- What is 50 pips a day strategy?

- What are the 50 pips a day trading rules?

- How do you get 50 pips in a day on FX?

If you want to be a successful trader, then trading strategy is a crucial element that you should focus on. Forex trading strategies allow traders to know the entry and exit before even looking at the trading charts. The 50-pips per day would be a profitable system if you knew how to implement it perfectly.

However, mastering any FX strategy involves understanding the process properly, besides knowing its rules and implementing it correctly. This article is about a 50-pips per day strategy.

Let’s go through all the information you need to know about this strategy and profit-making.

What is a 50 pips a day strategy?

You can take trading orders every day by using this trading method. It is a trading strategy that is easy to implement and requires only basic knowledge of understanding. Beginners often get confused while using chart patterns and technical indicators to create a suitable trading pattern. This method is entirely free from those issues.

However, if you are a day trader, this method would be suitable for you. Otherwise, traders who are comfortable with other approaches such as scalpers, swing traders, etc., may seek potentially profitable trading positions differently.

How do 50 pips a day work?

50-pips a day work fine on a 1-hour chart. You have to follow some steps to execute trades by this strategy entirely.

- Firstly, you need to choose pairs where major currency pairs show the most satisfactory results.

- You will come in front of your trading chart every day at the same time and then put two pending orders.

- Wait until any one of the orders gets hit, then close another one.

- Set stop loss and take profits.

- Wait until any one of the stop loss or take profit hits by the price movement.

This strategy is as simple as that; you don’t need to have more profound knowledge to make profits by using this strategy.

50 pips a day trading rules

Every trading strategy follows some rules or laws. So the 50-pips a day trading method also have some rules to follow, such as:

- You need to identify the 7 am GMT candle on the 1-hour chart. You can ask your broker for that or perform a simple google search to know what time is 7 am GMT in your local timezone and match it with your broker timezone.

- Open pending orders after the 7 am GMT candle closes.

- Trade major pairs to get the best output.

- Don’t hesitate to close another order when any one of the two pending orders is active.

- You must place stop loss and take profit when any one of the pending orders is active.

- Stop loss must be above or below 5-10 pips of the 7 am candle.

- The profit target will be 50 pips in every trade.

- Repeat this process every day in an average price movement.

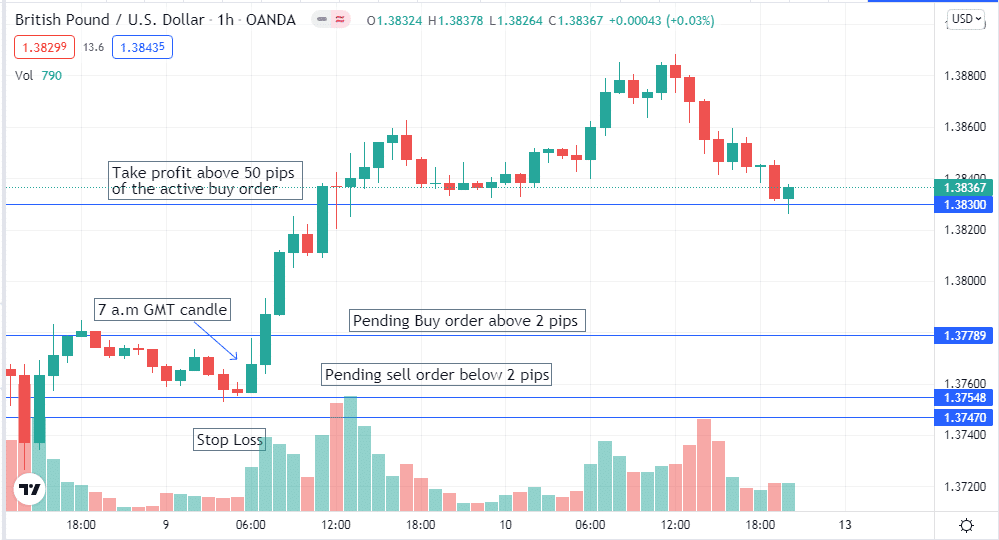

Bullish trade setup

This strategy doesn’t need any indicator to identify trade setup. All you need to do is find out the 7 am GMT candle in your chart. Use a 1-hour time frame to find your trade setup. You’ll have opportunities to enter and make profits from the market regularly.

Entry

When you find the 7 am candle, wait until the candle closes. Then place buy-stop order above two pips of the candle range and sell-stop order below the candle range.

Stop loss

Wait until the pending buy order hits. Once the pending buy order gets hit, cancel the sell trade. Put an initial stop loss at 10-15 pips below the 7 am GMT candle.

Take profit

Set take profit above 50 pips of the active buy order and wait until the take profit gets hit.

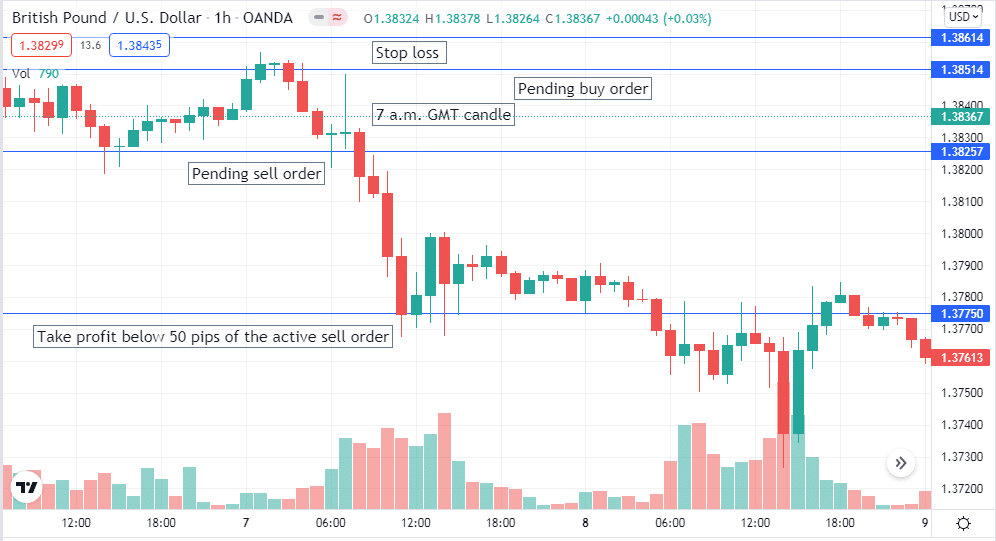

Bearish trade setup

A bearish trade setup for this strategy is just the opposite of the bullish trade setup. We suggest checking the trend of the price movement from bigger time frame charts such as 4-hours, daily chart, etc. Then identify the 7 am GMT candle on your trading chart. You will get the best setup on a 1-hour chart.

Entry

Wait until the 7 am GMT candle to close and open a pending buy trade above two pips of the candle and pending sell below two pips of the candle.

Stop loss

Wait until the pending sell order hits. Once the pending sell order is active, immediately cancel the pending buy order and put an initial stop loss at 10-15 pips above the 7 am GMT candle.

Take profit

Set take profit below 50 pips of the active sell order and wait until the take profit gets hit.

How to manage risks?

Currency pairs movement in the FX market is undoubtedly unpredictable. Moreover, different brokers such as market makers, dealing desk, etc., show some unusual 2-5 pips uncertain price movements depending on the participant’s action and spread.

Choose brokers carefully. Use acceptable stop loss and be careful that both pending orders don’t get hit. Choose the major pairs to trade with this strategy as you won’t have to face a lack of volatility. As a part of risk management, you can shift your stop loss but not more than 20-25pips.

Pros and cons of 50-pips a day strategy

There are always some limitations and positive factors for every trading strategy. What advantages and limitations of this strategy are:

Pros

- You don’t need profound knowledge to adopt this strategy.

- This strategy is comparatively simple to implement.

- This trading strategy doesn’t allow overtrading.

- A complete trading strategy.

Cons

- Profit is always limited to 50-pips.

- You have to spend a specific time in front of the chart regularly.

- If both pending orders get hit, then it would be a messy situation.

- This strategy is not suitable for the traders who seek lots of trade setups every day.

Is 50 pips a day a forex strategy for beginners?

This trading strategy is so simple. You don’t need to have a professional level of understanding to apply this strategy. So yes, this is a suitable strategy for beginners.

Final thought

The 50 pips per day strategy is an easy method of trading. But the winning ratio of this strategy is not so good as there are many other acceptable strategies to trading. The addition of some technical and fundamental analysis may increase profitability. You may not enter the market if an uncertain price movement occurs.