- What are biotech penny stocks?

- Are they worth investing in?

- Which are the best to buy?

Don’t you think penny stocks are a safer alternative to cryptocurrencies? We’re claiming this due to the sudden soar in these stocks during the once-in-the-century pandemic. In addition, penny stocks draw the attention of new traders to turn their little investments into big payouts.

Earnings with profits are not a desire in the capital market. However, big companies also invest in them. Yet, their volatility is risky as these are the equities with share prices under $5. But if you’re an investor, alert about the price swings, you can turn it into a great gambit.

What are biotech penny stocks?

Are you aware of the scope of biotech penny stocks? The global pandemic has caused an immediate increase in biotechnology stocks buying and usage.

These are the healthcare companies that use microorganisms and other organisms for the welfare of humanity. Yet, they first have to detect the disease and perform tests accordingly. Hence, they’re differentiated from pharmaceutical companies. These companies can sometimes strike gold with their lead products, including small to mid-cap drug makers. To invest in them, market participants have to pay attention to the phase of that particular stock as biotech companies have to follow four steps while developing new drugs:

- Drug discovery

- Pre-clinical testing

- Clinical testing

- Regulatory approval

The drugs in the last step turn out a successful stock.

Are biotech penny stocks worth investing in?

You might have to reconsider your decision to invest in penny stocks as their volatility puts your investment at risk. The answer to your question ‘Is they worth investing in?’ is yes. Well, it’s not a secret that the global pandemic has enhanced the usage of biotech stocks to sky-high levels. That’s why you can find several biotech large-gainers which are rising high in the trading market and prove to be diamonds for you with their profit potential.

Which are the best biotech penny stocks to buy?

Along with Covid-19, you can observe booming cases of depression, anxiety & addiction due to isolation. Therefore, therapeutics will spontaneously ascend in the coming year. Now the point of concern is which is the best one to buy in 2022? After doing active research, we’ve enlisted the five best biotech penny stocks to buy.

- Novartis AG

- AIM Immunotech

- Asensus Surgical

- Celsion

- iBio

The first in the list is not a penny stock. However, it is worth investing in Novartis as it upholds a futuristic technology and could find a huge boost in given circumstances. So, you may buy it under $100 before it jumps miles above, and then a hundred dollar price would look like pennies to you.

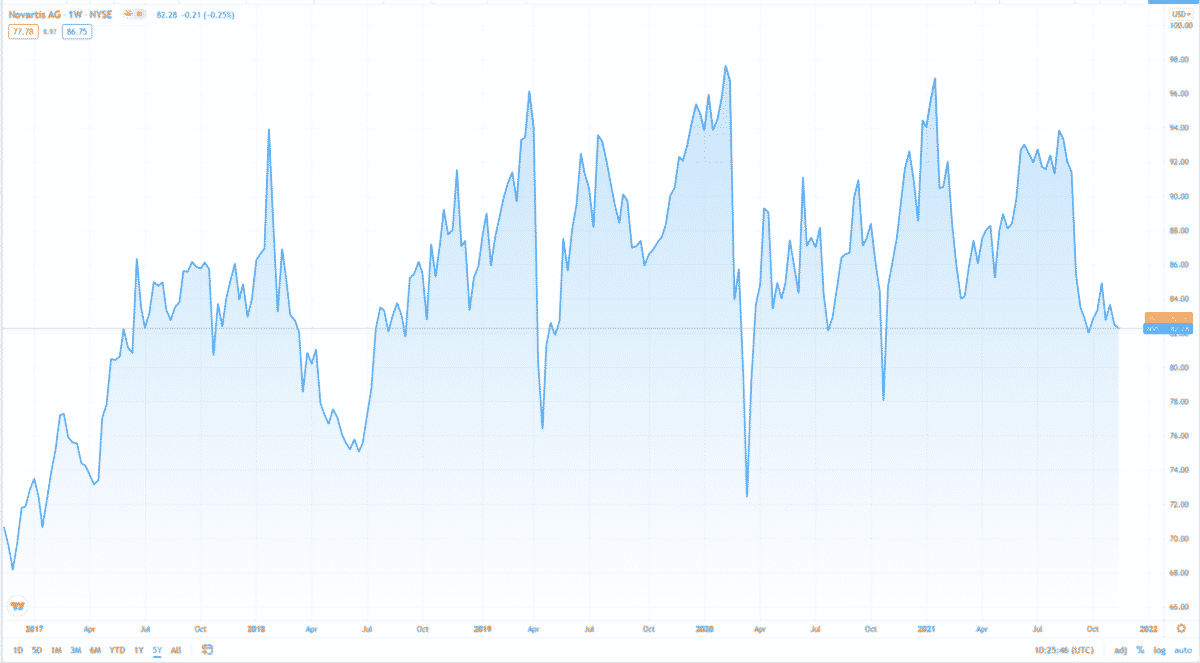

Novartis AG (NVS)

Price: $82.28

Novartis AG is an international American-Swiss corporation founded in 1996, one of the largest pharmaceutical companies in the world. Novartis products are used for vaccination as well as treatment of a wide range of diseases like:

- Hypertension

- Cancer

- Cataracts

- Migraines

It is publicly traded. Is it a good buy? Its economic health and growth prospects elaborate its potential to outperform the market in the coming days. According to Novartis’ average price forecasts, the target is $91.2, a 9.1% increase from its last price. It means it could yield a significant profit.

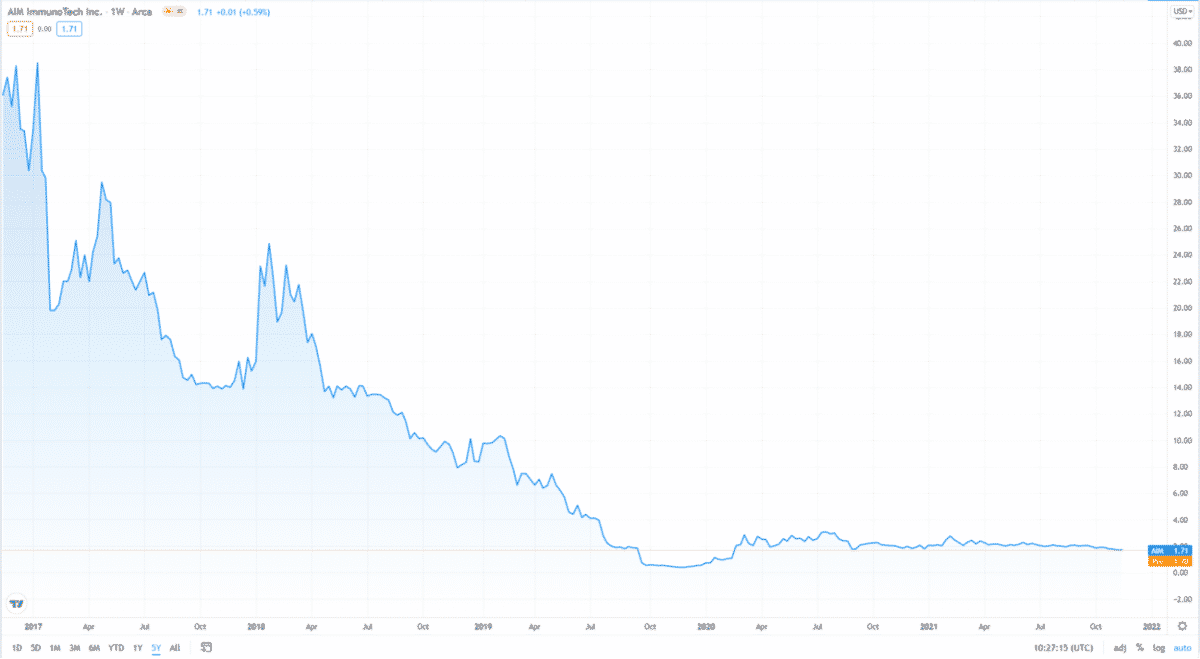

AIM Immunotech (AIM)

Price: $1.71

This is a biopharmaceutical company based in Ocala, Florida, founded in 1990. Formerly it was known as Hemispherx Biopharma. It is most products are therapeutics that are focused on treating life-threatening diseases:

- Cancers

- Viruses

- Immune-deficiency disorders

The company’s lead products are:

- Alferon N injection; a treatment for external genital warts.

- Ampligen; treatment for chronic fatigue syndrome and as a vaccine for influenza.

Due to all of these features, the company attracts a large number of investors. The predictions show a 13.6% increase in the prices of the company’s stocks.

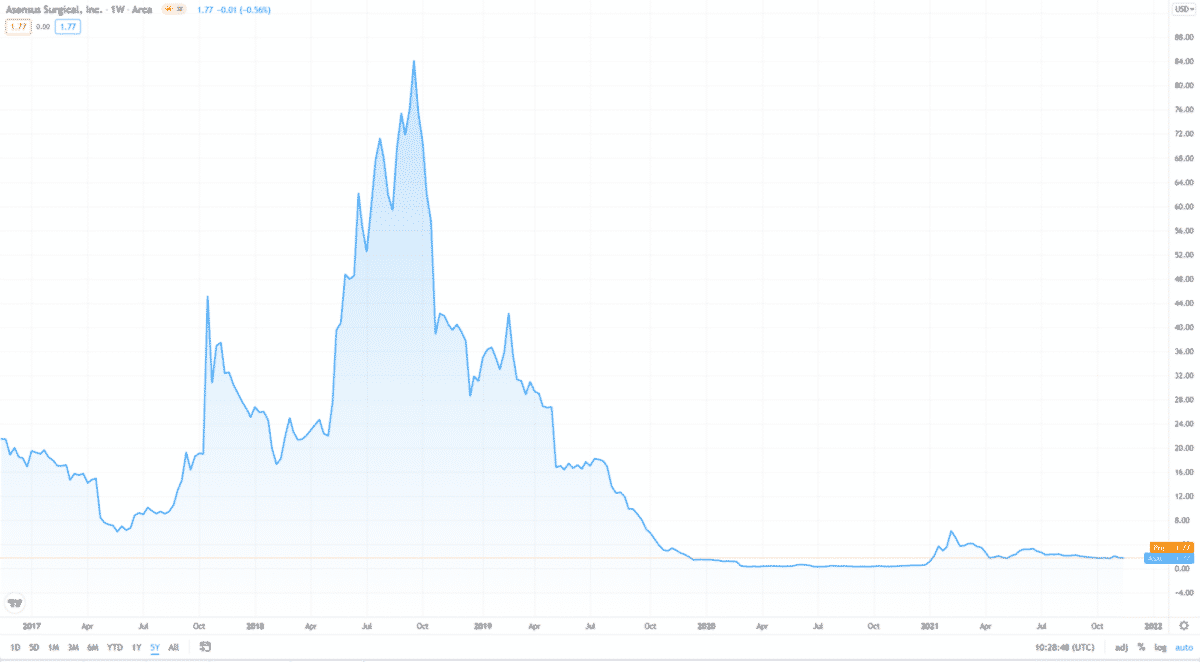

Asensus Surgical (ASXC)

Price: $1.77

The company was founded in 2006. It introduces a new standard of surgery by powering it with the Intelligent Surgical Unit. In addition, robotics week events are organized to raise awareness of the astonishing technology behind robot-assisted Laparoscopy to the public, doctors, and other hospital employees.

The forecasts represent a hype of 116.22% from the current price. The analytic statistics show that ASXC would be a good stock for potential investors.

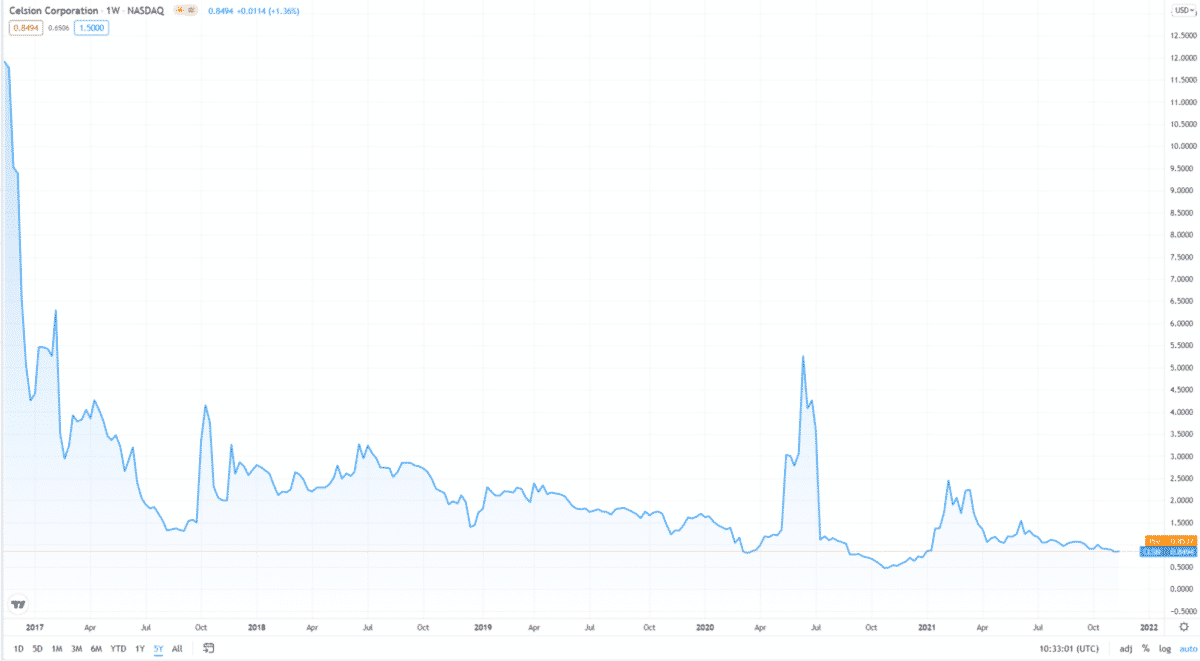

Celsion (CLSN)

Price: $0.85

Celsion, a clinical-stage biotechnology company founded in 1982. The company uses technologies like:

- Immune-therapy

- Chemo-therapy

- Gene-therapy

- LTSL

Celsion products provide treatment for surviving challenging cancers like:

- Ovarian cancer

- Liver cancer

- Indications of other cancers

ThermoDox is a Celsion lead product. Forecasts suggest that traders should buy CLSN stock as 5-15% acceleration is already recorded in its prices. Thus, it would be an excellent short-term buy.

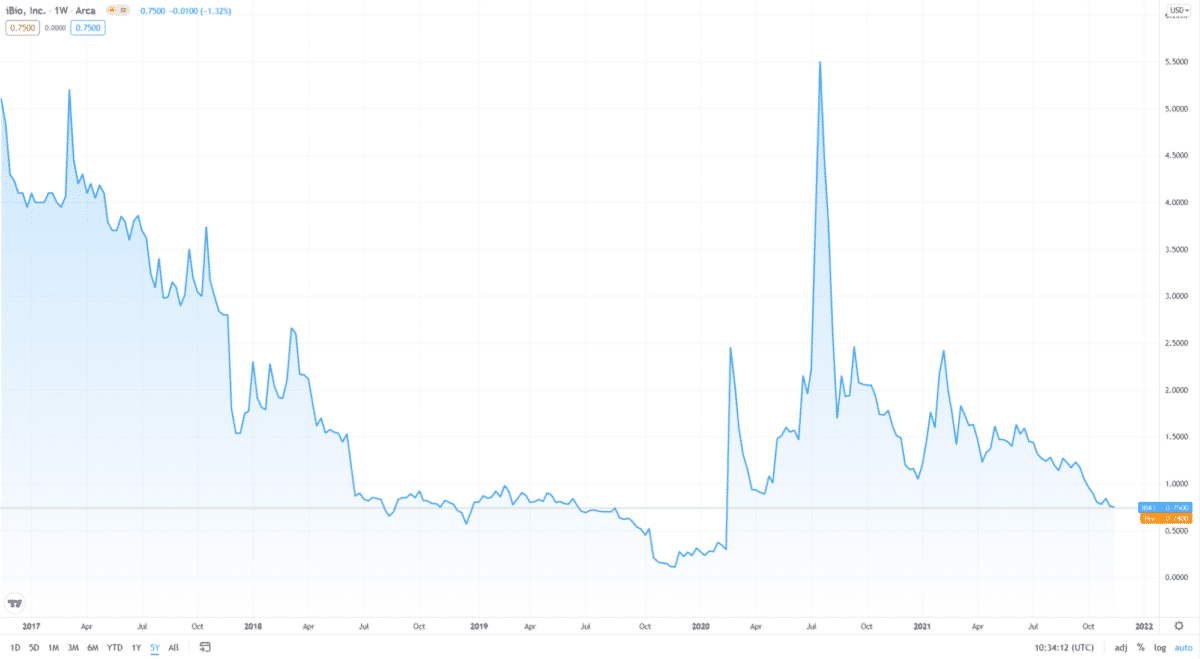

iBio (IBIO)

Price: $0.75

You might recognize this company from iBiology that provides free biological videos of the world’s leading scientists.

iBio is a biopharmaceutical company founded in 2008. It uses plants to generate drugs on a commercial scale for various infectious diseases. The company uses a technology combination of automated hydroponics, vertical farming, and glycan engineering technologies. The target diseases of the iBio FastPharming system are:

- Respiratory diseases

- Fibrotic diseases

- Infectious diseases

If you ask, will IBIO stock go up? The company has manufactured a vaccine recently as a lead product. The response is positive as there is an estimate of 276.27% rise predicted at its last prices.

Final thoughts

To sum up, everyone is aware of the extraordinary volatile nature of penny stocks. Yet the secret is, as you may know, that real estate is all about location. Keep in mind that penny stocks trade is all about management.

Such investment is riskier, yet momentum market participants can be seen investing in it when the biotech companies enter their last step in drug development. Before buying a stock, better to consider its relativity with today’s issues. Investing in the companies already trading with their lead products will also be less risky for you.