- What is a gas ETF?

- Is there a fund for gasoline?

- What is the best ETF for natural gas?

Seeing the possibility for more upside growth due to surging natural gas prices, you might be considering investing in this commodity. However, trading it straight in the futures market can be challenging. You can use natural gas ETFs to get exposure to this asset without the drawbacks.

The growth of the energy sector in America is not only due to oil exploration but also due to the natural gas revolution. With the same tenacity as drilling oil, natural gas exploration has sent the price of this commodity to half as much in the past two years.

Nowadays, businesses can find cheaper methods to produce natural gas. With production falling behind demand, the natural gas segment could see a recovery in the near term. This development will likely lead to massive returns for companies working in this field and investors who put money in the right companies.

Another option you can take is natural gas ETFs. Rather than picking individual stocks, you get a bucket loaded with target stocks in just one fund. While this option limits the potential return given by well-performing stocks, it will shield you from losing big time if you select the wrong companies. This article will discuss natural gas ETFs in more detail and cover three of the best funds to invest in 2022.

What are natural gas ETFs?

Natural gas is a type of commodity with multiple uses. Its primary use is providing energy for electricity generation, fuel, cooking, and heating. Another use is as a raw material for producing plastic and organic chemicals. The price of natural gas is influenced by supply and demand in the global market.

Natural gas ETFs track the performance of companies producing natural gas or follows the price of the commodity itself. However, the natural gas segment is a more extensive commodity sector subset. Without considering leveraged and inverse ETFs, there are only three natural gas ETFs listed in the stock exchanges in the US. These ETFs provide exposure to the natural gas market through futures contracts, not by holding physical natural gas. These securities are covered in the next section.

Top 3 natural gas ETFs

This section will cover the three natural gas ETFs in the US. They are arranged by the amount of net assets being managed.

No. 1. United States Natural Gas Fund (UNG)

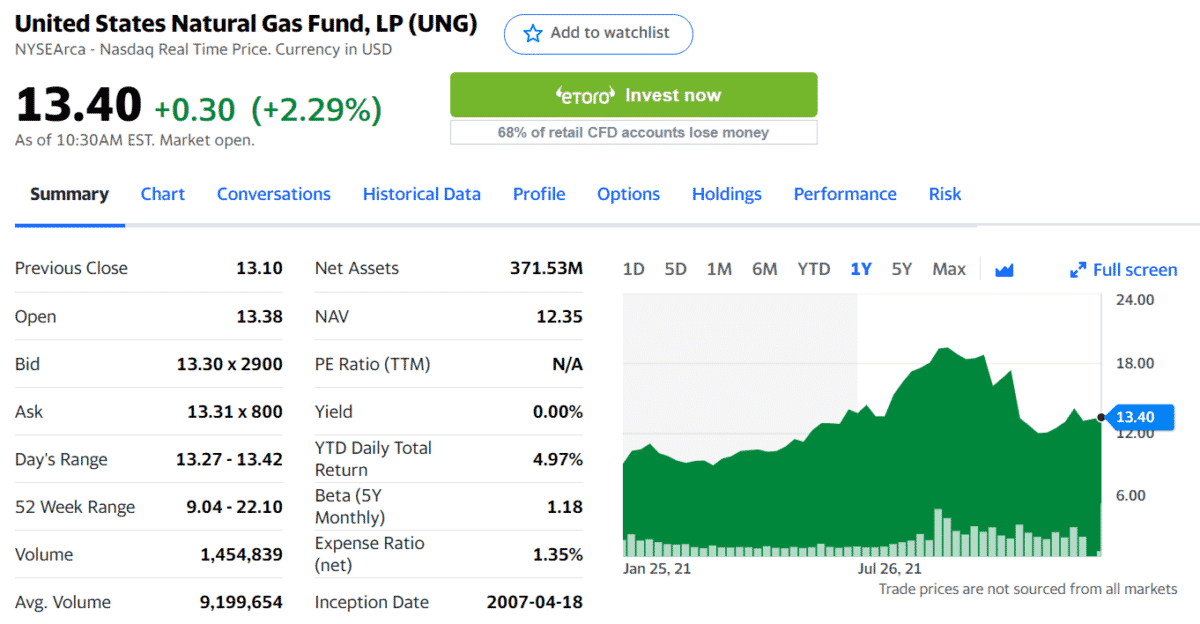

Price: $13.40

Expense ratio: 1.35%

Net assets: $371.53 million

As a commodity pool, UNG offers exposure to natural gas by holding futures contracts related to natural gas. This fund is different from other options of a similar structure because it is designed to expire after 30 days. As a result, it is prone to facing the negative impact of contango. Therefore, this fund is appropriate for investors with a short-term outlook. You can also use it as a hedge to counter the effects of inflation.

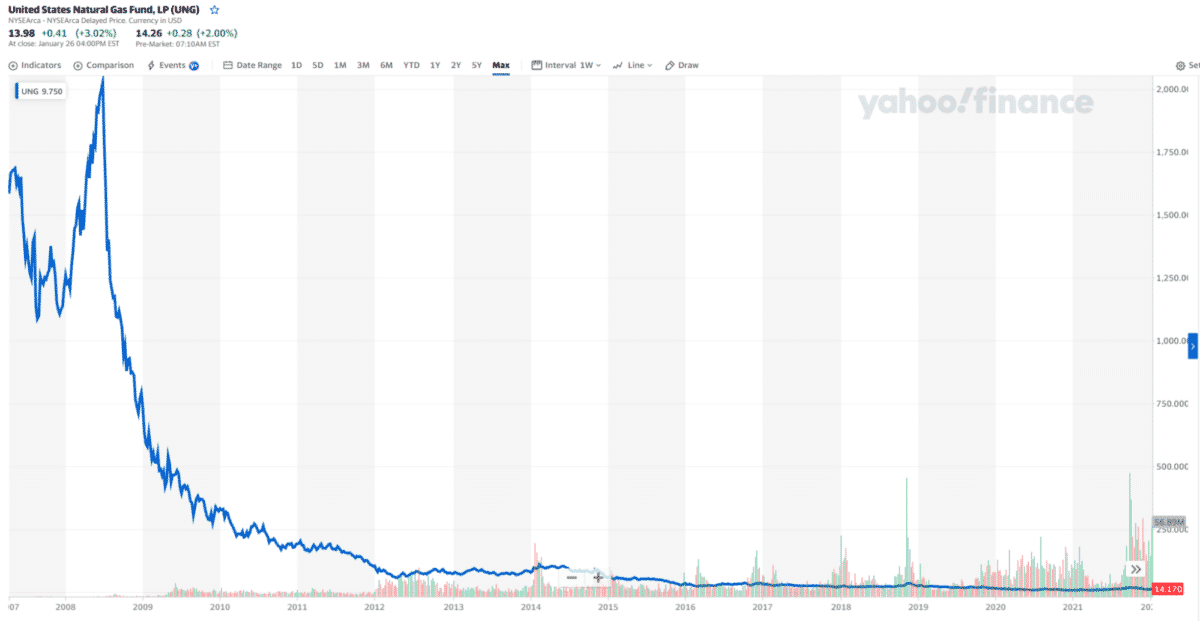

UNG ETF is the biggest fund in this list in terms of net assets. This fact might come as a surprise to you because this fund is continually losing ground for years on end. This is a far cry from its all-time high of about $2,000 in 2008. While it managed to create a new high and a higher low, its future is uncertain until it breaks the new high. If you believe in the natural gas industry as a whole, buying at this point when the price is meager can be a good idea.

No. 2. United States 12-month Natural Gas Fund (UNL)

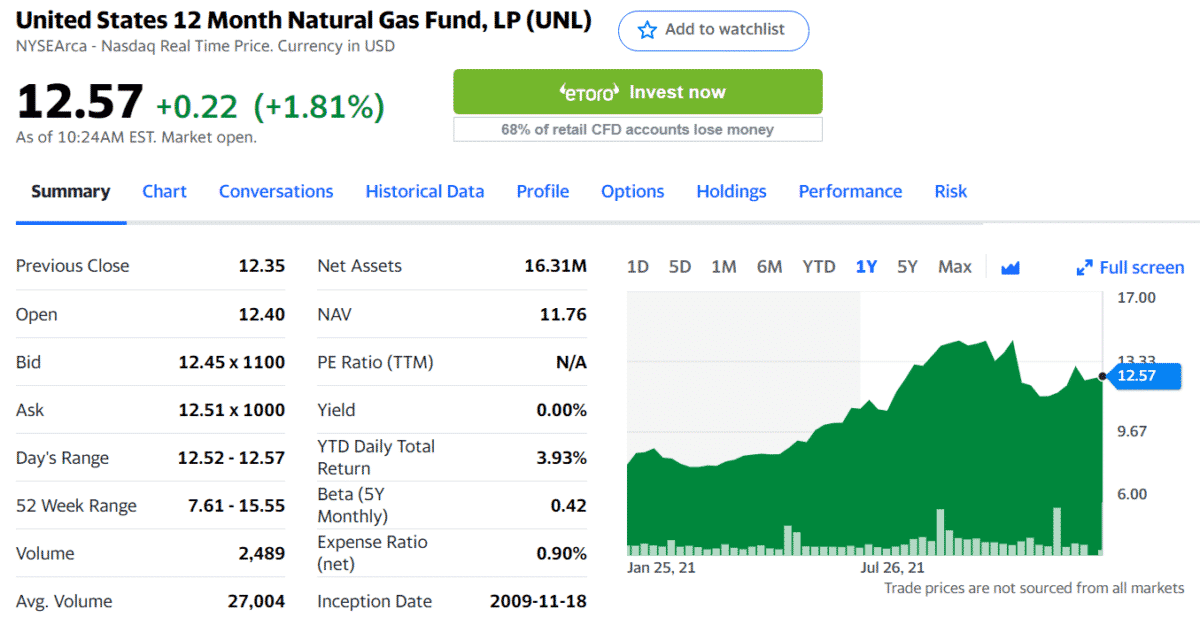

Price: $12.57

Expense ratio: 0.90%

Net assets: $16.31 million

As a commodity pool, UNL invests in commodity options and futures. Like UNG, this fund purchases natural gas commodity contracts. The main difference is that it holds contracts with different maturities to dampen the effects of contango. It is an appealing investment vehicle for those looking to find a safe haven against the impact of inflation.

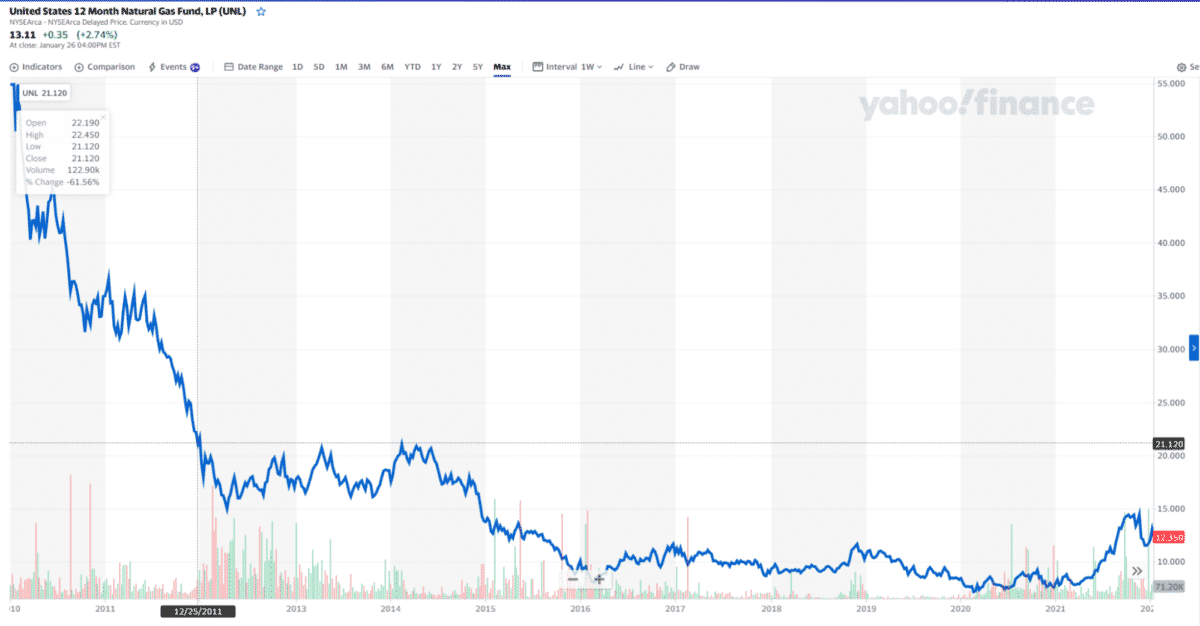

The UNL ETF is second on this list in terms of net assets. This ETF suffers almost the same lot as UNG. This fund is only a little better because it plummeted from a not-so-high peak. It reached a high of $57 when it debuted in the stock market in January 2010. In more than a decade, it now sits at $12.57, which is about a 77 percent decline from the all-time high.

In March 2021, the market experienced a strong rally, but it has retraced about half of the gains. It might be preparing for another bull run. You might be in for a lucrative ride at the current low price if you buy now and the price takes off later.

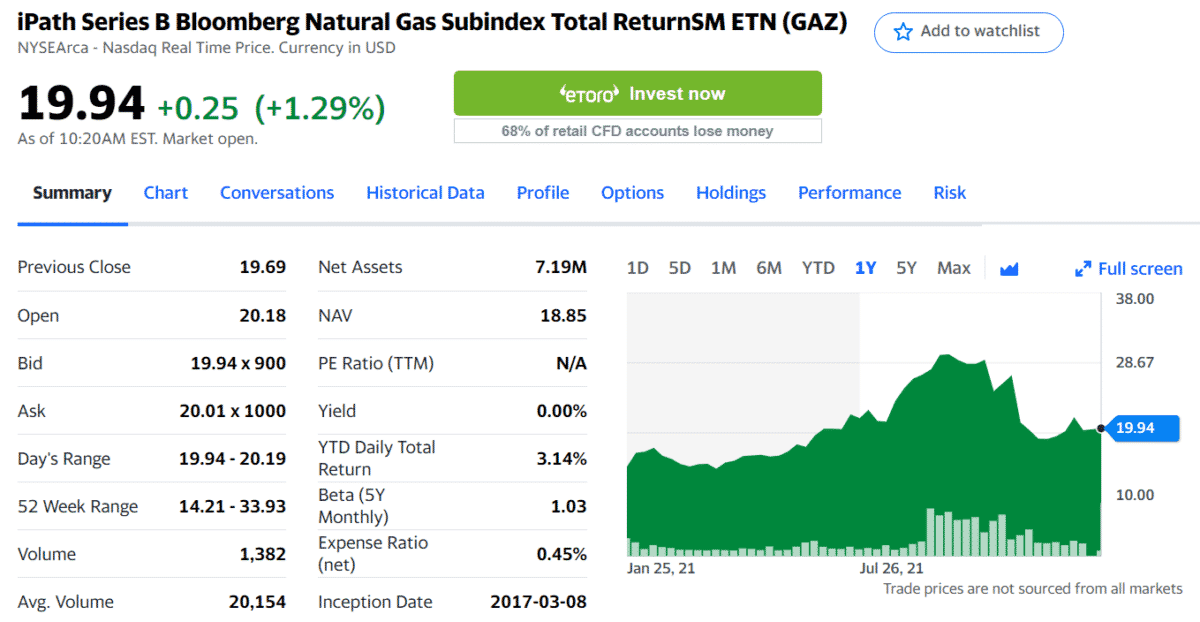

No. 3. iPath Series B Bloomberg Natural Gas ETN (GAZ)

Price: $19.94

Expense ratio: 0.45%

Net assets: $7.19 million

This fund allows investors to engage in the natural gas sector by owning futures contracts. As an ETN, GAZ possesses some stock characteristics and does not give interest returns. Inherent with all ETN products, GAZ investors are subject to the credit risk of the issuing company. Note that this fund does not move in congruence with natural gas price changes since the benchmark index comprises futures contracts.

GAZ ETF is the third on this list by the value of net assets. However, its technical aspect is the same as the other two. After finding support at around $14, the market made a rally starting April 2021, but it retraced more than 50 percent of its gains.

At this point, the price is closer to the long-term support at $14 than the recent high at around $29. If you believe that the natural gas segment will rebound shortly, buying now while a low price can be a great strategy.

Final thoughts

Although the funds above look cheap and may be worth buying, investing in them involves risk. Therefore, you must research each fund closely before you make a selection. Learn how these funds perform in different market conditions. Understand the risk before you decide to engage. If unsure whether an ETF is a good buy or not, be sure to consult a financial advisor.