- Why is it best to invest in electric battery stocks now?

- What is the future of the electric battery industry?

- Which electric battery stocks are worth investing in 2022?

Batteries power electrical devices. An electric battery is a source of electric power and comprises one or more electrochemical cells. Batteries are not only environment-friendly but are also cost-effective. As governments worldwide find ways to reduce carbon emissions from vehicles, electric batteries increase demand.

Best battery stocks to watch right now

However, not all batteries have the same capacity. Certain types of batteries store more energy than others, consuming less space and weighing less. Vehicles using these batteries are thus lighter and have better performance. This guide presents five of the best electric battery stocks ranked from highest to lowest in terms of market capitalization.

NIO Inc.

It is a Shanghai-based EV manufacturer that was first to offer “battery as a service” to EV owners. By the end of quarter three of 2021, the company had deployed a total of 517 swap stations in America. The EV manufacturer projects building 4,000 battery swap stations in China by 2025, with 1,000 touching international waters.

Why does it have the potential to grow?

In the third quarter of 2021, the company reported a total revenue of $1.52 billion, having a growth of 116.6% year on year and a gross margin of 20.3% from 12.9% from the same quarter of 2020. An analyst stated that the company is best positioned to take advantage of the electric vehicle adaptation trend in the next ten years.

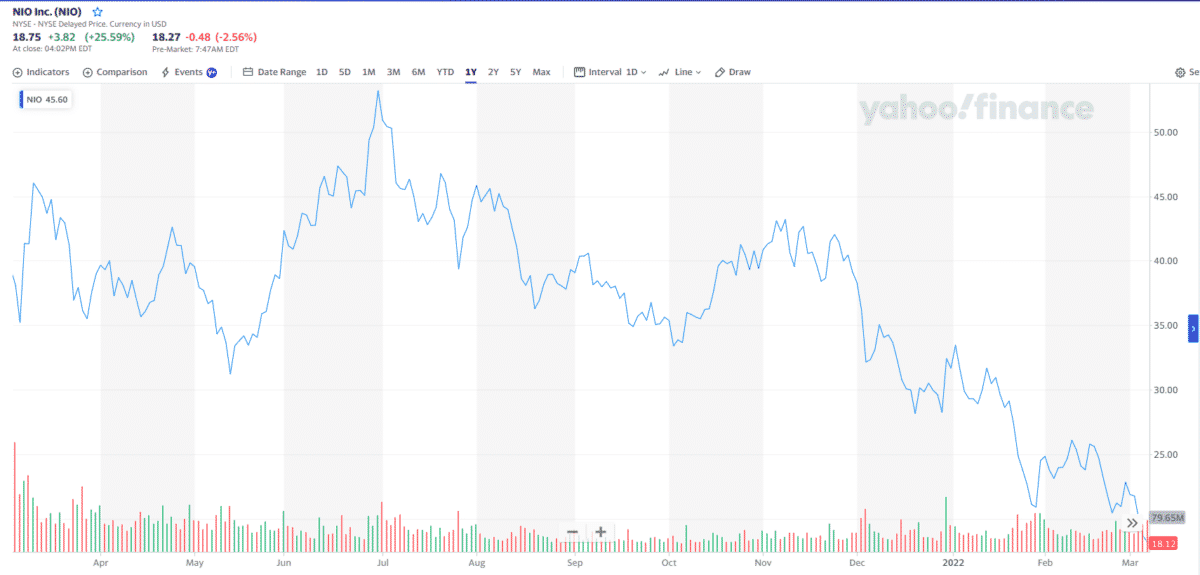

How much would you earn if you invested in NIO stock 1 year ago?

NIO’s share price on 16 March 2021 was $43.38. The stock lost 56% of its value a year later, with the share price closing at $18.75. If you had invested $1,000 last year, your account could have lost $567.77.

Albemarle Corporation

Albemarle Corporation is one of the biggest lithium suppliers in the world. While it does not directly manufacture EV batteries, it produces lithium metals used in manufacturing EV batteries. The North Carolina-based company has operations in Chile, Australia, and the US.

Why does it have the potential to grow?

The lithium manufacturer is dominating internationally due to its expanded production after acquiring the Chinese lithium converter firm Guangxi Tianyuan Ltd. The company reported increased revenue of 11% year on year and an earning exceeding $65.9 million in the third quarter of 2021. Andres Castanos, an analyst from Berenberg, maintained a buying rate on the shares and was eyeing a price target of $298 from $280.

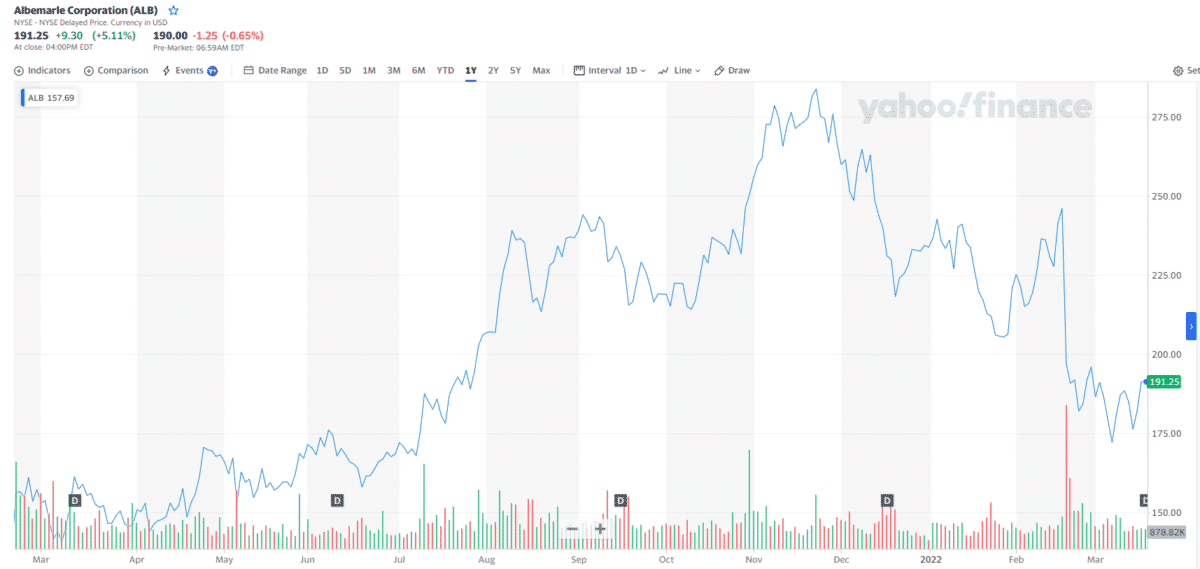

How much would you earn if you invested in ALB stock 1 year ago?

On 16 March 2021, the ALB stock price was at $155.36. Although there were a few drops in value as quarter one of 2022 is about to close, exactly a year after, the price was locked at $191.25, an increase of 23.10%. If you invested $1,000 in this stock one year ago, you could have earned $231.01 today.

QuantumScape Corporation

QuantumScape Corporation creates solid-state lithium-metal batteries that extend the range of electric vehicles and make them recharge faster.

EV startup backed by Volkswagen AG and went public in 2020. The firm plans to supply prototype battery samples to EV manufacturers in 2022, projects to test car batteries in 2023, and aims to begin producing solid-state battery cells in 2024.

Why does it have the potential to grow?

Recently, the company is becoming eye candy, gaining attention from retail and institutional investors. During its 2021 third-quarter report, the company announced a deal with one of the top ten global automotive OEMs to buy its ten megawatt-hours of batteries. Cowen analyst Gabe Daoud predicts the share price to hit $36.

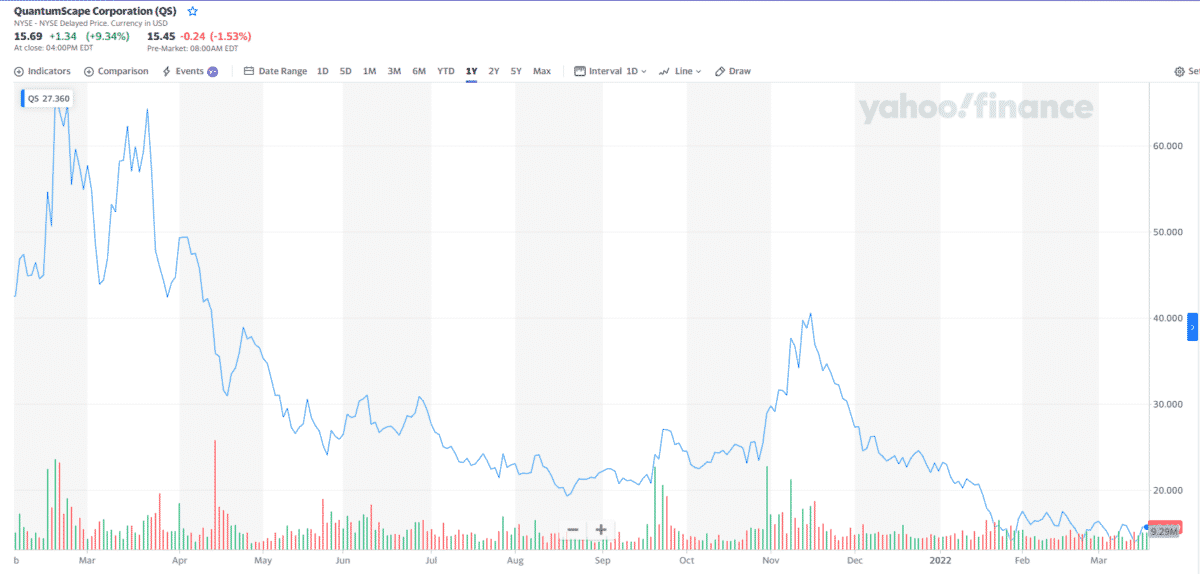

How much would you earn if you invested in QS stock 1 year ago?

The QS stock closed at $57.03 on 16 March 2021. Today its price declined heavily to $15.69. This price decline is equivalent to 72.48% of change. If you invested $1,000 in this stock last year, you could have lost $724.88 today.

Microvast Holdings, Inc.

Microvast Holdings, Inc. is a battery manufacturer specializing in fast-charging battery systems for passenger and commercial electric vehicles and heavy-duty trucks and railways. Moreover, the company produces energy storage systems.

Why does it have the potential to grow?

This Texas-based manufacturer recently expanded in Florida, acquiring a facility that will serve as its battery prototyping headquarters. The facility has an area of 75,000 square feet. From the 2021 quarter three report of the company, its revenue increased 20%, amounting to $36.9 million. The company is also looking at a revenue forecast of $145 million to $155 million as 2022 ends.

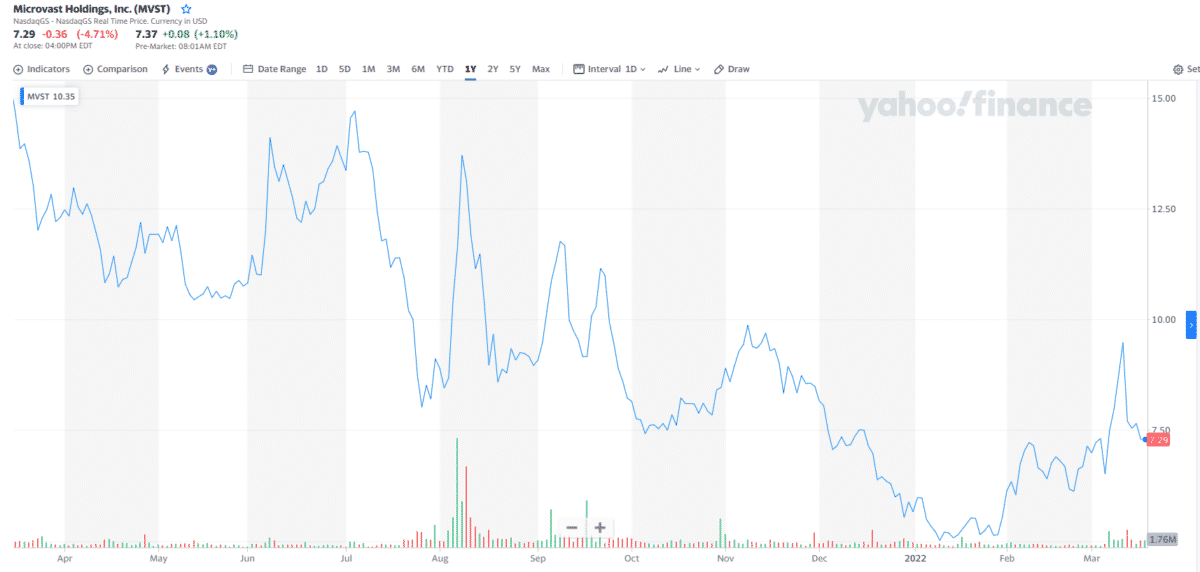

How much would you earn if you invested in MVST stock 1 year ago?

On 16 March 2021, MVST stock closed at $15.23. One year later, its price went down significantly to $7.29. This price decline is equivalent to 52.13% of change. If you invested $1,000 last year, you could have lost a hefty $521.33.

Solid Power Inc.

Founded in 2011, Solid Power, Inc. is a solid-state rechargeable battery maker for EV and mobile power markets. This Colorado-based company commercializes low-cost all-solid-state battery cell technology and eventually gives EVs a longer life.

Why does it have the potential to grow?

The manufacturer has been in the headlines attracting partnerships and expansions. The industry-leading producer recently closed a $12.5 million research deal to develop nickel and cobalt-free all-solid-state battery cells with Intelligence Advanced Research Projects Activity (IARPA). Another project is the development of all-solid-state batteries alongside SK Innovation Co., Ltd.

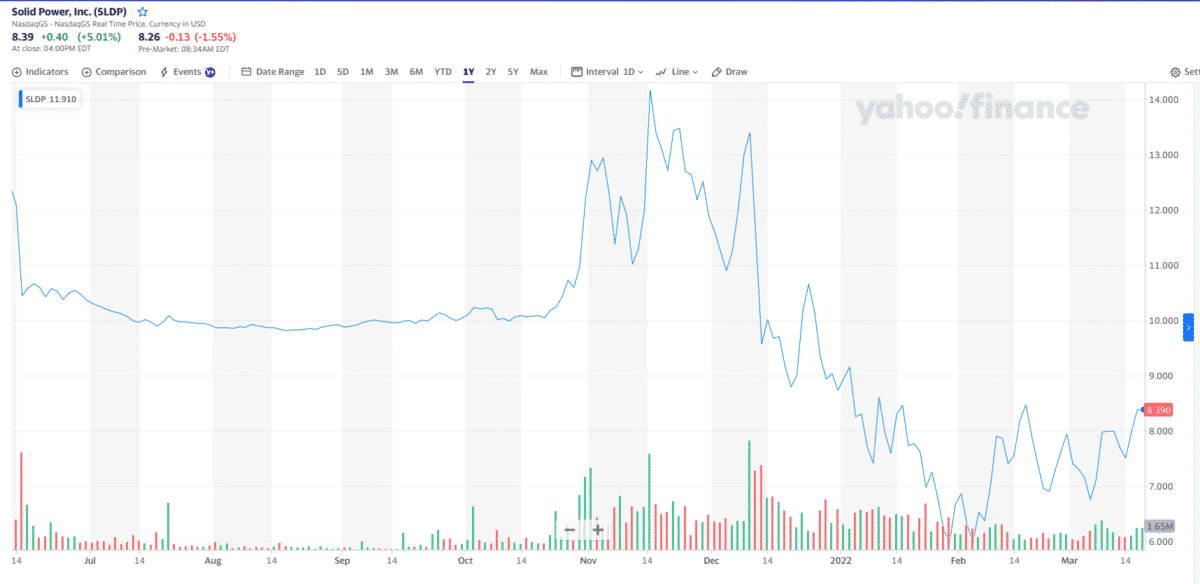

How much would you earn if you invested in SLDP stock 1 year ago?

SLDP closed at $10 on 18 May 2021. If you had invested $1,000 back then, you could have lost a nominal amount of $161. This is because the stock recorded a closing price of $8.39 one year after, which is a decline of about 16%.

Final thoughts

More and more companies are looking for solutions to reduce their carbon footprint and to be able to produce products that do not harm the environment. Reinvention is one way of matching the ever-growing demand, expanding the EV sector.

These innovations are welcome developments. In no time, investments would crawl toward this industry. Those already positioned themselves as front liners of this mass transition are already halfway embracing the future.