- What are silver ETFs?

- Which is the best silver ETF to buy?

- How to be part of the silver ETF market?

Silver is in the precious metal market known as the “poor man’s gold.” However, despite this tag, it has proven in times of economic and political uncertainty to be a haven investment asset together with gold.

The problem with most precious metals, silver included, is the initial investment capital requirements due to the minimum allowable buying unit, the associated transaction cost, and the storage costs for the physical stock. These costs are the reason for the creation of precious metal ETFs.

What are silver ETFs?

Exchange-traded funds are a pool of investment assets. Therefore, fund investors gain interest in all the underlying holdings of an ETF and the potential gains while minimizing the risks of investing in a single investment instrument.

When it comes to silver, it plays two roles, that of a currency and that of being an industrial component. As such, there are silver ETFs made up of companies dealing in silver bullion, those involved in the mining and industrial use of silver such as the medical field, energy, and motor vehicle, among others, or a combination of these two categories. The dual role of silver makes silver funds one of the most sought-after precious metal funds resulting in relatively better liquidity and market stability.

How to be part of the silver ETF market

Investors looking to avoid the hassle of owning physical silver bullions or single silver mining stocks have the silver ETFs. This pool of organizations dealing in silver, unlike the actual bullion, is available for purchase through either online brokerage firm.

The beauty of online brokerage firms is in the transparency it offers through 24/7 portfolio accessibility coupled with a choice of different silver ETFs under one roof for easy screening and trading. Investors can either own physical shares in the ETFs identified or speculate on changes in the silver ETFs through CFDs, contract for differences.

Once a broker is chosen, the rest is as simple as ABC.

| Step A | Step B | Step C |

| Deposit capital to invest in silver ETFs with your chosen broker | Screen the broker-provided ETFs for the ones that align with your investment objectives | Buy the silver ETF of your choice |

Best silver ETFs to hedge

It is already evident from recent massive sell-offs and unprecedented bullish runs that the post-pandemic investment market will be highly unpredictable. Investing in precious metals such as silver that do not correlate with the stock market ensures portfolio diversification and caution against these extreme movements.

The problem is that when it comes to silver as a metal, it is a byproduct of other base metals, leaving its supply at the mercy of others. As a result, silver prices don’t always reflect demand and supply forces resulting in extreme moves.

For a reason mentioned above, investors are better off investing in the following silver ETFs.

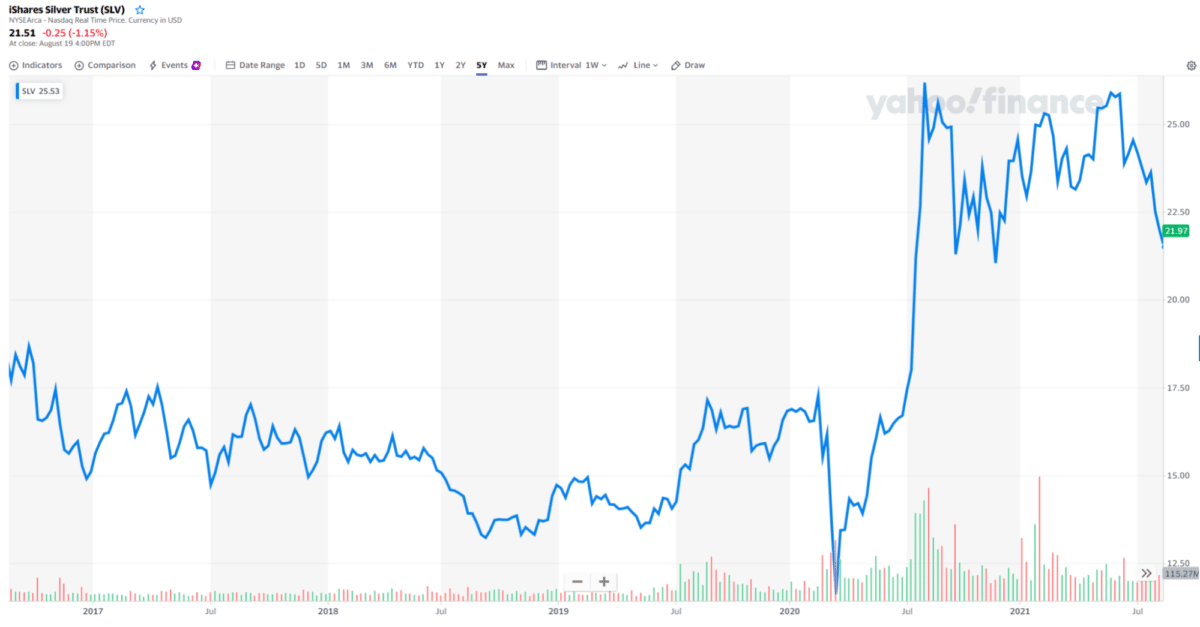

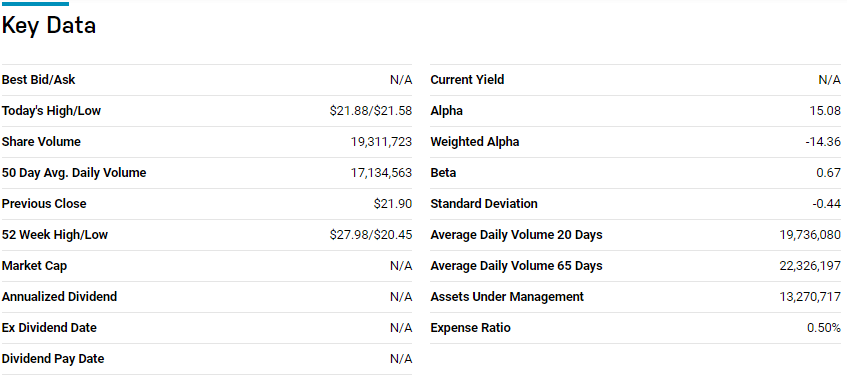

№ 1. iShares Silver Trust (SLV)

Price: $21.51

Expense ratio: 0.75%

The iShares Silver Trust ETF is the oldest silver bullion fund. This passively managed fund seeks to replicate the performance of silver as a commodity after liabilities and expenses. Rather than seek profitability, this fund seeks to reflect the current price of silver.

The SLV currently has $13.09 billion in assets under management, with an expense ratio of 0.5%. The iShares Silver Trust ETF 3-year returns stand at 14.91%, with the pandemic year returns being 46.05%.

As the economy resumes from the Covid-19 ravages and the uptake in solar energy and electric vehicles picks up, the demand for silver components will go up, pushing the value of this fund higher. Couple this with the rising inflation rates and the role of silver as an alternative currency, and this is a commodity ETF worth being in your crosshairs.

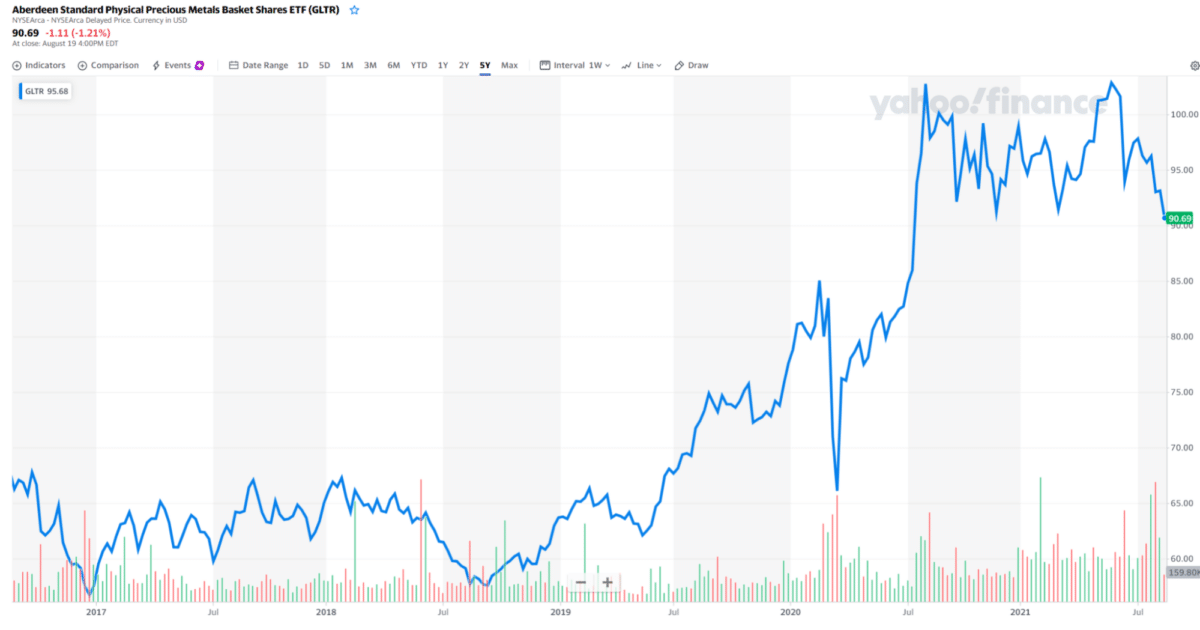

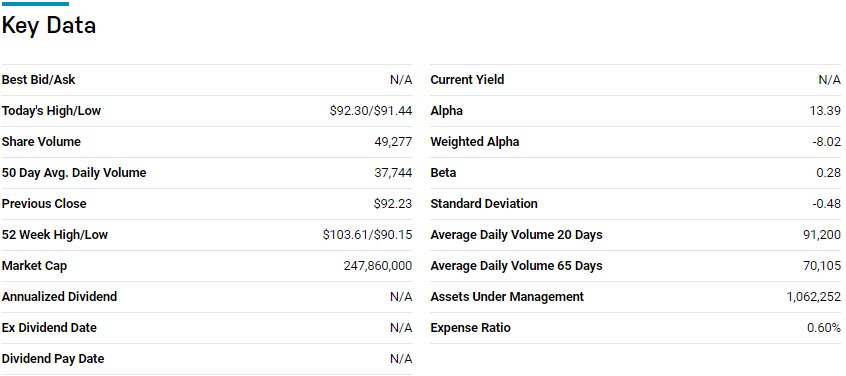

№ 2. Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR)

Price: $90.69

Expense ratio: 0.6%

The GLTR is a diversified fund that exposes investors to almost every precious metal spectrum. It seeks to reduce the credit risk of investing in individual precious metals by providing gold, silver, palladium, and platinum bullion ETF.

The GLTR has $1.05 billion in assets under management, with an expense ratio of 0.6%. In the last three years, this bullion fund recorded returns of 16.52%, with the pandemic year returns being 28.48%.

The diversification of this ETF ensures that a single metal market downturn does not result in financial ruin. The combination of alternative currency metals gold and silver with industrial metals palladium and platinum ensure that as investors seek a haven, post-pandemic before markets settle down, this ETF will benefit from both fronts-has a lot of legroom to run.

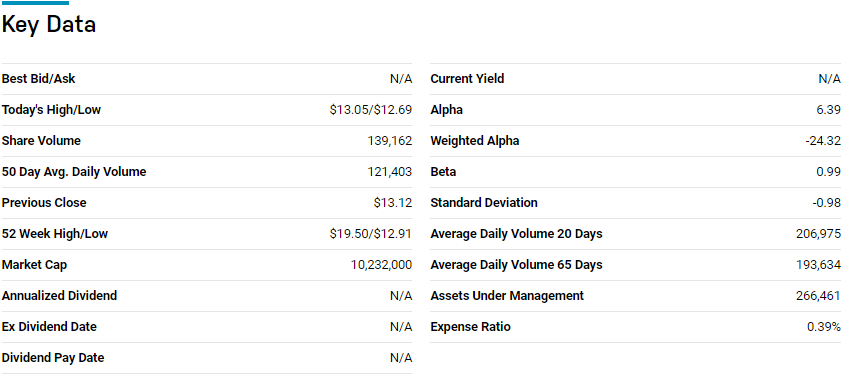

№ 3. iShares MSCI Global Silver and Metals Miners ETF (SLVP)

Price: $12.99

Expense ratio: 0.39%

The iShares MSCI Global Silver & Mtls Miners ETF is a non-diversified fund that exposes investors to companies exploring my silver through the MSCI ACWI Select Silver Miners Index. It invests at least 80% of its funds in holdings of its underlying index and other investments that mirror the economic traits of the underlying holdings.

This ETF fund has $260.91 million in assets under management with an expense ratio of 0.39%. It is ranked number three by US News among precious metal ETFs. This silver ETF has recorded 17.48% returns and one-year returns of 56% in the last three years.

As the economy continues to recover, mining activities will pick up the pace to match the demand needs making this ETF worth a look.

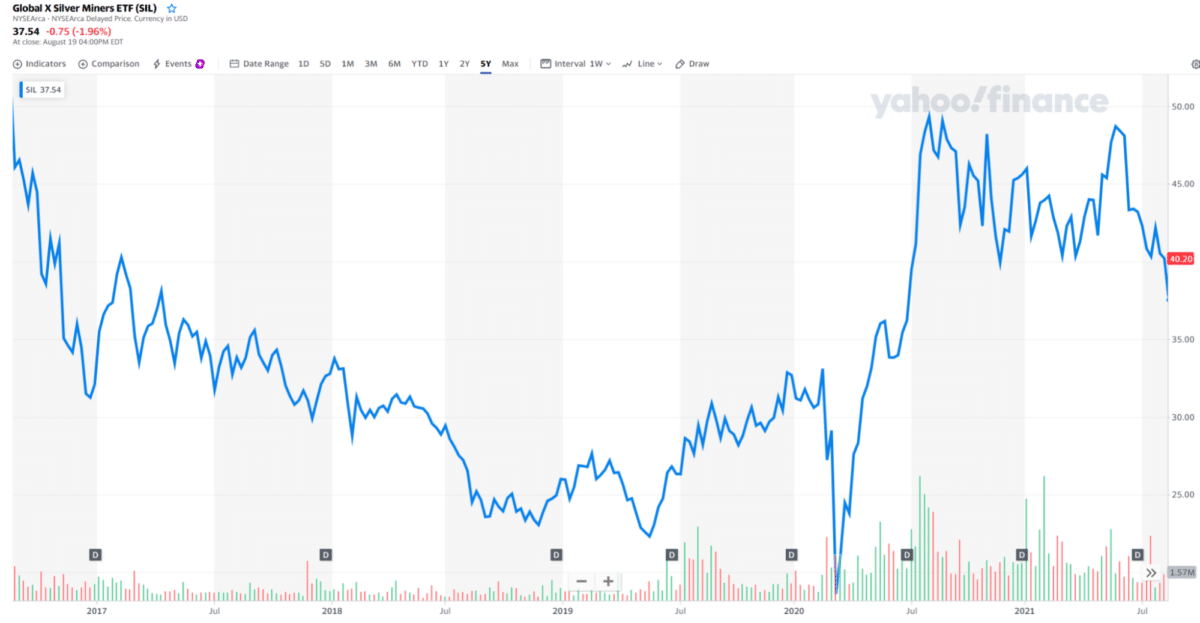

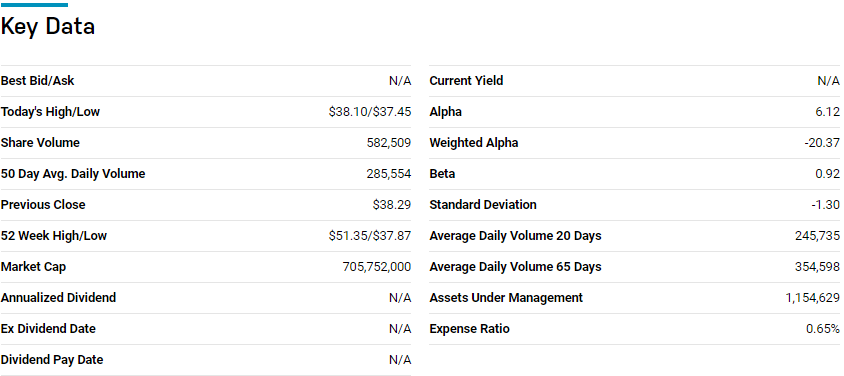

№ 4. Global X Silver Miners ETF (SIL)

Price: $37.54

Expense ratio: 0.65%

The Global X Silver Miners ETF is a precious metal fund that exposes investors to companies primarily involved in silver mining through the Solactive Global Silver Miners Total Return Index. It invests at least 80% of its funds in holdings of its underlying index and American and Global depository receipts based on the underlying holdings’ securities.

This non-diversified fund has $1.13 billion in assets under management with an expense ratio of 0.65%. It is ranked number four by US News among precious metal ETFs. This silver fund has recorded 17.97% returns in the last three years, with one-year returns of 41.04%.

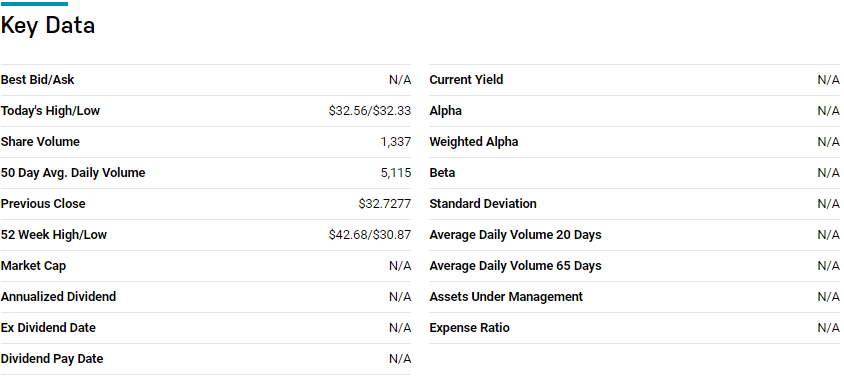

№ 5. Invesco DB Silver Fund (DBS)

Price: $32.34

Expense ratio: 0.75%

The DBS ETF tracks the DBIQ Optimum Yield Silver Index changes, negative or positive, by investing in future ETF contracts. Therefore, it monitors the underlying index’s money market income, ETF T-bill income, and treasury incomes.

The DBS has $22.86 million in assets under management, with an expense ratio of 0.75%. Its 3-year daily returns stand at 14.04%, with a whopping 44.86% return in the 2020-pandemic year.

Final thoughts

As the global community grapples with a post-pandemic world, the stock and currency market is experiencing volatility and unprecedented market movements. This increased volatility coupled with unchecked inflation, at least in the meantime by the Fed, calls for hedging against held investments.

Silver is one of the best hedging assets given its dual role, an alternative currency, and industrial use. As such, investing in silver ETFs at present ensures that one is not only hedged against inflation and stock market volatility but also the unpredictable spot silver movements.