Claimed to be a cosmic FX advisor, FXQUASAR is a fully automated software that works on the MT4 and MT5 platforms. The vendor claims that this ATS uses a reliable system for minimizing risks and a smart analytic process. To check the veracity of the vendor’s claims we will analyze the various aspects of the FX EA including its performance, strategy, support, and other characteristics.

FXQUASAR company profile

Other than the mention of the system being powered by Forex Store on the website, there is no info present concerning the company and its developers. We could not find details like founding year, location address, phone number, team member info, etc. The absence of info shows a lack of vendor transparency that raises suspicion of the company’s reliability.

The highlights of FXQUASAR

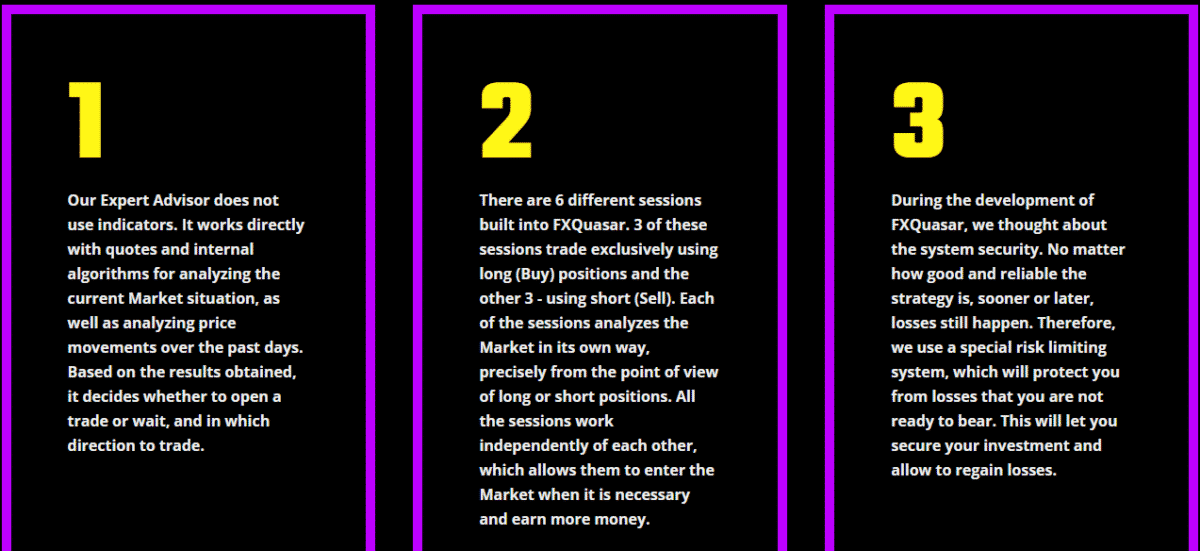

The significant features of this FX robot that the vendor highlights are:

- It works with all brokers including NFA regulated companies.

- The FX EA is designed to work on any account type.

- It does not use indicators but works directly with quotes and algorithms for market analysis.

- For trading, the ATS uses 6 different sessions with 3 of them trading long and the rest trading short.

- To minimize risks the FX EA uses a special system that secures your investment.

Facts & figures with FXQUASAR

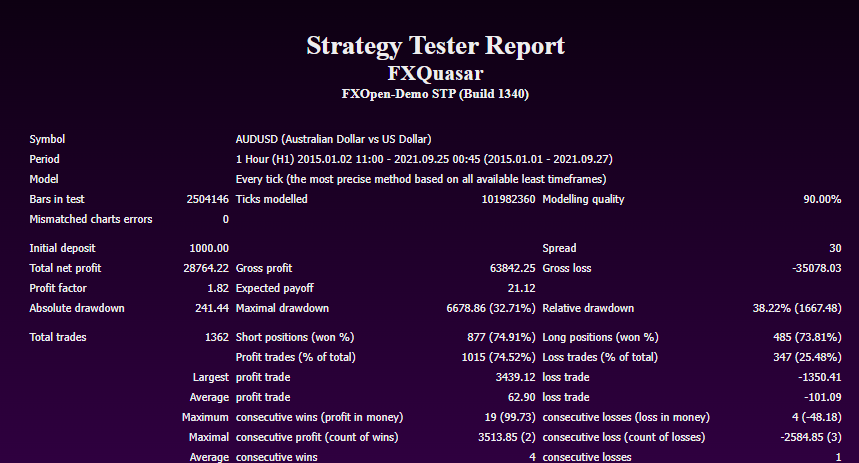

The vendor provides a strategy tester report for this FX robot. Here is a screenshot of the test:

From the above report, we can see the testing was done on the AUDUSD pair using the H1 timeframe from 2015 to 2021. For an initial deposit of 1000, the EA had made a total net return of 28764.22 for a total of 1362 trades. Profitability was 74.52% and the profit factor was 1.82. The maximum drawdown was 32.71%. From the results, we can see the drawdown was high and the profits were low considering the high number of trades and the duration of the test.

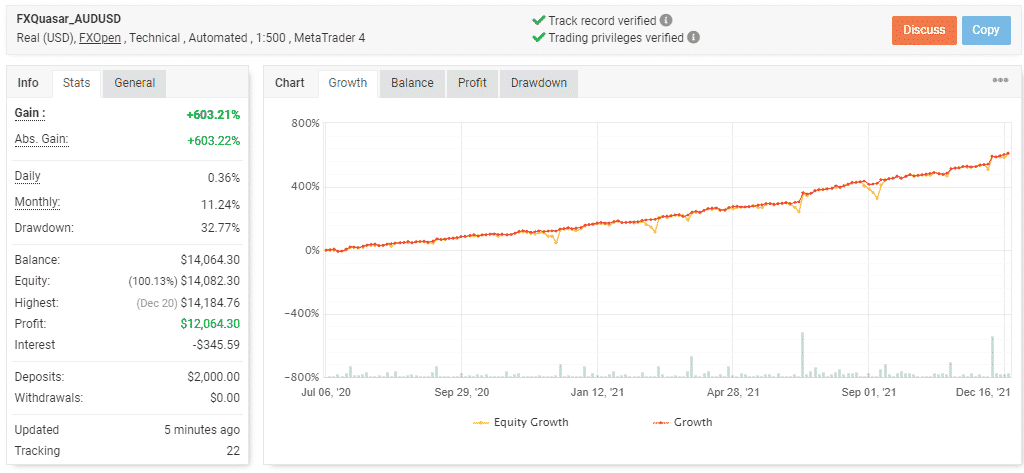

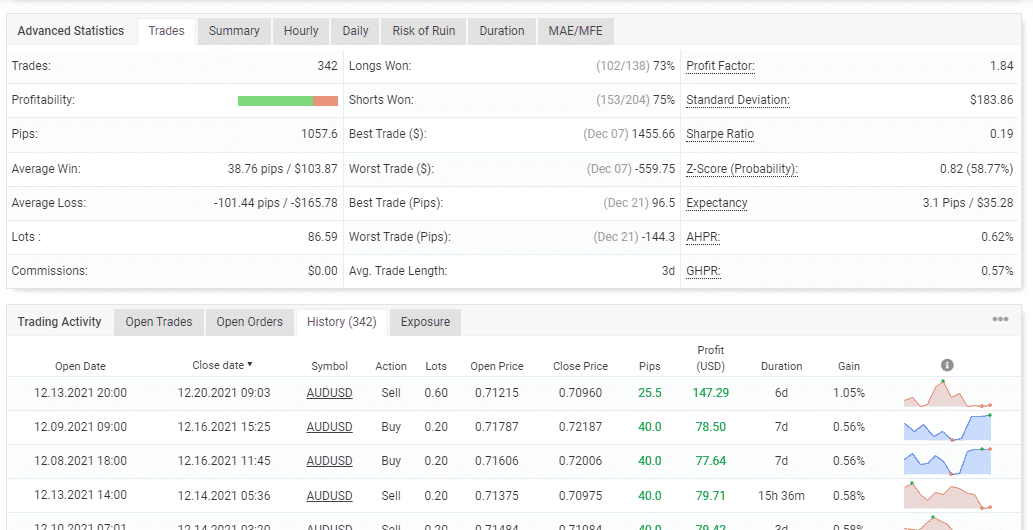

A real USD account using the leverage of 1:500 on the MT4 platform. Here are a few screenshots of the trading stats.

From the above stats, we can see there is a total gain of 603% and an absolute profit of a similar value. The daily and monthly returns are 0.36% and 11.24% respectively. A drawdown of 32.77% is present. For a deposit of $2000, the account that started in July 2020 has completed 342 trades with 75% profitability and a profit factor of 1.84. From the trading history, we can see the lot size used varies ranging from 0.20 up to 2.94. With the high drawdown, low profit factor, and big lot sizes it is clear that a high-risk approach is used. While the growth looks good, the risk factor can endanger your capital.

Comparing the backtesting report with real trading results, the drawdown and profit factor values are similar, confirming that a high-risk approach is used by the EA.

FXQUASAR packages

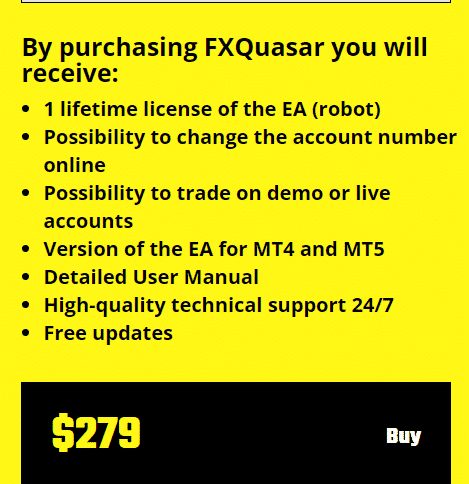

You need to pay $279 for purchasing this FX robot. Features included in the package are, a lifetime license, the facility to change the account number online, use of demo and live accounts, MT4 and MT5 versions, a detailed user guide, 24/7 technical support, and free updates. No refund offer is present which makes us suspect the reliability of the ATS. When compared to the market average, we find the price is expensive.

Assistance

An online contact form is the only support method this vendor offers. There is no live chat, FAQ, or other such support methods.

Other notes

Unfortunately, we could not find user reviews for this FX robot on reputed review sites like FPA, Trustpilot, etc.

Is FXQUASAR a reliable system?

If you are interested in investing in this ATS, here are the main things you need to consider:

- The vendor provides verified trading results that show decent growth and profits.

- Real trading results show a high drawdown and big lot sizes that denote a risky approach.

- There is not much info on the vendor indicating a lack of vendor transparency.

- The product is expensive when compared to prevailing market rates.