- What is crypto staking?

- How can you stake the digital assets?

- What are the benefits and drawbacks of this process?

The conventional Bitcoin mining process is being replaced with proof of stake, employed by various emerging cryptos. “Stakeholders” are cryptocurrency users who commit assets to the network to help the blockchain validate transactions.

Staking has the potential to reward you with the BTC you staked. On the other hand, stakes are more than a selfless gesture that aids the web. This article will cover the fundamentals of becoming a crypto stake master.

What is the process of crypto staking?

Proof-of-stake (PoS) cryptos use staking to add new transactions to the blockchain.

Using their currency, users first promise the BTC system something. Then, to verify transaction blocks, the protocol picks a validator from this group. Of course, investing more money increases your chances of being selected as a validator.

Every time a new block is uploaded to the network, the block’s validator receives a staking incentive in the form of a new BTC. On the other hand, other blockchains use a different kind of crypto as an incentive. For example, if players bet a certain coin, they’ll nearly always win back the same coin.

To stake, you must own crypto that uses the PoS mechanism. Many of the most popular BTC exchanges enable this. Afterward, you may choose how much you want to wager.

Coins that are staked are yours to keep, regardless of who owns them. To put them to use, you’ll need to stake them out at some point, and you may do so at any moment. Depending on the crypto, you may have to stake your coins for a particular amount of time before you may remove them from the system entirely.

Staking isn’t an option for certain cryptocurrencies, such as BTC and ETH. Instead, PoS coins are the only ones accepted.

Several cryptos use the proof-of-work (PoW) principle to add blocks to their blockchains. Unfortunately, proving your work requires a significant amount of computing power, which is why it isn’t easy to use. As a consequence, PoW cryptocurrencies use a considerable amount of power. As a result, Bitcoin has been criticized for its environmental impact.

It is significantly easier to provide PoS. Another benefit is that the system can handle larger transactions, making it more flexible.

Which crypto are you able to stake?

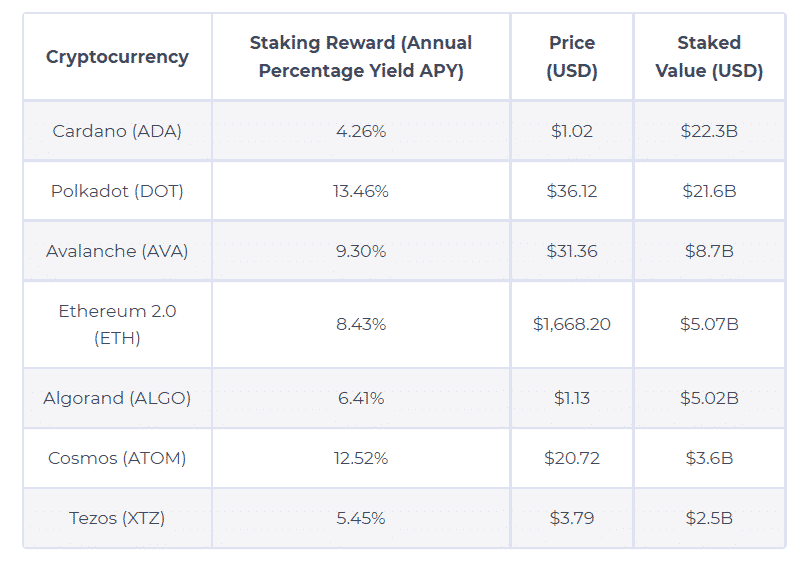

In July 2021, the US company Staked released the research “The State of Staking,” which estimates around $171 billion in assets staking across PoS crypto.

Listed below are the top five most valuable coins. They have huge market capitalization and a higher average yield for each.

- 6.8% Ethereum 2.0 (ETH 2.0)

- 4.6% Cardano (ADA)

- 14% Polkadot (DOT)

- 7.4 % Solana (SOL)

- 14.9 % Polygon (MATIC)

The number of validators in the network might affect the yield rate, which varies from platform to platform.

The pros and cons of staking cryptocurrency

Staking crypto has several benefits and drawbacks too. Let’s take a look at what they are.

Pros

- This is a simple technique to make money from your Bitcoin investments.

- Staking, unlike crypto mining, does not need expensive equipment.

- As a participant, you’re helping to strengthen the blockchain’s security and improve its performance.

- This has a less negative effect on the environment than crypto mining.

- For starters, there is the potential to earn a substantial amount of Bitcoin via staking. It’s possible to earn more than 10% or 20% annually if you’re fortunate. A good investment opportunity, in my opinion. Furthermore, all you’ll need to get started is proof-of-stake-based crypto.

- Staking your coin is another method to show your support for a cryptocurrency’s blockchain. In addition, staking is used to verify transactions to keep the cryptocurrency network functioning without interruption.

Cons

- If the value of crypto drops significantly, it’s best not to invest in it. The interest you earn on your staked assets might be lost if the value of those assets declines.

- Locking your money away for an extended length of time may be required to stake. If you have any staked assets, you can’t do anything with them, even selling them.

- A seven-day or longer delay may be required if you desire to un-stake your Bitcoin.

- The most major risk of cryptocurrency staking is that the price may decline. If you come across currencies with extremely high staking reward rates, this is something to bear in mind.

- Many smaller crypto projects offer attractive returns to entice investors, only to see their value drop. Cryptocurrency stocks may be a preferable alternative for those who don’t want to take on too much risk when investing in crypto. It’s yours, but before trading it again, you must un-stake it. To avoid any unpleasant surprises, find out how long the unstaking operation takes and whether there is a minimum lockup period.

When should you stake cryptocurrency, and when should you not?

As long as you don’t plan on exchanging your BTC shortly, it would help if you staked it. Because you don’t have to put in any work, you’ll be able to increase your BTC holdings.

It’s essential to think about whether or not each crypto is worth your time and money before investing in it. What if you don’t have any cryptocurrencies at the moment to put your money at risk? To make sense of the purchase, you need to know that the coin is an excellent long-term investment.

Final thoughts

Staking is a way to increase the value of your crypto assets or coins by receiving additional rewards. Cash deposits or stock dividends might help you think about it in terms of interest and returns. In essence, the network compensates coin holders for agreeing to allow their crypto to be used in the blockchain validation process. For BTC investors, staking may provide an extra source of income.