- What are some of the most prominent ETH-based crypto projects?

- What are the best ETH projects to invest in today?

- What is the best ETH project to hold for the future?

With a growth of 409% during the past year, Ethereum is the second-most valuable cryptocurrency globally. However, looking further out, we can see even more astounding numbers. The price of Ethereum has risen over 2,600% and 33,000%, respectively, in the past three and five years. Increases of this magnitude could profoundly affect a person’s financial situation.

In today’s cryptocurrency world, you may be thinking about where to invest in attempting to achieve a similar return. Although digital assets are highly volatile and have a lot to prove, a few projects function with smart contracts, just like Ethereum. Therefore, such projects could be a wise investment in the long run.

If you missed out on Ethereum, here are five ETH projects you should consider.

Best Ethereum projects to watch right now

Ethereum projects are currently focused mainly on decentralized finance, known as DeFi. The DeFi project aims to expand cryptocurrency applications to more complex financial applications, such as lending and derivatives.

DeFi gained significant traction in 2020, as the value of crypto assets locked in its protocols exploded 2,00% over the year, from $650 million to $16.05 billion.

Due to the popularity of Ethereum dApps, network congestion has increased transaction fees, the amount of ether required to send payments over the network, above every level. A direct result of miners competing to process transactions faster increases transaction time. Therefore, when a transaction’s fee is higher, ETH miners will be more inclined to add it to the blockchain more quickly.

How much would you earn if you invested in such projects 1 year ago?

With 50,000 transactions per second, Solana is a decentralized layer 1 blockchain Ethereum project. Unfortunately, it has still been experiencing problems during its teething stage, which has resulted in several outages. Nevertheless, there are many supporters of technology.

With $1,000 invested in Solana one year ago, one can almost afford a house in West Virginia today. At press time, Solana’s share price is $79.21, a significant increase over its January 11, 2021 price of $1.5386. In other words, an investment of $1 today would be worth more than $79.21 on January 11.

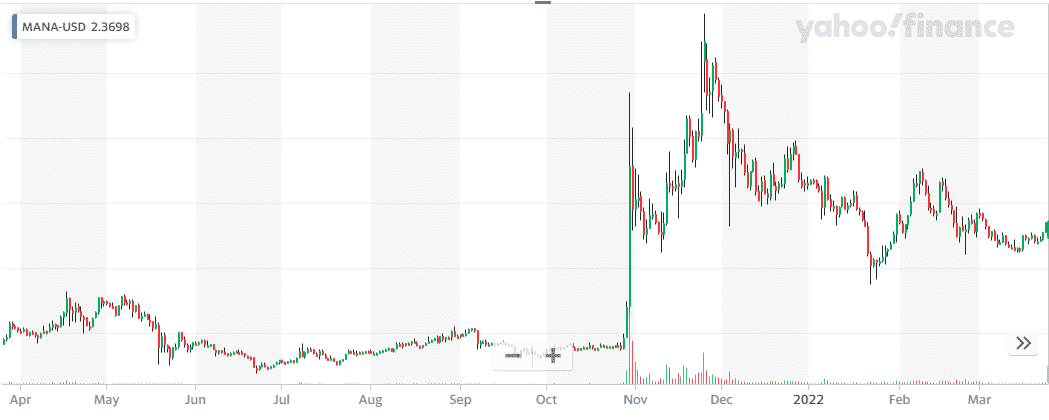

Decentraland (MANA)

Comparatively, Decentraland is a less game-like experience than a Sandbox. However, in addition to Sandbox land, you can also buy Decentraland land, which qualifies as virtual real estate.

Decentraland is the perfect place to visit with your friends, browse popular spots, go shopping, gamble in casinos, buy land and rent it out as advertising space to your favorite companies. The possibilities are boundless.

Why does it have the potential to grow?

Several recognizable giants are purchasing land in Decentraland and building there. Some of these organizations include the Bored Ape Yacht Club (BAYC) and the island nation of Barbados, which just signed a lease agreement for a virtual embassy on a plot of land.

A MANA token is Decentraland’s native currency and its governance token.

How much would you earn if you invested in 1 year ago?

On January 11, 2021, the Sandbox coin hit a high of $0.0379. Therefore, with $1,000 in SAND on the first of the year, you could buy 26,385.22 SAND coins. Based on the current $2.612 price, $1,000 invested would be worth $68918.19 today.

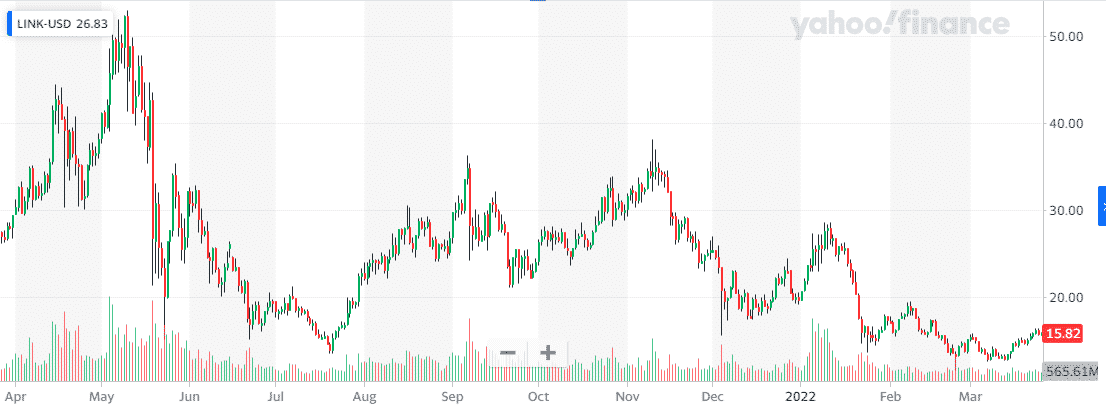

Chainlink (LINK)

As an Oracle platform, Chainlink provides links between smart contracts and real-time data from the outside world, such as current weather and stock prices. Intelligent agreements take advantage of this information to accomplish predefined tasks. Suppose, for example, that an insurance claim is paid out following a hurricane.

Why does it have the potential to grow?

Though Chainlink has been around since 2017. It wasn’t until its partnership with Google in 2019 that it rose to prominence in the space. The Chainlink cryptocurrency is backed by an ERC-20 token, LINK, and runs on the Ethereum platform.

How much would you earn if you invested in 1 year ago?

One year May 10, 2021, marked the all-time high for Chainlink at $52.88. By press time, the stock had risen much higher to $13.02. A $1 investment made one year ago would have been worth $39.86.

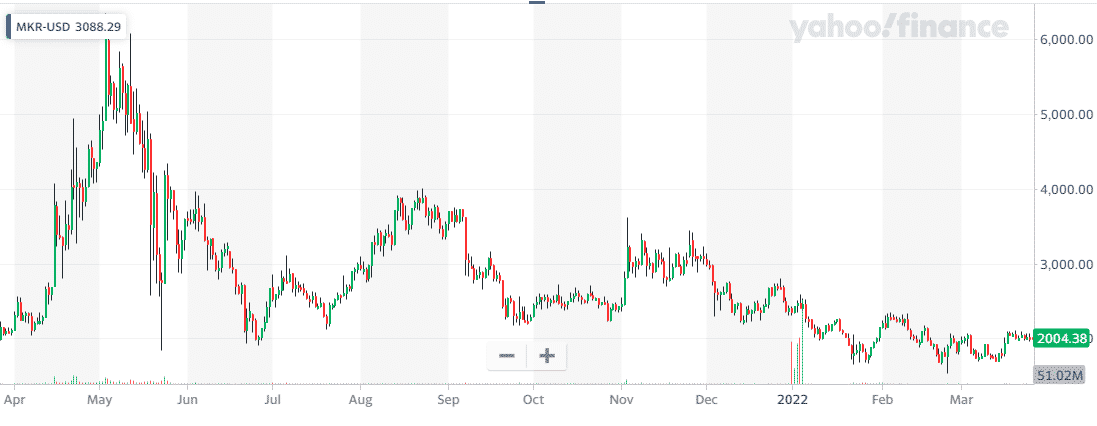

MakerDao (MKR)

Stablecoins aims to solve a particular problem with cryptocurrencies. Cryptocurrency prices fluctuate unpredictably. So, they are not suitable as payment methods or a reliable wealth store. Therefore, MakerDAO has taken the unusual step of presenting a detailed plan for eventually decentralizing the control of its stablecoin, dai.

Why does it have the potential to grow?

Most stablecoins are centralized, but MakerDAO has put forth a clear plan for decentralizing control over its stablecoin. Pegs are advantageous for lending protocols. For example, users can access loans without worrying about losing their investment due to crypto price volatility by pegging loans.

Then, what differentiates Dai from stablecoins such as Tether (USDT) and USDC? First, the Dai stablecoin is 100% backed by ETH instead of other stablecoins pegged to the US dollar.

How much would you earn if you invested in 1 year ago?

This coin is currently trading for $2003.22. If you had purchased this coin one year ago for $1987.1 in January 2021, you would have gained approximately $16.12 per coin.

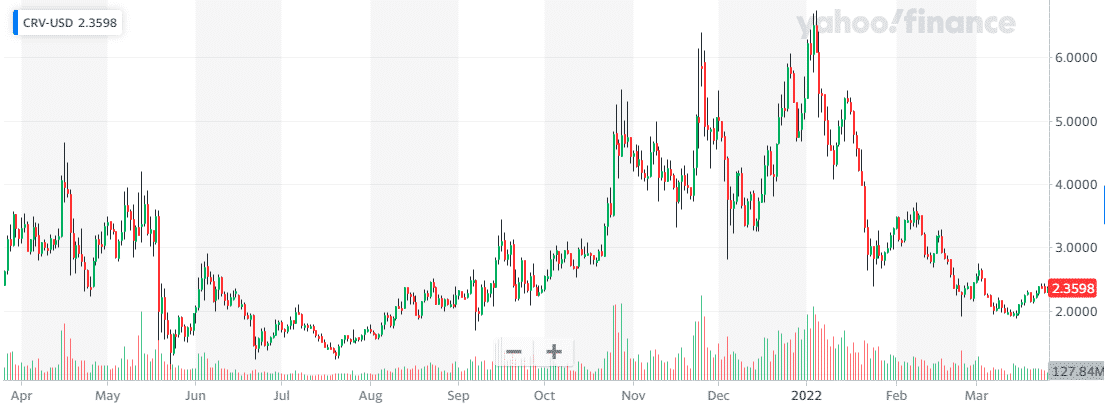

Curve Dao (CRV)

Curve Dao is a market maker automated by an Automated market maker (AMM). A fundamental difference sets it apart from other DEXs: it strives for stability rather than volatility and uncertainty. Therefore, Curve Dao is one of the best ways to earn a steady and consistent investment return. Therefore, if you’re into waving, go for it! As far as your bank is concerned, Curve is like a DeFi savings account.

Why does it have the potential to grow?

There is something special about Curve Finance. Its transaction fees, slippages, and impermanent losses are the lowest in the industry. Why is Curve able to accomplish this? To organize liquidity pools around asset types that behave similarly (e.g., stablecoins and BTC, wrapped BTC).

How much would you earn if you invested in 1 year ago?

Currently, the price of this coin is $2.3. In January 2021, if you had purchased this coin for $0.6, you would have gained approximately $1.7 per coin.

Cardano (ADA)

Cardano enables intelligent contracts via Ouroboros’s blockchain-based proof-of-stake protocol. The Proof-of-Stake system allows Cardano token holders to validate transactions by “staking” their cryptos.

Why does it have the potential to grow?

The overarching goal of Cardano is to be a sustainable and highly scalable blockchain. To accomplish this, Cardano intends to implement a two-layered system, which includes the Cardano Settlement Layer (CSL) and Cardano Computing Layer (CCL). A transaction is validated with Ouroboros using the first, while intelligent contracts work by the second.

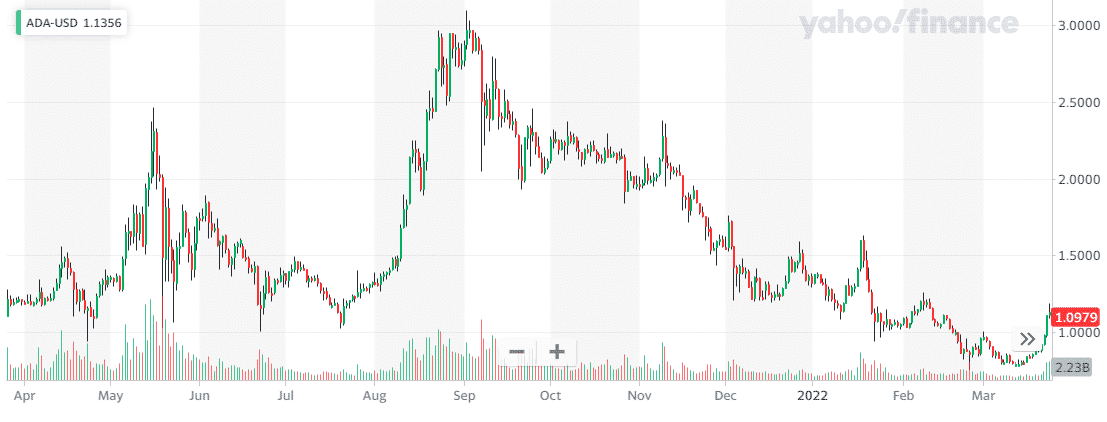

How much would you earn if you invested in 1 year ago?

Cardano could handle over 1 million transactions per second (TPS) with the upcoming Hydra layer-2 protocol, which builds on top of Cardano’s existing network to control excess capacity, compared to 250 in its current state.

As of this writing, the price of the coin is $1.1188. The cost of this coin was $0.1753 in January 2021, so if you had invested one year ago with that price, you would have earned approximately $0.9 per coin.

Final thoughts

Ethereum developers will be in high demand worldwide as the relevance and use of digital currency grow. As a result, there is a huge need for Ethereum projects.

We have included some of the most amazing Ethereum projects throughout this blog, some of which have already taken place, while the other two are currently in progress. This Ethereum community has a lot to offer, and we can anticipate a year filled with enhancements and revolutionary ideas.