- What is margin trading?

- What are the bullish and bearish trading setups for such trading?

- How does it work in crypto?

Wouldn’t it be fantastic if you could buy and sell cryptocurrencies using funds over your current account balance?

Bitcoin margin trading is what you’d expect it to be. Borrowing money from traders and charging them fees and interest might help them boost their profits or losses. A lot of successful investors use this method.

As a result of using margin trading on crypto exchanges, both profits and losses might be significant. Therefore, margin trading should be approached with considerable caution by novice traders. Here, we’ll explain what margin trading is and how to do it so that you can decide if it’s good for you.

What is margin trading in crypto?

It is a kind of trading in which investors borrow funds from a third party. If a trade is booming, traders may earn enormous profits by borrowing a large sum of money and using it to increase the size of their holdings. This strategy is widely used in the traditional stock, foreign exchange, and commodities markets. As a result, it is currently commonly used in bitcoin markets. In general, margin trading in cryptocurrencies allows traders to borrow money from other traders who earn interest on margin funds or the exchange (less common).

How to do margin trading in crypto?

Margin trading takes out a loan to make more significant or frequent deals. First, however, the so-called liquidation price must be considered. When the market reaches the liquidation price, the exchange will automatically close a trade. This ensures that traders only lose their own money and not their borrowed money.

When trading with one’s own money, the liquidation price for a long position on an asset is zero. In contrast, when leverage is increased, the liquidation price comes closer to what the investor paid for the stock.

It is possible to short Bitcoin via margin lending, allowing investors to profit regardless of the market’s direction.

A single Bitcoin (BTC) price is assumed to be $10,000. Bitcoin margin trading involves buying one Bitcoin with a 2x leverage and keeping the position open for a long time. To acquire a $20,000 position, they would have paid $10,000 upfront and borrowed another $10,000.

In this case, the sale price would be a little more than $5,000. When this sum was reached, the trader would lose their entire investment, interest, and fees. If the price of BTC plummeted to zero, a trader who bought $10,000 worth of BTC would typically be out of their entire investment. Due to the 2x leverage, the bet has doubled. As a result, potential earnings and losses have been increased by two times the original stake. To put it another way, if the price drops by 50%, they will lose 100% of their investment.

In this example, the exact liquidation price would be slightly higher than 50% less than the buy price because fees and interest are included in the cost of initiating the position.

Characteristics of a good margin trading equity

The most significant margin trading equities, on average, have the following characteristics:

Good volume

There is a great deal of interest among day traders in stocks because of the enormous volume and frequency they fluctuate. When a trader may buy and sell without changing the price, it is known as liquidity. Additionally, the foreign exchange market is highly liquid.

Some volatility

Volatility refers to the frequency with which the price of a financial asset changes.

Familiarity

Don’t forget to learn about how securities are traded and how the various triggers operate. To determine whether or not a stock is within a trading range, one must answer this question. Which way will the company’s earnings report go?

Sample of the margin trading strategy

There are several margin trading strategies. First, however, we explain a simple one based on candlestick patterns.

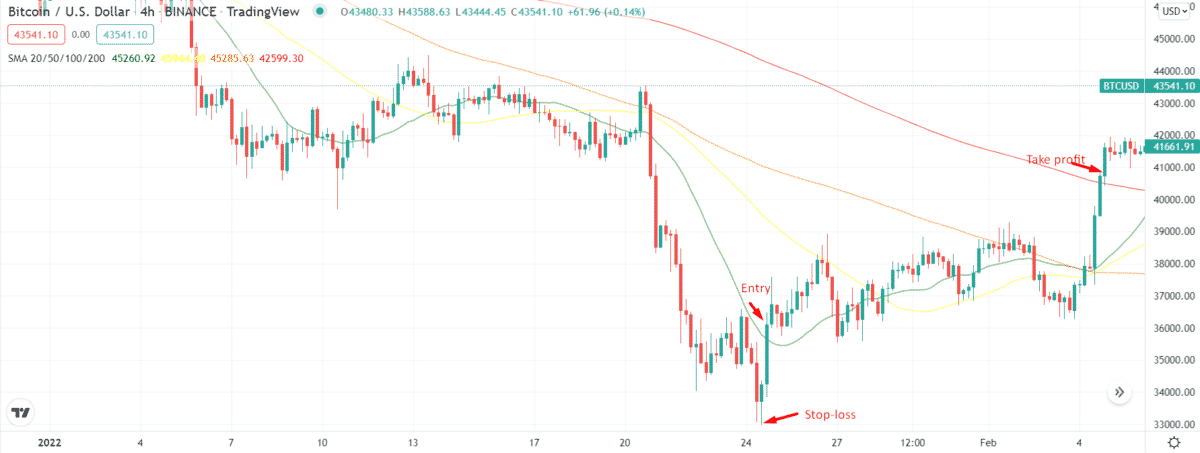

Bullish trade setup

We have to watch for the bearish trend to pause for a bullish trade setup. The bearish trend must have at least 20 to 25 candles. Once you find the price in a consolidation phase, look for a strong bullish candle covering the previous bearish candle. This is a bullish engulfing candle.

Once the candle closes, buy the asset immediately. However, if you are a conservative trader, wait for the price to hit a few pips above the high of the engulfing candle.

Place the stop-loss just below the recent swing low. Your take profit target should be twice the distance of entry and stop-loss. Take a look at the following chart to understand better.

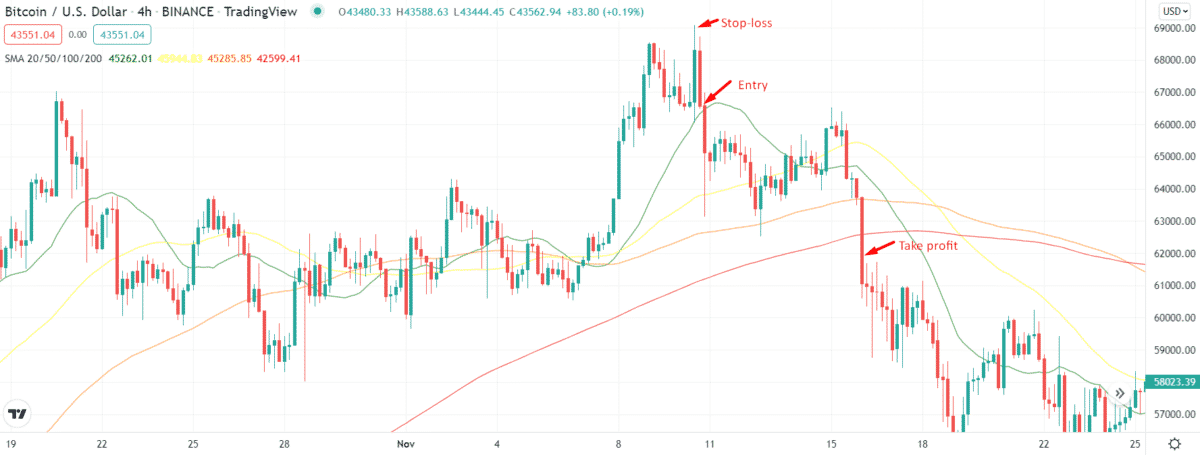

Bearish trade setup

We have to watch for the bullish trend to pause for a bearish trade setup. The bullish trend must have at least 20 to 25 candles. Once you find the price in a consolidation phase, look for the strong bearish candle covering the previous bullish candle. This is a bearish engulfing candle.

Once the candle closes, sell the asset immediately. However, if you are a conservative trader, wait for the price to hit a few pips below the low of the engulfing candle.

Place the stop-loss just above the recent swing high. Your take profit target should be twice the distance of entry and stop-loss. Take a look at the following chart to understand better.

Final thoughts

Professionals commonly use margin trading in crypto. Compared to typical markets, bitcoin exchanges frequently trade at a fragile volume. Increased volatility and “long squeezes” are possible due to leverage, which magnifies price changes and can lead to a rush to sell.