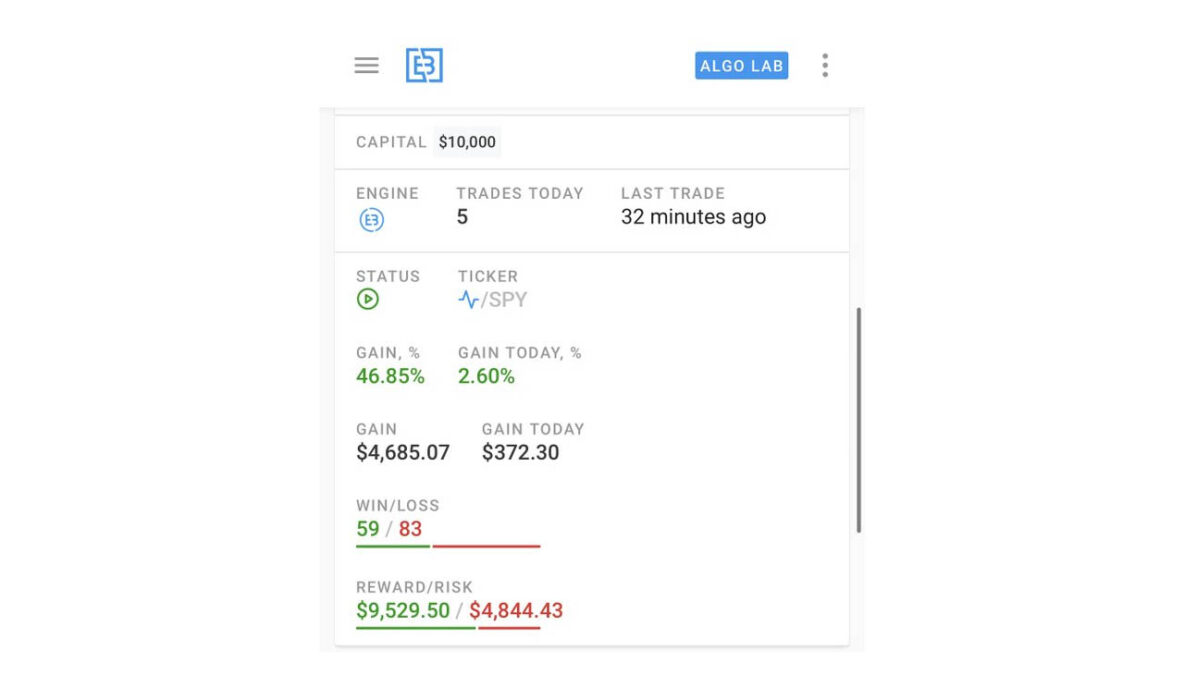

Breaking Equity is a leading online trading platform that offers advanced features and tools to help traders optimize their investment returns. It provides a personalized experience based on individual needs and investment strategies, including algorithmic trading, technical indicators, backtesting, automation, and educational resources. In this review, we will take a closer look at the features of Breaking Equity, its fees and costs, regulations and security measures, and customer support, to help you determine if it’s the right platform for your trading needs.

Features of Breaking Equity Platform

- Advanced Features: Breaking Equity offers advanced features, including algorithmic trading, technical indicators, backtesting, automation, and educational resources, which can help traders make informed investment decisions.

- User-Friendly Interface: The platform’s user interface is designed to be user-friendly and customizable, providing traders with a personalized experience based on their individual needs and preferences.

- Reduced Risk of Human Error: Breaking Equity’s automation tools can help reduce the risk of human error and improve the accuracy of trades, leading to potentially higher profits.

- Regulatory Compliance: Breaking Equity is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring that the platform complies with strict rules and regulations to protect investors.

- Security Measures: Breaking Equity stores customer funds in segregated bank accounts, uses two-factor authentication and advanced encryption methods to secure user data and communications, and complies with anti-money laundering (AML) and know-your-customer (KYC) regulations to prevent fraudulent activities on the platform.

- Customer Support: Breaking Equity offers customer support via live chat and email to assist traders with any questions or concerns they may have regarding their investments on the platform.

Step-by-Step Guide to Setting Up an Account on Breaking Equity Platform

Here’s a step-by-step guide on how to set up an account on Breaking Equity:

- Go to the Breaking Equity website and click on “Get started.”

- Fill in your personal information, including your name, email address, and phone number.

- Create a username and password for your account.

- Choose the type of account you want to open – Standard or Professional – and read the information on both accounts carefully.

- Provide additional information, including your date of birth, address, and national insurance number.

- Complete the verification process by uploading a photo ID, such as your passport or driver’s license, and proof of address, such as a utility bill or bank statement.

- Fund your account with a minimum deposit of £250 using a bank transfer or credit/debit card.

- Once your account is funded, you can start trading on the platform.

It’s important to note that Breaking Equity may require additional documentation or information to verify your identity during the account setup process. Additionally, the deposit methods and requirements may vary depending on your location and the account type you choose.

If you have any questions or issues during the account setup process, you can contact customer support via live chat or email for assistance. Breaking Equity’s customer support team is available to help traders with any questions or concerns they may have regarding their investments on the platform.

How to Manage Your Investments and Cash on the Platform

Managing your investments and cash on Breaking Equity is easy. Here are the steps to follow:

- Log in to your Breaking Equity account.

- Navigate to the “Accounts” section of the platform.

- Select the account you want to manage. If you have multiple accounts, you can switch between them by clicking on the account name or number.

- View your account balance and investment portfolio. The platform provides real-time updates on your investments and cash balance.

- Buy or sell assets to adjust your investment portfolio. Use the search bar to find the asset you want to trade and enter the amount you want to buy or sell.

- Monitor your investments and track their performance over time. The platform offers tools to help you analyze market trends and make informed investment decisions.

- Withdraw or deposit cash from/to your account. Navigate to the “Withdrawal” or “Deposit” section of the platform, select your preferred method (e.g. bank transfer or credit/debit card), enter the amount, and confirm your request.

- Review your transaction history and account statements. The platform provides a comprehensive view of your transaction history and account statements.

It’s important to note that Breaking Equity may require additional documentation or information to verify your identity before processing your withdrawal or deposit request. Additionally, some withdrawal or deposit methods may incur fees, such as credit/debit card withdrawals which incur a fee of 1% of the total withdrawal amount.

If you have any questions or issues during the investment and cash management process, you can contact customer support via live chat or email for assistance. Breaking Equity’s customer support team is available to help traders with any questions or concerns they may have regarding their investments on the platform.

Common Questions About the Platform and Answers to Them

Here are some common questions about Breaking Equity and their answers:

Q: Is Breaking Equity regulated?

A: Yes, Breaking Equity is regulated by the Financial Conduct Authority (FCA) in the UK. This ensures that the platform complies with strict rules and regulations to protect investors.

Q: What types of assets can I trade on Breaking Equity?

A: Breaking Equity offers a wide range of assets for trading, including stocks, ETFs, forex, indices, and commodities.

Q: What are the fees for trading on Breaking Equity?

A: Breaking Equity charges a commission fee of 0.5% per trade, with a minimum fee of £1. Additionally, some withdrawal or deposit methods may incur fees, such as credit/debit card withdrawals which incur a fee of 1% of the total withdrawal amount.

Q: Does Breaking Equity offer demo accounts?

A: Yes, Breaking Equity offers demo accounts for traders who want to practice their trading skills without risking real money.

Q: Does Breaking Equity provide educational resources?

A: Yes, Breaking Equity provides educational resources, including articles, videos, and webinars, to help traders improve their skills and stay up-to-date with market trends.

Q: What security measures does Breaking Equity have in place?

A: Breaking Equity stores customer funds in segregated bank accounts, uses two-factor authentication and advanced encryption methods to secure user data and communications, and complies with anti-money laundering (AML) and know-your-customer (KYC) regulations to prevent fraudulent activities on the platform.

Q: How can I contact customer support at Breaking Equity?

A: You can contact customer support at Breaking Equity via live chat or email.