- Why trading on Robinhood?

- What are trading options?

- How to trade options here?

Buying options is one of the best ways of limiting your risk when you are not sure where the price of a stock is going, but you want to protect your capital. Robinhood is one of the best online platforms to trade this type of derivative. Although options trading is one of the most confusing markets for beginners, in February 2021, the Options Clearing Corporation cleared 572 million options contracts.

The market keeps growing every day as apps like Robinhood compete to offer better deals for their users. The opportunity for trading these assets is there, and it has never been easier to make money from the markets. Let’s check how to do this.

What are trading options on Robinhood?

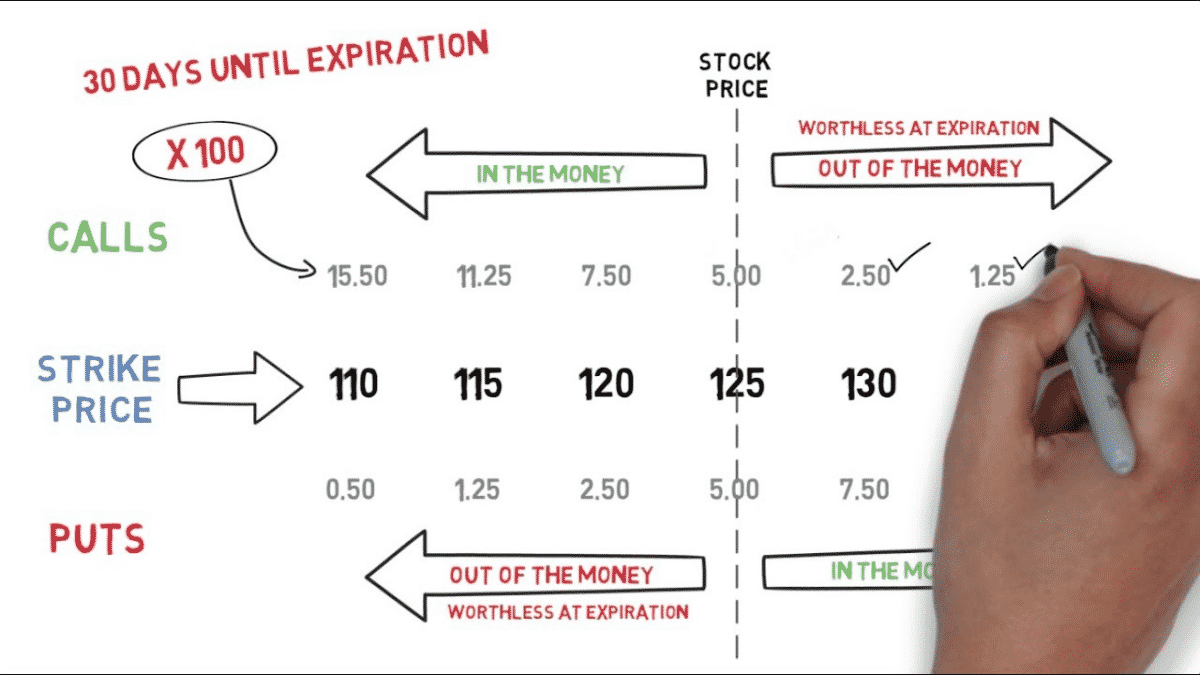

To buy an option contract, you pay a premium to the option seller to get the right to purchase 100 shares of the XYZ company at $100. The buyer will benefit if the price of the stocks reaches $100 before the end of the contract period. That way, when he buys the stocks, he could immediately sell them at the market price and profit from the trade.

However, if the price is never above $100, the buyer can’t be forced to buy the stock. So, the seller would keep both the premium and the stocks.

In any case, the buyer will lose the premium, and the seller gets to keep it.

Robinhood is a trading platform in which investors can trade stocks and options commission-free. This revolutionized online trading platforms and forced the industry to adapt to this game-changing event.

Why trading on Robinhood?

The platform was released in 2013, and since then, the company has been changing the game for everyone involved in the trading world. The name Robihood refers to the target of the company. It is for the small traders who are trying to enter the trading world. That is why its commission-free politics on stocks and options were so attractive to everybody.

Before Robinhood, nobody would have thought that trading options could be commission-free. However not only did the platform prove everyone wrong, it also forced all the big players to adapt to this strategy.

Besides all this, Robinhood does not require a minimum deposit to open an account. So, everyone can open a trading account.

How to trade options on Robinhood?

You need to follow a series of steps we will show you right now. Completing the process of buying your first options contract can be simple. Here, we want to show you how to do it right to increase your profit chances.

Step 1. Open an account

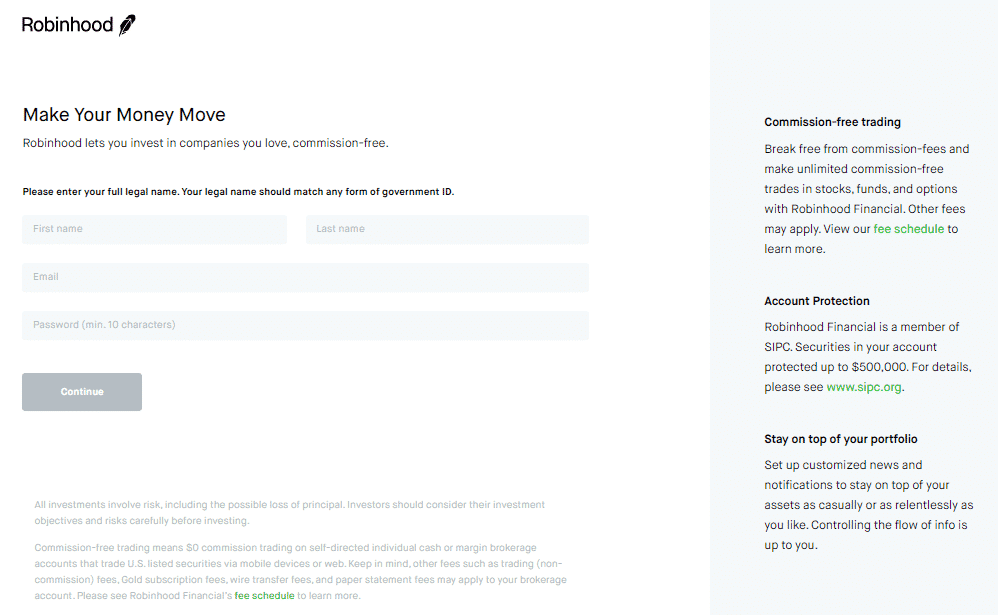

First, go to the website. Although you can do this on your computer, Robinhood is a mobile app, so you could only use the platform through an Android or Apple OS.

Next, you will have to fill up some fields to create your trading account. Finally, you will need an email account and choose a username and a password for the platform.

The second step consists of verifying your identity. Again, this is an ordinary and necessary procedure for this type of platform.

One crucial thing about Robinhood is that all of these steps are to fill up the application. After that, you need to wait a few days for the company’s approval to start trading.

Step 2. Understand the risk

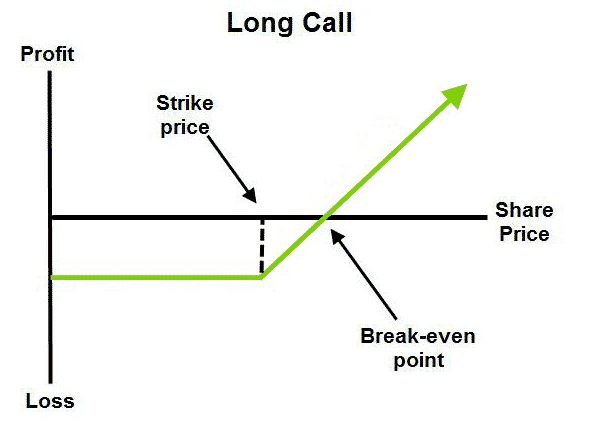

Now that you have complied with the platform requirements, you need to know what you are getting on. If you want to buy options contracts, you need to understand that risks are involved, and the possibility of losing money is real.

However, on the buying side of the transaction, the risk is always limited to the premium. This is just a fraction of the cost of the stocks. Nevertheless, this should not make you relax about your options trading. Controlling your losses, no matter how little they are, is the key to success in trading.

Step 3. Consider the greeks

The greeks are a set of parameters that work as benchmarks for the options. Every option contract has a value that depends on many factors. So the greeks are an indicator that has given traders the information they need to understand the level of risk and the probabilities of winning trades.

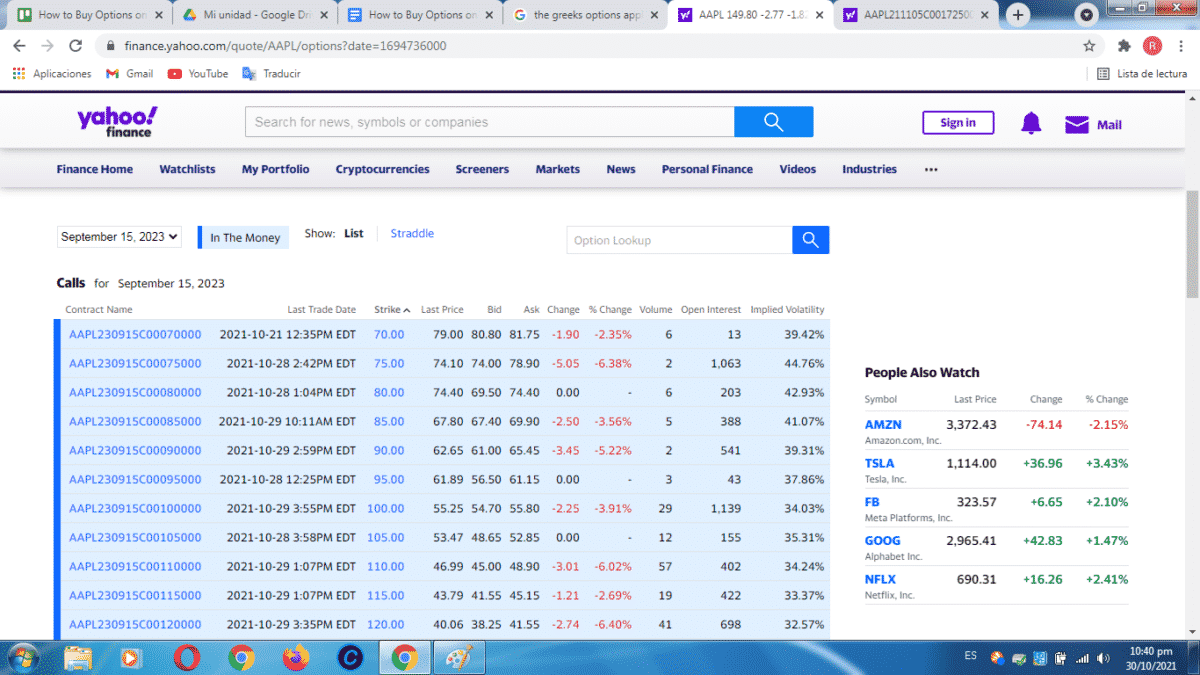

Step 4. Choose the option

This is the heart of the matter. Everybody can buy an option, but differentiating good options from bad options makes a trader successful. When you buy an option, you are betting that the price will move in the direction you want, and you will be able to buy or sell the stocks at a more reasonable price.

You need to consider the factors that may cause the movement and make sure it will happen within the chosen period.

Implied volatility, upcoming events, and expiration dates are essential to watch when choosing an option contract.

Step 5. Follow the trade

If you buy a European option, you can only exercise your contract at the end of the period. With American options, you can do it once the stock hits the strike price.

The inexperienced trader may think it only makes sense to follow the market if you buy American options, but that is not true.

You can trade options like stocks. That means that you can manage your risk if you think that the trade won’t go your way and you want to recover some money back.

Final thoughts

Robinhood is the trading platform that changes the game for all options traders. Its commission-free politics made the options market accessible to all investors and forced other platforms to follow its lead.

Option trading matches Robinhood’s philosophy of making the market accessible to small traders since it allows them to manage many stocks with just a fraction of the cost.

Also, as the platform is for the general public. Its transactions are simple, and the complex strategies that imply more risk are for advanced traders. So, if you want to trade options contracts, Robinhood is probably the right place to start.