- What is compounding?

- How to calculate compound interest?

- How does compounding work?

One of Warren Buffett’s famous quotes is: “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Warren Buffett learned from a young age to save his money, and by growing his wealth, he would become rich.

To most people becoming rich is just a dream, and this is because most of us are under the impression that we need vast amounts of cash to invest, a misconception that blinds our judgment.

If you are not born into riches, one of the best tried and tested methods to amass great wealth is to start compounding; starting as early as possible is highly recommended. Compounding could be a foreign concept to most, so we will explain how it works and the benefits of using it.

What is compounding?

It applies to both savings and investments; your bank will grant you interest on the money kept in your account when you save money. Instead of withdrawing your savings monthly, you can leave the interest earned and eventually grow your initial capital.

You can reinvest the dividends into your portfolio when investing in stocks, bonds, or other dividend-paying assets. You can continue growing your capital following this method for months, years, or decades.

The formula is straightforward if you invest with a fixed interest rate; however, the interest can fluctuate, resulting in a different compounded interest over time.

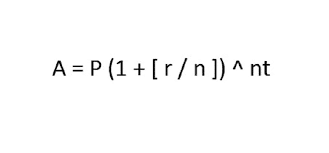

The calculation for compounding

- A – amount accumulated after investment term

- P – initial investment amount

- r – the interest rate per annum

- n – the number of times the interest compounds

- t – duration of savings (days/months/years)

How does compounding work?

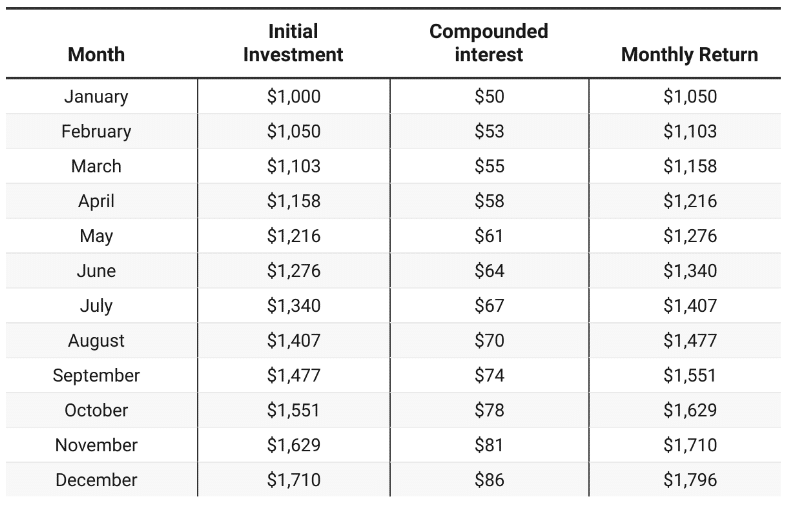

We have created a table to illustrate how compounding works. In this example, you saved $1000 with a fixed interest rate of 5% for 12 months. Interest earned monthly is reinvested, this way increasing the capital value. As the monthly investment grows, so does the interest.

The start-up capital was a $1000 investment, and after twelve months, it has grown to $1796, making you a profit of $796.

In the previous example, we showed how monthly compounding could grow your initial investment. Now, we will use another example of two scenarios of different investment styles.

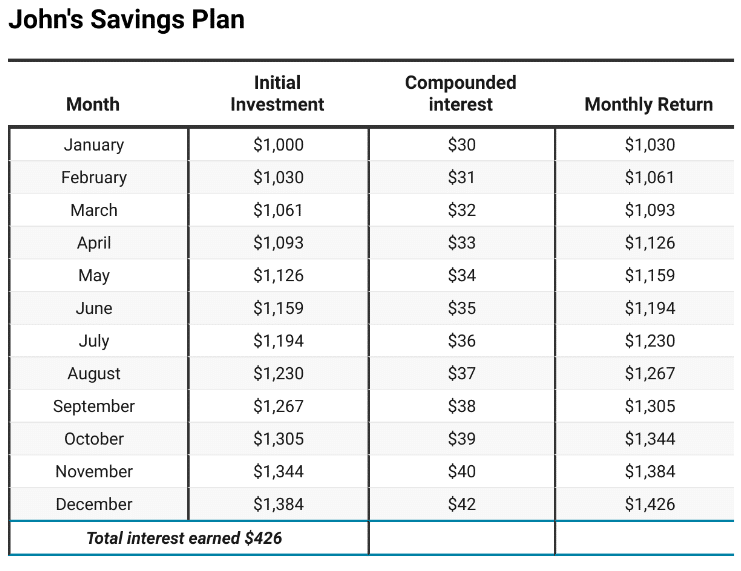

John is planning a holiday for his family and wants to save $1000 for 12 months. He opens an interest-bearing savings account with his bank. The bank’s current interest rate is 3%. John’s banker advises him to compound his interest by not withdrawing monthly.

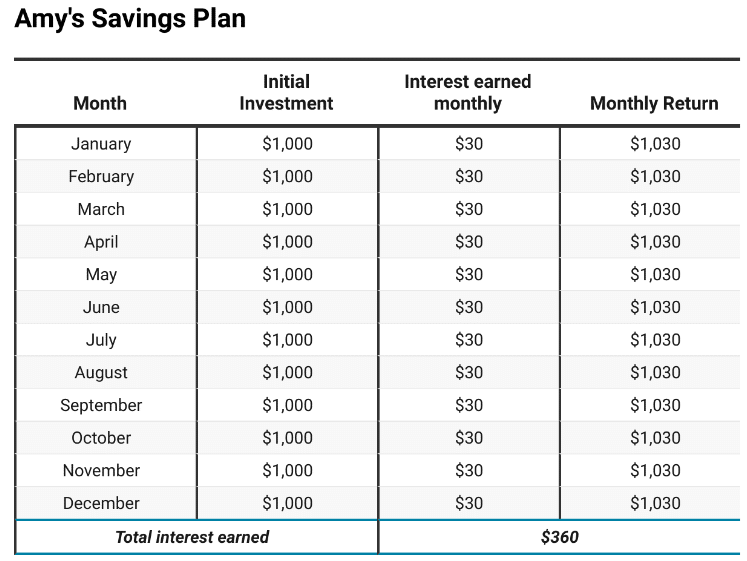

Amy is a college student, and she wants to save money to go on a summer trip with her friends. She opens a savings account and funds $1000. But unlike John, Amy opts to withdraw her interest monthly.

Let’s look at two saving scenarios:

- John’s total interest earned for the twelve months is $426

- Amy’s interest was $360

John’s total interest earned for the twelve months is $426, and Amy’s interest was $360.

So why is Amy less? The reason is that she did not compound her interest monthly. Every month her initial amount was $1000, whereas John reinvested his interest monthly, growing his monthly interest.

Pros and cons of compounding

The examples showed you how compounding works for a stable savings plan, but there are some benefits and risks to consider with any financial tool.

| Pros | Cons | ||

| • Require small investment | • Compounding requires patience | ||

| The plus side of compounding is that it requires a small initial amount; you don’t have to invest or save significant sums of money. | When you choose to compound, to take full benefit, you have to be patient. If you are not willing to wait for a more extended period, you might miss the full advantage of compounding. | ||

| • Investment grows quicker | • Risk of losses | ||

| Reinvesting your interest or dividends accelerates the growth rate of your investment. | To benefit from compounding, you have to leave your initial investment plus earnings tied in your portfolio for as long as possible. The risk is if the asset you invested in underperforms, you might lose your dividends and, in severe cases, your initial investment. | ||

| • The higher the interest, the greater the return | • Start at a young age | ||

| If there is an increase in the interest rate over time, your investment will increase because the interest on a more significant amount gives higher earnings. | The best way to start growing wealth is to start at a young age. Therefore the older you are, you might have to invest a more significant sum of money to get a quicker return in a short space of time. | ||

| • Investing in stable assets brings higher rewards | • Lack of discipline | ||

| Compounding works best if you choose an asset class with stable historical performance and a potential to grow consistently in the future. | When you compound, you have to keep your investment for quite a long time, requiring discipline and patience. If the highs and lows of the stock market are too frightening for you, you might exit your positions too soon and miss out on gaining more profits. |

Final thoughts

We are not all as lucky as Warren Buffett to know at a young age how money works. But we can find inspiration in his teachings. As we have seen, compounding is a powerful tool that will surely make you wealthier if used correctly.

We also showed how compounding vs. non-compounding is beneficial. However, it requires a little more patience and endurance to reap the benefits. Yes, there are pros and cons, but if we make wise choices with our money, the benefit outweighs the risk by far.