- Is investing in stocks worth it?

- Can you invest if you are under age 18?

- How can a teenager start investing?

Although you have to be legally an adult to invest in the stock market, there are ways in which, with the help of your parents, you can start building your future from a very young age. Young people have more risk tolerance, so they can afford to make more bad bets, but the one that goes well can make them rich.

We all wish we had invested in Bitcoin when the crypto was young, and we were young too. We would be rich by now. We didn’t, and we missed that chance, but you can now. Take advantage of your age, start building your portfolio, and luckily, you’ll start your adult life ahead of others. You don’t know how to do it? Read on so we can teach you.

Can you invest if you are under age 18?

Not by yourself. To invest in the stock market, you need to be legally an adult. But it is not all bad news. If you get the support of your parents, you can open an account where they are responsible for the investment until you become an adult. These accounts are called custody accounts.

Your parents can open one of these for you at any time, and you will get the account automatically once you turn 18 or 21, depending on where you live. Until then, no one can take out the fund from your account, not even the adult responsible for the account.

Is investing $100 in stocks worth it?

Investing $100 is a great way to start. As a teenager, no one expects you to put down a significant amount of money. Today, most online brokers don’t even require a minimum deposit so that you can start with even less than $100. So when you invest just $100, you’re already far ahead of most people who, instead of investing their money in stocks, prefer to keep it while inflation slowly destroys their savings.

While it is true that most attractive companies’ stocks quote above $100, there are good choices for you to invest with $100. Some of the best three choices are eBay, Upwork, or Morgan Stanley. However, investing in just one stock isn’t recommended since it’s very risky.

If the company you put all your money into goes bankrupt, you’ll lose your investment. But how can you diversify if you only have $100? There are two ways you can do this.

The first one is by buying fractional shares instead of the entire stock. The other is purchasing an ETF with a price lower than $100, such as BNY Mellon US Large Cap Core Equity ETF (BKLC). This last option is the one we recommend. It doesn’t have to be necessarily BKL, but you’ll be diversifying your investment by purchasing a good ETF, putting your money in many companies carefully chosen by the ETF managers.

How can a teenager start investing in stocks?

So, we have outlined the most common ways for a teenager to start investing in stocks. Beginning to invest from a young age creates a good habit and understanding the economic environment that will help the teenager later in life.

It’s not just about the amount of money he could make, but the knowledge acquired and the experience. By investing earlier, teenagers have a more accelerated learning curve that makes them more likely to continue investing later in their life. Let’s review the five key steps for a young investor to follow.

Step 1. Choose and buy a stock

This is the first way to start investing. Collect some money and buy your first stock. Before you do it, you need to research extensively on the company. Your first stock is important since this will be your first experience with the stock market. If your investment goes wrong, you could lose enthusiasm and avoid investing again. Keep in mind that stocks are long-term investments, and you won’t get rich overnight. What you are doing is to start building wealth slowly but regularly.

Step 2. Invest in a low-cost fund

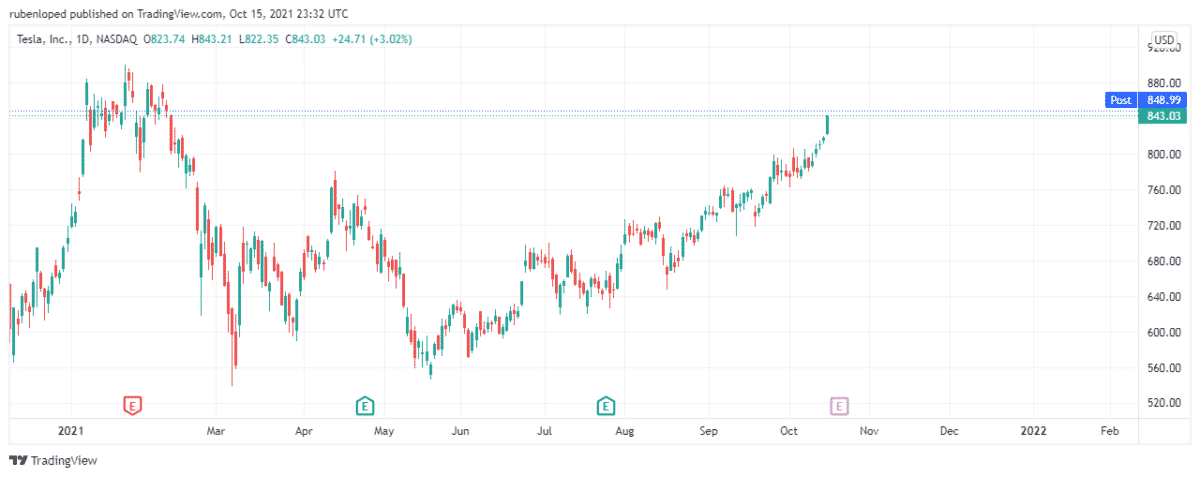

Since you are investing from a very young age, you probably don’t have enough money to buy all the stocks you want, or even buy one stock of a company you like, such as Amazon or Tesla. That’s why one of the best ways to start investing is by purchasing a low-cost fund. The most famous ETFs like the SPY cost around $440, cheaper than many stocks included in the index, but if you don’t have enough money to invest in popular funds, you can find other good options below $100.

For example, at the beginning of 2021, the BKLC started quoting $70.25. Now its price is $84.35. That’s an investment you could have made with less than $100. The profit of such investment would have been $14,10. It may not seem like a lot, but it really is because that’s a profit of 20% in less than a year, which is remarkable.

Step 3. Open a Roth IRA

After you start investing for your future as a young adult, you can go even further and think about a longer period like your retirement. With this in mind, one of the best ways of securing your future is investing in a Roth IRA. With a Roth IRA, you pay taxes on your investment upfront, and then your money accumulates tax-free for you to withdraw it when you retire. You could also withdraw your money in case of emergencies without having to pay any penalties.

Step 4. Open a high-yield savings account

Among many other things, the internet has made it possible to create online banks that don’t have to invest in infrastructure and maintenance of their offices. This reduction in costs allows these banks to open higher interest to their users. That’s how high-yield saving accounts began. These accounts offer 20 or 25 times more interest than traditional banks do. With these accounts, you are not risking your money. Rather, you are yielding around 2% a year, depending on the bank.

Step 5. Start now

No matter which of these steps you take first, the important thing is to start investing now. By doing so, you’ll be working on your future, and in the next few years, you’ll be glad you started investing when you were young.

Final thoughts

It’s never too soon to start investing. The sooner, the better. As a young teenager, you should convince your parents to help you open a custody account. As a young teenager, any little investment you do now can make a great deal in your future. You can use the funds to buy your house, pay for your studies or even retire when you are old. Whatever it is that you want to use the money for in the future, the best way to do it is to start investing right now.