- What are aluminum stocks?

- Are they worth investing in?

- What is the price of aluminum stock?

As the pandemic seems to be ending, the economy appears to start recovering, and the industrial sector is recovering with it. Aluminum is one of the most important metals for this industry, and the demand is growing consistently.

In 2017 aluminum companies experienced good times with most of the big players increasing their stock prices, but now with the metal price reaching a decade-high, the price of these stocks is coming back to 2017 levels.

If you do not want to miss this chance to profit from this increase in the demand for this valuable material, read on to find out the best stocks to invest in during 2021/2022.

What are aluminum stocks?

They are the shares of companies linked to the extraction, production, or commercialization of aluminum.

Aluminum is commonly used in industries such as construction, automotive, technological or aeronautical. It is one of the most common metals on earth, produced in the five continents. Even so, the demand for metal grows every day, which is making aluminum stocks rise. Moreover, as the world recovers from the pandemic, the industrial sector starts to take off, and aluminum is critical in developing all kinds of projects.

Due to different problems, the final consumers like Europe and the USA cannot satisfy their demand. Also, now that China has become a consumer instead of an exporter, the demand is even higher. This can make the prices rise even more during the following year.

Are aluminum stocks worth investing in?

Aluminum has a bright future, not just because of the current high prices and the high demand, but also because of the features of the material. In a world that aims to be every day more environmentally friendly, efficiency is fundamental for all kinds of projects.

Aluminum, for example, is expected to replace many heavier car parts today so cars can become lighter, more fuel-efficient, and consume less energy. This is just one example of how aluminum is essential today and will also be in the future.

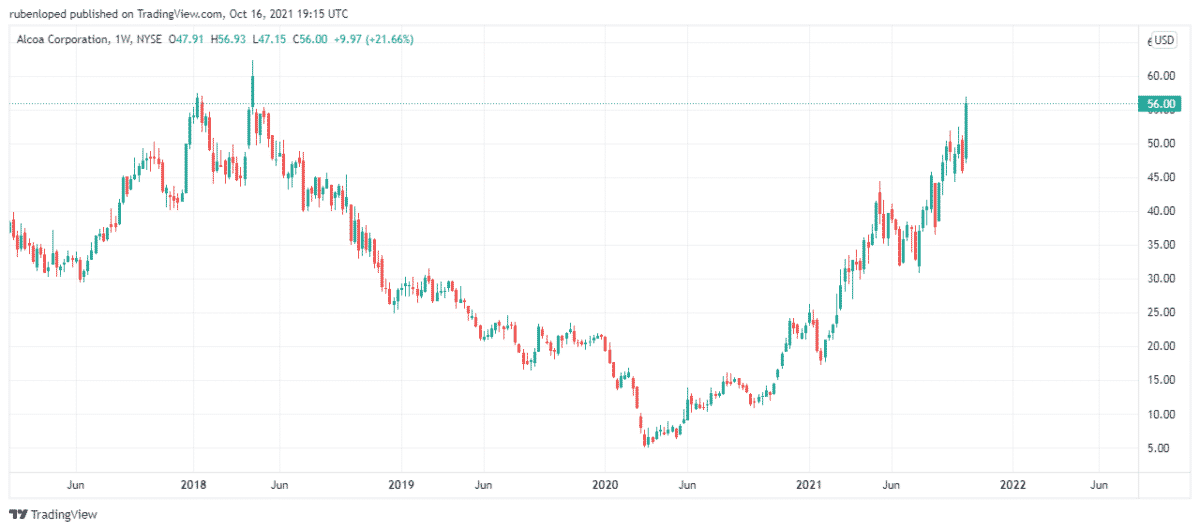

Alcoa (NYSE: AA)

Price: $56.00

Alcoa is one of the big names in the aluminum world. Anyone who has worked in industrial construction has probably heard it. The company has been around since the 18th century.

The high aluminum prices benefit Alcoa’s stock prices, and they have been up-trending since 2020 but more aggressively since 2021. Today the price is ten times what it was at the end of 2019, and now it’s close to 2017’s price.

Alcoa has received $309 million, and it is using that money to pay the high debt the company has today. As long as Alcoa continues to do things right and aluminum prices remain at the same level or even rise, the stock prices of Alcoa will keep increasing.

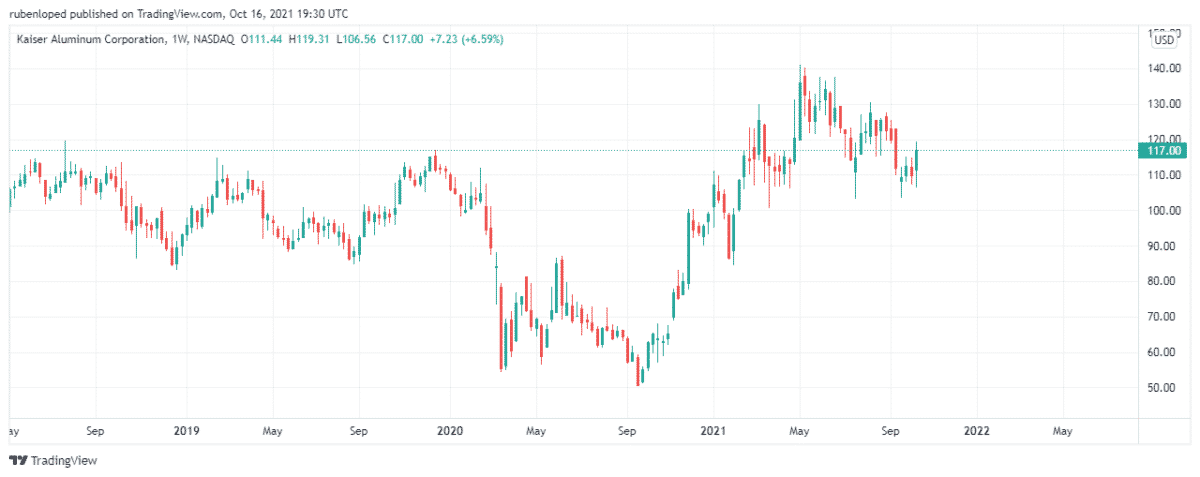

Kaiser Aluminum (NASDAQ: KALU)

Price: $117.00

As a leading manufacturer of semi-elaborated products for the aerospace, engineering, and automotive industries, Kaiser Aluminum serves customers worldwide. In contrast to Alcoa, Kaiser Aluminum is not a primary aluminum producer, so it does not benefit directly from its high prices but from the high demand.

As a result, the company has generated staggering growth in its second quarter of 2021, with sales increasing by an incredible 168% compared to the second quarter of 2020.

Since the low of September 2020, Kaiser Aluminum stocks price has risen to double its price and now quote at $117.00. The company still has some issues to solve, but in the long-term, the company is looking good, and right now, the problems with the supply chain of aluminum should favor the price up-trend.

Vedanta (NYSE: VEDL)

Price: $17.90

It is a natural resource Indian company engaging multiple business areas related to ore extraction, especially the extraction of aluminum, which gets more relevant due to the current increase of the prices. Moreover, China has emerged as a major importer of aluminum, which provides a window of opportunity for the company to trade with the giant. However, the political conflict between the two nations may interfere.

Like most sectors, Vedanta reached a low at the end of 2019 and has increased its stock price. Vedanta has the added value that it is not just an aluminum company but a natural resource company. Thus, the current increase in price, especially of oil, is benefiting the company.

Aluminum Corporation of China (NYSE: ACH)

Price: $17.97

Aluminum Corporation of China engages in the enterprise of non-ferrous metals. The company is the only and biggest producer of aluminum in China and has benefited from the country’s market, the biggest aluminum market in the world.

The company’s stocks are four times higher than in 2020 when they reached the penny stocks level price by quoting below $5. Its current stock price is over $17 per share, and it is expected to continue rising as many of its peers in its industry do because of the high aluminum prices.

Constellium (NYSE: CSTM)

Price: $19.14

It is a French company specializing in designing and manufacturing aluminum parts for the aerospace, packaging, and automotive industries. The company was trading at $14.41 per share at the beginning of the year. But it is now worth $19.14 per share. That’s an increase of almost 35%.

During the second quarter of the year, Constellium sales increased 31%, generating $1.770 million. If the experts are right, the company should do just as well in the year’s second half. Hence, the company’s share prices will also increase by the end of the year.

Final thoughts

The increase in aluminum prices is here to stay. The problems in the supply chain, the rise in demand from Europe, the USA, and now China, give a solid bullish sentiment to the market. Also, the current situation doesn’t seem to be a momentary increment that will fade away.

Increasingly more manufacturers will use aluminum due to its high resistance and lightweight, which favors energy efficiency. We see that aluminum stocks are a good investment now and in the future with all this said.