- How to start investing in hedge funds?

- Should you invest with these funds?

- What funds are better?

Hedge funds are managed portfolios in charge of making the kind of investment rich people do to get even richer or, at least, keep their capital safe. Unfortunately, due to the high requirements, only 4% of the people in the US qualify to invest in hedge funds. However, such funds are appealing because they are poorly regulated, so they can get into riskier operations to make disproportionated returns.

Hedge funds are not for the common investor, but they can include 35 not accredited investors into the fund. So, not only rich people get in. If you are interested, read on to learn all about hedge funds. Then, get to know why the rich like them so much.

How to start investing in hedge funds?

These funds are for the rich with a high-risk tolerance. The requirements to get into these funds are very high due to the fund’s regulations. So, to start investing in a fund, you need to have a net worth of at least $1 million, not including the value of their primary residence, or individual annual incomes over $200,000 ($300,000 if you are married).

Hedge funds vs. mutual funds?

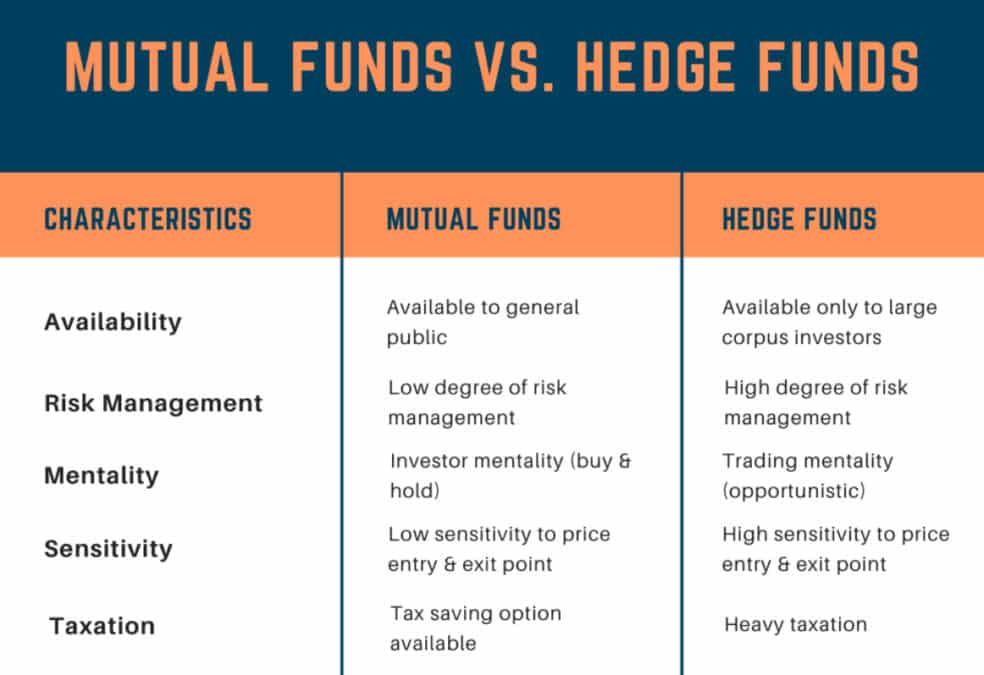

It could be easy for an inexperienced investor to confuse hedge funds with mutual funds. And there is a reason for that. In essence, they are built in similar ways, but the devil is in the details, and these details are not littles. So let’s see the top similarities and differences between both funds.

Top three similarities

- Pool investing

Both are investment companies, which put part of their capital in the fund to invest in different assets.

- Diversification

Both funds offer diversification to the investors. In their attempt to beat the market, the funds choose the best assets to get attractive returns.

- You can lose all your money

The financial professionals make the investment decisions of the fund, but that doesn’t guarantee you anything. If the investments go wrong, you may lose all your money.

Top three differences

- Risk

Such funds take high-risk investments to seek large profits. Also, since they are not very regulated, hedge funds can invest in more unstable assets like crypto or use leverage to profit from them. In contrast, mutual funds can only invest in shares quoting in the stock market.

- Requirements to enter

While you need to be an accredited investor to invest in a hedge fund, mutual funds are open to everyone. Moreover, the minimum investment is getting lower every time to convince more small investors to get in.

- Payments

For a hedge fund to be profitable, it needs to outperform the market widely since the payments required for the fund are very high in comparison. While mutual funds demand 1 or 2% of your investment annually, most hedge funds use the model “two and twenty” to charge the investors. In this model, every person in the fund must pay 2% annually and 20% on the profits.

To understand how this fund charges the members, let’s think of one investor that decided to put $2,000,000 down in a hedge fund. The fund uses the model two and twenty. So just the first year you’ll be given 2% of your investment. That is $40,000.

Now, let’s imagine that they invested half of your money on bitcoin at the beginning of the year. Of course, this is a simplification. No fund would invest half of your money in one asset.

As we can see in the image above, by the beginning of the year, the price of Bitcoin was $29,131.41. On October 14, the price was at $57,548.71, which means that the $1.000.000 invested on January 1 is worth $1,975,486.6. That’s $957,486.9. Over that profit, the fund gets to keep 20%, that is $195,097.32. That way, the net profit for the investor is $780,389.28.

Should you invest with hedge funds?

They are a great way of diversifying your portfolio if you already have invested in traditional markets like stocks, bonds, and mutual funds. However, for inventors that barely comply with the requirements to get into the funds without previously investing in the traditional markets, it doesn’t seem like a good option since these funds are very risky. Moreover, over the past decade, most haven’t outperformed traditional indexes like the S&P 500.

Yet, these funds are still appealing to many investors since they allow them to conduct operations such as short-selling stocks, which protects the investor’s capital more effectively in bearish markets. Hence the hedge part of the name.

How to invest in a hedge fund?

We mentioned earlier that there are some exceptions in which you can invest without being an accredited investor. Those exceptions are often granted to friends or close family members, so it is doubtful that anyone will get a chance to apply. However, if you can invest in a hedge fund, here is the right way to do it step-by-step.

Step 1. Make sure you have already invested in traditional markets

Hedge funds are for rich people already invested in all the markets, the playbook says, and now they are willing to take higher risks. Also, these funds make sense in long-term investments, so the money you put into hedge funds should stay there for a while before you make some profit out of it.

Step 2. Minimum initial investment

Make sure you comply with the requirements to become an accredited investor. For this, you need to have a net worth of at least $1,000,000 or make $200,000 per year and $300,000 if you are married.

Step 3. Look for funds accepting new investors.

In contrast to mutual funds, hedge funds are not available for everyone to buy on the market. Once the acceptance period for members has passed, it is hard to get into these closed portfolios.

Step 4. Forget about your money for a while

The idea is that you will let a professional trade with your money, so you don’t have to do it, but sometimes, even if you do want to take your money, it’s not that simple. For example, sometimes, the fund locks your money for a period, and you won’t be able to take it until that period ends. But, again, that is to protect other investors’ money and avoid getting many withdrawals that can affect the fund’s investments.

Step 5. Know the fund

These funds are highly unregulated institutions, so their practices can be risky, and some can even be in a moral grey area. But, in most cases, when you lose your money, if you think that there is something odd, the government won’t help you. So make sure that the interests of the fund managers are always the same as yours.

Final thoughts

Contrary to what many advertise, hedge funds have not made more profit than the market in the last decade. Instead, the market has outperformed hedge funds consistently. Despite this, hedge funds do make money, and they offer the best protection in bear markets. Investing in one is a risky decision that only makes sense once you have a complete portfolio with all other traditional markets on it.