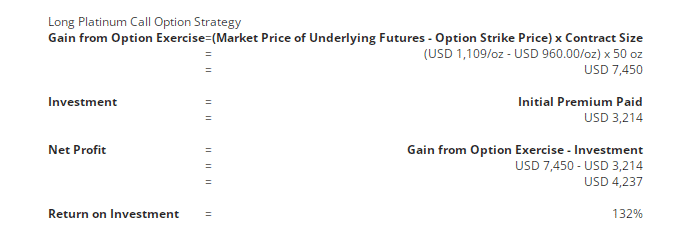

Due to the underlying price of 50 troy ounces of the metal stock in each NYMEX Platinum futures contract, the premium you need to pay to own the put option is USD 3,214. Based on the assumption that gold futures are now trading at USD 1,109 per troy ounce at the expiration day, the platinum futures have risen by 15%.

If this price remains unchanged, your call contract will be in the money.

Gain from call investment exercise

If you exercise your call option now, you gain an ownership position in the platinum futures at the strike price of USD 960.00. This means you can purchase the underlying platinum at the strike price of USD 960.00/oz on delivery day.

A long call position on NYMEX Platinum covers 50 troy ounces, resulting in USD 7,450. As a result of this short position, you gain USD 149.00 per troy ounce, based on the market price of USD 1,109 per troy ounce of underlying platinum futures. Your net profit from the long call strategy will be USD 4,237 after deducting the premium of USD 3,214 you paid for the call option.

In the case of the NYMEX Platinum futures contract, the underlying price is 50 troy ounces of it, so you must pay USD 3,214 as the premium to own the put option.

Sell to close the contract

A call investment is often not required to realize a profit in practice. Through a sell-to-close transaction in the stock market, you can close out the position. There may still be some time before the offer expires, so any time value remaining from the sale will also be included in the proceeds.

Since the sale occurs on the day before the call’s expiration, there is virtually no time left to sell the stock. As a result, you will receive an amount equal to its intrinsic value from its share sale.

Long platinum put option

By buying (going long) platinum put options, you can profit from a fall in platinum prices if you are bearish.

The NYMEX plat near-month futures contract is trading at USD 964.00 per troy ounce. This NYMEX plat agreement will expire in the same month and will have a strike price of USD 960.00, priced at $64.27/oz.

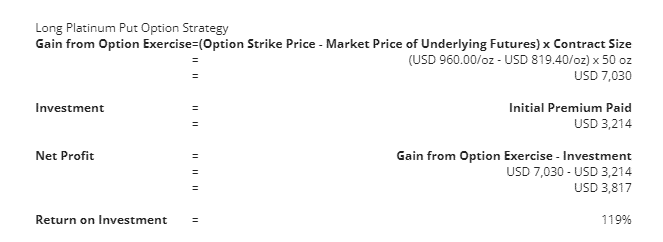

Due to the underlying price of 50 troy ounces of platinum in each NYMEX Platinum futures contract, the premium you need to pay to own the put price is USD 3,214.

Gain from put investment exercise

On the day of expiration, its price has fallen by 15% and is currently trading at USD 819.40 per troy ounce.

You now have a valuable put-opportunity. If you exercise your put agreement now, you get to buy 50 troy ounces of platinum at USD 960.00/oz on delivery day. To put it another way, you can sell 50 troy ounces of the metal on delivery day at USD 960.00/oz.

A profit of USD 140.60/oz is earned by taking an offset long futures position in the underlying platinum futures contract at the market price of USD 819.40 per troy ounce. Each NYMEX Platinum put option covers 50 troy ounces of metal for a gain of USD 7,030 with a long put position. You will have a net profit of USD 3,817 if you deduct the US$ 3,214 premium you paid to buy the put option.

Sell to close

For the put strategy to be profitable, it is not always necessary to exercise it. Instead, the position can be closed out by selling the put contract in the equity market using a sell-to-close transaction. During the sale of the shares, any remaining time value will also be included if there is still some time before the agreement’s expiration.

Because the sale is conducted on the option expiration day, there is virtually no time value left. Therefore, upon selling the premium option, you will receive its intrinsic value.

Final thoughts

Calls and puts are the two main types of options. Traders who are bullish about platinum prices purchase platinum call options. Platinum put contracts can be purchased by traders who believe the price of platinum will fall.

A trader can use more than one method to buy or sell options. Many professionals sell options as part of their trading strategy. Spreads, which involve simultaneously buying and selling contracts, can also construct more complex option trading strategies.