- What are spatial computing stocks?

- What potential do they hold in the future?

- Which are the top five best spatial computing stocks?

As a subset of computing, spatial computing (SciComp) modifies the way people interact with technological devices. Breakthroughs in artificial intelligence and sensor technology enable specific spatial computing applications to become a reality despite the phrase’s 20-year-old origins. In another way, we can integrate digital activities into our surroundings via spatial computing.

It’s possible to use spatial computing in several ways. For example, self-driving automobiles employ spatial computing to navigate their environments. The potential of this technology is vast, even though it is still in its infancy. In certain firms, autonomous machines are already used, which is projected to continue. For example, Tesla dominates the market for vehicle batteries because of its Gigafactory robots.

Let’s look at the top five best spatial computing stocks for investing in 2022.

Sony Group Corporation (SONY)

Sony is a Japanese multinational with headquarters in Tokyo. Consumer, professional, and industrial electronic devices are part of SONY’s product portfolio. Its PlayStation VR device has turned virtual reality gaming into a centerpiece for its product line. Designers in various areas, including automotive and industrial design, computer graphics and visual effects, and filmmaking, may now bring their concepts to life in 3D with the Spatial Reality Display.

Zacks Audio Video Production estimates profits growth of 19.3 percent for the current year, but the company’s predicted earnings growth rate is more than 100 percent more than the industry average. In addition, there has been a 5.6 percent increase in the Zacks Consensus Estimate for this company’s current-year earnings over the past 60 days. Currently, Sony has the highest Zacks Rank of any company.

Why does it have the potential to grow?

Sony has been a familiar name for as long as anybody can remember. As a consequence, it has a great deal of potential. Digital media semiconductors, audio recording technology, consumer electronics, video games, and consoles are sectors where the company is a leader and a driving force. Sony has re-emerged from its pandemic sabbatical with a full tank of gas. In the preceding five years, annualized sales rose by 27%, and in the most recent 18 months, they rose by 16%.

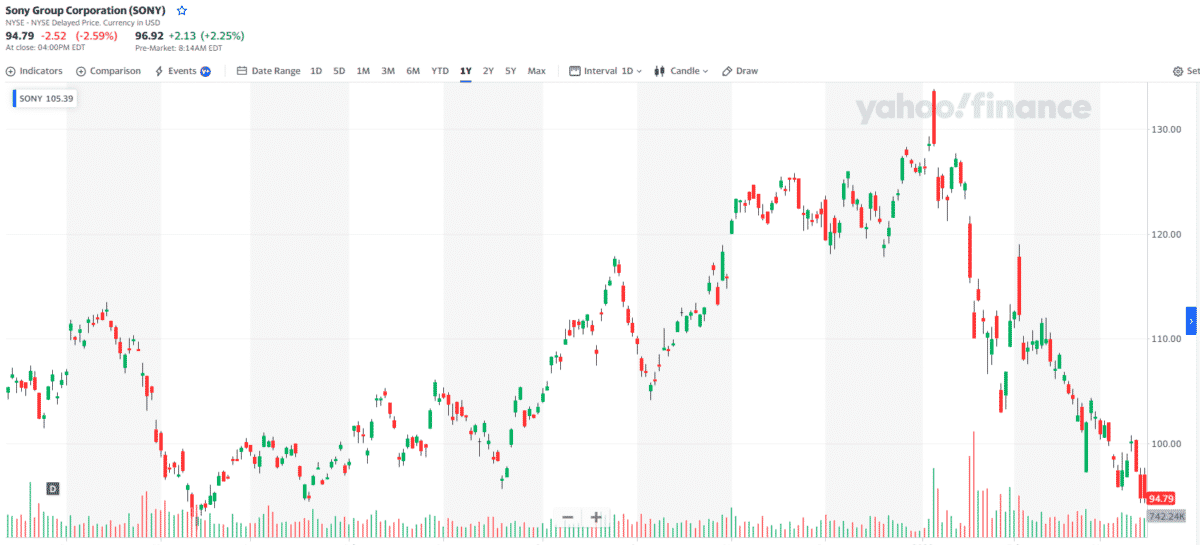

How much would you earn if you invested in SONY 1 year ago?

On 15 March 2021, this stock traded at $105.12 a share. The price fell to $94.79 a year later. Investing $1,000 in the previous year would have yielded a loss of around $98.26.

NVIDIA Corporation (NVDA)

The NVIDIA Corporation is devoted to developing graphics processing units. Developers may use the company’s graphics processing units to bring virtual worlds to life if desired. Nvidia’s headset drivers support Oculus, Valve Index, and HTC Vive.

Compared to the Zacks Semiconductor general industry, the company’s expected earnings growth rate for the current year is 33.7 percent. Additionally, the Zacks Consensus Estimate for this Zacks Rank #1 company’s current-year profitability has been revised 15.1% higher over the previous 60 days.

Why does it have the potential to grow?

According to Nvidia’s most recent financial report, the company is on track to be profitable in 2022. With this surge in shares, the company’s market value topped $800 billion. It’s not out of the question that Nvidia’s current pricing will continue to increase, fueled by the growth potential of its service sectors. Nvidia’s market value may soon surpass $1 trillion, given its excellent profit margins and huge earnings growth potential compared to its rivals.

How much would you earn if you invested in NVDA 1 year ago?

On 15 March 2021, this stock traded at $131.82 a share. The price rose to $213.30 a year later. Investing $1,000 in the previous year would have yielded a profit of around $618.

Microsoft Corporation (MSFT)

As a provider of many products and services ranging from software to devices to solutions, Microsoft is one of the world’s most well-known names in the industry. Users may walk from one area to another in real life while experiencing another experience thanks to DreamWalker, a virtual reality-based product developed by this company.

Zacks Computer-Software sector profits are predicted to be 2.1 percent this year, while the company’s expected earnings growth rate for this year is expected to be 28 percent. Profit estimates for this firm have been revised 0.4 percent higher over the last 60 days. Currently, Zacks Investment Research has Microsoft ranked second.

Why does it have the potential to grow?

Microsoft’s annual cash flow growth is 26.7 percent, more significant than many of Microsoft’s rivals. Moreover, the firm’s annualized cash flow growth during the previous three to five years has been 19.6%, compared to the industry average of 12.4%. We may conclude that Microsoft has a promising future based on these numbers.

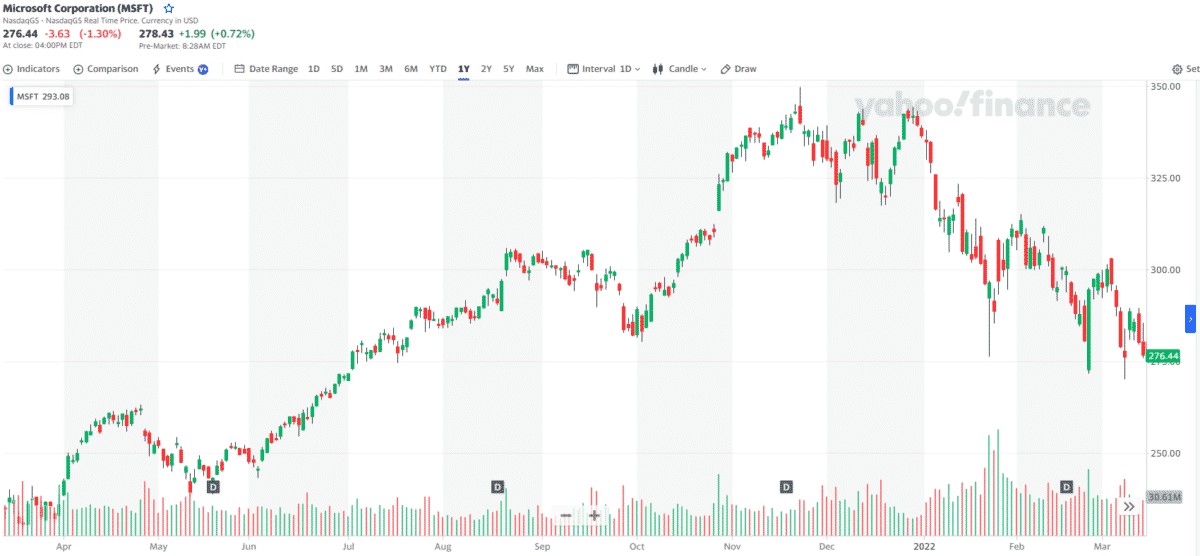

How much would you earn if you invested in MSFT 1 year ago?

On 15 March 2021, this stock traded at $232.91 a share. The price dropped to $276.44 a year later. Investing $1,000 in the previous year would have yielded a loss of around $186.89.

Alphabet Inc. (GOOGL)

Performance and brand promotion are only two of the many services offered by GOOGL. As one of Google’s most popular services, Google Maps has focused on providing more spatial computing to the general population. When it comes to motion tracking, Google’s ARCore offers six degrees of freedom for the user to move.

The Zacks Internet Services sector is expected to expand at a pace of 7.2 percent this year, compared to 18.2 percent for the firm. For this Zacks Rank #2 firm, the most recent revision to the Zacks Consensus Estimate for current-year earnings was a 0.3 percent increase over the previous sixty-day period.

Why does it have the potential to grow?

The share price of Alphabet has risen by more than 80% in the past year. As GOOG and GOOGL stock has just climbed so drastically, many investors will shun it. That makes perfect sense. Since March 2020, there hasn’t been a substantial dip in the stock market. Speculators may sell their Alphabet stock at a profit shortly, expected. It’s safe to say that Alphabet still has a promising future, even at its current share price.

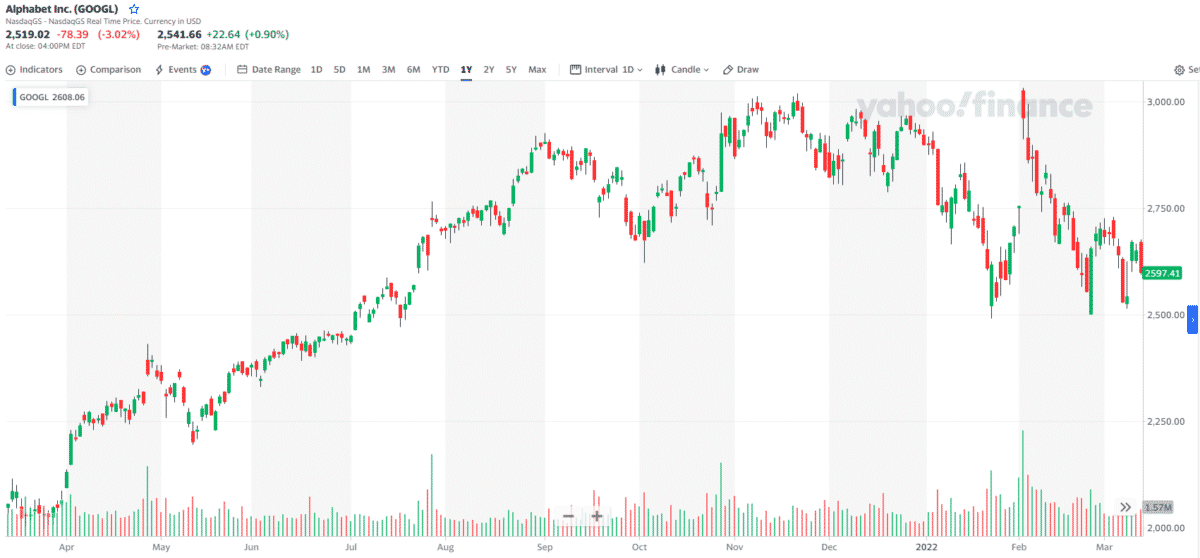

How much would you earn if you invested in GOOGL 1 year ago?

On 15 March 2021, this stock traded at $2,054 a share. The price soared to $2,519 a year later. Investing $1,000 in the previous year would have yielded a profit of around $226.38.

Deere & Company (DE)

An array of goods are produced and sold by Deere & Company. It saves the company time and money by creating virtual models of tractors at an early stage of development. Deere is also using AI and machine learning to increase yields, reduce costs, and enhance environmental sustainability in agriculture.

In comparison to the Zacks Manufacturing, farm equipment industry, which is expected to expand earnings by 17.6% this year, the company’s profit margins are expected to rise by 82.5% this year. According to the Zacks Consensus Estimate, current-year earnings for this Zacks Rank #2 business have been revised by 20.5 percent in the past 60 days.

Why does it have the potential to grow?

Deere’s long-standing brand strength and the recent spike in reorders in the commercial agriculture business have helped the company gain a foothold in the market. In addition to improving prices and profitability, Deere is gaining recognition for various innovative efforts that might extend the company’s client base. As a result of Deere’s commitment to modernizing agriculture, the company has been working on several initiatives. Because of this, we may conclude that it has a promising future ahead of it.

How much would you earn if you invested in DE 1 year ago?

On 15 March 2021, this stock traded at $370.26 a share. The price gained to $393.86 a year later. Investing $1,000 in the previous year would have yielded a profit of around $63.7.

Final thoughts

Robots employing spatial computing might replace humans as the primary method of selecting and delivering products at Amazon and other major retailers. We may soon see total automation of both order fulfillment and warehouse management. Therefore, when purchasing shares in a spatial computing firm, it is vital to consider the organization’s financial health.