- How to invest in stocks?

- Can I invest in stocks if I’m under 18?

- How old do you have to be to invest in stocks?

It is never too soon or too late to invest in stocks. But the younger you start investing, the better. That’s why the perfect time to begin buying stocks is right now. Instead of saving your money in the bank, you could send part of that money to your stock account and enjoy the benefits later.

Some investing models could make more than $1,000,000 by the time you retire by putting between $200 and $300 per month if you start at 25 years old. Buying stocks is a proven way of increasing your capital, and you could even create passive incomes from the dividends some companies offer. Go through this entire article to find out how to invest no matter your age.

What is investing?

Investing is putting your money to work for you. By putting your money into some activity, you expect that it will produce value from which you later will make a profit. For example, the easiest way to invest in the stock market is by buying a company hoping that the value of those stocks will rise later and you profit when you sell it.

Sometimes it’s a little hard to differentiate investment from speculation, but some differences we can outline from the two are:

- Time

When speculating, you expect to make money fast, and you are not interested in keeping your money for a long time.

- Risk

Generally, investing means a lower reward but also lower risk. In contrast, speculation is a high-risk activity that could signify a big reward.

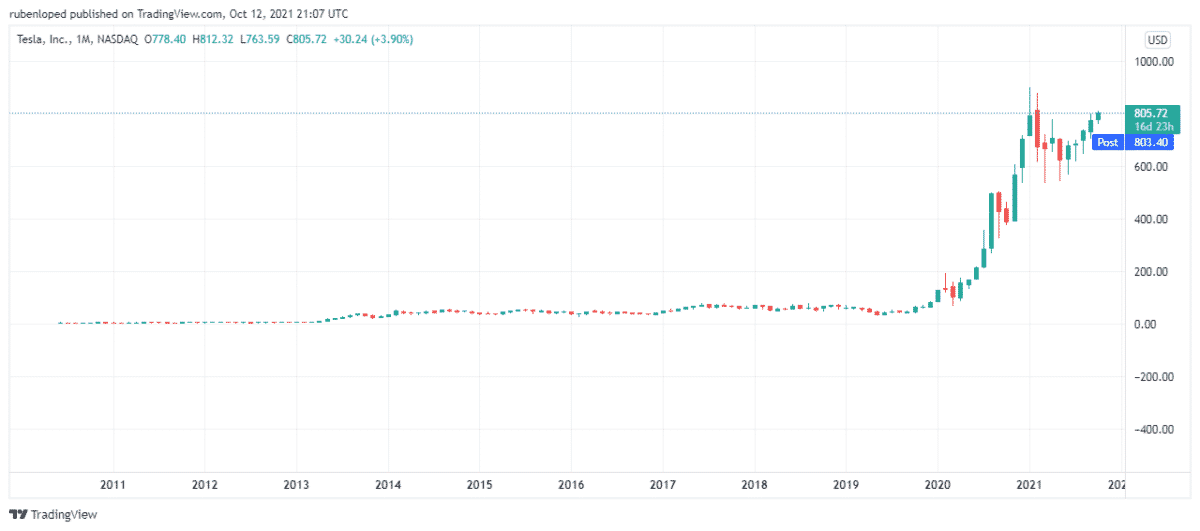

Tesla success

In March 2011, Tesla’s shares cost around $4.92. Today, Tesla is one of the companies with a higher growth rate, and its current stock price is $805.72. If you had invested $1,000 in Tesla stocks at that time, you would have owned 203 Tesla shares. By keeping your investment until today, ten years later, you would have today $163,601.76. That’s a 16,280.48% profit.

How old do you have to be to invest in stocks?

The simple answer is that you have to be legally an adult to open an investment account. That means that, depending on your country, you would have to be 18 or 21 years old to open an account. However, there are some options for minors to start investing in stocks at an early age. However, all of these options require adult supervision.

Those kinds of accounts are called custodial accounts. This type of account may be an option for parents wishing to ensure the financial security of their children, at least for their early adult years.

The more popular options are Uniform Transfer to Minors Act (UTMA) accounts and Uniform Gifts to Minors Act (UGMA). Both types are designed for the child to take control of the money after the person turns 18 or 21.

How to buy stocks in 2022?

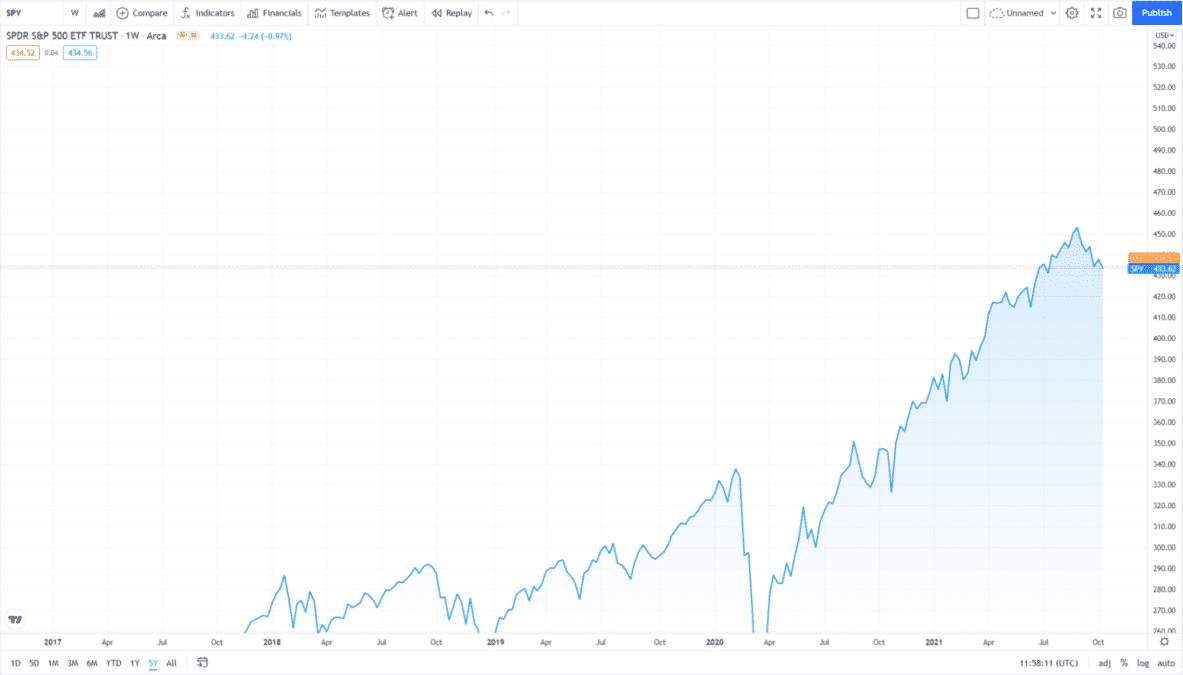

We already said that the best moment to buy a stock is right now. The sooner you get into the market, the better. You can see headlines all over the internet about how every company in the S&P 500 will make money next year. Thus, 2022 seems to be a good year for the stock market.

However, if you don’t know how to do it right, you are just going to lose money. That’s why we’ll give you five steps to invest in stocks next year.

Step 1. Invest in yourself

There are many ways of getting the information you need to invest, but there is no one way of investing right. Thus, you have to understand that information and adapt it to you.

Many investors have many different strategies, and they can all be successful, yet one of those strategies may not be suitable for you. When you invest in yourself and study your situation, you’ll see that some strategy is not ideal for you. Understanding the market allows you to adapt ideas to your circumstances to make the most out of it.

Step 2. Choose the broker for you

Investing in the stock market used to be a job only for rich people and business professionals. Today, thanks to the internet, you can invest from your home through your computer. The options to invest are many. There are a lot of brokers online competing to offer you the best deal. It’s worth it to take all the time needed to choose the right broker for you. Some brokers charge you fees or demand high minimum deposits. Some have good educational programs. These and many other features must be taken into account when choosing the best broker for you.

Step 3. Time frame

We already said that the sooner you invest in stocks, the better because the effect of compound interest is greater in longer periods. But not just that, when you are younger, you can take more risks. So, for example, if the goal is to get enough money to retire at 65, the guy who starts at 30-year-old has a wider margin of error than the guy that is just starting at 45 years old.

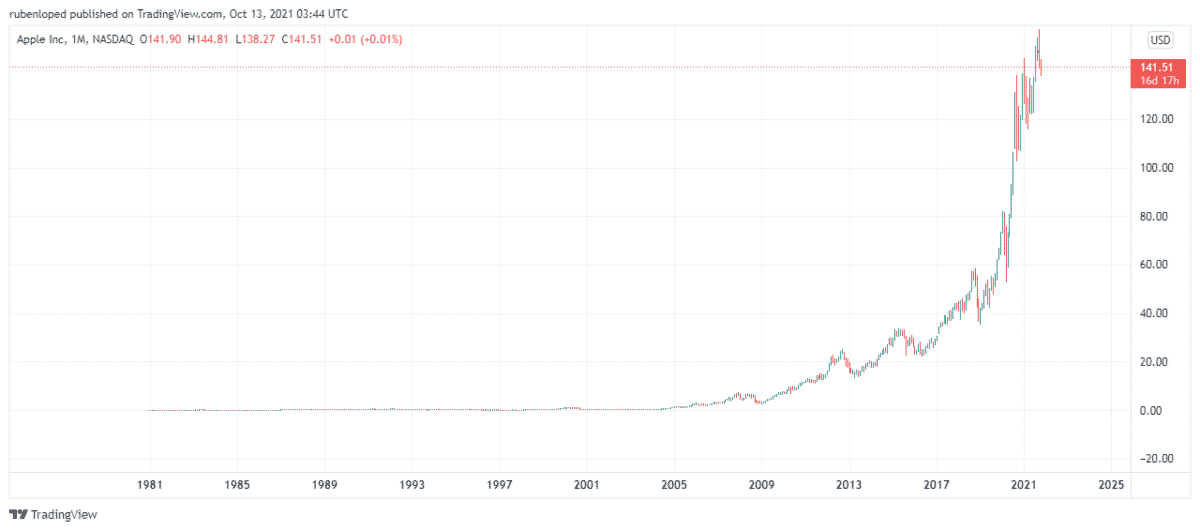

Another example of high reward through time is Apple Inc. Forty-one years since the company went public, and its growth has been constant since then. If a young man invested in the company as soon as it went public, he would have a nice retirement fund today.

For example, imagine that as soon as Apple Inc. started selling shares, a 25-year-old guy decided to invest $1,000 in the company.

The initial price of every stock was $22, which means that he would have bought about 45 shares of Apple Inc. Now, through time Apple Inc. has split its stocks four times.

Three times 2 to 1, and one 7 to 1. In other words, the company gave our guy two shares for every share he already owned and then seven shares for every share he already owned before the last split. That way, he would own today 45 x 2 x 2 x 2 x 7 = 2520 Apple Inc. share.

Today, the current apple value is $141,51. So, 41 years later, our guy would be 66 years old and own $356,605.2 with just one risky investment he made because he was so young and his retirement was so far away he could afford to lose $1,000.

Step 4. Diversify

Of course, we all want to find that one stock that within a few years will make us rich, but the possibilities are against us. If we invest in one promising start-up, there is a much higher likelihood of losing our money if the company goes bankrupt, then we will be rich in ten years. So, to avoid losing all your money on one bad bet, you have to make smart investments in big companies before you buy riskier stocks, but the key is to diversify your investments.

Even big companies lose money, and sometimes entire industries crash. The trick is to invest in as many companies as you can from different sectors and never compromise most of your money in one company. Experts recommend putting just about 4 or 5% tops in one company.

Step 5. Dividends

Once you start building your portfolio, you may want to consider stocks that generate passive incomes. You can classify stocks in many ways. One of them depends on the dividends they offer. Some companies don’t offer dividends, so making money out of these companies is by selling the stocks after they revalue. Conversely, by investing in companies that offer high dividends, you can create a passive income stream that you can reinvest to create an advantageous cycle.

Final thoughts

Investing in stocks is an activity for all ages. Even non-adults can start investing in stocks with the help of their parents. The sooner the person starts investing, the more benefits the person will get from it.