BestFXNetworks is an easy to set up, 100% automated Forex robot that was created in 2020. The vendor confirms that the system has been showing good performance in the market since 2021. As such, the successful bids exceed the unprofitable ones most of the time. Let’s assess the veracity of these claims in this BestFXNetworks review.

BestFXNetworks company profile

This robot was allegedly created by a team of traders and software developers with substantial trading experience. However, details about the parent company are unknown. As such, the presentation fails to tell us where the company is located, when it was founded, its history in this market, etc.

The highlights of BestFXNetworks

The key features of this EA are available here:

- It works with all brokers and supports micro, STP, Cent, and ECN accounts.

- The system performs automatic risk adjustment on total assets.

- It can easily be installed in a few steps.

- It provides full time support.

- The system has 100% verified results.

- The EA comes with easy parameters and a built-in magic number.

- It is not necessary to disconnect the EA at the period of the news release.

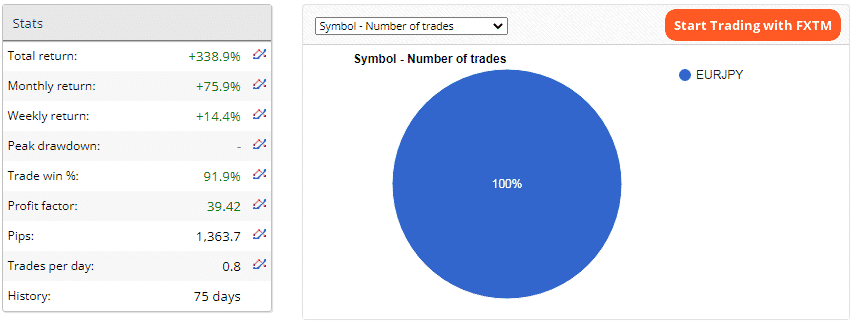

- It mainly works on the EURJPY currency pair.

BestFXNetworks applies neural networks in trading. The EA usually examines trading data and predicts how the market will behave. It then utilizes the findings to place buy/sell orders.

Facts & figures

Backtest results for this EA are missing. In that regard, we cannot make a comparison of its past performance and current statistics found on the FXBlue website.

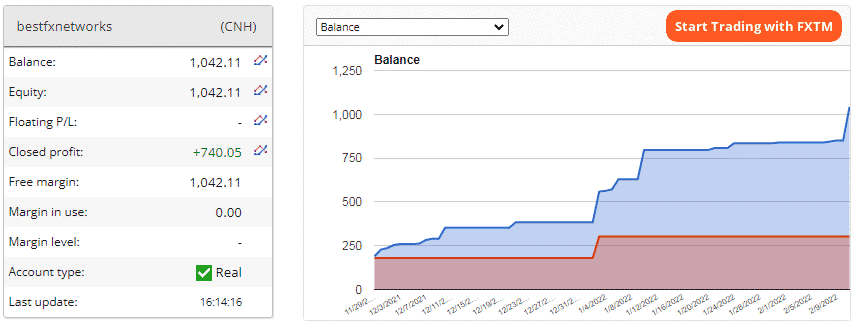

The system has traded on this account for 75 days, and during this period, it has made a profit of $740.05. So, the current available is $1042.11.

The account has grown substantially during this trading period as the recorded total return rate is 338.9%. The monthly (75.9%) and weekly return rates (14.4%) look promising. From the 91.9% win rate, it is apparent that the robot wins a majority of the orders it places. There’s a profit factor of 39.42.

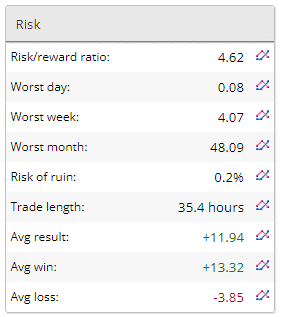

The trade length for an order is 35.4 hours, and till now, the average win value ($13.32) is higher than the average loss — 3.85. Essentially, the robot has a high winning streak. The risk/reward ratio is 4.62, and the risk of ruin of 0.2% tells us that the system is safe from destruction.

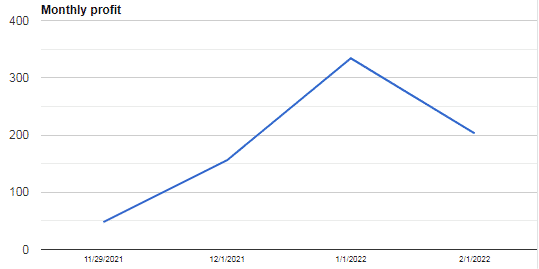

The EA made profits consistently from November 2021 to January 2022. Unfortunately, the profitability rate has declined significantly in February.

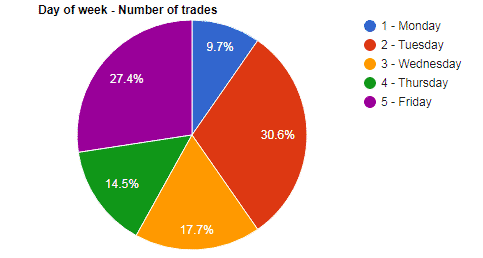

The EA’s trading activities are minimal on Monday but increase rapidly on Tuesday. The system is also very active on Friday.

The grid approach is on the board. Many trades were closed with profits.

BestFXNetworks packages

The basic, standard, and premium plans for this robot cost $129, $149, and $169, respectively. We find these packages to be fairly priced as most vendors tend to sell their EAs at $200 and below. The numbers of real and demo accounts provided range between 1 and 3. Free upgrades and email support are featured in the package as well.

Assistance

You can get assistance on how to use the robot or on other issues by contacting the support team through the email address provided on the sales pitch. The vendor doesn’t provide other customer support options.

Other notes

There is zero customer feedback on this EA. Consequently, we cannot assess how the trading community feels about it.

Is BestFXNetworks a reliable system?

A reliable system is one that has a sound trading method backing it up. This allows it to have a high profitability rate compared to trading costs and risks. In this case, we have learned that the system is based on the grid approach. Therefore, though it shows spectacular trading outcomes in the live market, the possibility of trading risks increasing and eroding the gains made is very real.