- What are EV charging station stocks?

- Why are these potential stocks investments?

- How to invest in EV technology?

Electric vehicle (EV) charging stations are an attractive sector that may catch the market share of the traditional fuel station. Legacy automakers like General Motors, Ford, etc., are investing in this sector as electrifying transportation may be the future.

So the rise of EVs introduces charging stations that may be going to the next gas stations. While you can charge most EVs at home, these stations allow public access to public charging, any garage, retail site, or other locations, a more practical proposition.

This technology is attractive as it will reduce carbon emissions, greenhouse gas emissions, be cost-effective, etc. Moreover, range anxiety or road trip is a key impediment to the adoption of EV technology, and the EV charging stations are the solution. So it makes sense that stocks of these companies may grow in the future.

Many companies already provide this service. Choose the best company stock by checking the company profile, historical data, future projections, capital, etc.

Best five EV charging station stocks

Already big giants of Vehicles companies are investing in this sector. You can invest in stocks of these companies or ETF funds that track the performances of these asset classes. We research the performances and outlooks of many EV charging station stocks, and our study suggests the top five potential stocks among them are:

- ChargePoint Holdings (CHPT)

- EVgo (EVGO)

- Blink Charging Co (BLNK)

- WallBox NV (WBX)

- Volta (VLTA)

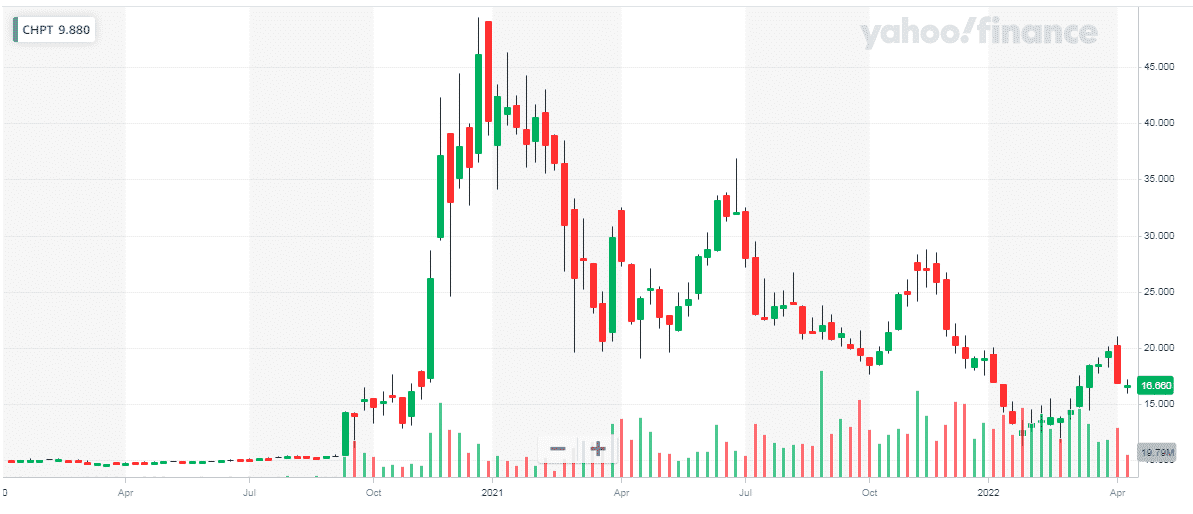

ChargePoint Holdings (CHPT)

ChargePoint Holdings is one of the top names in the EV charging company industry. This company makes money by offering EV charging stations and effective maintenance. This company has twenty-six thousand charging stations across the United States. Globally this company has 118,000 stations.

Why does it have the potential to grow?

The charging infrastructure demand has been soaring recently. This company provides equipment for charging system networks, including software and hardware. Moreover, the revenue generation percentage of this company stock is attractive.

How much would you earn if you invested one year ago?

In the past year, the stock CHPT declined approx. 66%. That can be an opportunity to buy deep. This company showed negative earnings and only $146 million in sales last year. This year the stock price may soar as the quarterly revenue already increases.

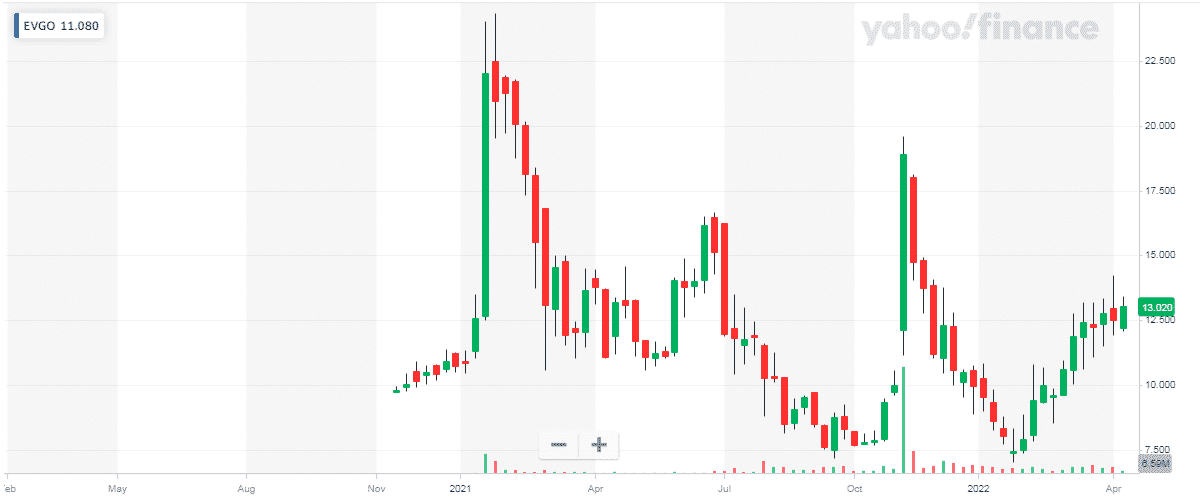

EVgo (EVGO)

EVgo is one of the fastest-growing EV charging companies in the United States.

Why does it have the potential to grow?

EVgo offers fast charging that is time-efficient and takes only 15-45min. This company has PlugShare, enabling users to locate and select nearby public chargers using EV drivers. Moreover, EVgo has partnerships with Uber, General Motors, and Meijer.

How much would you earn if you invested one year ago?

This company’s stock price declined 25% in the past year, but it has 310,000 customers currently and can be tripled in size in the next five years.

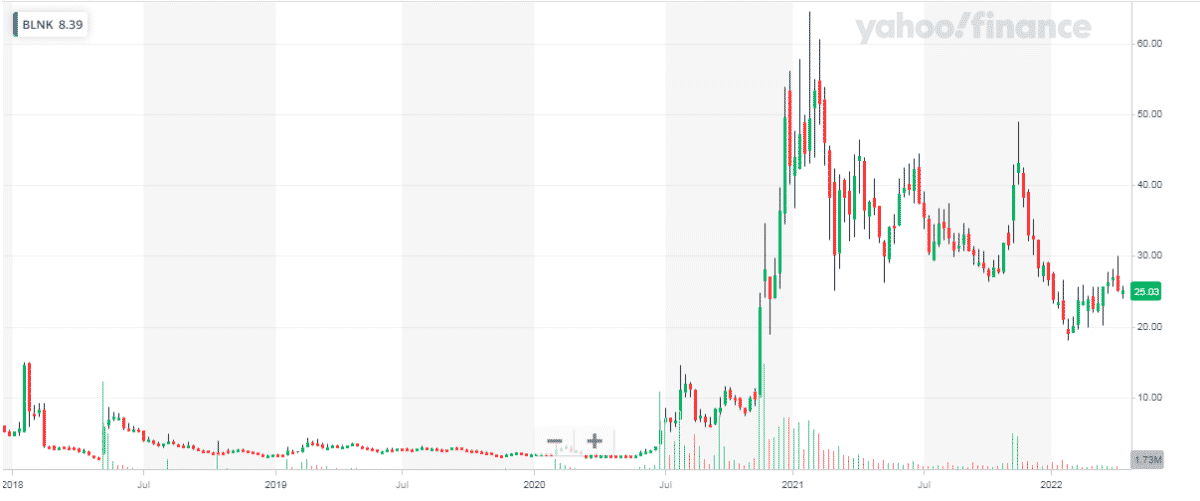

Blink Charging Co (BLNK)

Blink Charging Co. is a company that provides EV charging services and charging equipment. Currently operates across thirteen countries and 30,000 charging ports.

Why does it have the potential to grow?

Recently this company announced that it would deploy EV chargers across the United States and Canada, already doing business worldwide in many countries. Besides the GM partnership, this company has a partnership with ABM Industries.

How much would you earn if you invested one year ago?

In November 2021, this company reported a 607% YOY revenue and sold 3,016 charging stations, a 351% increase from the previous year.

WallBox NV (WBX)

WallBox creates EV charging and energy management systems that enable users to control power consumption and save money.

Why does it have the potential to grow?

This company announces it will sell Pulsar Plus in Canada, the best-selling charger. Additionally, it has changer and energy management solution services in over eighty countries.

How much would you earn if you invested one year ago?

WBX reports $79M in sales in 2021, followed by $24M in 2020. That’s rapid growth, and recently this company’s stock was listed on the NYSE.

Volta Inc. (VLTA)

Volta Inc. is another popular investment asset among emerging EV charging company stocks.

Why does it have the potential to grow?

Volta Inc. has a unique approach to combining digital media with charging stations that drives the revenue of this company. Additionally, many hedge funds are already taking a stake in this company’s stock by checking on its potential future.

How much would you earn if you invested one year ago?

The price of VLTA has been declining for several months; last year wasn’t a good year for investors of this stock. Meanwhile, as the company expands its business and continues to grow, this declining price can be an opportunity to buy on deep as the company has the potential to grow.

Final thought

We make this list of the top five EV charging stocks by doing sufficient research checking on and comparing the primary data that indicates the company or stock’s future. There is no alternative to electric vehicles to reduce carbon emissions; this sector is a futuristic project.