- What are they?

- Are they worth investing in?

- How to pick up best?

No, Uranium is not just for nuclear weapons. When we talk about investing in Uranium stocks, we are not talking about North Korean or Iranian companies. It is one of the most efficient energy sources we can find on Earth and the heart of nuclear reactors worldwide.

Just one gram of Uranium can produce 1 MW of energy. In contrast, you would need three tons of coal or about 2271.25 liters of fuel oil to produce the same energy.

Nuclear energy is a clean energy source, and the world seems to be recovering enthusiasm in the last months due to the urgency to reduce CO2 emissions. Keep reading to learn where you should put your money to take advantage of nuclear energy production with Uranium stocks.

What are Uranium stocks?

There are shares of companies related to the nuclear energy production business. These stocks could be in any area of the industry. Uranium stocks go from the mining company that takes the Uranium in the first place to those who use the element to produce electricity.

When managed properly, nuclear energy is one of the cleanest and more efficient energy sources on the planet. However, nobody discusses that today, the problem with nuclear energy is the consequences for the environment once something goes wrong.

Several nuclear power plants have been shut down worldwide after events like Chernobyl, where the whole place was ruined for 1,000 years, and Fukushima, which raised protests worldwide.

However, today, the climate change situation has left the government without a choice, so they are now turning back to Nuclear energy, increasing the demand and increasing Uranium prices globally.

Are Uranium stocks worth investing in?

It looks like there is no choice for governments. The most famous and publicized renewable energy sources like solar and eolic energy are far from sustainable solutions because of their cost and instability. Solar energy production is zero during the night, and eolic energy depends entirely on the weather. So, they offer a reasonable amount of energy to the system, but they are not reliable.

Nuclear energy is a clean and reliable energy source that offers nations long-term solutions for their energy problems.

Even countries that had turned their backs on Nuclear plants like France and Japan are now making plans to make Nuclear energy a key player in the energy sector to meet their zero-emission goal by 2050.

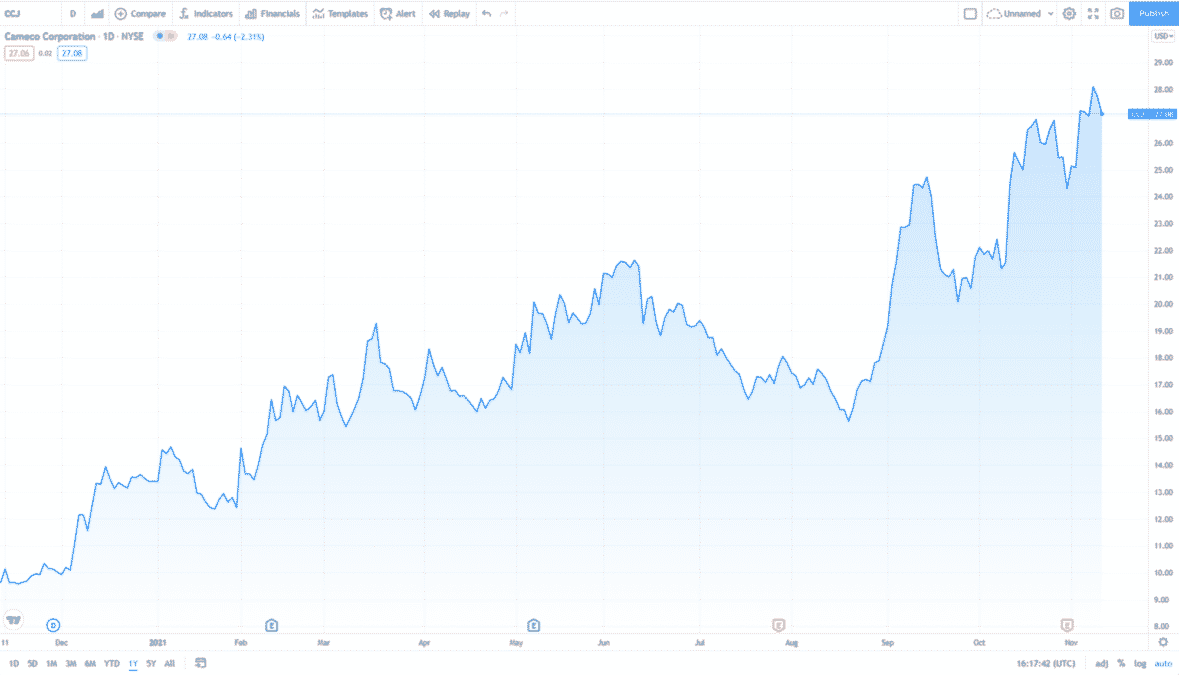

Cameco (CCJ)

Price: $26.93

It is a Canadian company founded in 1998. The company engages in the uranium and fuels services business. Cameco’s uranium sector involves the exploration, mining, milling, and commercialization of uranium concentrate.

It is the world’s largest publicly traded uranium company. Cameco is responsible for more than 18% of uranium production worldwide. This puts it in second place as a uranium producer in the world.

This company is doing well, and the experts forecast that it will do even better in the future. The bank of America just upgraded Cameco shares from neutral to buy and updated its price target to $32.23 per share.

Energy Fuels (UUUU)

Price: $10.15

Energy Fuels is an American company involved in the exploration and exploitation of uranium deposits. The company headquarters is in Lakewood, CO. and its main projects are in Nichols Ranch, Alta Mesa, and White Mesa Mill, all inside the USA. Recently the company released its Q3-2021 Results reflecting a robust balance sheet with $132 million in working capital.

Energy fuels decided not to sell any uranium during 2021. Instead, the company has decided to collect all the material extracted during the year to sell it later when the price rises. This reflects the strong financial position of the company and the strategic view of the head border.

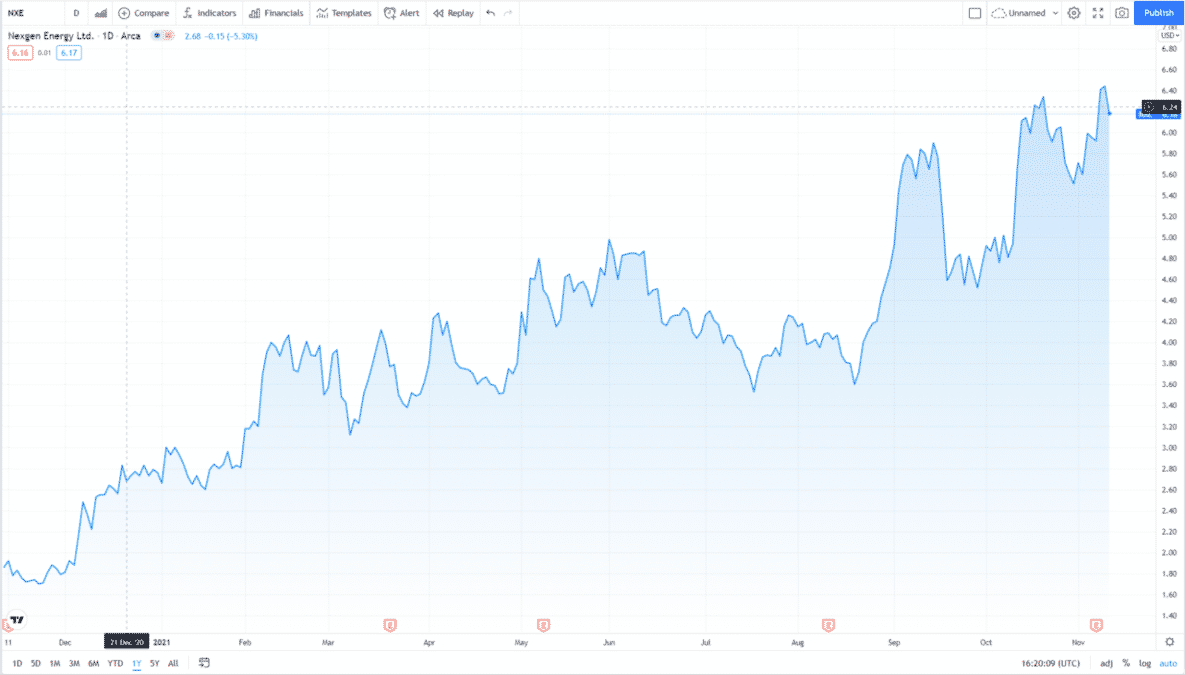

NexGen Energy (NXE)

Price: $6.03

NexGen Energy is a Canadian company involved in the commercialization, exploration, and development of Uranium properties for clean energy production.

Currently, NexGen Energy is developing six main projects simultaneously. They are Arrow, South Arrow, Harpoon, Rook I, IsoEnergy, and SW1 property.

The future looks bright for the Canadian company founded in 2011. The short, medium and long-term indicators have pointed to buying the stock before the Q3 reports are due in November.

The company’s stock price has been increasing throughout 2021, and experts predict it will increase even more and possibly reach $8.

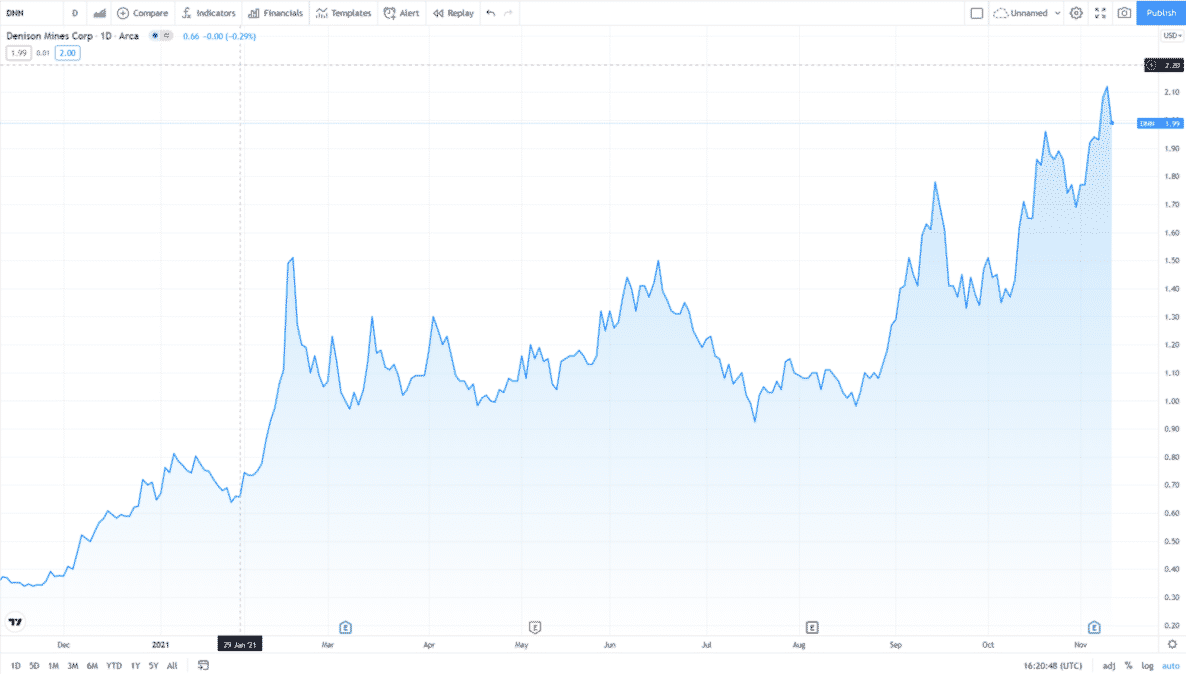

Denison Mines (DNN)

Price: $1.94

Denison Mines is another Canadian company. This one is located in Toronto and was founded in 1.997. The company engages in the exploration and development of Uranium, and it develops different projects like McClean Lake and Mill, Wheeler River, Waterbury, Midwest, and Hook-Carter.

During the year, the stock price of the company reached levels below $1 several times. However, the price has been trending up since August due to the rise of the Uranium price. We are still waiting for the Q3-results of the company, but for the Q2-result, Denison Mines reported revenues of $4.6 million, up from $2.9 million the prior year.

Uranium Royalty Corp. (UROY)

Price: $ 5.27

Canada is one of the leading countries in the uranium industry, and Uranium Royalty Corp is proof of that since it is our fourth Canadian company on the list. In addition, the corporation is the only royalty focused on Uranium listed in Nasdaq worldwide. Uranium Royalty Corp is focused on gaining exposure to uranium prices by making different strategic investments in the sector.

Like many Uranium companies, the stock prices of the companies have skyrocketed during the year. The shares have almost reached $6 per share during some sessions.

Final thoughts

The environmental crisis is changing the way we live, and it will have consequences along with all the industries. Something we thought was part of the past, like nuclear energy, is returning after the disappointment of renewable energy sources like solar and eolic. The stability of nuclear energy has proven to be the best way to replace fossil fuels. As previous accidents have shown, there are risks involved, but there doesn’t seem to be any other option at the moment.