- How do I make a good retirement plan?

- What is the best investment strategy for retirement?

- What is the most critical factor in retirement planning?

Planning for retirement is a daunting process that tends to change with time. Since your goal is to retire comfortably, securely, and enjoyably somewhere, your plan should focus on building a financial buffer that will cover all the necessary expenses.

To kick off the process, you should consider how much time you have left before retirement and what kind of life you would like to live when it happens. After this, you are ready to select which retirement account you will use to generate the fund to finance your future.

When preparing to retire, you must invest your savings in allowing it to grow. However, the contributions being made to your retirement plan are not tax-free. The tax deductions manifest the moment you begin withdrawing money from your savings. Thus, it would help if you explored options to reduce the tax deductions.

Five steps to establish a retirement plan

Below are five steps you can follow to establish a robust retirement plan. You can apply these suggestions regardless of your age right now. Of course, the younger you begin your saving and investing activities, the better.

№ 1. Consider your time horizon

Initiate your planning by considering your age right now and the age you expect to retire. If this time horizon is relatively long, you can take riskier investments to search for significant returns. If you have 30 years or more before retirement, using more dangerous instruments such as equities as your primary investment vehicle is viable.

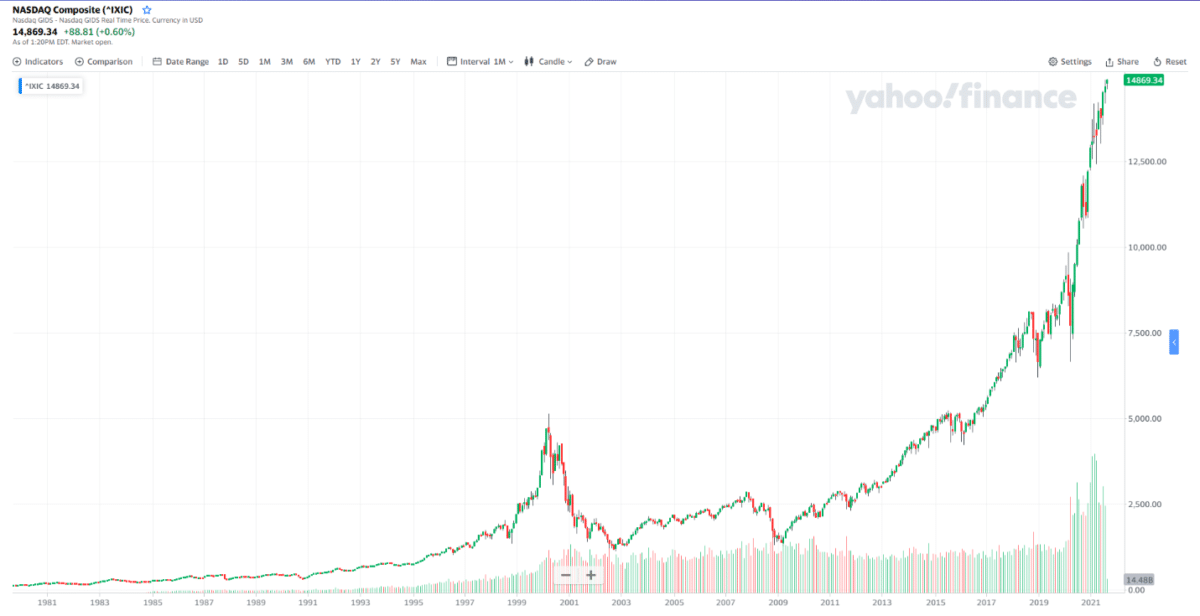

Although stocks can see volatile movements from time to time, the market propensity over the long haul is still bullish when considering the stock market as a whole. Stocks even outperform other investment vehicles, including bonds. What we are talking about here as long term is ten years or longer.

The above chart shows the growth of the NASDAQ Composite, a stock market index. From the time of its inception until to date, its trajectory is bullish overall. This example shows the bullish propensity of stocks.

In addition, you must seek a return that will beat inflation. This way, your money will have ample purchasing power on your retirement. Consider a minimal inflation rate of three percent. Your savings could lose 50 percent of their value in about 24 years. The yearly impact might not look substantial, but it can significantly affect after a long time.

Generally, the more advanced your age is, the more focused you keep your capital and consistent income. This could mean not investing in assets that could provide significant returns but could subject the portfolio at times to a big drawdown. Thus, you might choose bonds overstocks. The return might not be as hefty, but your portfolio will not fluctuate as much. What you need is an income that can provide for your needs. With bonds, inflation is less of a concern.

№ 2. Estimate your future spending habit

The size of your portfolio dramatically depends on how much you spend during your retirement. Many people assume that they would spend about 70 percent or 80 percent only of their regular spending before retirement when they retire. This assumption has been found and proven incorrect, particularly if you still have a mortgage to pay and because of unanticipated medical expenses. You will have more significant problems if you have not considered your bucket list or travel goals.

Therefore, experts suggest that you should assume 100 percent retirement spending as you are spending now. Take note that living expenses increase year on year, and healthcare services become more costly over time. People nowadays have a longer life expectancy and desire to have an easy life during retirement. To enjoy the rest of your days, you need to save more and invest appropriately.

Quite possibly, you might buy a house or send your children to school after your retirement. This means your need for cash might be more significant than you initially suppose. Therefore, you must consider these things when preparing your retirement plan. Each year, revisit your plan and assess to see if you are in the right direction regarding your savings goal.

№ 3. Compute your returns after tax deductions

After you have considered your time horizon and estimated your future spending habits, the next thing to determine is the rate of return after tax deductions. This will help you figure out if your portfolio is indeed capable of generating the desired income. Do not shoot for a before-tax rate of return that is more than 10 percent. This is generally unrealistic whether or not you are considering long-term investments. As your age advances, the expected return goes down because you need to put money in low-risk investments, which typically include low-yielding assets.

You have to balance your portfolio against your income and need to come up with a reasonable rate of return. For instance, if your portfolio is $500,000 and your income need is $60,000, without considering taxes, you will rely on a massive 12 percent return to fend for your needs while maintaining your account. Compare this with a portfolio of $1 million. Assuming the same amount of cash needed, your expected rate of return is six percent only, which is reasonable.

Whatever account is being used to hold your retirement portfolio, tax payment is something you must consider. That is why you must determine the actual rate of return after the tax consideration. Understanding this matter can significantly help you when you begin withdrawing funds from your retirement plan.

№ 4. Balance reward versus risk

Regardless of who manages your portfolio, it would help if you struck a balance between risk and reward. Perhaps this is the most critical element of your retirement plan. It is you who must decide the amount of risk you will take to achieve your return goal.

Do you feel at ease with the risk that your portfolio is being subjected to? As already pointed out, this has something to do with your time horizon. So this is an important question you must answer. Getting help from a financial advisor or members of your family is not a bad idea but a serious matter you must attend to.

№ 5. Plan your estate well

Consider estate planning in your retirement plan. Here you might need the service of different professionals to get it right, which may include an accountant or a lawyer. Life insurance is a crucial aspect of your estate plan. The combination of life insurance and an estate plan makes the distribution of your assets as smooth as possible after your passing while ensuring your family does not go through financial difficulties. A clear plan removes the complex and often costly process of probate.

Another crucial aspect of your estate plan is tax. This comes into the picture if you are considering leaving assets to your family or a charitable institution. It would help to compare the tax involved in either giving the assets via the estate proceeding or bequeathing the benefits thereof.

In terms of the investment approach, the standard practice is thinking in terms of the annual returns. These returns will cover your cost of living for each year, considering the effect of inflation and striving to maintain the value of your portfolio. Then you can transfer ownership of the portfolio to your chosen beneficiaries. At this point, seeking guidance from a tax advisor is beneficial.

Final thoughts

Planning for your retirement entirely rests on your shoulders. You cannot count on the pension provided to you by your employer. Managing your portfolio is still your primary responsibility, even if you use a fund manager.