- How to make money from crypto?

- What do you need to know about risk and volatility?

- Which five steps will help you to triple your capital?

Making money from financial trading requires a high potential instrument that can increase the investment value tree to five times that it is strongly possible in the cryptocurrency market.

Making money from investment requires substantial knowledge about the particular market and instrument. Although crypto trading is new globally, it became popular among investors due to its high profitability. Many people became millionaires just by holding crypto assets. Moreover, after the Covid-19 pandemic, people became aware of the rising inflation that increased investment in this market.

Stay with us to see the top five ways to make x3 of your capital from cryptocurrency trading.

How to invest in crypto: basics

As the cryptocurrency market is new globally, many people don’t know how to start trading. Crypto trading is similar to other financial instruments where you have to buy an asset and hold it for future price appreciation.

Many platforms allow exchanging crypto with fiat. You have to open an account on such a platform and buy BTC, ETH, and other crypto assets using your credit card, bank transfer, and other online payment gateways.

Many brokers allow holding and trading cryptocurrencies with a vast number of deposit methods. Make sure that you have budgeted your money before investing in cryptocurrencies.

Understand your goal

Crypto trading is like traditional stock trading, where we analyze potential instruments based on technical and fundamental analysis and invest money with the hope of future price appreciation. However, it would help if you had a proper plan, including how much loss you can tolerate and how much profit you want from crypto trading in the next one to five years.

If you can make X3 of your investment in a year from crypto trading, it will significantly return compared to other markets.

Prepare for risk and volatility

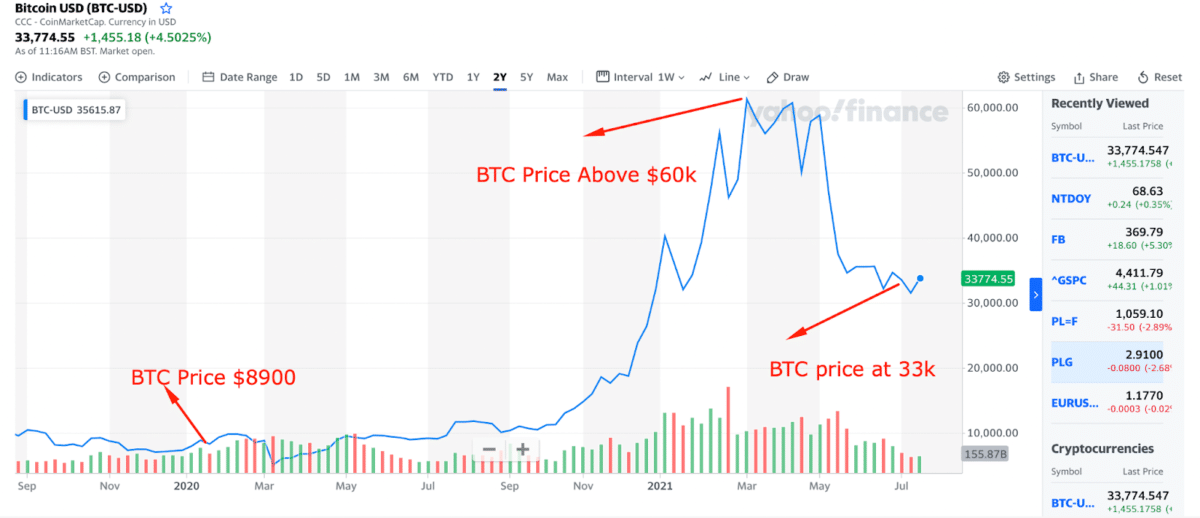

Higher profitability involves higher risks and volatility. If we analyze the Bitcoin price from 2020 to 2021, we can see how much volatility it shows:

Here we can see the BTC price was at $8900 at the opening of 2020 that surged higher above $60,000 with X7 capital appreciation. Later on, the price came lower but still at the 50% level. So if you bought $1000 worth of Bitcoin in 2020, you would gain $7000 profit after 12 months.

Making X3 profit from such a volatile market is easy, but you have to face the market volatility associated with it. The main risk of this market is the sudden market crash that may take away all your gains in a single day.

Top five steps to make x3 from crypto

In this section, we will see five methods that can allow you to make X3 from crypto trading:

HODLing

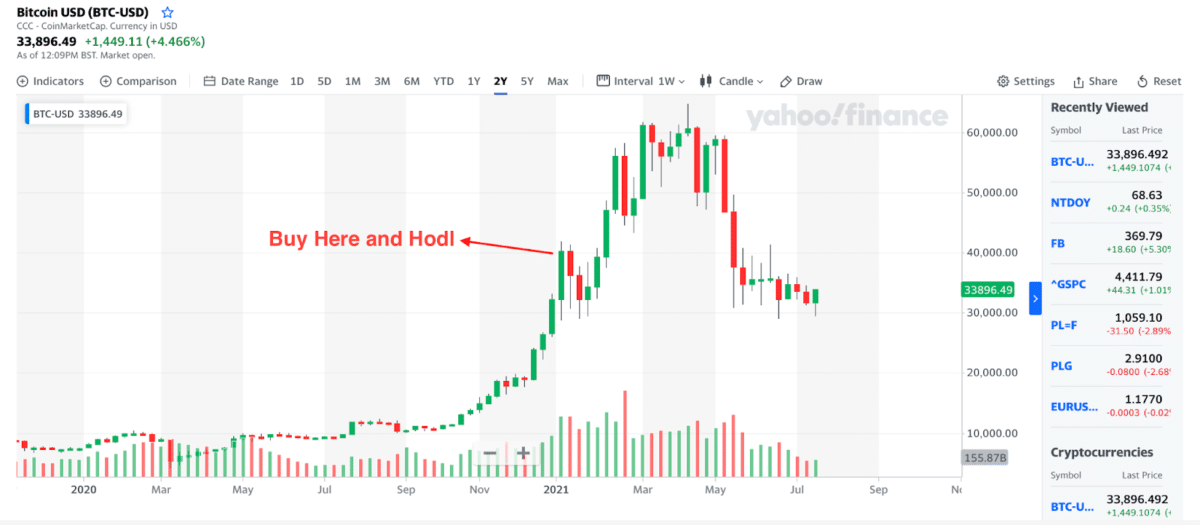

HODLing means buying an asset and holding it for a considerable time until the profit target is achieved. Investors should find a falling instrument and open buy position in this approach once it shows any strong rejection. However, if the price moved lower, hold the trade instead of closing without losses.

For example, if you bought BTC at $40,000, you would face a loss immediately, as shown in the above image. BTC/USD moved to the $30,000 level after the buying trade, and if you HOLD the trade, you will gain a profit of $20,000.

Diversification

It is a straightforward step where you have to buy an asset from low but differently. For example, if you have $1000 in your crypto wallet, you can diversify the investment in different crypto assets that are potential.

In that case, you can make a list of crypto assets from high to low potential and invest them with the below-mentioned concept:

- Asset 1 (30%/ $300)

- Asset 2 (20%/ $200)

- Asset 3 (20%/ $200)

- Asset 4 (20%/ $200)

- Asset 4 (10%/ $100)

In this way, you can easily make X3 of your capital in a year.

CFDs

If you are a forex trader, this method is perfect for you. CFDs allow buying an asset without owning it. Most retail FX trading brokers allow CFDs to trade in forex, stocks, indices, metals, and cryptocurrencies.

You have to find a broker that allows crypto trading in CFDs and buys or sells trades like forex pairs. In addition, some brokers enable cross crypto pairs where you can trade pairs like ETH/BTC, ETC/LTC, etc.

CFDs trading requires a specific trading strategy using technical and fundamental tools. Moreover, MT4, MT5, and cTrader based platforms have an auto trading facility using robots and Expert Advisors.

Swing trading

Swing trading requires short-term and long market views where traders find swing lows to buy and swing highs for sell trades.

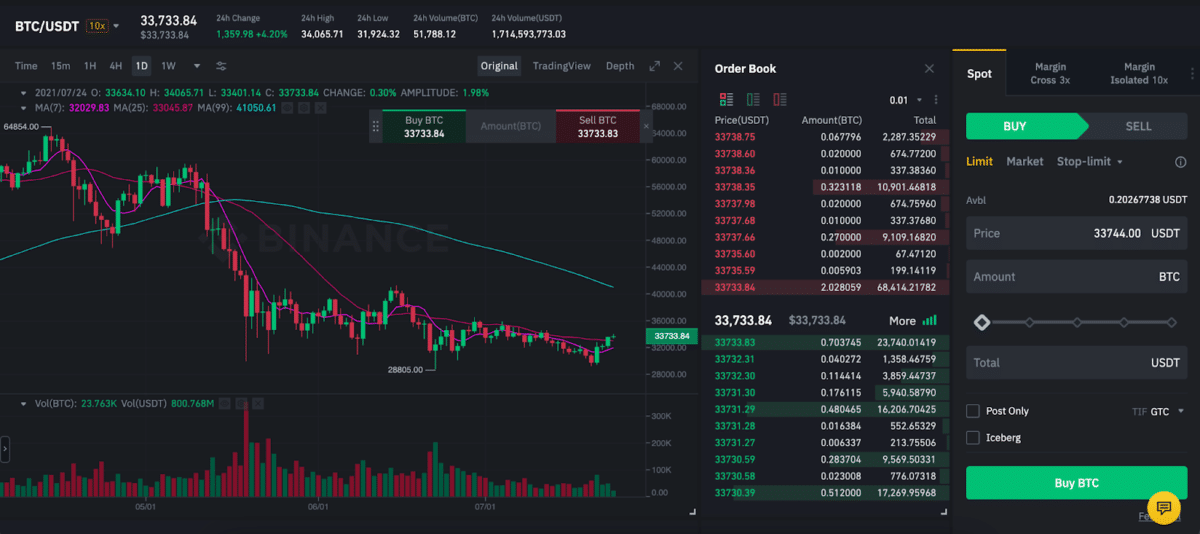

Most crypto brokers allow advanced trading charts, where you can see real-time candlestick charts.

The above image shows the price chart of a crypto trading platform with a real-time candlestick chart.

In swing trading, you can easily take trades with a 1:3 risk: reward ratio. Therefore, it is easy with swing trading to make x3 of your investment from a single trade or a set of trades.

Intraday trading

Intraday trading is a process to open and close all trading activities within the trading day. The cryptocurrency market is open 24/7, and there is no boundary on timing. Therefore, you can do day trade or scalping from any crypto trading broker.

However, the crypto market is decentralized, and it is not connected to any central bank. Therefore, the intraday price movement does not rely on any fundamental events. As a result, technical analysis is more potent in intraday trading than fundamental trading.

Final thoughts

Trading in the financial market involves some risks that a trader cannot ignore. If you are diversifying your investment, you can eliminate some risks. If some assets make losses, you still have balances in your account that can help you to grow your capital.

However, risks from geopolitical uncertainty, environmental concern, and natural disaster have no way to eliminate. Therefore, even if you manage your money, there is a possibility of making losses. Therefore, the best approach is to invest the money that you are ready to lose. Lastly, success in financial trading does not come immediately. Thus, making x3 of your investment might require considerable time.