- What are deflationary tokens?

- Are they worth investing in?

- Do they have the potential to grow in the future?

Inflation has hit a 30-year high and impacts everyone. On the other hand, investors are increasingly turning to cryptos in these challenging times. This is a good moment for deflationary currencies, which are performing well.

Figures released by the Labor Department show that in October 2021, prices rose at their most extraordinary pace in more than 30 years. Experts expect a 6.2% growth over the previous year.

As a result, the leading cryptocurrencies rocketed to fresh all-time highs as inflation faded. The most responsive were Bitcoin and Ethereum. With these new highs, the theory that digital currencies are deflationary and act as a buffer against inflation was further solidified. Gold will always be the gold standard for inflation protection. However, there are a few things to keep in mind regarding cryptos.

What is deflationary crypto?

The quantity of deflationary crypto tokens decreases over time. In other words, as time passes, the total number of tokens in circulation decreases. This strategy is used to avoid an oversupply of a specific token on the market. In addition, the token’s value rises as a result.

A coin with a 2% yearly supply decline is an example. There are 20,000 of these coins in circulation each year, let’s assume for this example. By the end of the year, it will be down to 18,600 coins.

There will be 18,228 in the third year, 17,863 in the fourth, etc. As the supply of these coins declines, their demand and value will grow. As a result, deflationary token crypto projects achieve their objectives in various ways.

Due to its scarcity, deflationary cryptocurrency preserves its value, making it an excellent investment. A cryptocurrency with no cap would never grow in value since there would be no demand.

Best deflationary crypto projects to watch right now

Let’s take a look at the most deflationary coins in 2022.

Bitcoin (BTC)

A large portion of the population has come to equate Bitcoin with the concept of crypto. It was one of the first digital assets to be released in the digital market. Bitcoin is the most deflationary crypto. This crypto is both deflationary and inflationary. Bitcoin is a deflationary currency since miners only get half of their reward every four years. The mining process increases the total number of coins in circulation, making it an inflationary practice.

Why does it have the potential to grow?

There are a total of 21 million Bitcoins in circulation. Once this number of coins has been reached, no new coins will be created, and miners will no longer get block rewards for their efforts. So it will face more scarcity, and its value will increase.

How much would you earn if you invested in BTC 1 year ago?

BTC’s price on May 1, 2021, was $57,828. A year later, the coin price closed at $38,023. So if you had invested $1,000 last year, your account could have lost $342.4.

Binance Coin (BNB)

Practice is known as “Buyback and Burn,” which lowers the quantity of BNB tokens in circulation on the Binance network. They purchase coins from investors who made a profit of more than 20% in the previous quarter and move them to inactive addresses.

Two hundred million deflationary crypto tokens were initially planned for Binance’s currency supply. The Binance network has a plan to burn roughly half of its currencies to reach the goal of 100 million. On October 18, 2021, Binance completed its 17th quarterly BNB burn, burning 1,335,888 BNB. As of January 16, 2022, there are 166,801,148.00 BNB in circulation.

Why does it have the potential to grow?

The Binance network has a plan to burn roughly half of its currencies to reach the goal of 100 million. So its value will increase after this whole process.

How much would you earn if you invested in LIT 1 year ago?

BNB price on May 1, 2021, was $619.35. A year later, the coin price closed at $384.99. So if you had invested $1,000 last year, your account could have lost $378.39.

Polygon (MATIC)

The Polygon Network’s native currency performs two functions: it pays transaction fees and participates in the PoS consensus process. Using Polygon’s official documentation, MATIC’s value is supported by burning a percentage of its transaction fees in every block.

Why does it have the potential to grow?

Because of its engagement in multiple dApps and DeFi initiatives has massive potential for steady development as the crypto world grows more inclusive.

How much would you earn if you invested in MATIC 1 year ago?

MATIC’s price on May 1, 2021, was $0.7868. A year later, the coin price closed at $1.0855. So if you had invested $1,000 last year, your account could have gained $379.6.

Ripple (XRP)

This list would be incomplete without mentioning XRP, a deflationary cryptocurrency. While mining XRP, fees must be paid for each transaction. These fees are not distributed to validators as a reward or sent to a centralized authority. Therefore, XRP is a deflationary currency since they are burned.

Why does it have the potential to grow?

Due to XRP’s efficiency as a currency, long-term growth of its use is possible. XRP can handle thousands of transactions per second while still lightning-fast for transaction processing.

How much would you earn if you invested in LIT 1 year ago?

XRP price on May 1, 2021, was $1.65. A year later, the coin price closed at $0.5925. So if you had invested $1,000 last year, your account could have lost $640.9.

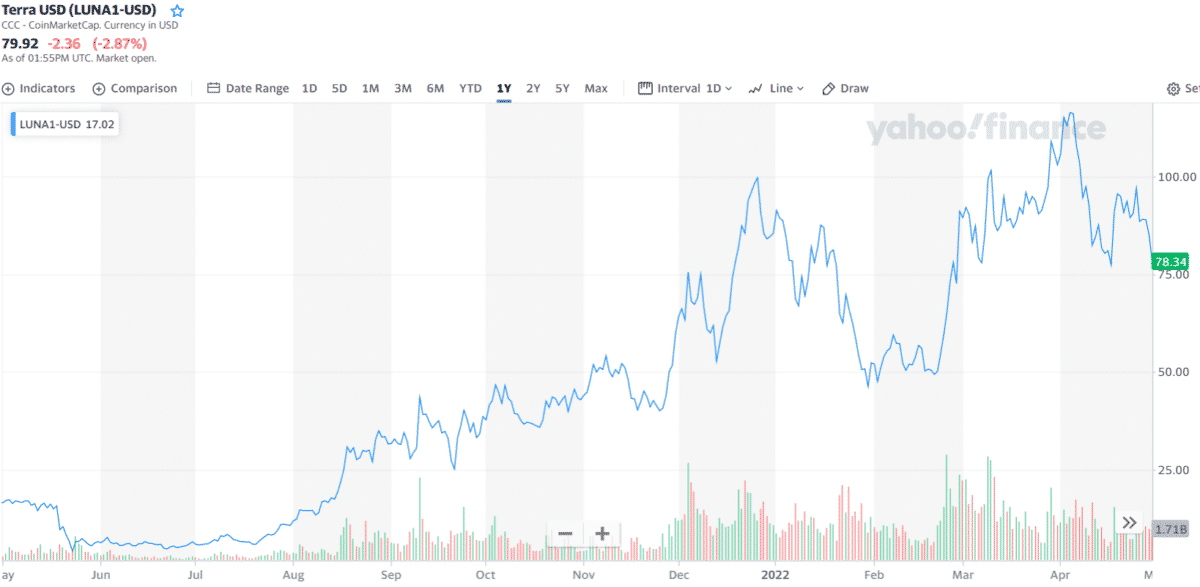

Terra (LUNA)

The Terra ecosystem’s native currency is the second deflationary crypto list. As of the project’s launch, LUNA has 1 billion coins. As demand increases, the circulating supply of deflationary crypto will be reduced.

Why does it have the potential to grow?

Delegated proof of stake is enabled on the Terra blockchain, ensuring the network’s stability and security. Terra’s on-chain data reveals five clear LUNA’s substantial growth potential indicators.

How much would you earn if you invested in LIT 1 year ago?

LUNA’s price on May 1, 2021, was $16.54. A year later, the coin price closed at $79.92. So if you had invested $1,000 last year, your account could have gained $3,831.9.

Final thoughts

Many additional deflationary coins may be found in the market. For example, Ethereum Classic, SafeMoon, Tenset, Filecoin, Tron, Bomb, Nuke, and a slew of others.

The value of these tokens increases when a percentage of their supply is burnt up over time. While their scarcity makes them an attractive investment for some, they safeguard against inflation and price rises due to their rarity. Some are inflationary and others deflationary, as a consequence.