- How do you trade Evening Star patterns?

- What does this pattern mean?

- Is the pattern good or bad for profit-making?

Candlestick trading is a popular subset of technical analysis. It allows you to trade the markets using specific candle formations containing one, two, or three candles. With this method, you can find plenty of trade opportunities on your charts every day. We will consider the Evening Star pattern in this article.

It is a strong and effective reversal candlestick formation. Not only is it reliable, but it can help you determine the presence of a critical resistance level. However, note that the Evening Star rarely occurs compared to other patterns, such as Morning Star, Engulfing patterns, etc.

One reason for this rare occurrence is that the third candle is often too strong that it engulfs and completely deforms the pattern’s structure. You may take a higher risk than normal if you take the trade. This is not to say that the pattern does not work. The entry is just challenging at times.

The article will learn the elements of this pattern, the requirements of the trade, and how to trade it. You will also understand why the Evening Star is a vital downside reversal pattern.

What is the Evening Star?

You can use this pattern as a tool to predict a reversal of the trend to the downside. Unlike other candlestick formations, this takes time to form as it requires three candles. Normally, it forms at the end of an uptrend, signaling a trend reversal. At other times, it may form at the upper boundary of a ranging market or at a pullback area of a bearish market. The important thing is that it somehow rejects a resistance level.

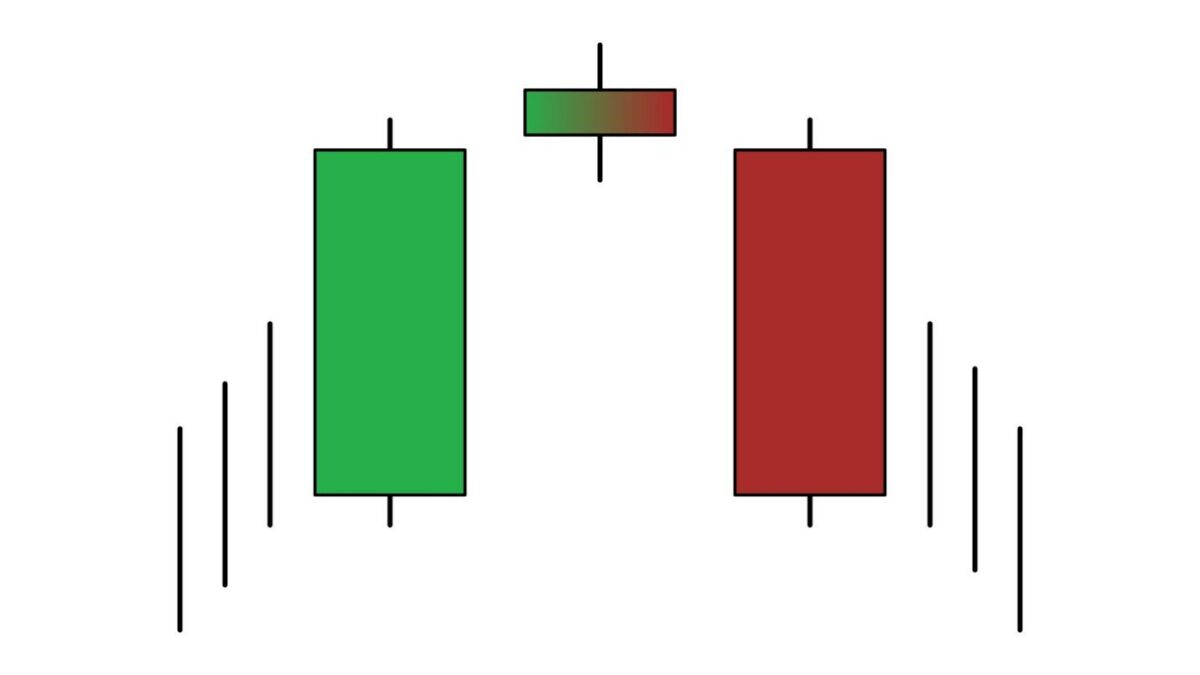

The three candles making up the Evening Star are explained below:

- Bullish candle with a big body

- Indecision candle (e.g., spinning top, shooting star, and dojis)

- Bearish candle with a big body

The Evening Star pattern sentiment

It often appears at midnight, meaning the market changes sentiment from bullish to bearish.

- The first candle is representative of a strong uptrend that is met with resistance.

- The second candle’s small range signifies weakness or exhaustion of the initial uptrend.

A big, bearish third candle is the deciding factor, confirming the trend reversal.

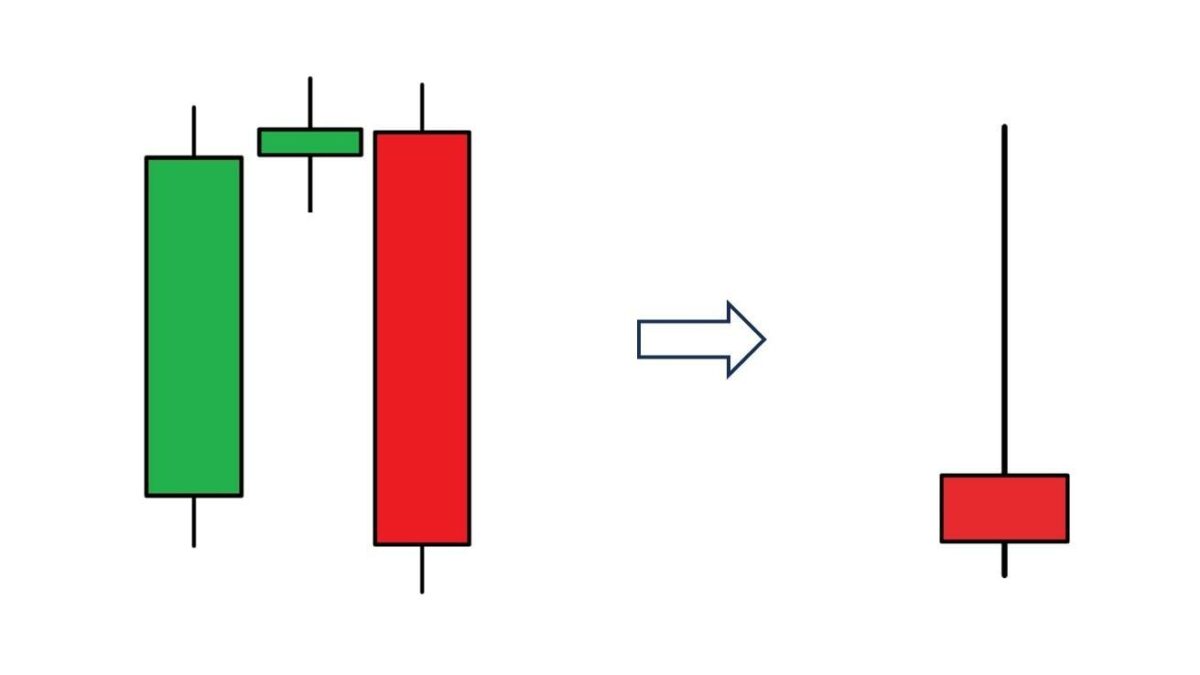

Do you know that you can combine the pattern into a single Shooting Star candle? To do this, simply get the opening and closing prices of the three candles. Referring to the image below, you can see that the first candle gives the low price, the second candle sets the high price, and the third candle provides the closing price. The candle addition will result in a shooting star as you can see below.

Requirements of the trade

We have set in the foregoing section what qualifies as a valid Evening Star setup. Here we will add other requirements so that you can trade high-quality setups only. Consider the following tips when looking to trade this pattern:

- A valid setup must occur at the end of an uptrend. If the setup forms in the context of a bearish market, the corrective swing should be obvious and substantially long.

- Trade the pattern only in the presence of a trend or when the price is moving. Do not trade the pattern when the price action is generally sideways or consolidating. The exception is when the pattern rejects a resistance level.

- A gap between the first and second candles or the second and third ones is not needed unless you trade the stock market. In currency trading, price seldom jumps from one period to another.

- The third candle must close below the middle body of the first candle. If it engulfs the first candle, that is a stronger sell signal. The only challenge in this last scenario is how you will get a high reward-risk ratio.

How to trade the Evening Star pattern?

The best way to trade with this pattern is to combine it with the concept of resistance or supply. Generally, trading this setup without confirmation is not a good idea. Like other candlestick formations, it is not suitable to be traded alone.

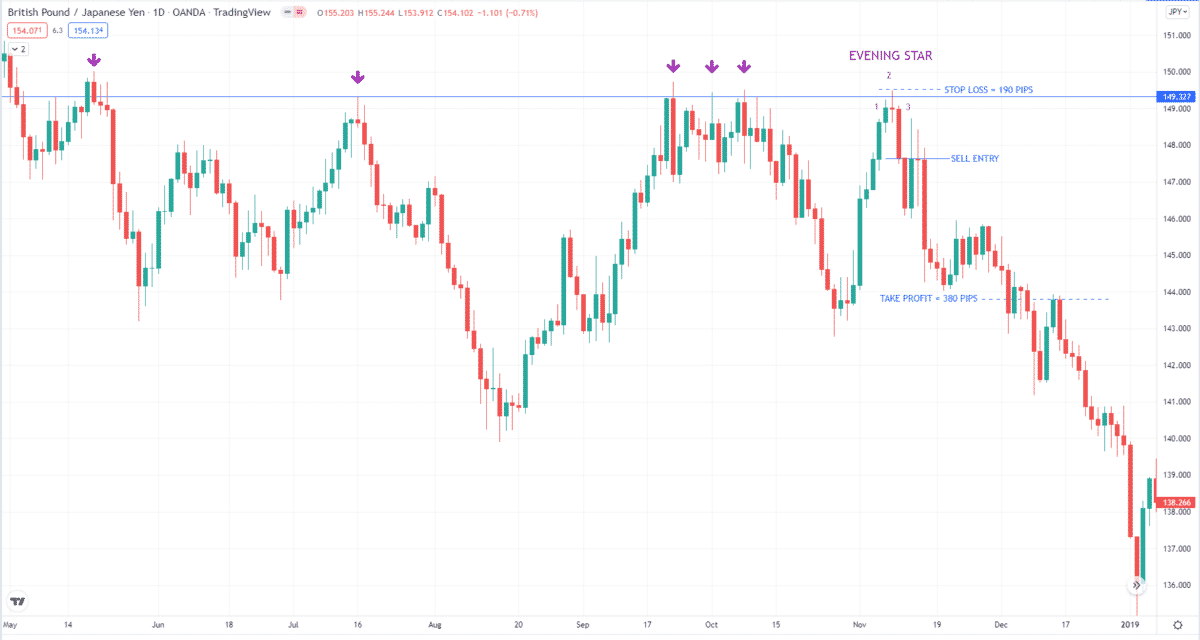

In the GBP/JPY daily chart below, the market left an obvious resistance level after failing to break it at least five times. It printed an Evening Star right around the resistance area. Because of this, the price turned around and made a significant sell-off after that, as you can see below. The next time price revisits the level.

This formation is labeled as 123 in the above image. This setup is not standard because the first candle is smaller than the third candle. However, it is still a tradable setup. You should open a market sell at the close of candle three and put your stop loss above candle two.

This trade will involve a risk of 190 pips. To get a return of two times the risk, you can place the target 380 pips below the entry. The good thing about this target is that it is close to a swing low but not beyond it.

Final thoughts

Because the Evening Star is composed of three candles, you can easily identify it on your charts. There are two ways in which you can use this pattern.

- First, if you have bought an asset at a low price, you can close your buy position when you see an Evening Star.

- Second, you can utilize the pattern as a signal to take the opposite side of the market and join the herd of sellers.

Be aware that taking the Evening Star setup that occurs out of nowhere is not a good strategy. Do not use it as a standalone trading system. The best way to trade the pattern is with the help of confirmatory tools such as trend, resistance, or supply.