- Is it worth investing in the copper industry?

- Which stocks are worth investing in 2022?

- Are there any stocks poised to benefit future developments in the sector?

Copper is a lightweight metal with a steady demand due to its multifarious applications. It is expected that this demand would rise, given the shift to low-carbon energy sources. For this reason, investing in copper stocks can be a lucrative deal.

To help you in this endeavor, we present five copper stocks worth investing in 2022. They are arranged from the highest market cap to the lowest.

BHP Group Limited

Based in Australia, BHP Group is a world leader in producing natural resources. Some minerals mines are coal, iron, copper, potash, cobalt, and nickel. Apart from this, the company markets natural gas and oil, but this latter operation is combined with Woodside Petroleum (WPL).

Why does it have the potential to grow?

It is producing copper at increasingly higher volumes, which should translate to continuous growth and bigger dividend payouts. The company is looking to reward its shareholders with at least 50% of its profits through dividend payments. If it has excess cash, it shares such as well with investors.

How much would you earn if you invested in BHP stock 1 year ago?

On 22 February 2021, BHP stock closed at a price of $77.55. One year later, its price went down a little to $69.34. This drop in value is equal to 10.5 percent of the previous price. Had you invested $1,000 last year, you could have lost a nominal amount of $105.

Rio Tinto Group

It is a mining company with diversified operations based in the United Kingdom. Its production includes copper, gold, aluminum, industrial minerals, diamond, iron ore, and uranium. Its mining operations also cover basic materials such as lithium, borates, titanium dioxide, and salt.

Why does it have the potential to grow?

Apart from mining, Rio Tinto is undertaking various other projects such as Winu in Australia and Resolution Copper in America. The next big thing in its mining operations could be related to discovering a gold resource and copper in Winu.

How much would you earn if you invested in RIO stock 1 year ago?

The share price of this stock was $90.37 on 22 February 2021. One year later, its price descended to $77.63. This means the stock lost 14 percent of its value from one year ago. If you invested $1,000 last year, your account could have lost $140.

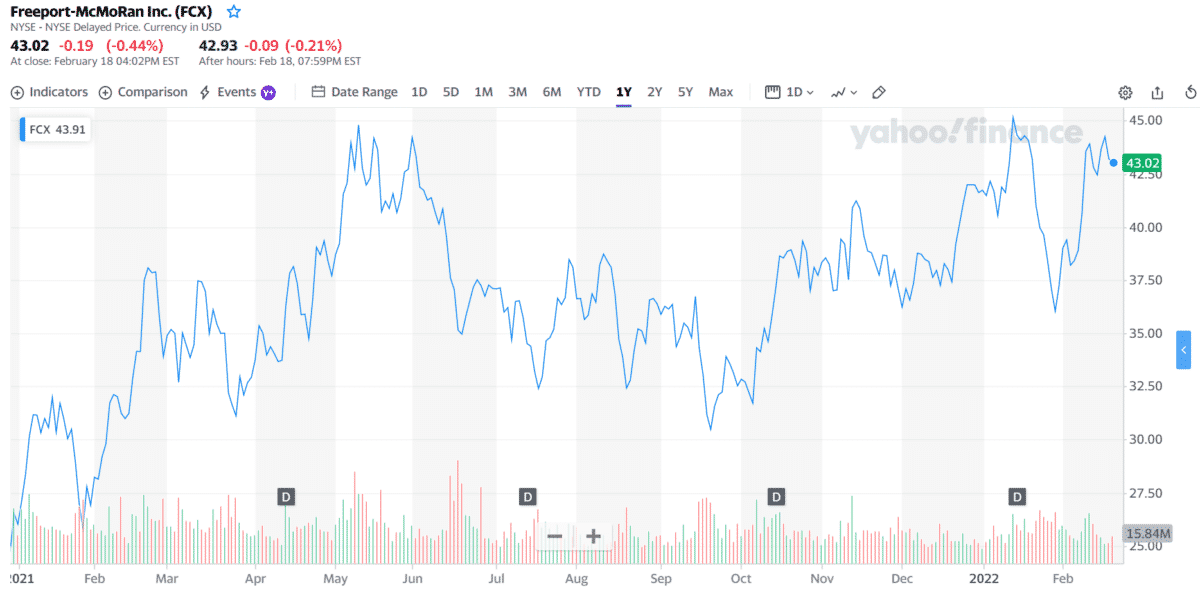

Freeport-McMoran Inc.

It is a world-renowned copper stock. In addition to copper, FCX also produces molybdenum and gold. Its most prized asset is the Grasberg mining site in Indonesia. This site has proven to have large deposits of gold and copper. The company also runs large-scale mining operations in Peru and Arizona.

Why does it have the potential to grow?

The biggest project in the company’s pipeline that will impact its bottom line in the near term is that in Grasberg, Indonesia. Once operational, it has the capacity to deliver about 703 million kilograms of copper every year. Some other projects for long-term growth include the extensions in Indonesia, Chile, and Arizona.

How much would you earn if you invested in FCX stock 1 year ago?

On 22 February 2021, the FCX stock closed at $38.08 per share. One year later, its share price climbed to $43.02. This price change represents a growth of about 13 percent in one year. Had you put money in this stock one year ago, you could have realized a profit of $130 today.

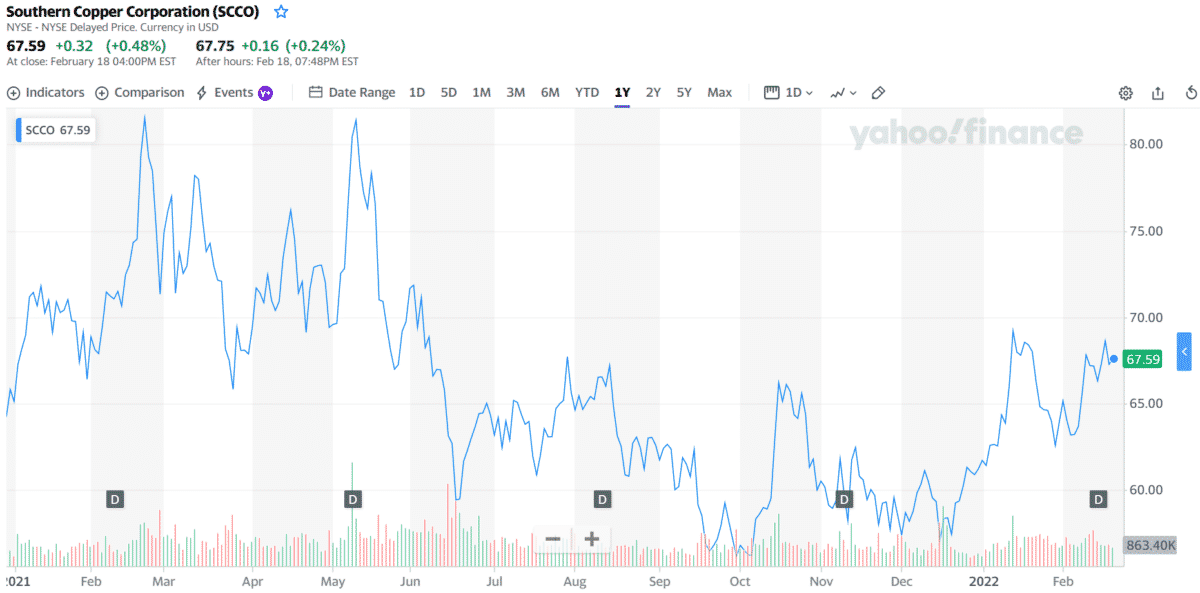

Southern Copper Corporation

Southern Copper is a household name in the industry of copper production. It has mining activities in Peru and Mexico. Grupo Mexico is the owner of the firm. The parent company is a large corporation involved in the infrastructure, transportation, and mining sectors. Southern Copper occupies the fifth position in the list of biggest copper producers worldwide.

Why does it have the potential to grow?

The long-term growth of Southern Copper will likely be driven by its major expansion projects. To boost its copper production over the next ten years, it plans to invest about $1.7 billion yearly in related projects.

How much would you earn if you invested in SCCO stock 1 year ago?

The SCCO stock closed at a price of $81.53 on 22 February 2021. Today its price declined to $67.59. This price decline is equivalent to 17 percent of change. If you invested $1,000 in this stock last year, you could have lost $170 today.

Tech Resources Limited

Based in Canada, TECK is a mining firm with diversified operations. It produces zinc, copper, and coal for making steel. It puts money in oil sand mining projects as an additional investment to increase profits. In 2020 the company generated 44 percent of its gross profit from copper.

Why does it have the potential to grow?

TECK hopes to become a leader in copper production in the future. In view of its northern Chile project, the company expects to produce 102 percent more copper in 2023. A few other projects are in the pipeline to satisfy any demand for copper in the future anywhere in the world.

How much would you earn if you invested in TECK stock 1 year ago?

This stock is the big winner in this list of five copper stocks. The stock price of TECK was only $23.25 on 22 February 2021. After one year, its price climbed to $35.49. This price increase is equal to about 52 percent of the previous year’s price. If you invested $1,000 last year, you could have made $520 in profit today.

Final thoughts

As the world is transitioning to low-carbon energy sources, it will need more supply of copper. This demand could drive the price of copper higher in the future. Companies that have made the preparations could cash in on this development. They could realize growth in share price and provide higher dividend payments. This market outlook suggests that this sector is a promising investment for any investor.