Volatility Factor 2.0 is an EA that relies on market volatility to make profits. The vendor wants to convince us that the strategy makes more than 10 pips per trade. This is what supposedly makes the EA ideal for any trader. We review the robot to ascertain if it can benefit you.

Volatility Factor 2.0 company profile

The brain behind Volatility Factor 2.0 is FXAutomater. The company has been in this market since 2009 and is renowned for creating fully automated Forex robots. It works with professionals who are claimed to have many years of experience in trading, software developing, and researching.

The highlights of Volatility Factor 2.0

The EA offers a variety of features, which you can find below:

- Unique broker spy module.

- Three intelligent built-in protection systems.

- Advanced money management systems.

- Supports 4 currency pairs; GBPUSD, EURUSD, USDJPY, and USDCHF.

- Advanced high-impact news filter.

- Trades micro, mini, and standard accounts.

- Operates with any MT4 broker, including ECN.

According to the vendor, Volatility Factor 2.0 has two advanced built-in strategies. First, there is the volatility-based trading algorithm that instigates trades, which capitalize on market volatility. In essence, the robot places trades in the direction of medium-term market impulse. The second approach takes advantage of pricing oscillations around a current price point.

We would also like to make you aware that the grid approach is part of the game plan. We are disappointed that the team is hiding this truth from the public. In case you are considering buying this product, think carefully if you can bear the risks that come with this approach.

Facts & figures

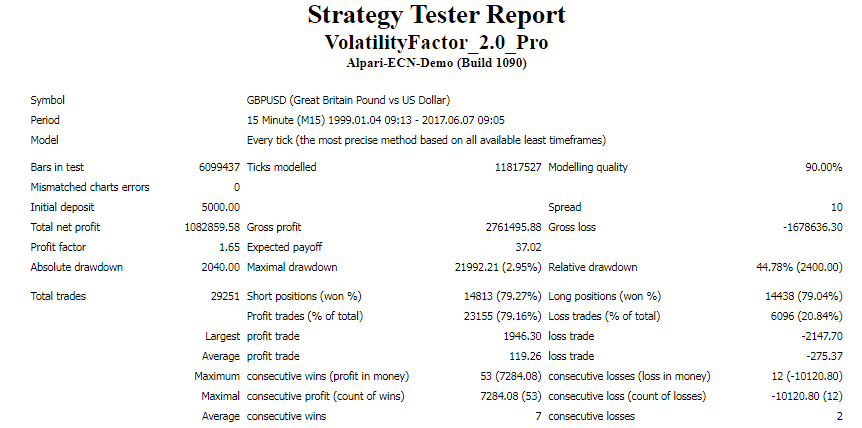

This strategy tester report tells us that the EA was able to deliver a million in profits (1,082,859.58) within 18 years of trading. Using a $5000 deposit, the robot traded on the 15 minute chart and completed 29251 orders. It won 79.16% of these trades. The profit factor was 1.65, whereas the relative drawdown was 44.78%. The drawdown was rather high, and a sign that the strategy used was high-risk.

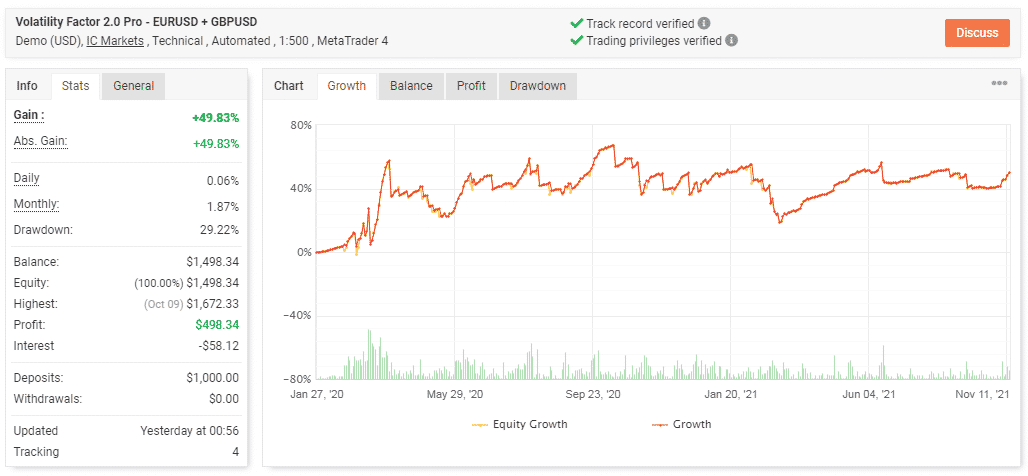

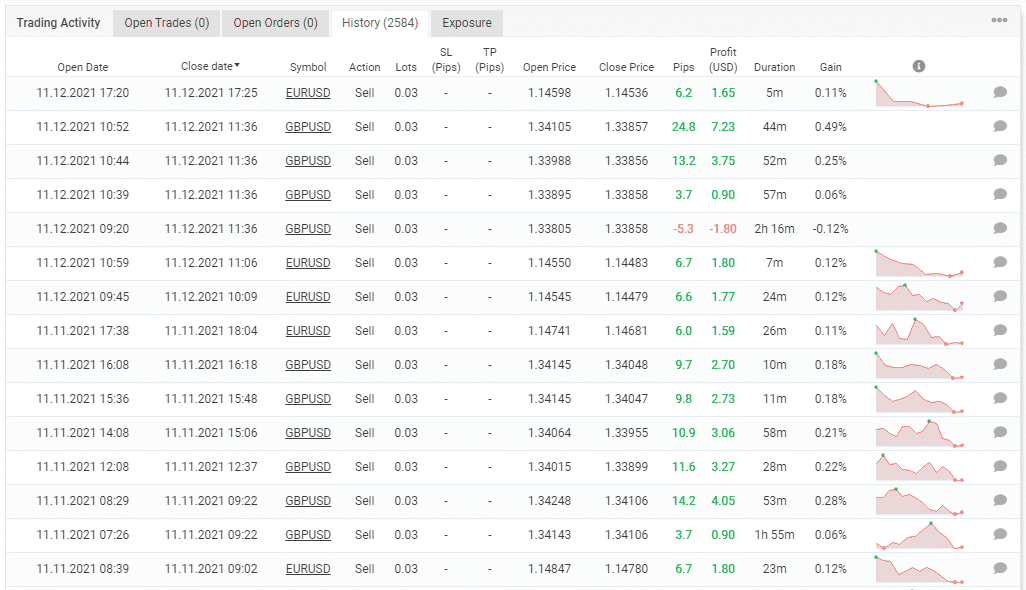

We have the results of a Demo account that is being hosted by IC Markets. The EA is trading two currency pairs (EURUSD and GBPUSD). Unfortunately, the system’s activities have not been yielding gainful results. It only manages to make 1.87% monthly. So, since January 27, 2020, to date, a paltry profit of $498.34 has been realized. The precarious nature of the trading algorithm is also portrayed in the real market as we have a drawdown of 29.22%.

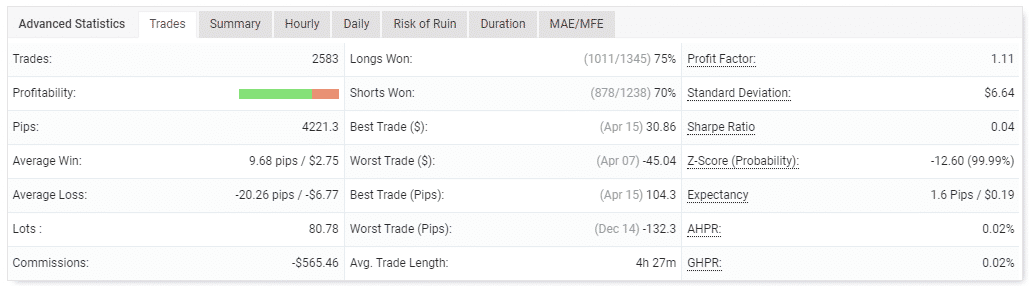

The system has made 2583 trades, but most of them are not lucrative. This is illustrated by an average loss of -20.26 pips that is twice higher than the average win of 9.68 pips. The win rates of long (75%) and short positions (70%) along with a profit factor of 1.11 tell of a robot that is not doing well. The lots traded are 80.78.

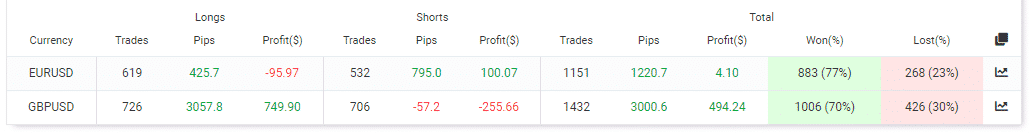

The system mainly traded with the GBPUSD pair.

The robot applied the grid approach and focused on short timeframes.

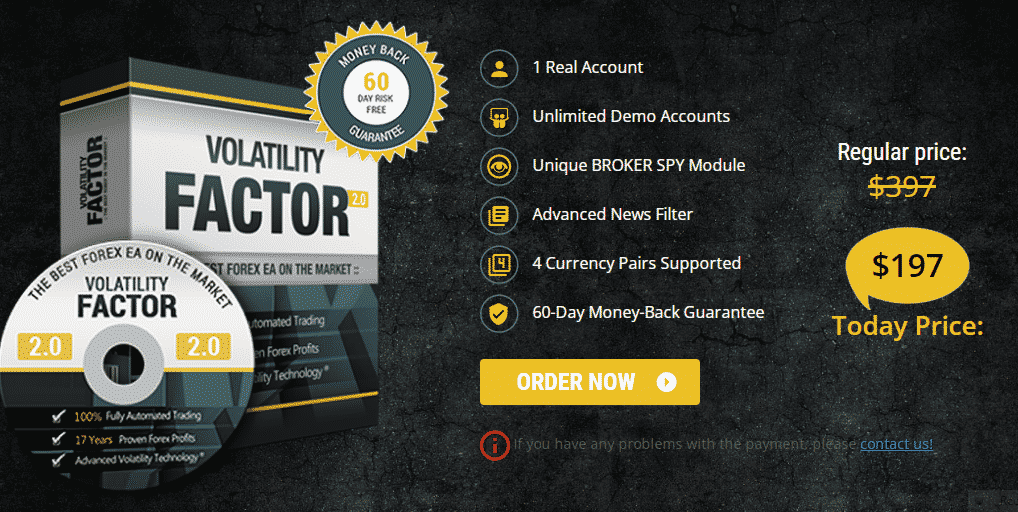

Volatility Factor 2.0 packages

Volatility Factor 2.0 is now available at $197. This follows the vendor’s decision to decrease the price from $397. The license comes with 1 real account and unlimited demo accounts coupled with a 60-day money-back guarantee.

Assistance

The vendor offers customer support. If you have any comment, question, or feedback, you are asked to email the team by filling in the form provided on the official site.

Other notes

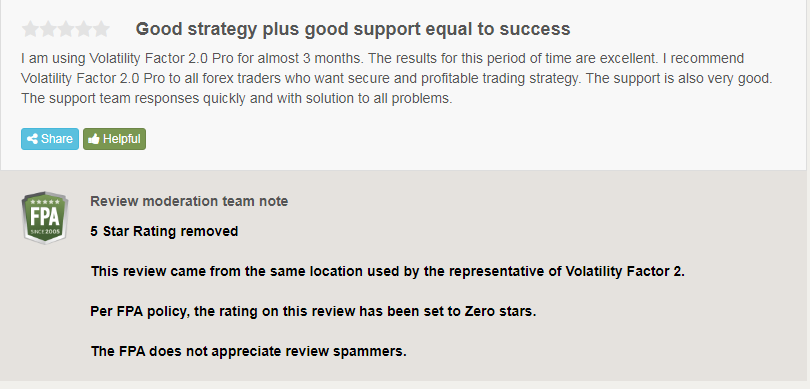

Volatility Factor 2.0 has a review on FPA. The testimonial is positive and says that the results generated by the EA are excellent. However, the review has been spammed by the FPA moderation team, indicating that the comment was made by a representative of the company. This action points to a vendor desperate to dupe traders into purchasing the system.

Is Volatility Factor 2.0 a profitable bet in 2021?

No, it is not. This is because:

- It generates small profits

- Trades dangerously

- Has a poor risk/reward ratio