- What is tech royalty crypto?

- Which tech royalty crypto assets are worth investing in now?

- What could drive the growth of tech royalty cryptos?

Tech royalty cryptocurrencies are hot right now, given the forthcoming Ethereum 2.0 upgrade. Once implemented, this upgrade is expected to catapult the Ethereum coin and blockchain to greater heights. At the same time, tokens running on top of this blockchain will have a share of this success. Below are five tech royalty crypto assets worth monitoring in the first half of 2022.

The Graph (GRT)

It is a platform that records blockchain data and provides a search function. Its token is GRT, which is responsible for running the network affairs. The platform essentially organizes blockchain data in much the same way as Google indexes internet data. This service is essential, especially when the internet has transitioned to the next higher version (i.e., Web 3.0).

Why does it have the potential to grow?

The GRT network is bound to grow on three grounds:

- The introduction of new subgraphs managed by the network.

- There is a larger, highly engaged user base due to amplified awareness of opportunities brought about by the GRT network.

- The growth of Web 3.0 will likely need the network’s service.

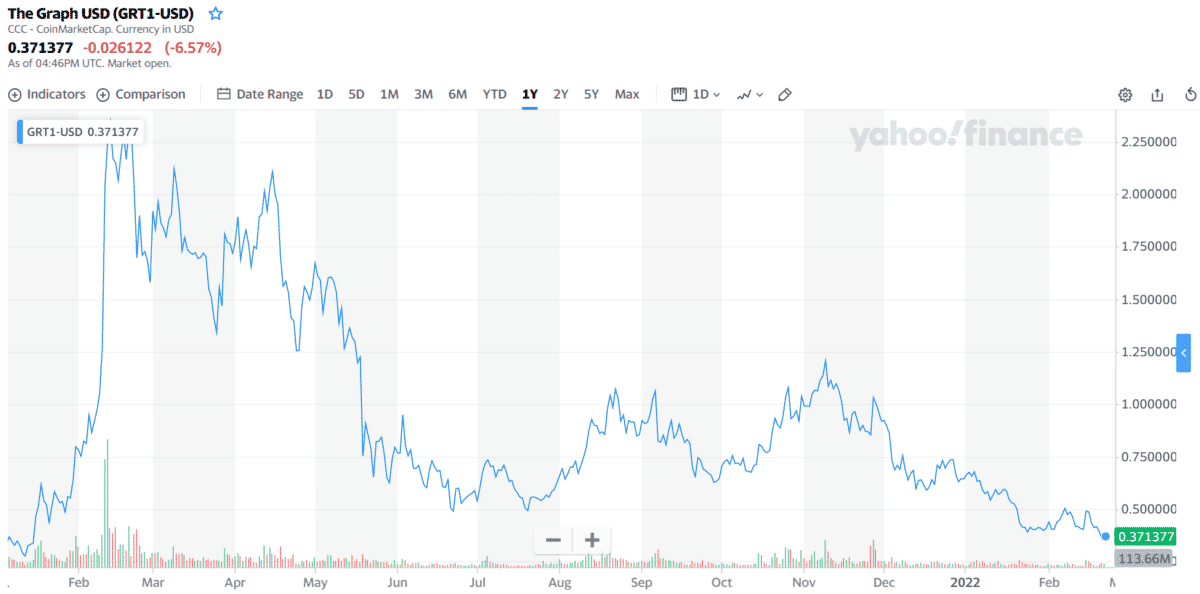

How much would you earn if you invested in GRT 1 year ago?

Looking back on 23 February 2021, GRT had a closing price of $1.697920. One year later, its price went down to $0.371377. This price change is about -78% of the former price. Investing $1,000 one year ago could have led to a loss of $780 today.

Ethereum (ETH)

Ethereum is a powerful blockchain supporting the ETH token and myriads of decentralized applications. As a P2P network, Ethereum lets you transfer money to and from another person without a mediator. While it is difficult to gain access to the traditional banking system for the common folks, you can access the services of Ethereum with just an internet connection.

Why does it have the potential to grow?

Ethereum could see a lot of growth in the coming years if the Ethereum 2.0 upgrade was rolled out in the first half of 2022. This rollout will transition the network to the proof of stake verification system, which is environmentally friendly and facilitates speedy transactions.

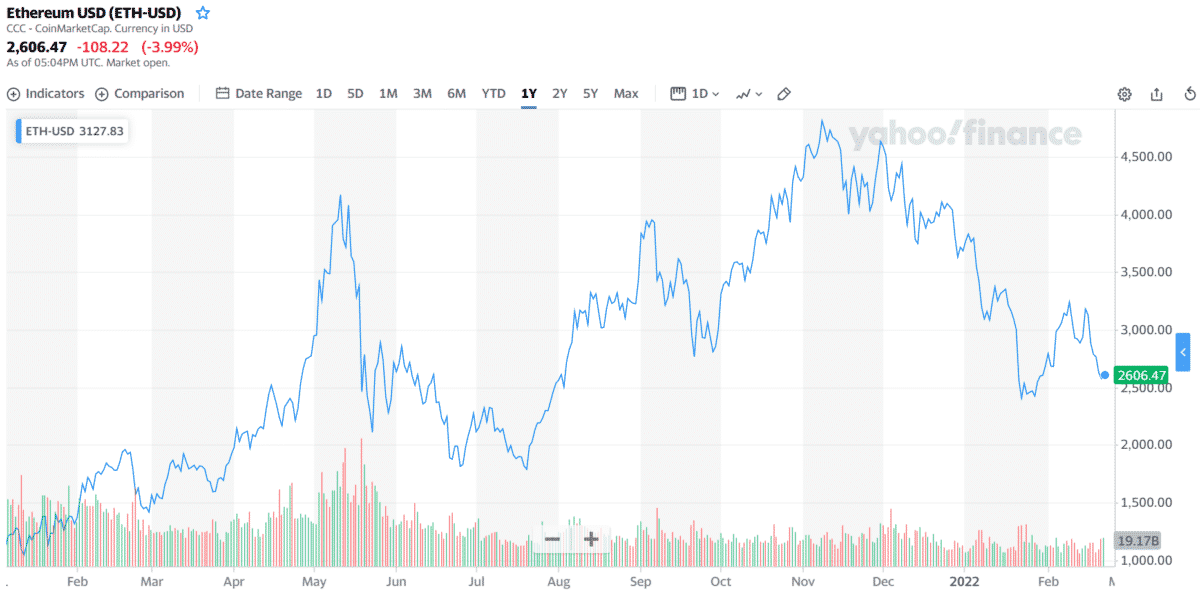

How much would you earn if you invested in ETH 1 year ago?

On 23 February 2021, ETH closed at a price of $1,570.20. One year later, its price jumped to $2,606.47. Such a massive growth is equal to about 66% price change. Had you put in $1,000 of investment last year to this asset, you could have earned $660 today.

Polygon (MATIC)

Polygon is a side chain running in parallel to the Ethereum blockchain. It is basically a support system that allows Ethereum transactions to be completed fast with affordable fees. The Polygon network makes use of MATIC as its governance token, which facilitates staking, payment of fees, and more. Apart from being a network token, MATIC is also a full-fledged cryptocurrency that you can buy and sell in exchanges.

Why does it have the potential to grow?

Polygon is a DeFi platform that facilitates almost instantaneous transactions at very low fees. This platform offers much the same services as Ethereum but at fees much lower than Ethereum charges. It might encounter lower usage when the Ethereum 2.0 upgrade has been deployed, but it is yet to be seen.

How much would you earn if you invested in MATIC 1 year ago?

The price of each MATIC coin on 23 February 2021 was only $0.1370. One year later, its price rose to $1.4344. Such price change is equal to 947 percent of the previous price. Last year, putting in $1,000 in this crypto-asset could have netted you $9,470 today.

Avalanche (AVAX)

Avalanche is a platform that is smart-contract ready and provides interoperability between other blockchains. It aims to become an exchange for digital assets. Developers can develop and run decentralized applications in Avalanche as well. This functionality earns the network a reputation as a potential Ethereum killer.

Why does it have the potential to grow?

This is one reason why investing in this crypto is promising. AVAX has become more popular among investors and traders, given the highly anticipated partnerships. Lately, AVAX rolled out a change that links it with Ethereum. Because it believes blockchain connection is the thing of the future, the link makes it easy to transfer assets between the two blockchain networks.

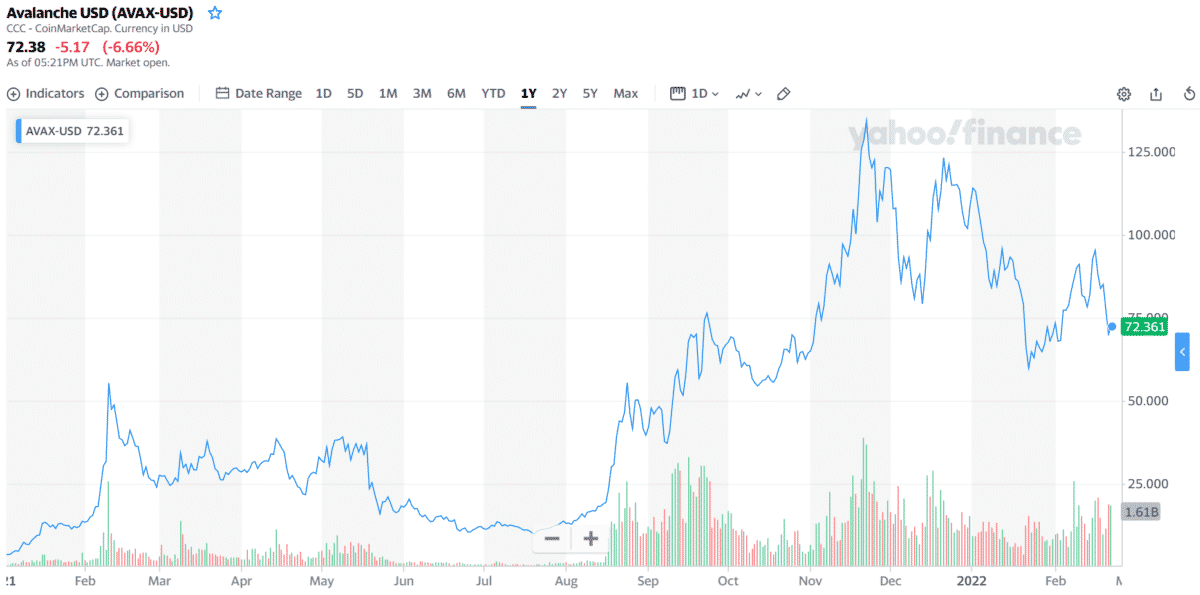

How much would you earn if you invested in AVAX 1 year ago?

AVAX closed at a price of $27.563 on 23 February 2021. One year later, its price catapulted to $72.361. Such price movement is about 162 percent growth from the previous year’s price. Anyone investing $1,000 in AVAX one year ago is bound to enjoy a profit of $1,620 today.

Fantom (FTM)

Similar to Avalanche, Fantom is another smart-contract platform. It is created to facilitate the transfer of digital assets and support decentralized applications. It belongs to the group of blockchains known as level one, and it offers low gas fees and has great scaling capacities.

Why does it have the potential to grow?

The network recently deployed Fantom Finance to facilitate seamless lending, trading, and borrowing of digital assets. With this development, DeFi becomes more accessible to users.

How much would you earn if you invested in FTM 1 year ago?

The price of each FTM coin on 23 February 2021 was only $0.44. One year later, its price climbed to $1.54. Such a price difference is equal to a growth of 250 percent. Last year, owning $1,000 worth of FTM coins could have earned you $2,500 today.

Final thoughts

The above five tech royalty crypto assets are worth investing in 2022. Four of the five coins mentioned managed to return a good profit after one year. If the proposed plans and current projects come to fruition, these crypto-assets are bound to see more growth in the future. While this information should come as good news to crypto investors, you must not lose sight of the potential risks. Just invest the amount you can comfortably let go if the investment fails.