- What are crypto mining stocks?

- Which are the top crypto mining stocks to invest in?

- What potential do they hold in the upcoming future?

The top names that spring to mind are Bitcoin, Ether, and Dogecoin when it comes to crypto. Cryptos such as Bitcoin and Ethereum have become more popular because of their rapid value growth. Crypto may be purchased on exchanges, but users can also mine the money on their computers by completing complex mathematical equations.

These currencies are based on blockchain technology, which is a distributed ledger. A sophisticated encryption system keeps track of all the coins and keeps them safe. The person who adds new currency to the blockchain ledger is a “miner.”

As part of the crypto transaction verification process, miners must solve complex mathematical equations to generate new crypto tokens on the blockchain. These transactions are recorded on the blockchain’s decentralized ledger. For their efforts, the miner is compensated with crypto tokens. The creation of new cryptos expands the currency’s reach.

Best cryptocurrency mining stocks to watch right now

Let’s go through a few of the top crypto mining stocks to invest in this year.

Marathon Digital Holdings Inc (MARA)

MARA plans to build the largest mining operation in North America at the lowest potential energy costs.

Why does it have the potential to grow?

For Marathon Digital, solving one of mining’s key weaknesses is a way to stay relevant and dominate the crypto market. Because of Marathon Digital, investors may participate in the Bitcoin market without dealing directly with it. To become the largest mining company in North America, Marathon has established a clear growth target.

How much would you earn if you invested in MARA 1 year ago?

MARA’s share price on 14 May 2021 was $23.08. The stock’s share price closed at $11.39 a year later. So if you had invested $1,000 last year, your account could have lost $506.49.

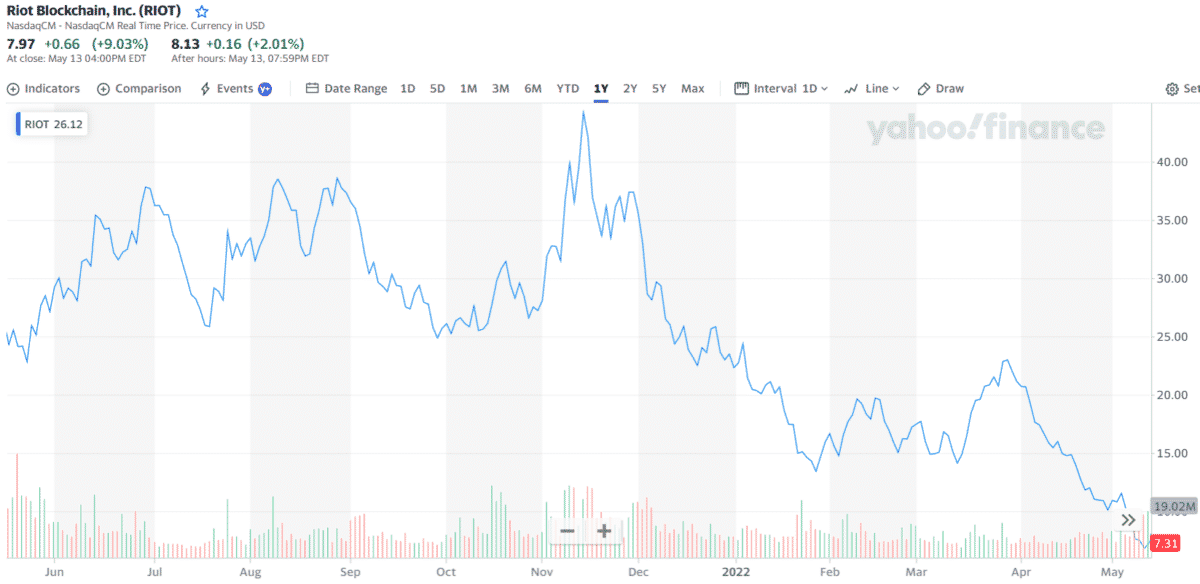

Riot Blockchain (RIOT)

Riot Network, Inc. is a Bitcoin mining startup quickly establishing large-scale mining in the United States to support the Bitcoin blockchain. The company will boost the Bitcoin mining hash rate and infrastructure capacity. Riot’s current hash rate capacity is 2.2 EH/s, using around 73 MW of power. To reach a self-mining hash rate of 2.6 EH/s and electrical consumption of around 83 MW, Riot plans on installing 3,600 more S19 by the end of September 2021.

Why does it have the potential to grow?

Due to the company’s exclusive focus on BTC mining and the increase in its mining operations, the financial gains have been extraordinary. When Whinstone US, a Bitcoin mining firm, was purchased by Riot in May 2021. As a result of this acquisition, Riot will be able to become one of the largest hosting and mining companies in North America.

Development and modernization of the company’s mining activities are achieved via industrial-scale infrastructure expansion and the purchase of the current generation of miners. 7.7 EH/s is Riot’s target for overall hash rate capacity.

One of the industry’s largest and most efficient BTC mining fleets was built by Riot to demonstrate its commitment to being a leader in this space.

How much would you earn if you invested in RIOT 1 year ago?

RIOT’s share price on 11 May 2021 was $26.02. The stock’s share price closed at $7.97 a year later. So if you had invested $1,000 last year, your account could have lost $693.69.

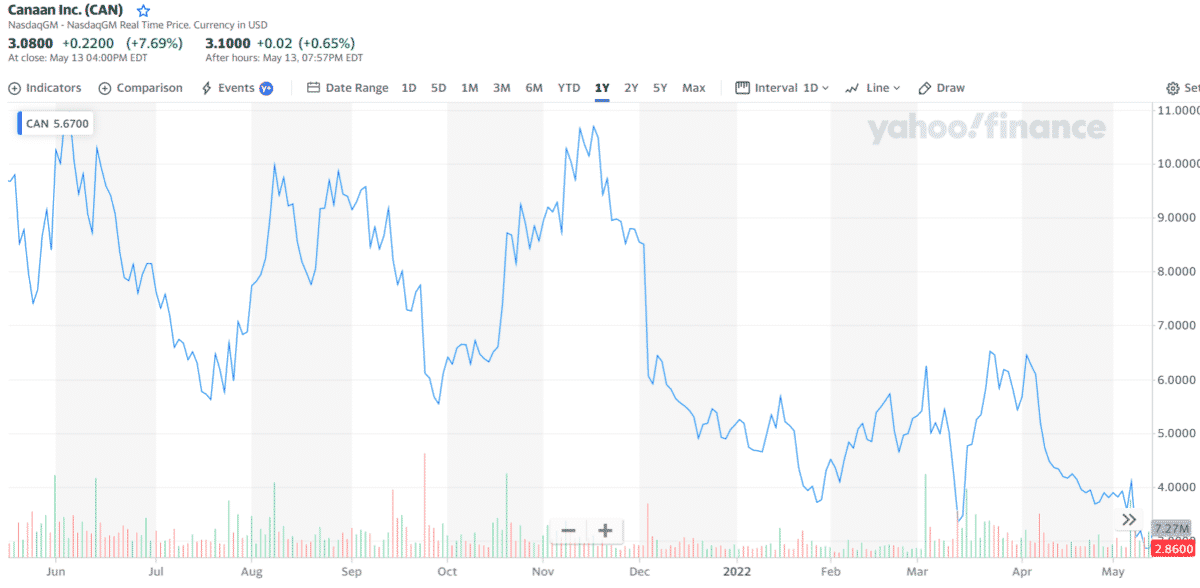

Canaan (CAN)

Canaan Inc. is a Chinese Bitcoin mining gear company. This company was one of the first to exploit application-specific integrated circuit (ASIC) technology to develop BTC mining equipment.

Founded in 2013, the company built the first ASIC Bitcoin mining equipment. Last year, Canaan introduced the world’s first 7nm ASIC device, providing Bitcoin miners with more energy-efficient processing power.

Why does it have the potential to grow?

In the last quarter of 2021, the company had net revenues of $167.5 million and net earnings of $37.9 million. Since its IPO in 2019, the Bitcoin miner manufacturer has seen its quarterly net sales soar.

Sales of computing power by the company have broken a previous record. An incredible 126.7% growth in the total amount of processing power sold was observed in the third quarter of this year. Because of the increased demand for Bitcoin mining equipment, there has been a massive increase in supply. HIVE Blockchain Technologies Ltd. has ordered 4,000 Bitcoin mining machines with Canaan.

How much would you earn if you invested in CAN 1 year ago?

CAN’s share price on 11 May 2021 was $9.69. The stock’s share price closed at $3.08 a year later. So if you had invested $1,000 last year, your account could have lost $682.14.

Core Scientific (CORZ)

Following the SPAC protocol, the first new crypto stock of 2022 was the Bitcoin (BTC) miner Core Scientific (CORZ). The majority of the money came from Blackrock, Inc.

Why does it have the potential to grow?

By mining its Bitcoin and supplying infrastructure and technology to third-party miners, Core Scientific sets itself apart. In North America, it is a large Bitcoin miner with 6.6 exahashes of mining power, more than double the power of most of its opponents. Customers possess a total of 6.9 exahashes. The business specializes in digital asset mining and has filed more than 70 patents. In addition, green electricity and carbon credits will make its activities carbon neutral. A Texas location is also in the works, as are others in Gwinnett, Kentucky, North Carolina, and North Dakota in the United States of America.

EBITDA (profits before interest, taxes, amortization, and depreciation) is expected to reach $203 million in 2021, even though Core Scientific has not yet revealed its financial results. In 2022, EBITDA is expected to reach $572 million. Core Scientific reported a $75 million net loss in September of last year.

How much would you earn if you invested in CORZ 1 year ago?

CORZ’s share price on 11 May 2021 was $9.75. The stock’s share price closed at $4.25 a year later. So if you had invested $1,000 last year, your account could have lost $564.1.

Hut 8 Mining (HUT)

Hut 8 has the most self-mined BTC in North America. “Selling Bitcoin” is no longer an option, according to Hodl’s most recent financial report.

Why does it have the potential to grow?

There is a strong emphasis on the company’s BTC balance sheet at Hut 8. All of the company’s actions are seen through the prism of the balance sheet. The firm is now worth ten times as much as the amount of BTC it currently has on its books. In addition, hut 8’s hash rate is expected to reach 6.0 E/H by 2022.

Hut 8’s hash rate is expected to quadruple in the same time frame. Both parameters will be closely monitored in the future. You should consider Hut 8 if you believe in the value of Bitcoin. However, due to its substantial BTC holdings, it may one day become a Bitcoin platform play.

How much would you earn if you invested in HUT 1 year ago?

HUT’s share price on 11 May 2021 was $4.61. The stock’s share price closed at $2.74 a year later. So if you had invested $1,000 last year, your account could have lost $405.6.

Final thoughts

There has been massive profit for mining firms worldwide since the introduction of the Bitcoin sector. Experienced cryptocurrency investors buy mining stocks instead of Bitcoin or Ethereum, much as they would conventional gold mining stocks. As a result, these crypto mining stocks’ volatility has been reduced. If you’re looking to invest in cryptos, mining stocks are a safe bet.