- What does it mean to short crypto?

- What are the strategies for this?

- What are the reasons?

A trader’s ability to profit from Bitcoin’s recent and historical volatility may be greatly enhanced by learning how to short the crypto. If you think an asset will increase in value, you may buy it and wait for the price to go up. However, they may not be aware that there are ways to profit when they feel the asset’s value will decline: short selling the asset.

This may help with auxiliary trading tasks like tax administration and risk management when done correctly. However, shorting is a more complicated investing strategy. Therefore, it’s essential to know how it works before applying it.

What does it mean to short cryptocurrency?

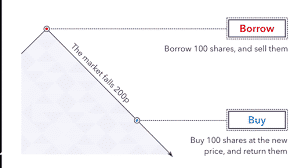

To put it another way, shorting crypto is the practice of selling it at a higher price to buy it back later when the price of a crypto asset is expected to fall.

You don’t have the cryptocurrency you wish to make money with. You’re “short” coins, which is why short selling is referred to as such. A basic understanding of crypto long and short positions is necessary for understanding shorting.

To go long on crypto is to essentially buy it with the hope that its value will climb in the market. For example, consider buying a $10 cryptocurrency with the expectation that it would grow to a $12 value. By selling it when the price increases, you may make a profit.

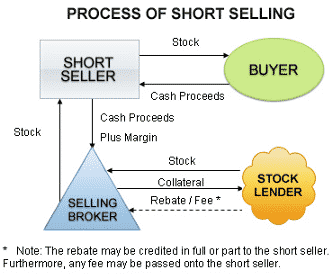

On the other hand, shorting involves borrowing a cryptocurrency and selling it at the current market price, expecting a price decline. Then, when the coin’s price decreases or retraces, you repurchase it, making a profit equal to the difference between the selling and buying prices.

Cryptocurrency short selling: why should you do it?

In addition to profit and market research, shorting Bitcoin is done for various reasons. You should short crypto for the following reasons.

Valuation

At any one moment, a currency’s value may be excessive, or it may be in a price bubble. If you want to benefit from this trend, you may choose to short-sell Bitcoin.

Their response has been to sell crypto and wait for it to recover. Then, calculate the current market price and compare it to its inherent worth before deciding whether or not to redeem the borrowed crypto.

Volatility

The volatility of cryptocurrencies may put Risk-averse investors off, but traders can take advantage of it. The price of cryptos has fluctuated greatly in the past.

This trend will appeal to traders who aren’t afraid of taking a chance. If you’re an experienced currency trader, you’ll gain from currency volatility.

Management of risk

Volatility in the BTC market may encourage short selling, but it is bad for long-term investors. If you already own BTC, you may short sell it if you feel its value will decrease.

There is a possibility that if you’re accurate, the benefit from shorting crypto might surpass or even exceed the cost of owning it. Hedging, in a nutshell, reduces one’s exposure to the risks of a deteriorating market.

What are the strategies involved in BTC shorting?

There are presently many methods to short Bitcoin and many short trading techniques. Some well-known cases include:

Trading on margin

Margin trading is designed to be the easiest alternative. Coins like FTX and Phemex provide margin trading on their platforms. You borrow BTC from a broker to perform a deal.

In addition, you should be aware that margin includes borrowing or leveraging money. Consequently, it will enhance your earnings and raise your losses.

Typically, the broker will offer you a percentage of the money you may borrow from the exchange and utilize to trade with during your trading session. As part of the agreement, you must refund the money you borrowed and finish the transaction within a specific amount of time.

Futures

Every asset has a future market, and Bitcoin is no different. In futures trading, contracts are utilized to acquire and sell assets. The contract stipulates the date and price at which the security will be sold. Buying a futures contract is a method to wager that the underlying asset’s price will grow. A good return on investment is therefore anticipated.

Then, if you feel that Bitcoin’s price will drop shortly. After that, you’ll need to obtain contracts that bet on a lower BTC price.

To put it another way, selling a futures contract short implies promising to sell it at a lower price. Another advantage is that it enables novice traders to have a footing in the market with a lesser initial commitment.

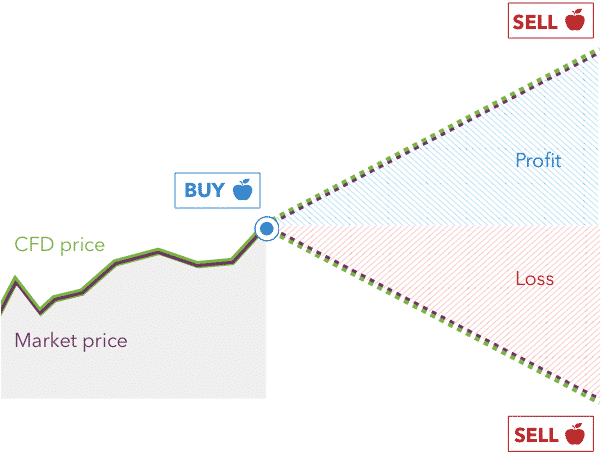

CFD

It is an acronym that translates to “contract for differences” or “CFD.” If the open and closing prices diverge by a certain amount, settlement funds are distributed according to this financial method.

Similar to Bitcoin futures, in principle. They’re making wagers on the value of a digital currency. A CFD is thus an investment in Bitcoin’s value decreasing. The result of shorting Bitcoin is a short position.

When the price of BTC falls below $55,000, it is feasible to short sell and liquidates your investment. It’s excellent that you earned a $5000 profit. Settlement terms may be adjusted in contracts for difference (CFDs), unlike Bitcoin futures, which cannot.

Binary options

You may utilize binary options to go short on Bitcoin if you choose. Even if the market price declines, you aim to sell the currency at today’s price. To execute a put order on a call or put option, you’ll need to work with an escrow provider or another third party.

Many foreign exchanges provide binary options. Since you placed a put order, the money you invested is being squandered. As a result, it’s not the most cost-effective solution. The most important benefit, though, is that you may be able to reduce your losses by postponing the sale of your put options.

A low-risk trading approach for short-term contracts. Is this a good thing? Of course, it is. The outcome may go anyway. But, unfortunately, you might also lose all you’ve worked so hard for.

Predictions for the market

Predictions of future events are also a lucrative business. Like a regular retail atmosphere, this has a lot of the same things you’d find here. In the role of a trader, you are allowed to place a bet on a certain event. The price of Bitcoin must fall by a specified percentage or amount. Assuming your guess is correct, you’ll be well-off if someone moves into the bed.

To put it another way, if you initiate a prediction market shorting transaction, you’re betting against the cryptocurrency’s value declining. In the event your prediction comes true, you’ll be able to retain your earnings. Therefore, you don’t need to borrow money from others.

Final thoughts

Do you believe you’ll be able to short crypto after reading this article? You should be able to get started at the very least.

A short position in BTC is a sale made at a higher price than the current market price because the investor believes the price will decrease due to market fear or retrace after a spike. This allows you to repurchase it at a lower price in the future. The information in this article should have clarified for you what crypto shorting is and where you may legally engage in it.