- What are the qualities of a successful trader?

- What are some trading mistakes you must avoid?

- What are the things you should consider before you trade?

Trading the forex market has become increasingly more difficult as time goes by. J. Soros, the most famous investor in the FX market, has increased his capital since December 2012 by more than $1 billion, working with the USD/JPY pair.

How can you succeed in such a huge market actively traded by participants of different capacities and propensities?

Let’s learn how to possess the qualities of a good trader and discuss some mistakes you must avoid at the get-go to have a better chance of success.

What is forex trading?

It involves buying one currency and selling another to facilitate a business transaction or generate profits from price movement. As a trader, you will predict if a currency pair will go up or down shortly and trade in the anticipated direction before the expected move. If you have made the correct prediction, you will make money in the process. If you made the wrong call, you would lose money instead.

Things to consider before you trade

Preparation is crucial to success in trading. The best way to demonstrate your preparedness is whether you have a trading plan in place.

Your trading plan should consider at least these three elements:

- Time frame

- Methodology

- Market

Time frame

You use it when looking for trade opportunities that define your trading personality. If you like to trade the five-minute or 15-minute chart, it means you are an impatient trader, so you want to trade in and out of positions quickly.

Meanwhile, if you choose the daily chart as your trading time frame, it means you are a patient trader, and you want to trade in a slightly relaxed way whatever trading style you assume is good as long as you do not switchgear on a whim.

Methodology

You have to define your trading method even before you take your first trade. Without it, you are just gambling, not trading. Find or create a trading method you can relate with. The complexity of the trading system does not matter as long as you can follow it consistently.

Test your trading system first with a demo account to see if it works. If your system generates trades with more than a 50% win rate, that is a system with an edge. When you get consistent results after demo trading for a few months, that is the time to consider trading live.

Market

Some currency pairs behave in a more orderly manner than others. Just by looking at the chart, you can quickly tell if a pair is suitable for your trading system or not. Since markets change personality and behavior from time to time, testing your system in different pairs still works wonders. Find a good number of pairs to trade with your system. Following too many instruments may not be suitable for you as you start.

Take the above GBP/CAD daily chart. Are you going to trade this market? That all depends on your trading system. The market condition is ranging. If your system trades trending markets, then you must avoid this pair.

Attributes of a successful trader

In any field of endeavor, attitude is the most crucial factor for success, and trading is no different. You must develop the following four qualities of a successful trader:

- Patient

- Disciplined

- Objective

- Realistic

Patient

Once you have fully tested your system, be patient when waiting for a signal to enter or exit a trade. It may not come soon, but it will later. When you trade support or resistance levels, for example, have the patience to wait until the price gets to a level you marked on the chart as your entry price. If the price comes close but does not touch it yet, wait until it does. If not, move on to another trade candidate.

Disciplined

If you have a written trading plan, the best way to demonstrate discipline is consistency in following the plan. Consider it a sin every time you act against your plan. Reward yourself when you have followed your goal in a series of trades.

Objective

It would help if you traded based on what you see and not on what you feel. If a potential trade looks like a good setup but does not qualify as a valid trade based on your plan, have the confidence to let it go. Also, you must stick with your trading system regardless of what you hear elsewhere. If you believe that your system gives you an edge in the market, you do not need ideas from others to trade.

Realistic

Being realistic means, for example, not expecting to make $100 on a trade if your capital is only $250. Depending on your risk-reward ratio, a return of one to four percent per trade is realistic in most cases. Another way of being realistic is in terms of your risk-reward ratio. Although getting a reward that is five times the risk is possible, it may not be accurate. Typically, a reward that is two times the risk is real enough.

Trading mistakes to avoid

Success in forex trading requires the cultivation of good habits. Often it means letting go of bad habits. In this section, you will learn some trading mistakes you must avoid.

Not having a trading plan

Trading without a plan is like going to war without a battle plan or setting sail without a compass. Having a trading plan helps you trade objectively. Following it makes you understand if your trading process is aligned with the market process. If your results do not turn out well after consistently following your goal, you can adjust your plan to improve your results.

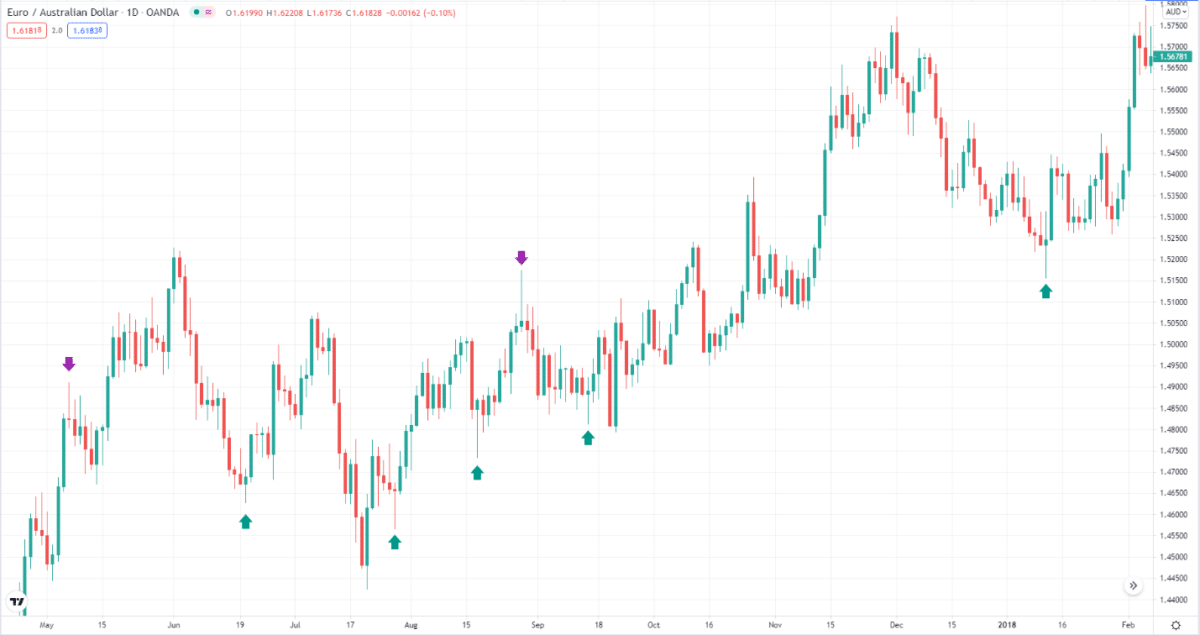

Consider the above daily chart of EUR/AUD. The green-up arrows mark the bullish pin bars, while the maroon-down arrows mark the bearish pin bars. The question is, are you going to take these trades? The answer depends on your trading plan. If the setup is defined in your trade plan, then you can take these trades right away as soon as they form.

Taking too much risk per trade

Many traders do not know how much risk each trade takes. They do not know what percentage of the account is at risk in every trade. In other cases, some traders understand that they should not risk more than two percent per trade, but they do not know how to put this idea into practice. Risking too much per trade is one mistake that can blow your account in no time.

Being too emotional with losses

Accepting a loss is a challenge to many traders. That is why they may take risky actions to avoid a loss. This includes adjusting the stop loss, increasing the risk in the process. Other traders engage in revenge trading or reverse trading after a loss. While trading in the opposite direction might be suitable if part of your trade plan, revenge trading is almost always detrimental. Thus, when a trade turns out to be a loser, accept it and move on. There is always a chance to recover the loss if you stay in the game long enough.

Final thoughts

Before you trade, see that you have a trading plan in place and then follow it to the letter. If you develop the attributes of a successful trader, you will be on your way to trading success. If you have committed any of the trading mistakes discussed, dare to admit those mistakes and then flush them out from your trading.