- How will float in stocks help in your decision to invest?

- How much float in stocks is considered safe?

- What is float level good for investors, high float or low float?

Investing requires a lot of research and analysis to be done correctly. Stock selection is the most critical aspect of stock investing. One way to approach this process is to look at your interests and create a list of the top three stocks for each interest.

As an investor, one of the first things you must consider when considering any stock is its float. Based on this metric, you will know how many shares of the stock are available for public trading. The stock’s float also represents the company’s total liquidity. Therefore, by looking at this figure, you can get a sense of how volatile the stock’s price may be.

What is float in stocks?

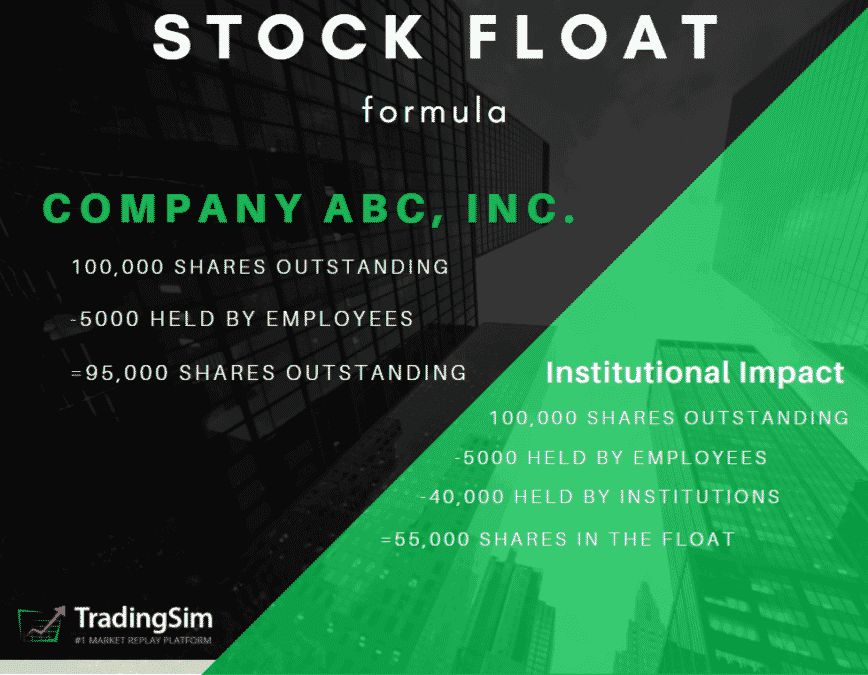

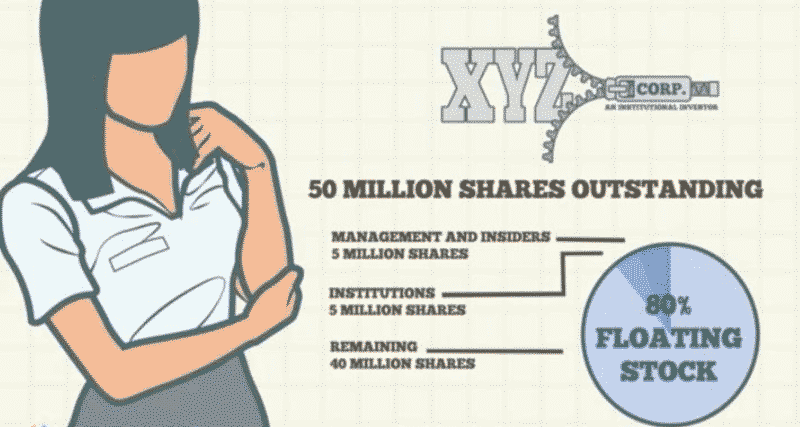

In stock market parlance, float refers to the portion of issued shares, expressed as a percentage or a whole number, being made available for investors to trade publicly. You can get a company’s float by taking out the restricted shares from the issued shares. Refer to the image below. Meanwhile, a restricted share is the number of shares possessed by institutional investors or insiders. The restructuring or the normal purchase and sale of shares will not impact the float.

Investor’s Business Daily, headquartered in California, is a news website that covers the stock market, economics, international business, finance, and others. The website advises investors to look for stocks with less than 400,000 shares traded per day. The reason is that for stocks that are thinly traded or those with an insufficient number of shares, there will be a massive spike in price once a large purchase is made. On the other hand, the price will probably plummet once investors sell the stock.

Stocks that have massive floats have their advantages. Since they are slow-moving in volatile times, they will also have a slow downward trend. The trade-off is that vast gains are less likely to be anticipated. Given these characteristics, an investor should not be complacent with the assumed results.

Sample scenario

Let us say Company ABC has five million shares in total, but insiders hold one million shares. Since the employees of Company ABC are not allowed to trade their shares for a specific period, these shares got the name “restricted”.

Therefore, the company’s float would be four million: five million – one million.

Thus, only four million shares of the stock are tradable in the open market. Take note, however, that the float may be presented as a percentage. Refer to the image below. Some investors feel expressing float as a percentage is more practical and insightful than the actual number.

Thirty-six years ago, in October 1986, when Microsoft was just around 11 years in the market, it had 25,520 issued shares resulting in a float of 5,614. The software maker presented a 21 USD initial price per share during that time. Since then, Microsoft has made great strides, trading at 343 USD and a market cap of 2.252 trillion USD. Those who spotted the chance and never wavered despite the possible ups and downs are probably reaping now what they have sown.

Other relevant terms

One of the terms you might have encountered as you learn about float is outstanding share. This term refers to the overall number of issued shares. This includes those shares that can be bought and sold publicly and the restricted shares.

Meanwhile, restricted shares refer to those issued to corporate associates, such as executives, employees, and other insiders. These shares may be non-transferable, as the company may define. You may have also heard of authorized shares. These are the maximum shares that a corporation can issue legally.

High float vs. low float

Demand and supply play a significant role in the valuation of stocks in the market. It can raise the price of stocks or push them down. Take note that a float can be high or low.

Low float

Low-float stocks have a small percentage of shares accessible for trading publicly. There are two possible reasons for this. Either there are many tightly held or restricted shares, or there are very few investors. Low-float stocks are the most unpredictable stocks in the market, but the potential short-term gain in these types of stocks can be extreme.

These stocks are low in supply; hence, they have a limited number of buyers and sellers. TKK Symphony Acquisition Corp. (TKKS) and Jaguar Health Inc. (JAGX) are examples of low-float stocks. TKKS, a blank check company, has a float of around 640,000. Meanwhile, JAGX, a pharmaceutical company that develops gastrointestinal products, has 840,000 floats.

High float

In contrast with a low-float stock, a high-float stock has a significant portion of the shares being made accessible for public trading. Most of the time, these types of stocks are easy to recognize as they are mostly leaders in their respective industries.

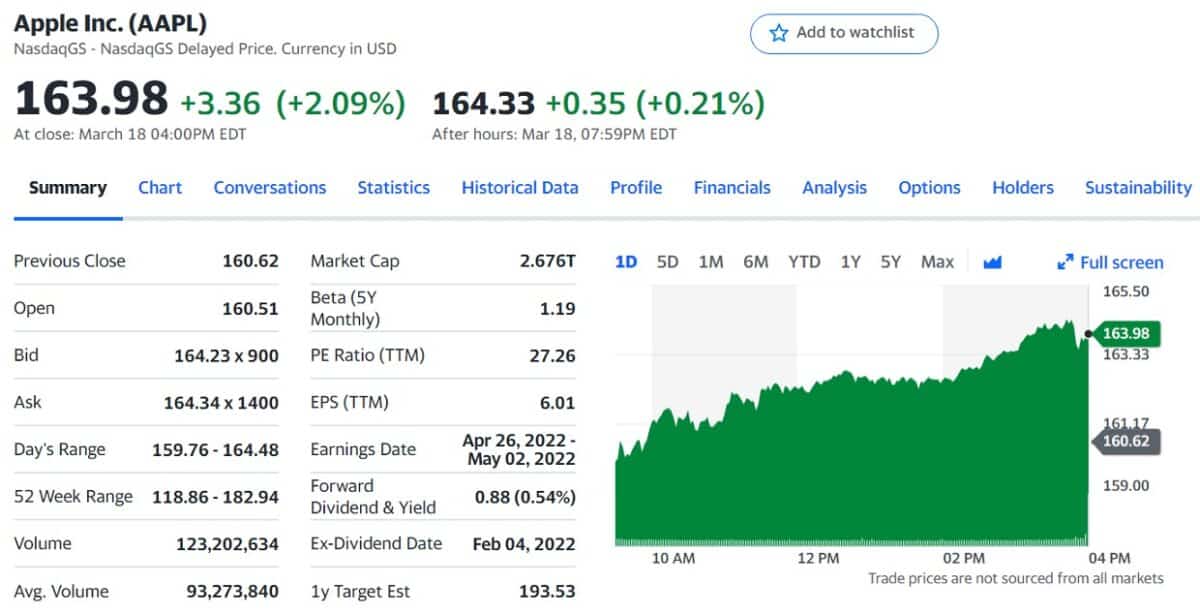

Two of the many examples of these stocks are Apple (AAPL) and Cisco Systems (CSCO). APPL, a multinational technology giant specializing in electronics and software, has 16.3 billion floats. Meanwhile, CSCO, a networking equipment company, has a float of around 5.2 billion.

Final thoughts

There are way too many factors moving the price of stocks. It would help to keep your eyes open for fundamental indicators that may influence how a stock is valued. Another thing you have to consider is the collective action of buying and selling by all market participants. All these things add up to a single metric, that is, supply and demand.

For beginning stock investors, the term “float” is one of the primary things you must look at. Grouping stocks into either high float or low float is one way to narrow down your options. Once you have done that, your stock selection process is still not over. Each category might still have an unmanageable amount of choices. Therefore, your learning should continue by becoming familiar with other stock terms.