- What stocks are better and why?

- How to choose a stock for investment?

- How to invest personal funds and make good money?

The largest stock exchange globally is the New York Stock Exchange, and it has a market cap of $24.4 trillion US dollars, followed by the Nasdaq, Shanghai, and Hong Kong Stock exchanges.

The NYSE alone trades over 2800 companies’ stocks, including blue-chip and high growth companies.

With this vast array of stocks, it can be daunting to choose the correct option. Many investors are entirely lost and often fall into the pitfall of choosing the wrong stocks. In addition, they usually have the funds ready to start investing, but due to a lack of knowledge and proper guidance, they eventually lose their money.

Therefore, the following tips aim to make you aware of the pitfalls so that you protect your investment before even diving into the stock market.

What are stocks?

It is a portion of a company’s equity; the stocks are a proportionate claim of its assets and revenue earned in profits.

When you purchase stocks of a public company, you essentially own a portion of it. People invest in stocks because they anticipate the value of the assets would increase, and they would then make profits from this. Another reason is that certain shares pay dividends from the company’s revenue, which serves as a consistent income.

Types of stocks

There are various types of stocks which we will explain in detail.

Common stocks

If you own common stocks, you own the right to vote, and you earn a share of the company’s profits. And as we mentioned, you could be eligible to earn dividends.

Preferred stocks

Preferred stockholders are paid returns of fixed dividends, and they get better treatment to common stockholders. Should a company be liquidated, the preferred stockholders would be paid out first before common stockholders.

Large-cap, mid-cap, small-cap stocks

A large-cap stock is a company whose market capitalization is over $10 billion. Stocks with market capitalization between $2 billion and $10 billion are considered mid-cap, and those under $2 billion are small-cap stocks.

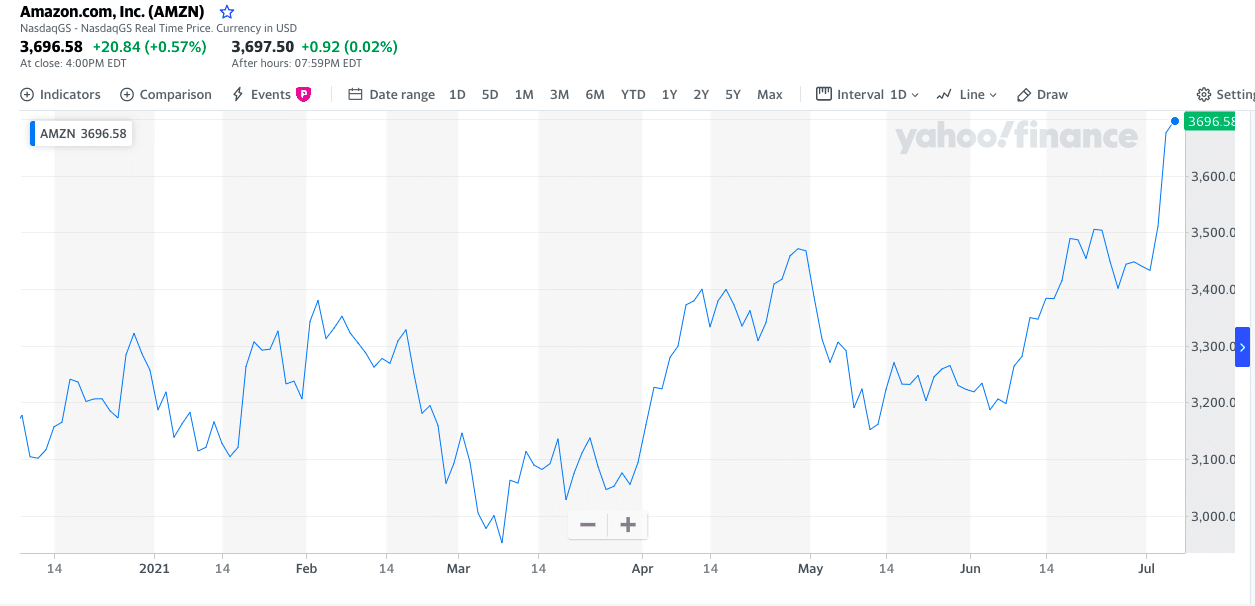

Amazon Incorporation is one of the examples of a large-cap stock with a market cap of $1.88 trillion.

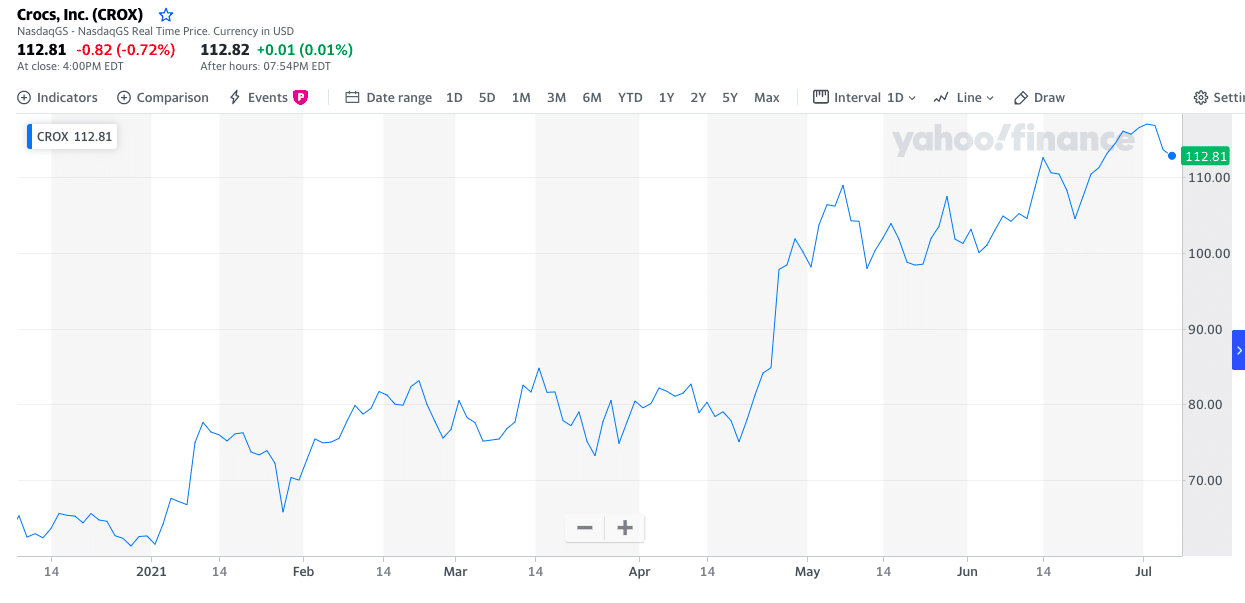

Crocs Incorporation is an example of a mid-cap stock with a market cap of $7.36 billion.

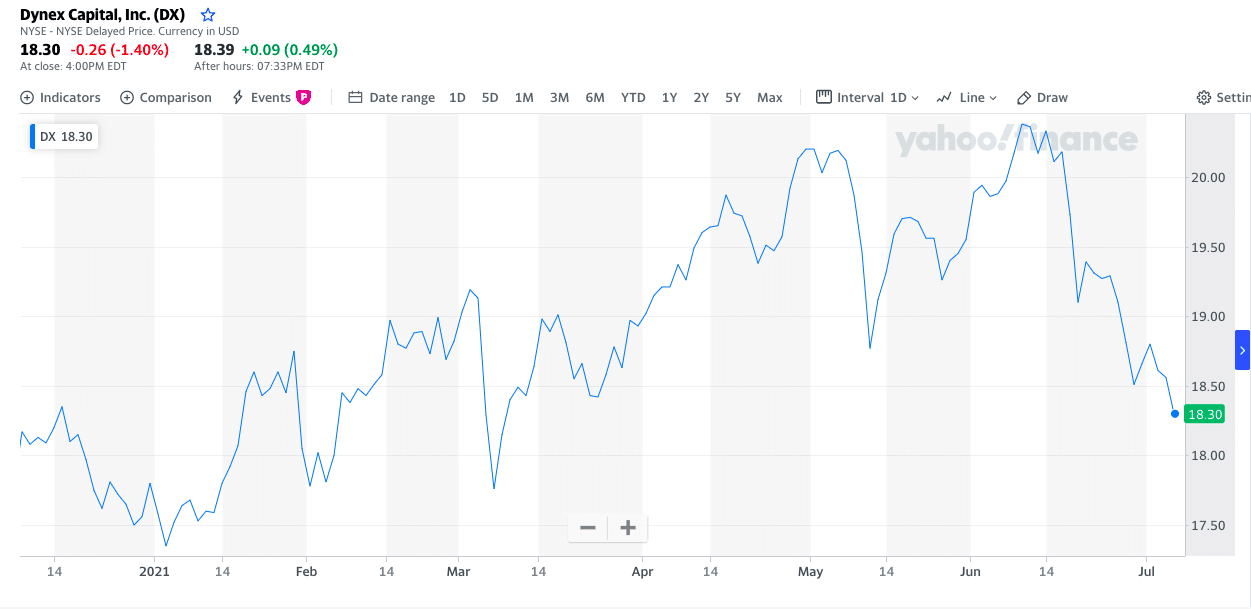

Dynex Capital, Inc. is an example of a small-cap stock with a market cap of $585.3 million.

Growth stocks

Growth stocks companies re-invest a portion of the earnings to accelerate the company’s growth, and so doing would pay our fewer dividends. Growth stocks are long-term investments, and the return on investment is proportional to the growth rate. Therefore, a high growth rate would result in higher earnings.

Income stocks

Income stocks are like preferred stock, you earn higher dividends than growth stocks, and the companies perform consistently, but their growth is not remarkably high. However, they can pay out higher dividends due to the stability of the business.

Blue-chip stocks

These are stocks of companies with a long history of sound financial performance, and they are generally well-known. These types of shares are considered a safer investment option.

Avoid these to prevent buying the wrong stocks

Investors fall into the trap too often of purchasing the wrong stocks, and this can be due to many reasons, such as unscrupulous investment managers and lack of knowledge. Whichever the reason, we will clarify some points to prevent you from investing in the wrong stocks.

Investing without proper goals

First of all, it is better to consider what you want to benefit from the investment. In other words, you need to have clear goals and consider things like:

- How much capital to invest?

- What are the expected returns?

- What is the investment term: short, medium, or long-term?

- How much are you risking?

- What fees and taxes are associated with the investment?

Once you have a documented set of goals, you can start approaching financial advisors to guide you through the process.

Lack of knowledge

Not understanding how investments work or lacking the basic knowledge of stocks is a common occurrence. As a newbie to investing, you should familiarise yourself with how the stock market works and which top-performing companies to consider.

Poor investment advisors

Taking advice from advisors who lack the knowledge or who promise unrealistic returns is another pitfall. Finding a financial investment firm with a good reputation and expertise as well as a long history of top performance would be in your best interest. Just taking advice blindly without conducting your research will result in purchasing the wrong stocks or investing too much capital in the wrong stocks.

Investing in well-known companies

Investing in popular companies or those whose names you know are another mistake investors make. Novice investors have the perception that these companies are profitable, but there are thousands of stocks available. Yes, you might make good returns with the likes of Google, Netflix, or Tesla. But by not considering other stocks, you could be missing an opportunity to diversify or even earn greater returns.

You can keep yourself up to date with the best mid to long-term stocks by going over the earnings reports, which will specify growth rates, net income, earnings per share, and many other essential factors to consider.

Investing too much in one stock

Investing all your capital in one stock is risky because if the stocks should underperform, you could risk losing a significant portion or all of your capital. Diversifying your investment is an excellent way to prevent tying your money in one stock, and it will minimize risk.

Final thoughts

Investing in stocks can be challenging as just the number of companies alone is frightening; furthermore, there are many financial indicators to consider. Stock investment also requires significant capital, and it would be wise to take the time to research all avenues before investing your hard-earned money into the wrong assets.

You can start by following these tips as it will enhance your skills and knowledge; in addition, you will be aware of what to avoid, and it will give you some leverage to challenge your financial advisors so that you don’t come across as a complete novice.