As the vendor puts it, FXRapidEA trades rapidly and is highly profitable. We are also informed that the robot follows the trend and uses a drawdown system to minimize losses. Let’s assess the truthfulness of these statements and determine if choosing this EA is the right call.

FXRapidEA company profile

The vendor of this robot is anonymous. The name and profile of the parent company are not indicated in the sales pitch. So, it is virtually impossible to determine its reputation in this market.

The highlights of FXRapidEA

The features of the robot are included in this section:

- It is compatible with any broker, even NFA regulated brokers and brokers with FIFO rule.

- Fully automated and very easy to install and configure.

- Trades on 4 main currency pairs: EURUSD, NZDUSD, AUDUSD, and USDJPY.

- The minimum deposit required for trading is $460.

In regards to the trading strategy, the claim is that FXRapid EA concentrates on trend trading. Utilizing special algorithms, the software identifies a trend and initiates trades in the direction of that trend. When a minor rollback of the price occurs in the course of the trend, the EA opens other orders in the direction of the anticipated trend. The goal is to optimize the profits gained. When the trend direction changes, trades are closed. We also noticed that the grid approach is present.

Trading results with FXRapidEA

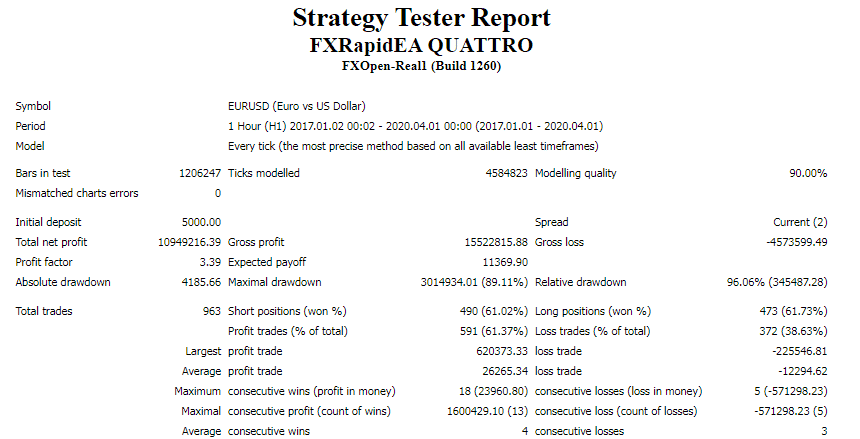

These backtest results reveal that the EA underwent testing from 2017 to 2020. As such, the EURUSD pair was traded on the H1 chart using a deposit of $5000. A total of 963 trades were completed during this period. Although only 61.37% of the orders were successful, you can see they led to an insane profit amount ($10949216). Each trade must have brought in huge profits then. In any case, we doubt if this profit amount can be attained in real market conditions within such a short time.

The EA traded with huge risks to the balance, as illustrated by the massive drawdown — 89.11%. The profit factor was 3.39.

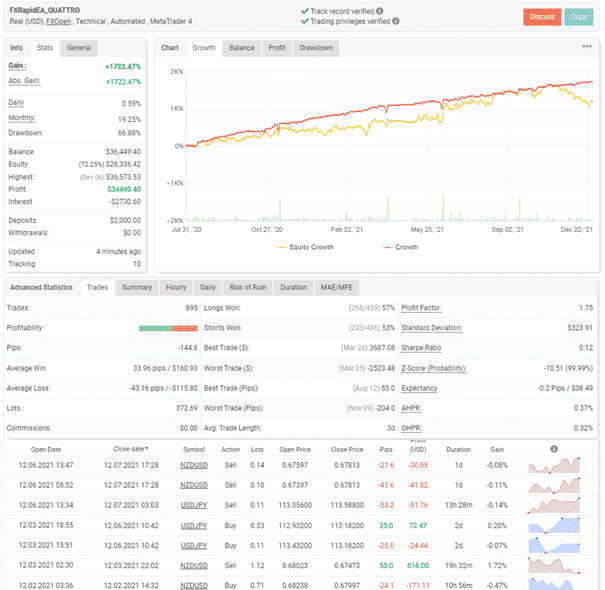

At a glance, these results are not good. The first thing that caught our attention was the large drawdown — 66.88%. It speaks of a system that trades dangerously. So, even though the strategy seems lucrative as it has brought $34449.40 profits to date, this money can be lost in a jiffy.

From 895 trades, only 57% of the long positions and 53% of the short ones have been won. The number of lots traded (372.69) is quite high. The value further demonstrates the EA’s risky trading activities.

As we look at the trading history, it is apparent that the EA applies the grid strategy. Trades are also conducted using long timeframes. A series of losses have been made.

FXRapidEA packages

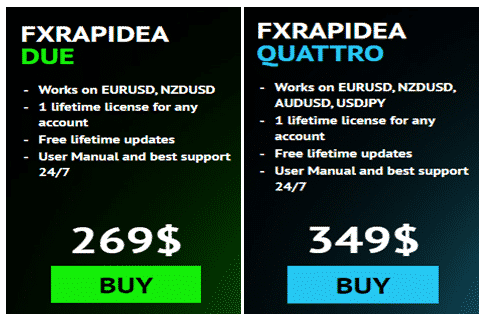

We have two packages for this EA — Due and Quattro. The first option costs $269, while the second one is $349. If you buy the Quattro version, you will be able to trade all the 4 currency pairs supported by the robot. Both packages feature one lifetime license for any account, free lifetime updates, a user manual, best support 24/7, and a 30-day money-back guarantee.

Assistance

The only means you can use to forward queries regarding the product to the support team is to fill the contact form provided on the EA’s official website. But there’s a hitch: the devs do not say which email address you should use to reach them.

Other notes

FXRapidEA has zero customer feedback. We don’t know why customers are not purchasing the system, considering it has been live trading since 2020.

Is FXRapidEA a profitable bet in 2022?

There are a few drawbacks of the system every trader needs to know about:

- It uses the grid approach

- The system reports poor win rates

- The profit factor is average