- What is fintech, and what is its potential?

- Is the fintech sector a profitable option for investors?

- Which are the top three fintech ETFs right now?

“Financial technology” is abbreviated as fintech. It refers to companies that deal with contactless banking, e-commerce, budgeting, credit, and other related technologies. ETFs, pave the way for investors in this tight market category, as they can be modest, unpredictable startups that are difficult to pick individually.

Due to the pandemic, fintech usage has increased, with more people using contactless payment solutions that meet a demand not met by traditional banks.

Consider companies such as Square, Paypal, Apple, and others. Everyone now has a cell phone and access to the internet, paving the way for fintech to keep growing in popularity.

What is an ETF?

ETFs, or “exchange-traded funds,” are mutual funds that trade on stock markets and often track a certain index. You obtain a bundle of resources when you participate in an ETF. You may purchase and sell throughout market hours, possibly minimizing your vulnerability while also helping broaden your portfolios.

ETFs are traded on financial markets and have frequent price fluctuations like other stocks. ETFs, like mutual funds, are a pool of dozens, hundreds, or even hundreds of stocks and shares in a single investment.

Top three fintech ETFs

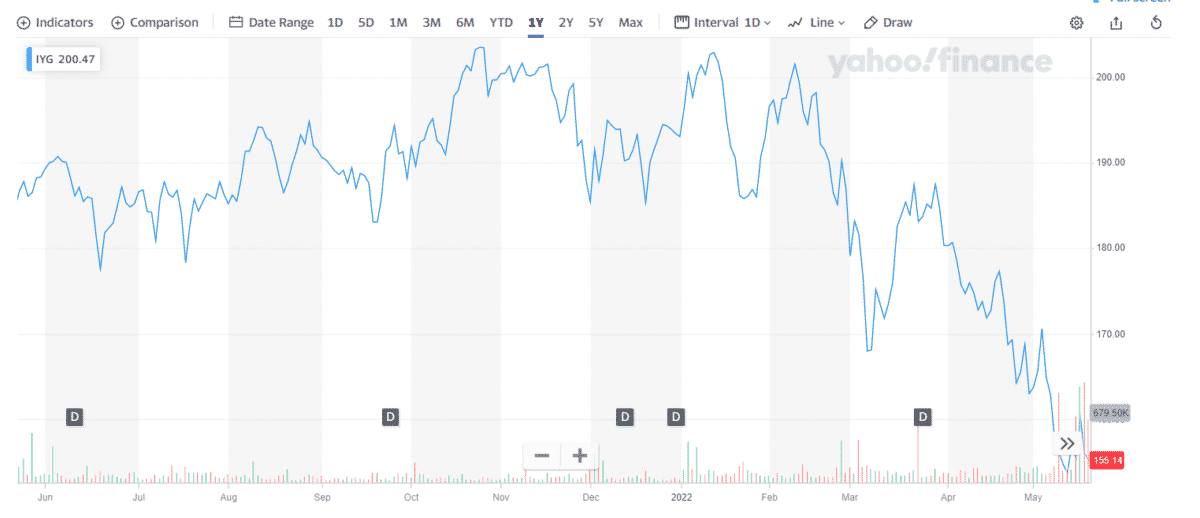

ETFs may be perfect for you if you seek a low-cost, tax-efficient option to invest in various asset types. For example, IYG has been the top-performing fintech ETF in the past five years. The stock price has increased by 40%, from $107 to $155.

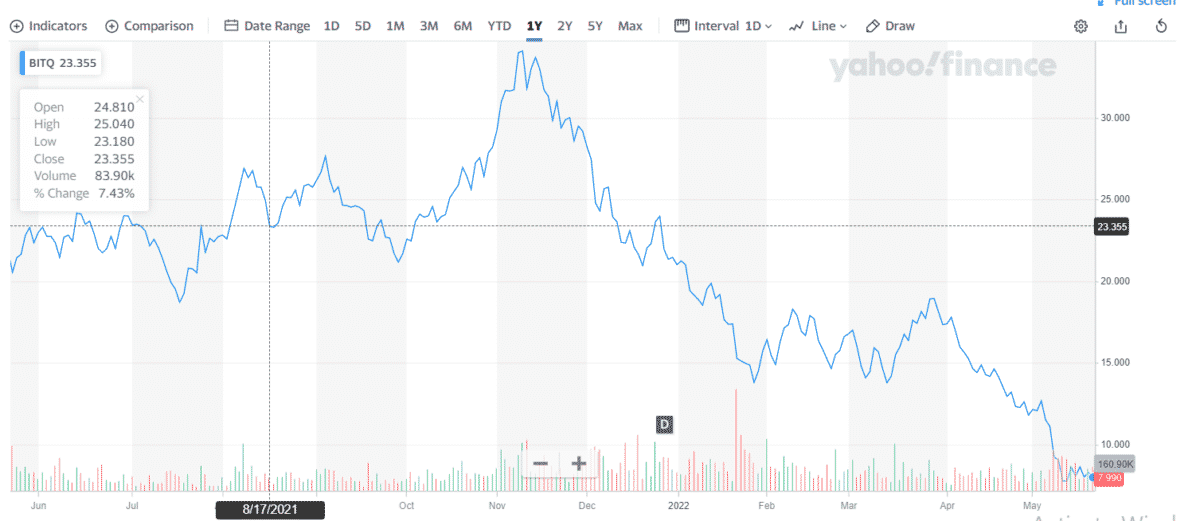

BITQ is another fintech ETF that has regularly offered boons to its investors; the stock price rose from $22 to $33 in a year.

However, here are our top three ETFs for the fintech sector.

- Global X FinTech ETF

- Ark Fintech Innovation ETF

- ETFMG Prime Mobile Payments ETF

Let’s take a closer look at these fintech ETFs.

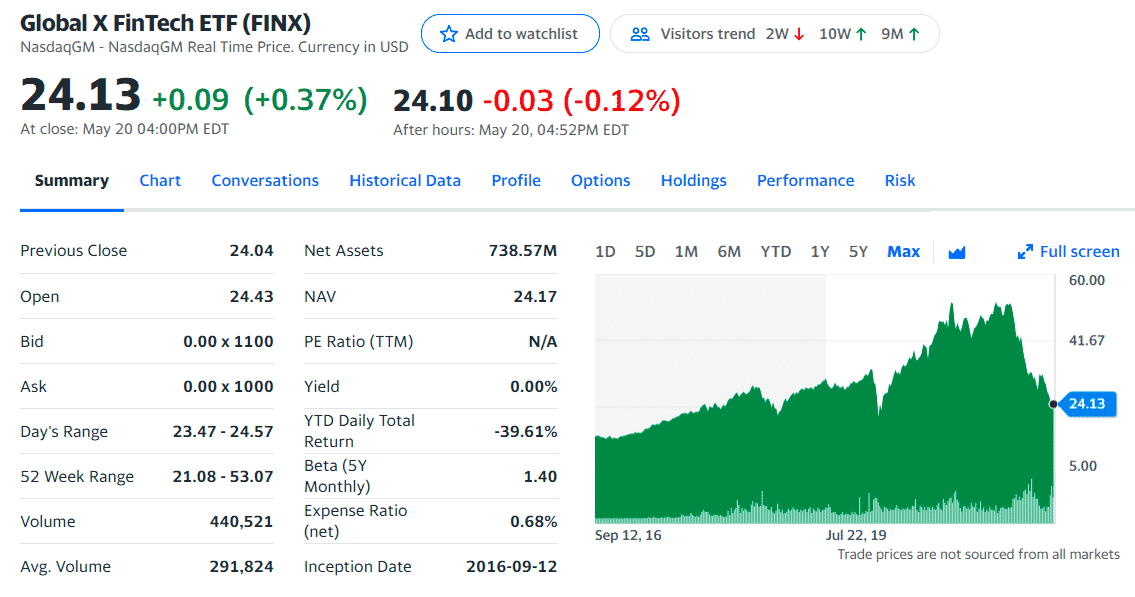

Global X FinTech ETF (FINX)

Price: $24.13

Expense ratio: 0.68%

Net assets: 738.57M

The oldest entry in this category, Global X’s FINX, has more than $1 billion in the capital. The fund invests in financial firms and companies in developed countries that rely on technology for most of their revenue: healthcare, financial advisory, payment systems, loans, fundraising, blockchain, etc.

Because the portfolio is market-cap-weighted, it favors the United States at 65%, followed by Australia at 15%. Big tech firms like Intuit, Square, Fiserv, Paypal, and other companies are among the top ten holdings. FINX has 40 assets and a 0.68% expenditure ratio.

It is a reputable ETF with a rich history of investing in fintech businesses. According to Global X, the fund’s strategy is to invest in “businesses on the cutting edge of the developing financial technology sector.”

According to Global X, the fund’s strategy is to invest in “businesses on the cutting edge of the developing financial technology sector.”

How much would you earn if you invested 1 year ago?

This asset has lost almost half its value in the past year. The stock has lost almost 60% of its value. The interest of investors in the fintech sector is also at an all-time high. Moreover, the yearly chart is printing a double bottom, leading to a 73% rally. Hence now is the right time to invest.

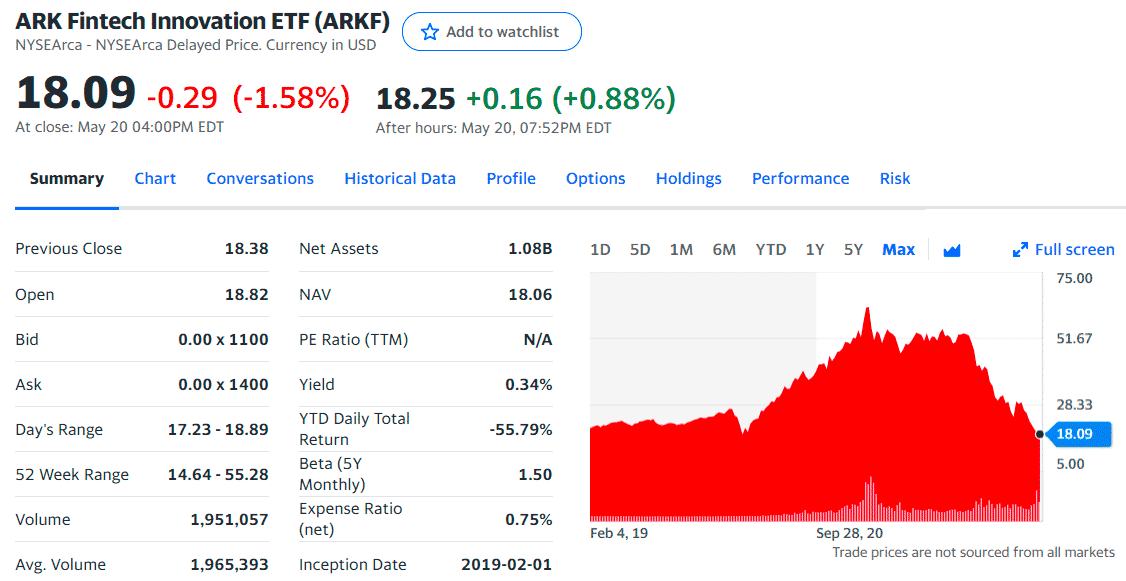

ARK Fintech Innovation ETF (ARKF)

Price: $18.09

Expense ratio: 0.75%

Net assets: $1.08B

Fintech ETF from Cathie Wood’s famous ARK Invest. Due to their spectacular success in 2020, ARK has had extraordinary money inflows recently, for better or worse. ARKF is actively managed, allowing managers to pick and choose which stocks to include in the fund. ARK is primarily interested in “disruptive” businesses.

ARKF is the fintech advancement ETF from ARK. The fund backs businesses focused on mobile payments, electronic wallets, and crypto. This fund aims for long-term capital growth.

Since its inception in early 2019, ARKF has accumulated approximately $4 billion in cash. The fund’s goal, according to ARK, is to capture “the debut of a digital platform new product launch that has the potential to transform the way the finance system operates.”

The Ark group of ETFs has gained notoriety in recent years due to the outperformance of its flagship product, the Ark ETF (ARKK).

How much would you earn if you invested 1 year ago?

If you had invested one year ago in ARKF, you would have lost 50% of your holdings. Still, the recent interest of financial institutions in blockchain technology could initiate a long-term rally for ARKF.

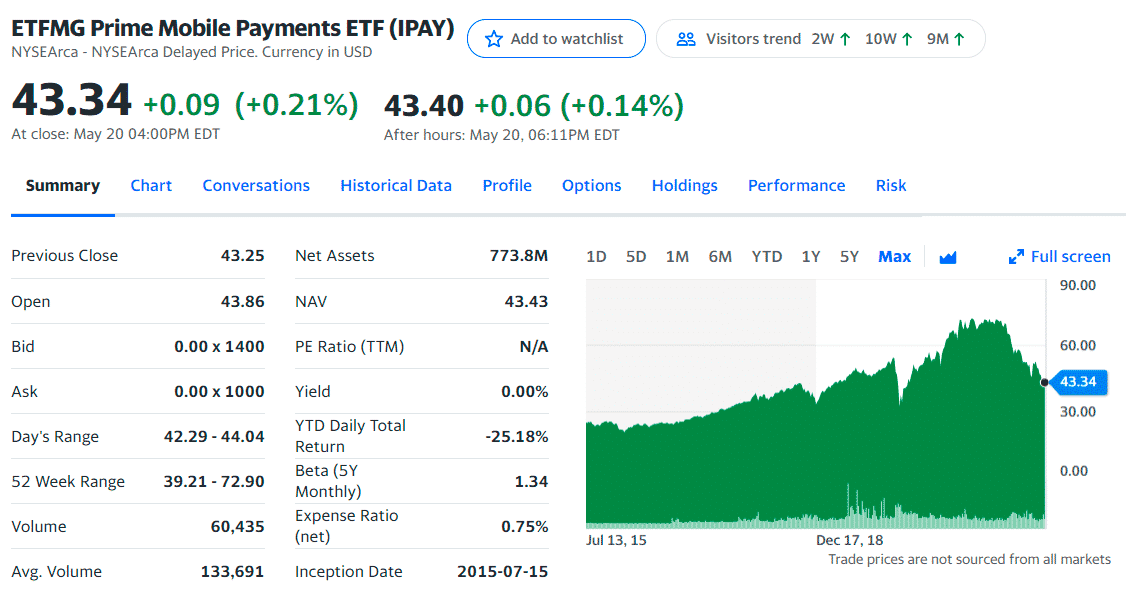

ETFMG Prime Mobile Payments ETF (IPAY)

Price: $43.34

Expense ratio: 0.75%

Net assets: $773.80M

This fund backs companies that are making the transition from traditional cards and currency to digital systems. The Prime Mobile Payments Index’s price and yield performance are tracked.

The digital and mobile payment industries are included in this index.

It focuses on the operation of companies that:

- Provide services or apps for payment processing.

- Offer payment options.

- Build or deliver payment preinstalled software or architecture.

According to estimates, “unbanked” digital money will reach approximately $500 billion in the next decade. With so much money flowing around through traditional finance, fintech solutions that address this demand have a lot of promise.

The ETFMG Prime Mobile Payments ETF aims to track the value and yield performances of the Prime Digital Payments Index as accurately as possible before fees and costs.

The index serves as a reference point for investors following the mobile digital payments business, emphasizing credit or debit card networks, transaction equipment, application solutions, online payment facilities, and payment services.

The financial sector is not immune to digitization. For example, customers may use the internet to send money worldwide, pay at stores with their phones, purchase ETFs online, make payments later, take out loans, and keep track of transactions.

How much would you earn if you invested 1 year ago?

Your wealth would have been halved had you invested a year ago in this ETF. This could be attributed to the economic slowdown because of Covid-19 and other external factors. However, the ETF rewarded its holders with a 10% return in the past two months.

Final thoughts

The word “fintech” has entrenched itself as a catch-all phrase. However, pacesetters are fintech businesses created for this purpose and have successfully made it to the stock exchange following the venture capital stage.

Established profit and for-profit firms that have shifted to become technology companies and can be used in the financial universe offer the substructure.